How to Make Sure Your Personalized Portfolio Doesn’t Backfire

A total wealth approach can lead to better outcomes.

Everything is personalized these days, from your Netflix queue to your drink at Starbucks. These everyday experiences often cause people to equate more customization with improved outcomes, leading to a belief that more personalization is always desirable.

But in an investment context, that’s not always the case.

Direct-indexing providers offer investors a wide range of personalization options, from security and sector exclusions to environmental, social, and governance considerations, but this personalization only makes sense if it better helps achieve financial goals.

Customizing a portfolio based on investors’ preferences is not necessarily a guaranteed way to boost returns and, depending on the specifics of the strategy, may even cause investors to underperform.

So, how do you make investment personalization actually work? We believe that it needs to consider an investor’s total wealth, including nontradable assets.

As such, an important reason to personalize a stock portfolio may be your job.

In our new study, we explore the benefits of personalizing portfolios based on the risks embedded in restricted stock units and future employment income. We find that incorporating total wealth leads to materially better risk-adjusted returns.

Why It’s Important to Avoid Career Concentration in Your Portfolio

Financial assets like stocks and bonds are often just a fraction of many investors’ total economic worth.

Human capital—which we’ll define as the value of future earnings from your employer—is generally a person’s most significant asset. However, it also carries unique risks, which have implications for how a portfolio should be constructed.

An oil executive with significant wealth tied to stock grants and future bonuses might need a different stock portfolio from a technology entrepreneur. Holistic portfolio construction must consider these unique risks.

Michael Kitces, a financial planning thought leader, described it this way: “Another potential use of direct indexing is for clients whose human capital is tied up in one company or industry and who want to be certain that their financial assets don’t further concentrate their wealth dependency on the same company or sector.”

How Career Customization Improves Risk-Adjusted Returns

Stock-based compensation, such as RSUs, has been rising in recent decades and is no longer available only to top executives. In fact, most share-based compensation goes to employees outside of the C-suite.

Our analysis indicates that share-based compensation as a percentage of company revenue quadrupled from 2007 to 2021, peaking at 4.4%.

Given this, our study explores optimizing portfolios based on total wealth—rather than just financial assets—to diversify the unique risks associated with RSUs and human capital.

In short, we find that incorporating total wealth leads to materially better risk-adjusted returns at the overall portfolio level.

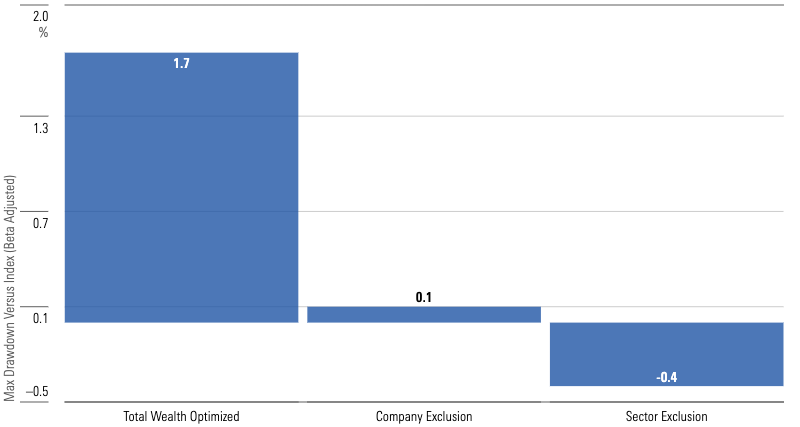

Historical analysis over a 10-year period shows an average reduction in nonmarket portfolio drawdowns of nearly 1.7% compared with a cap-weighted benchmark across a sample of 263 firms. The results suggest that our approach effectively diversifies specific risks in investor portfolios.

By contrast, simple security or sector exclusions—common direct-indexing customizations—are ineffective in reducing nonmarket risk. Worse, sector exclusions often increase the risk as measured by maximum nonmarket return drawdowns.

Max Drawdown Reduction vs. Index

The Dangers of Concentrated Risk—and How to Avoid It

Every few years provides a stark reminder of the dangers of concentrated risk.

Last year’s reminder was obvious: the complete demise of a few regional banks. Many of those bank employees were heavily invested in their company stock, either through RSUs or inside retirement plans.

The financial repercussions were severe. Consider the specific details of the Silicon Valley Bank bankruptcy, for example. The Wall Street Journal reported that SVB stock made up nearly 20% of the company’s retirement plan assets.

SVB employees not only lost their jobs (human capital) but also substantial portions of their net worth (financial capital). With the benefit of hindsight, many of these employees’ total wealth was overly exposed to firm-specific risks. This highlights the importance of a well-diversified portfolio that accounts for multiple factors in safeguarding investors.

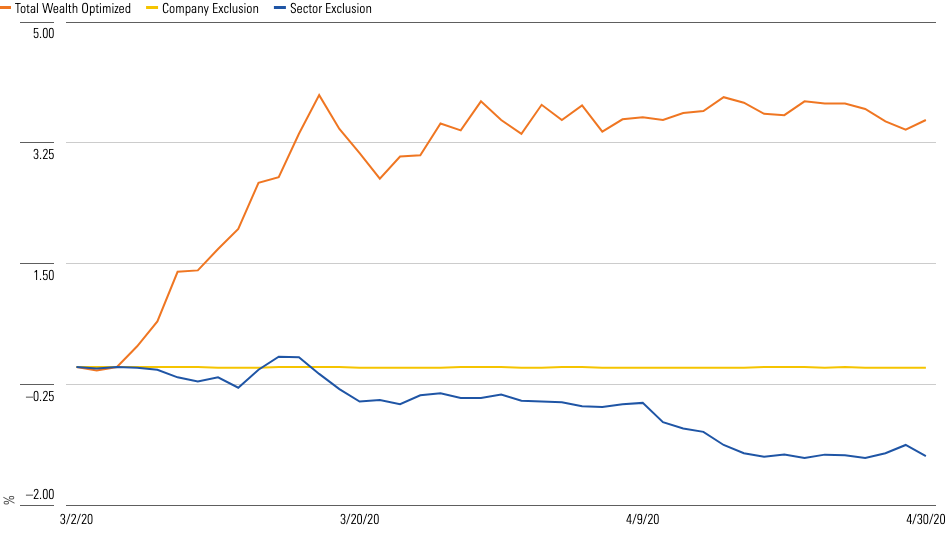

A couple of years earlier, leisure companies, such as casinos, were arguably the most negatively impacted businesses by the coronavirus lockdowns. Our study compares the losses of a portfolio optimized for total wealth against casino companies.

In that scenario, a portfolio optimized against the risk of casino stocks would have mitigated losses during the peak of the covid market crash.

Drawdown Reduction vs. Index

How Personalization in Direct Indexing Can Benefit Investors

The conclusion we reach: Direct indexing offers huge potential for investors in an area that’s often underappreciated.

The commonly cited use case for direct indexing is that tax-loss harvesting at the security level improves aftertax outcomes.

Of course, we share this view. But the total wealth framework—personalizing portfolios beyond just tradable securities—could be a significant breakthrough for advisors to add additional value for clients. Why? Because many investors’ total wealth is overly exposed to single sources of risk, which can be effectively diversified by a total wealth optimization framework.

Personalization has an important role to play in the future of investing. But that personalization needs to be built with a disciplined framework, rather than the simplistic approaches that seem to be pervasive today.

Morningstar Direct Indexing portfolio manager Andy Kunzweiler and senior investment analyst Audrie Pirkl contributed to this research.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/s3.amazonaws.com/arc-authors/morningstar/571f02f7-3d9f-40ca-a254-c1ae121baeab.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHYIMOHDUREGTCIGI46ZAN6UWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/571f02f7-3d9f-40ca-a254-c1ae121baeab.jpg)