How to Use Bitcoin in Your Portfolio

What you need to know about the advantages and risks of investing in cryptocurrency.

Bitcoin was first created in early 2009, partly as a response to distrust of national governments and traditional financial institutions in the wake of the global financial crisis. As the oldest and most established cryptocurrency, bitcoin still accounts for the lion’s share of investor interest and assets, but there are now thousands of digital currencies on the scene.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll cover a wide range of asset classes and walk through what you need to know to use them effectively in a portfolio. For cryptocurrency, our view is that it should occupy just a small slice of a diversified portfolio and only if you intend to hold on to it for at least a decade before selling.

[Portfolio Basics: How to Build an Investment Portfolio]

What Is Bitcoin?

Bitcoin was originally conceived as a digital, encrypted alternative to traditional currencies controlled by central banks. It exists only in digital form and doesn’t rely on third-party intermediaries to verify transactions or record ownership transfers. Instead, bitcoin is a form of virtual, decentralized money that is secured by cryptography. Bitcoin lives digitally on a blockchain, a type of distributed ledger that registers transactions by cryptographically linking together a string of blocks that cannot be altered after being recorded.

Bitcoin isn’t the only cryptocurrency. The second-largest one is ether, which is tied to the ethereum blockchain. Ethereum supports “smart contracts” that automatically transfer digital assets when certain preset conditions are met. Other major types of cryptocurrency include stablecoins, which are tokens linked to a hard currency such as the US dollar, and altcoins, a wide range of cryptocurrencies that apply blockchain technology in more specialized ways. And don’t forget memecoins, which are based on images, videos, phrases, or even dog breeds such as the Shiba Inu, which inspired Dogecoin and Shiba Inu Coin. All told, there were more than 5,000 cryptocurrencies with a total market cap of about $2.5 trillion as of May 31, 2024, based on data from CoinMarketCap.

The vast majority of these can only be traded on a specialized exchange. Investors buying crypto will typically use a hardware or software wallet to store their private keys (similar to a password) and make transactions. Investors can also gain access to some cryptocurrencies by investing in an exchange-traded fund or grantor trust.

For the purpose of this article, I’ll focus mainly on bitcoin and ether, the two most widely used cryptocurrencies. These two currencies combined account for about 70% of crypto’s global market cap and more than half of all trading volume as of May 31, 2024.

Long-Term Performance

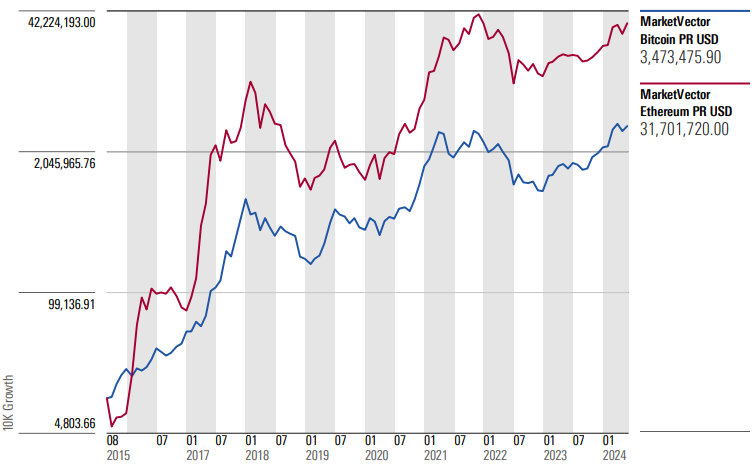

Cryptocurrency has been subject to both breathtaking highs and painful lows. As shown in the chart below, an investor who invested $10,000 in bitcoin or ether in September 2015 would have seen the value of the initial investment balloon over time. This growth has been something of a self-fulfilling prophecy. Because cryptocurrencies don’t generate cash flows, there’s no way to assess their underlying value using traditional investment analysis. Instead, spectacular returns generate more investor interest and buying activity, which drives prices even higher.

Growth of $10,000

What Are the Advantages and Risks of Investing in Cryptocurrency?

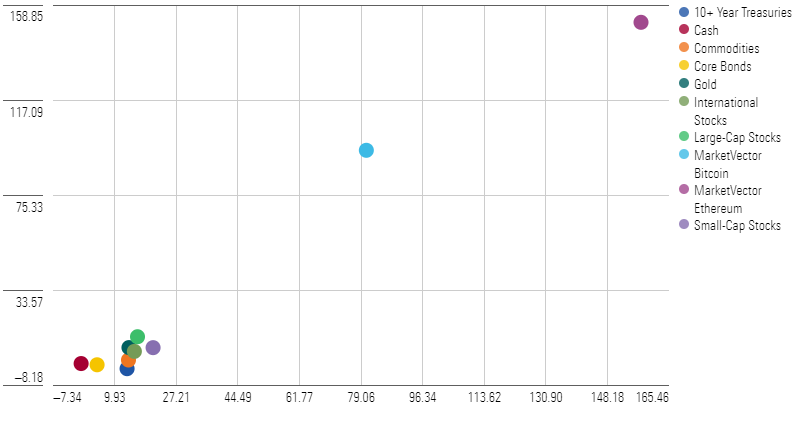

With high returns come high risk, and crypto is no exception. Crypto’s risk/reward profile lies at the far end when compared with other risky assets, such as stocks. Since September 2015, bitcoin has been nearly 5 times as volatile as US stocks, and ether has been nearly 10 times as volatile. This outsize level of volatility means that even a small amount of cryptocurrency can dramatically increase a portfolio’s risk profile.

Risk and Return Since September 2015: Bitcoin, Ether, and Other Assets

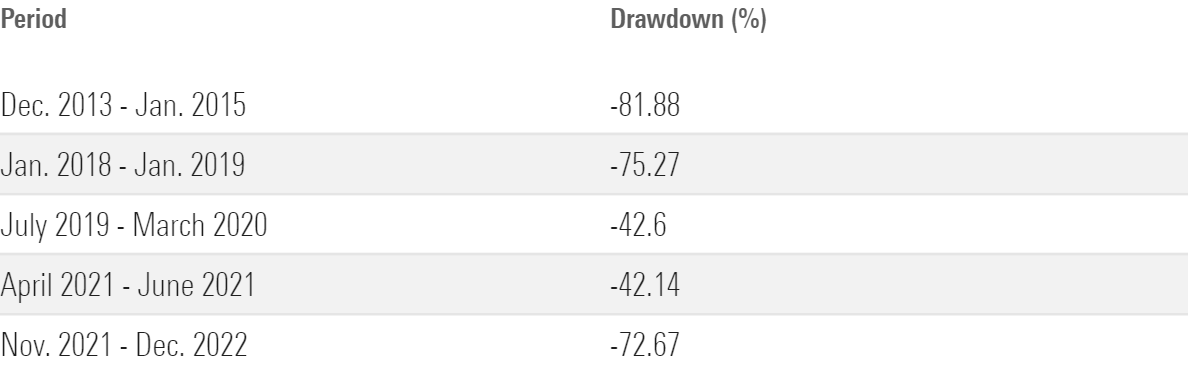

The level of drawdown risk has been extreme, as well. As shown in the table below, bitcoin has suffered losses of 40% or more during at least five periods over the past decade or so.

Previous Drawdowns: Bitcoin

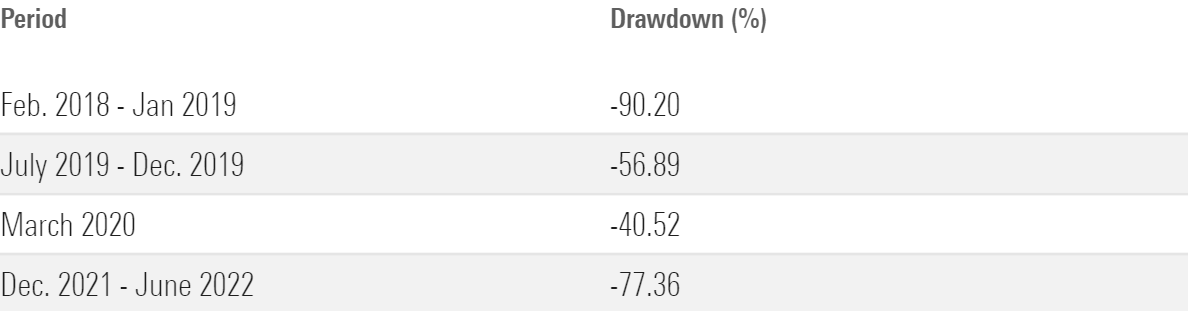

Ether has suffered similar levels of drawdown risk.

Previous Drawdowns: Ether

So far, bitcoin has historically generated strong enough upside returns to make up for its losses. Ether, however, is still down from its peak in November 2021. It’s also worth noting that a large number of cryptocurrencies are essentially “dead,” or worthless. Based on data from CoinMarketCap, there were more than 1,400 cryptocurrencies with no trading volume as of this writing, making it unlikely that investors would be able to realize any gains.

How to Invest in Bitcoin and Other Cryptocurrencies

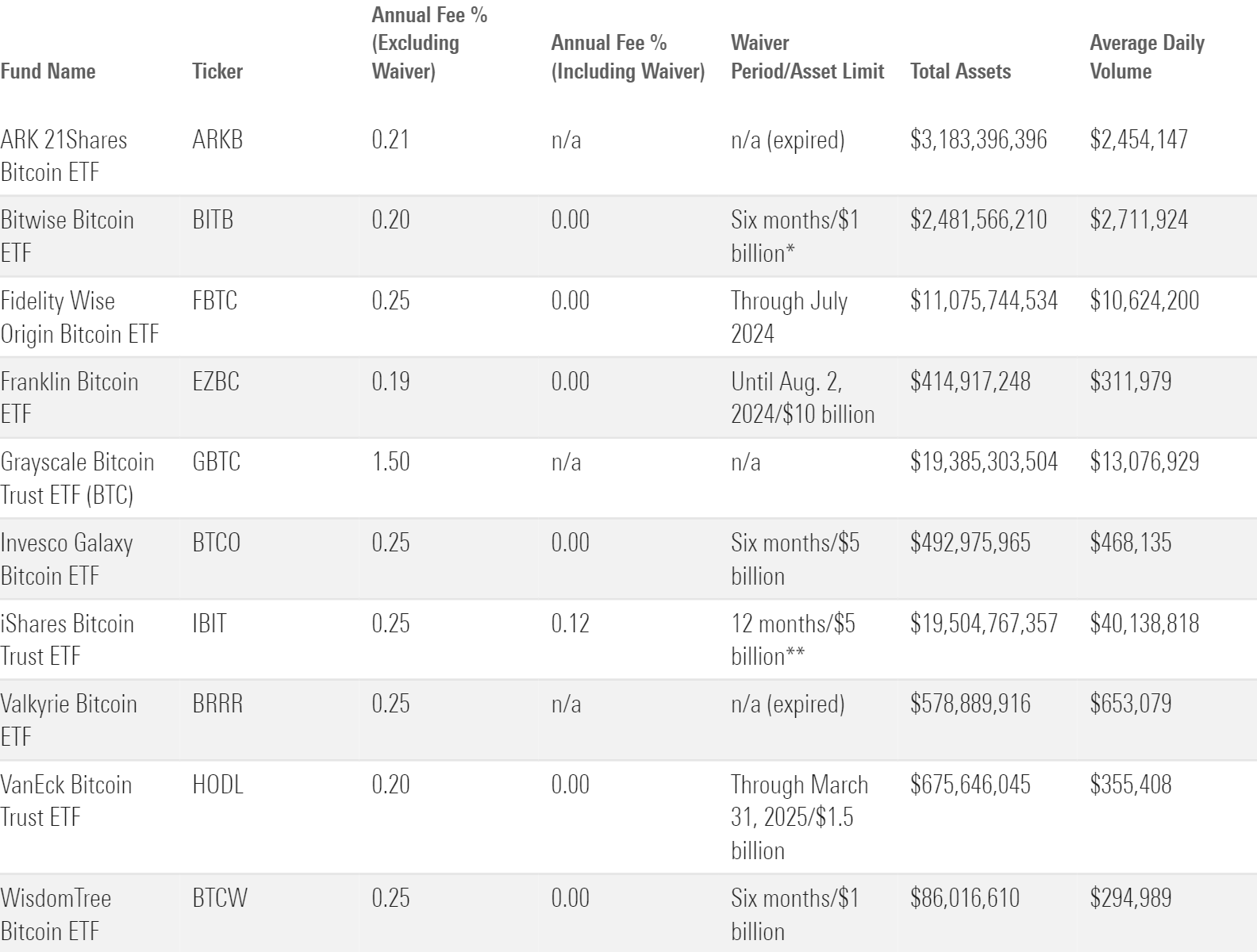

As mentioned above, specialized crypto exchanges were previously the main way to invest in cryptocurrency, aside from a few grantor trusts and ETFs that invest in cryptocurrency futures. In January 2024, however, the Securities and Exchange Commission approved 11 spot bitcoin ETFs that invest directly in bitcoin (rather than bitcoin futures). These are a better option because they should track the price of bitcoin more closely, even after fees and trading costs. The table below shows some key statistics for the bitcoin investment options that are currently available.

Bitcoin ETFs

In addition, the SEC recently approved a rule change that will allow for spot ether ETFs. However, individual funds still have to clear a remaining hurdle by having their registration statements approved before they begin trading.

Crypto investors can also find a variety of digital asset ETFs that invest in stocks of companies that are involved in the crypto ecosystem, such as crypto mining, mining equipment suppliers, and companies that develop and use blockchain and other digital asset technologies. So far, though, most of these crypto-related equity funds have been slightly more volatile than pure plays on bitcoin and/or ether.

How Long Should I Hold My Investments in Cryptocurrency?

Morningstar’s Role in Portfolio framework recommends holding cryptocurrency for at least 10 years. We came up with this guideline partly by looking at the historical frequency of losses over various rolling time periods ranging from one year to 10 years. We also considered the maximum time to recovery, or how long it usually takes to recover after a drawdown.

How Much of My Portfolio Should Be in Cryptocurrency?

Over the past several years, crypto’s meteoric rise could lead to a simple conclusion: The more, the better. Despite its extreme levels of volatility and drawdown risk, returns have been high enough to offset the additional risk. However, it’s hard to know if this pattern will hold going forward.

It’s also worth noting that as bitcoin, ether, and other cryptocurrencies become more mainstream, they’re becoming less valuable as portfolio diversifiers. While correlations against most other major asset classes have remained low in absolute terms, they’ve steadily trended up in recent years. As a result, there’s no guarantee that adding crypto will improve a portfolio’s risk-adjusted returns, especially to the same extent it did in the past.

In addition, crypto’s popularity with momentum investors and speculative buyers makes it prone to pricing bubbles that will eventually burst. It’s also nearly impossible to pin down what its underlying value should be. For those reasons, a portfolio weighting of 5% or less seems prudent, and many investors may want to skip cryptocurrency altogether.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHYIMOHDUREGTCIGI46ZAN6UWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)