Markets Brief: Friday’s Job Report in Focus

Plus: Small stocks as takeover candidates, private capital is booming, and value stocks outperform

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Is the Inflation Threat Fading?

The latest PCE measure of US inflation was in line with expectations last week leaving investors unperturbed. While we can’t know what lies ahead, it seems likely that the macroeconomic environment is stabilizing and consequently a less powerful driver of investor confidence and market movements. When this happens, investors tend to become more focused on individual companies and their idiosyncratic characteristics.

Value Stocks Overtake Growth

Following a sharp difference in returns last week, the Morningstar US Value index is now ahead of the Morningstar US Growth index over the year to date (up 7.58% and 6.59% respectively). Despite this, Morningstar equity analysts continue to see better investment opportunities in value companies, where the average discount to fair value is typically larger than for growth stocks.

Why Smaller Companies Become Takeover Targets

The difference between value and growth companies is especially pronounced among mid-size and smaller companies. This is important as these companies are often targets for acquisition by their larger peers and private capital, a process that can lead to a rapid realization of this value. A good recent example was provided this week by the agreed takeover of Marathon Oil by ConocoPhillips. To take a deeper look at smaller company investments, check out this recent article by Morningstar editor Tori Brovet.

Private Markets Grow, New Investors Move In

US private capital investors are continuing to engage in new deals while exits and fund raising becomes more difficult. This reflects the remaining unused capital from earlier funding rounds and the continuing desire of companies to raise capital in private markets. As private markets continue to grow and managers seek new sources of capital, the industry is increasingly focused on investors that had previously been excluded from this market. As with any new strategy, it is important to understand both the benefits and drawbacks before diving in. To find out more about the latest developments in this market, check out PitchBook’s latest Deal Roundup here.

Summer Can Encourage Bad Investing

This week is cluttered with economic data of which the US Unemployment (more commonly referred to as Non-Farm Payroll) Report on Friday is likely to create the most noise in markets. Disappointing economic news can have a greater impact at this time of year. A situation encapsulated in an old London investing motto, “Sell in May and Go Away”. While attempting to time investing in this way was long ago debunked, markets tend to be less liquid in the summer and consequently prices can be more volatile. This can be dangerous for investors as it encourages myopic decision making. It is therefore more than usually important to resist the urge to respond to each new headline and instead test every decision by whether it is focused on long term gains.

Highlights of This Week’s Market and Investing Events

- Tuesday, June 4 - April Job Openings and Labor Turnover Survey (JOLTS report)

- Wednesday, June 5 - May ADP Employment Survey, Earnings from Lululemon Athletica LULU

- Thursday, June 6 - Earnings from Nio NIO

- Friday, June 7 - May employment report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended May 31

- The Morningstar US Market Index fell 0.59%.

- The best-performing sectors were energy, up 2.04%, and real estate, up 1.71%.

- The worst-performing sector was technology, down 1.90%.

- Yields on 10-year US Treasury notes rose to 4.51% from 4.46%.

- West Texas Intermediate crude prices fell 1.59% to $77.23 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 350, or 50%, were up, three were unchanged, and 350, or 50%, were down.

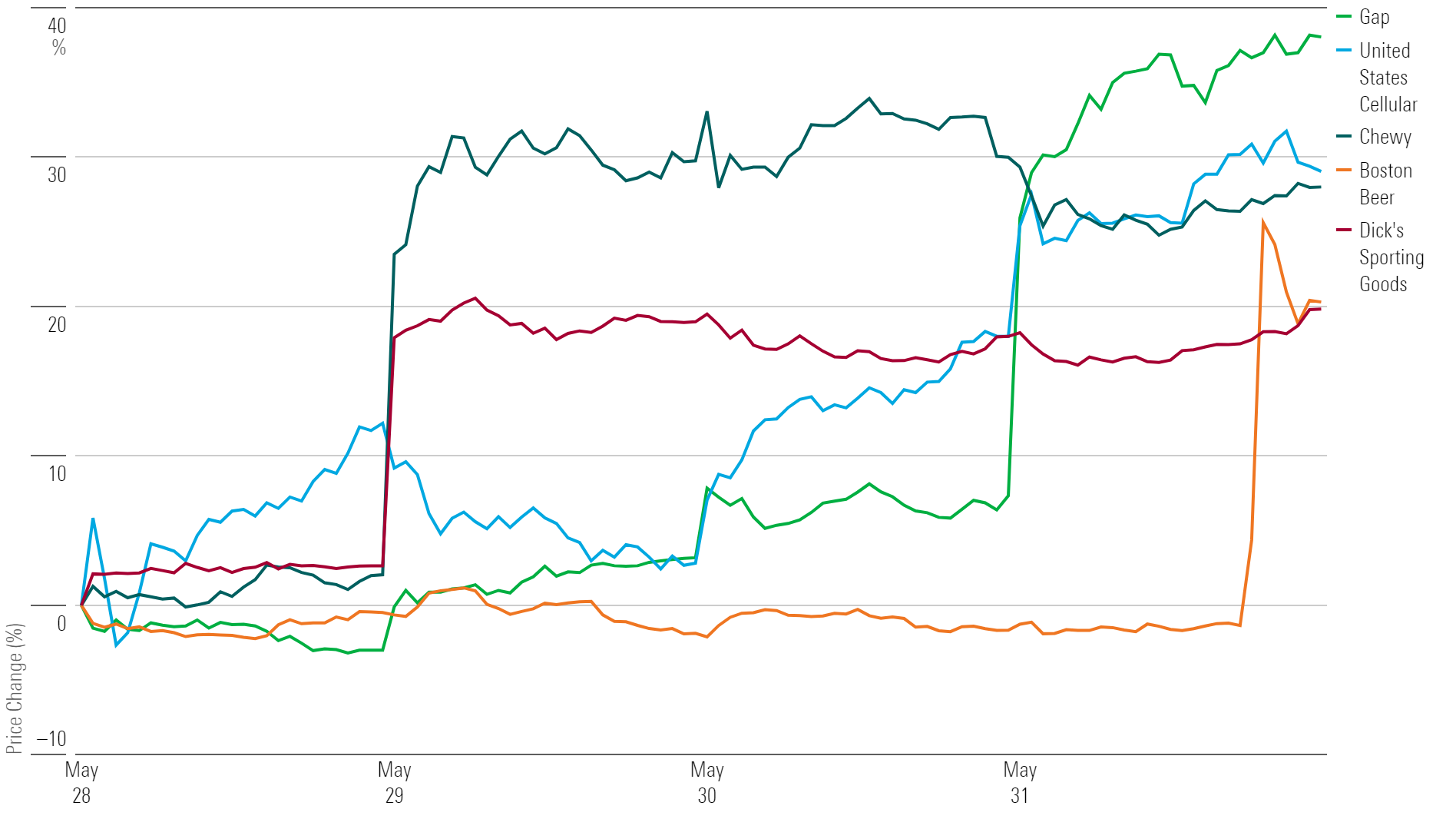

What Stocks Are Up?

Gap GPS, United States Cellular USM, Chewy CHWY, Boston Beer Company SAM, and Dick’s Sporting Goods DKS.

Best-Performing Stocks of the Week

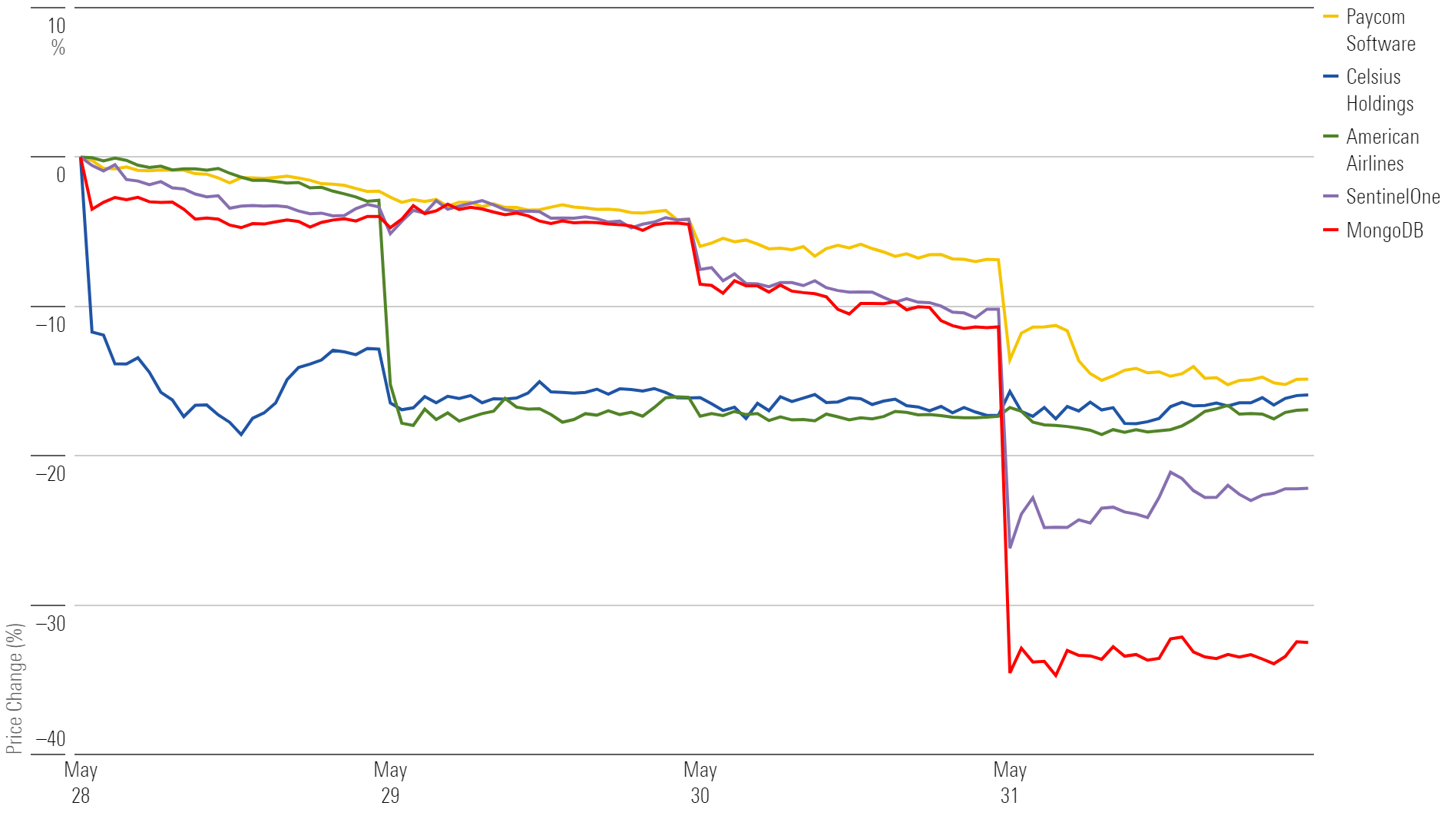

What Stocks Are Down?

MongoDB MDB, SentinelOne S, American Airlines AAL, Celsius Holdings CELH, and Paycom Software PAYC.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MMHQLYAKXBAGNG7XEYXPX4Y4S4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)