Markets Brief: US Jobs Report In View as Q3 Begins

Plus: Earnings season is approaching, small-cap stocks underperform, and Europe has election fever.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Is the Fed Beating Inflation?

The first half of 2024 closed with the news that inflation has continued to fall in line with expectations, as the core PCE measure of inflation declined from 2.8% to 2.6% over the last 12 months. One may expect this to encourage bondholders, but prices fell on Friday as the yield on the 10-year Treasury rose to 4.4%. This reminds us that the link between economic data and short-term price movements is not predictable.

Small-Cap Stocks Struggle, Stay Undervalued

The Morningstar US Market Index finished the week flat, having risen 14.07% over the first half of the year. Although smaller companies’ stock prices rose over the week, the sharp bifurcation in US equities remains. The Morningstar US Small Companies Index is up 1.85% in 2024, and it remains deep in undervalued territory, according to Morningstar analysts. While valuation can be a good guide for the relative long-term returns of equities, it is typically a poor guide for timing investments, and it tends to confound those who use it for this purpose.

Earnings Season Approaches

As we enter a new earnings season, two key points are noticeable. Earnings expectations are high but falling, with year-on-year profit growth expected to be 8.8% for Q2, compared with 9.0% three months ago, according to FactSet Earnings Insight. Additionally, companies that disappoint investors are being treated harshly—as evidenced by Nike NKE, which fell 20% on Friday after posting results below expectations. You can read what David Swartz thought of those results. High expectations and weaker results create fertile ground for volatile prices. It may be important to remember that successful investing depends on remaining invested while others react to events.

European Markets Volatile

Equity markets outside the United States have made good progress this year, but they’ve continued to trail larger US companies. The Morningstar Developed Markets ex-US Index is up 4.76% over the first half of 2024. Investors in French stocks have had an especially tumultuous time following the announcement of a snap parliamentary election, with the Morningstar France Index falling 7.69% over the last month. Geopolitics—specifically the economic impact of elections—will likely dominate commentary this week, with both the French and UK elections taking place. At the Morningstar Investment Conference in Chicago last week, Ian Bremmer, founder and president of the Eurasia Group, highlighted the risks these and other geopolitical trends pose to investors.

Employment Back in the Spotlight

As we enter a shortened trading week, the big economic news will likely be the US non-farm payroll data released Friday. Economists expect the unemployment rate to remain steady at 4% and earnings growth to fall, according to MarketWatch. In a week when many market participants will be away from their desks on July 4, any significant deviation from expectations could create volatility, but it likely wouldn’t require a change in strategy.

Highlights of This Week’s Market and Investing Events

- Tuesday, July 2: May Job Openings and Labor Turnover Survey

- Wednesday, July 3: Markets close at 1:00 pm EST in observance of Independence Day, June ADP Employment Survey, Minutes from the June Federal Open Market Committee meeting

- Thursday, July 4: Markets closed

- Friday, July 5: June Employment Situation Report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended June 28

- The Morningstar US Market Index rose 0.02%.

- The best-performing sectors were energy, up 2.53%, and communication services, up 1.43%.

- The worst-performing sector was utilities, down 0.99%.

- Yields on 10-year US Treasury notes rose to 4.36% from 4.25%.

- West Texas Intermediate crude prices increased 0.99% to $81.53 per barrel.

- Of the 702 US-listed companies covered by Morningstar, 343, or 49%, were up, 5 were unchanged, and 354, or 50%, were down.

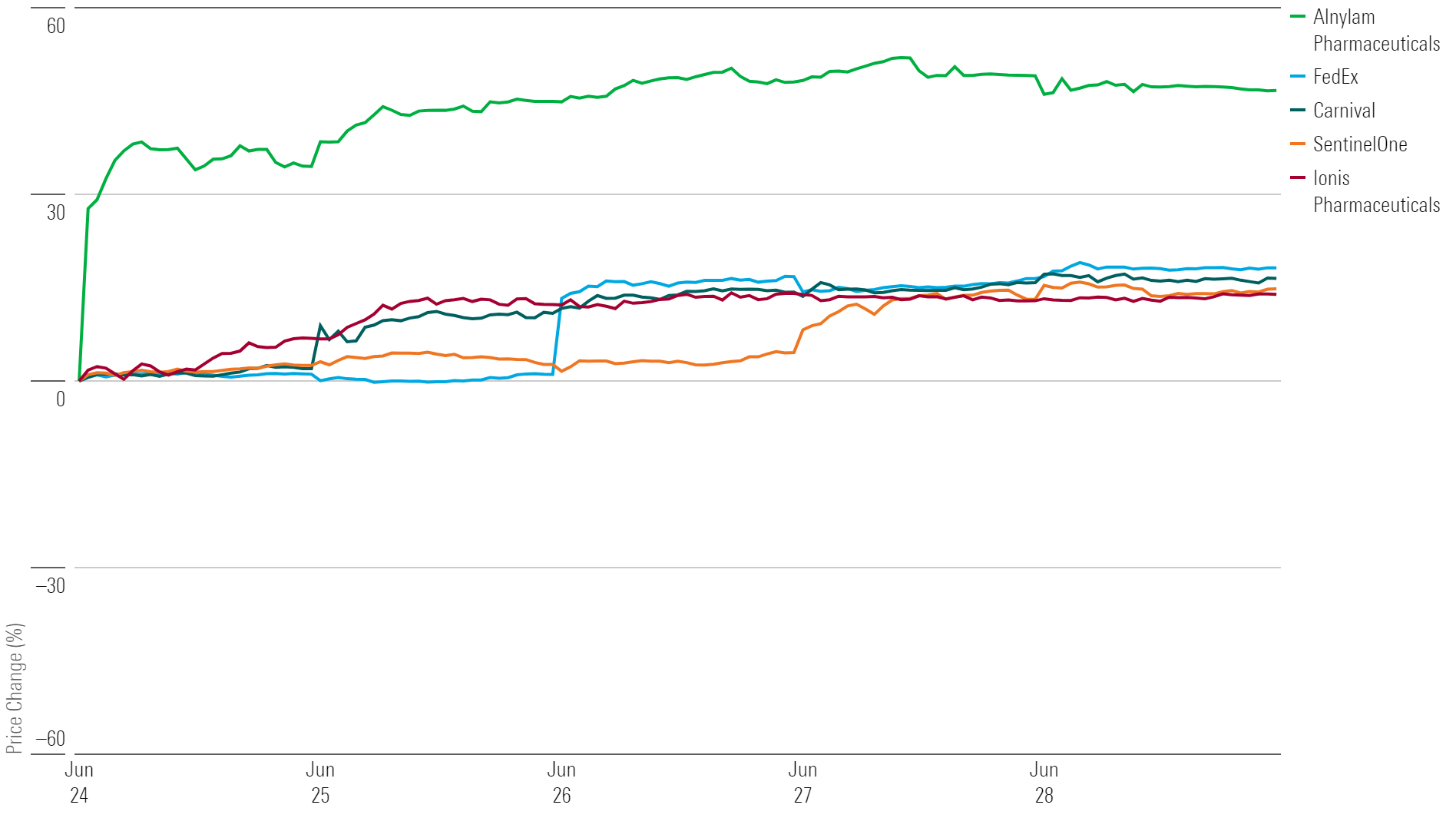

What Stocks Are Up?

Alnylam Pharmaceuticals ALNY, FedEx FDX, Carnival CCL, SentinelOne S, Ionis Pharmaceuticals IONS.

Best-Performing Stocks of the Week

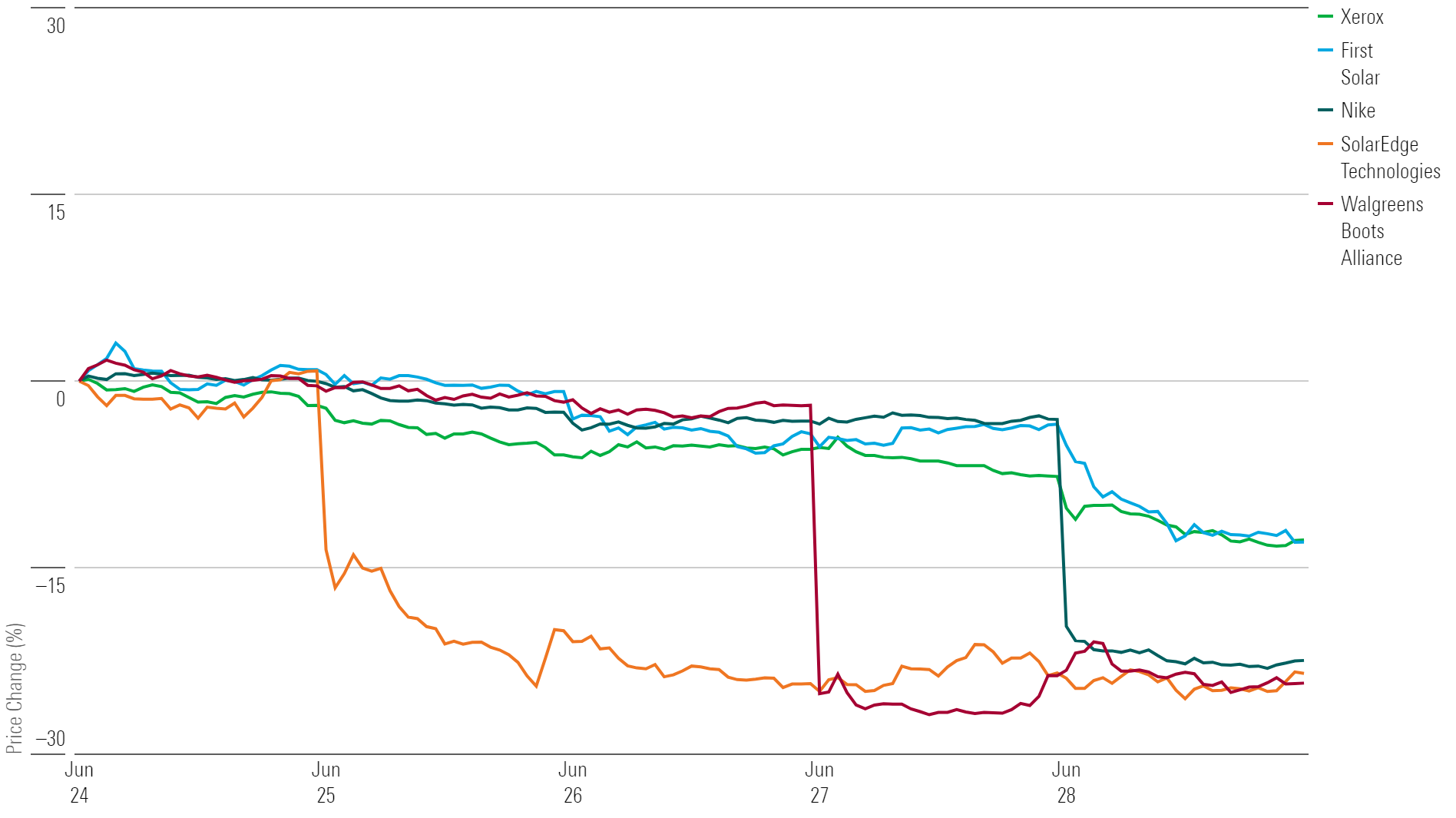

What Stocks Are Down?

Walgreens Boots Alliance WBA, SolarEdge Technologies SEDG, Nike NKE, First Solar FSLR, Xerox Holdings XRX.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)