How to Use TIPS in Your Portfolio

What you need to know about the advantages and risks of investing in TIPS.

Treasury Inflation-Protected Securities were originally introduced in January 1997 and are designed to provide inflation-protected interest and principal payments. Unlike other bonds, which generate returns in nominal terms, TIPS are designed to be a direct hedge against inflation. Their principal value is designed to adjust to reflect changes in the Consumer Price Index. If the inflation-adjusted principal amount goes up, their semiannual interest payments will also increase based on the higher principal value.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are TIPS?

TIPS are bonds issued by the US Treasury with maturities of five, 10, or 30 years. They pay a fixed rate of interest every six months, but the amount of interest varies based on any changes in the principal value. Every six months, the Treasury updates the principal value of existing bonds to reflect changes in the Consumer Price Index. If inflation goes up, the principal value also increases. Investors holding TIPS to maturity will receive either the adjusted principal amount or the original principal amount, whichever is greater.

What Are the Advantages and Risks of Investing in TIPS?

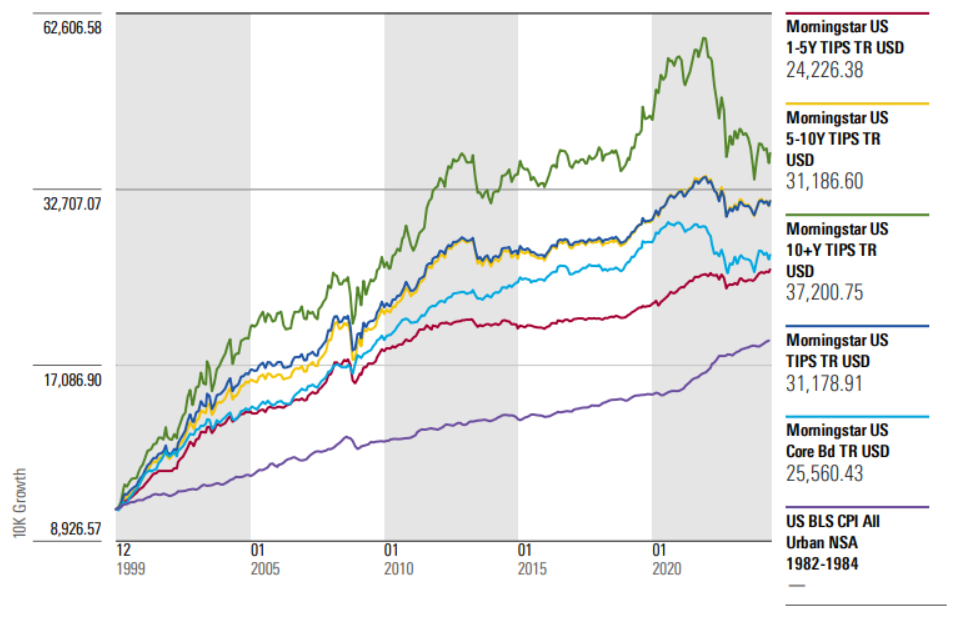

As shown in the graph below, TIPS have indeed outpaced inflation over longer periods. Bonds in most maturity ranges have also outperformed other investment-grade bonds (labeled “core bonds” in the graph).

Long-Term Growth of TIPS vs. Inflation

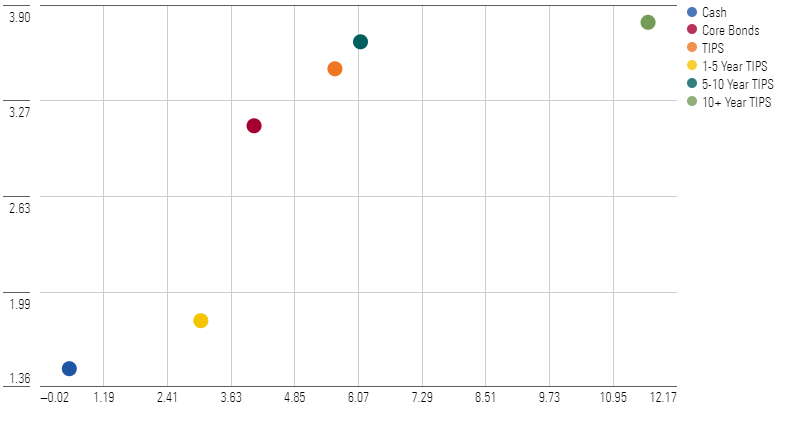

But as shown in the scatterplot below, volatility has been higher, as well. That’s especially true for longer-maturity TIPS. Over the trailing 20-year period through May 31, 2024, TIPS with maturities of 10 years or more have had about 75% as much volatility as stocks, but returns have also been significantly lower. In other words, they haven’t generated high enough returns to compensate investors for their higher level of risk.

Trailing 20-Year Risk and Return: TIPS and Other Assets

The main reason? Interest-rate risk. TIPS can be highly sensitive to changes in interest rates. Like other bonds, their principal value declines during periods of rising interest rates, and that may or may not be offset by adjustments for higher inflation at the same time. Interest-rate risk can be particularly pronounced for TIPS because issuance has historically been weighted more toward longer-term bonds; as a result, most TIPS benchmarks have relatively long durations.

On the extreme end, TIPS with maturities of 10 years and more have lost as much as 41% of their value during interest-rate spikes, as shown in the table below.

Risk and Drawdown Stats

TIPS have also exhibited some other performance quirks. When interest rates spiked during the 2013 taper tantrum, TIPS lost significantly more than other investment-grade bonds. And their limited liquidity was a major liability during the global financial crisis in September and October 2008, when TIPS lost nearly 12% of their value.

How to Invest in TIPS

Investors have several options for investing in TIPS. First is purchasing an individual bond, which can be done through TreasuryDirect or a brokerage account. Constructing a TIPS ladder, which is a series of bonds with staggered maturity dates, is another option. Investors seeking a steady stream of income during retirement, for example, could purchase 30 separate sets of TIPS with maturity dates ranging from one year to 30 years from now. Coupons from the bond portfolio and cash flows from maturing bonds can be used to cover each year’s living expenses. Because there are no TIPS available with maturity dates between 2035 and 2039, though, it’s not possible to compile a perfect ladder with bonds on every rung. Instead, you’d have to buy more bonds with adjacent maturity dates to fill in the five-year gap. [1]

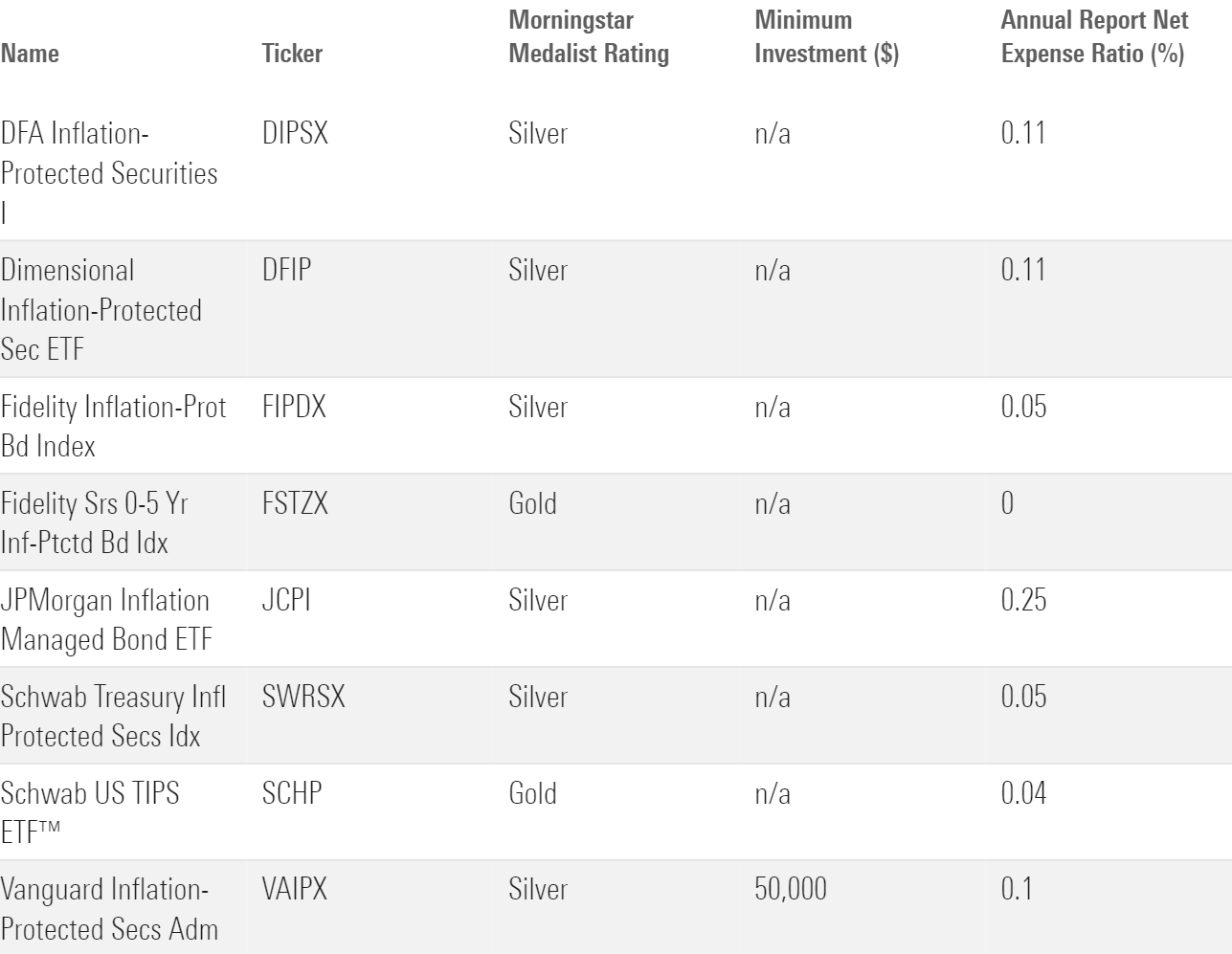

TIPS funds are a bit more straightforward because they don’t require purchasing individual bonds, although they also lack the cash-flow-matching properties of a ladder. The table below shows a few funds with Morningstar Medalist Ratings of Silver or Gold.

Selected TIPS Funds

In addition, iShares now offers a series of target-maturity TIPS ETFs with maturity dates between 2024 and 2034. Investors could use these funds to construct a 10-year TIPS ladder without the hassle of buying individual bonds.

How Long Should I Hold My Investments in TIPS?

If you’re investing in a TIPS fund, I recommend using one with a short or intermediate-term maturity and holding it for at least two to six years, as outlined in Morningstar’s Role in Portfolio Framework. As mentioned above, longer-maturity TIPS funds can be extremely sensitive to interest-rate risk and drawdown risk, making them difficult to use in a portfolio.

For individual bonds, you’ll want to match up the timing of when you’ll need the proceeds with the maturity date of the bond. Although the principal value will still fluctuate, interest-rate risk is a nonissue if you hold the bond to maturity.

How Much of My Portfolio Should Be in TIPS?

If you’re a younger investor, you may not need any exposure to TIPS. There are two reasons. First, human capital—or the present value of all the earnings you’re going to generate during your lifetime—is likely your largest asset. Because wages normally increase over time to keep up with inflation, this human capital provides a built-in hedge against higher prices for goods and services. Second, your investment portfolio is probably heavily weighted toward stocks, which are one of the best ways to offset long-term inflation risk.

Investors approaching retirement or already in retirement have a greater need for an inflation hedge to protect their fixed-income holdings. Based on Morningstar’s Lifetime Allocation Indexes, it’s reasonable to allocate 20% to 40% of a portfolio’s fixed-income assets to TIPS.

Individuals who construct a ladder of these bonds to support spending during retirement may be able to allocate a higher percentage of their portfolio to TIPS, but this strategy is designed to be self-liquidating. In other words, a 30-year TIPS ladder will end up with a portfolio balance of zero by the end of year 30. That means retirees concerned about longevity risk or who want to leave money behind for heirs will want to keep some assets invested outside the TIPS ladder to fund those goals.

It’s also important to note that both interest payments and increases in the principal value for TIPS are subject to ordinary income tax. As a result, TIPS are best held in a tax-sheltered account, such as an IRA.

Finally, TIPS aren’t always a compelling portfolio addition. At times, they’ve had negative real yields, which would lead to a loss of spending power over time despite the inflation adjustment. As of this writing, however, real yields on 10-year TIPS are about 2%, which is relatively attractive compared with previous levels.

[1] This site has a helpful tool for investors interested in constructing a TIPS ladder.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VPCBITMQP5FKLIZ32POIXOV3MQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)