Markets Brief: Tech Stocks Lead Ahead of Nvidia Earnings

Inflation falls, bonds and equities rise, and meme stocks make a comeback

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Inflation Data Causes Relief

Investors appeared to breathe a sigh of relief last week as the April Consumer Prices Index showed that inflation continues to slow. Core CPI (which excludes volatile food and energy prices) rose by 3.6% over the last year, a decline from 3.8% in March and in line with the expectations. The improved inflation data was accompanied with more evidence that the economy is slowing in the form of weaker retail sales and industrial production. In an environment where inflation is seen as the main enemy, market participants appear willing to overlook the prospect of a softer economy.

Bond Prices Rise, Equities Too

This sanguine view of the future was seen most notably in US Treasury bonds as yields fell for both shorter and longer term debt. As a consequence, the Morningstar US Core Bond index rose 0.57% over the week and is up 2.32% over the last month. Although this will be a relief for bond investors who have experienced negative returns in two of the last three calendar years, bonds are less likely to provide diversification for the equity positions in portfolios as the prices of equities and bonds are more likely to be correlated. This may change if investors become more concerned about a weakening economy.

Technology Leads the Way Ahead of Nvidia Results

Equity investors also displayed their relief at the improving inflation picture with the Morningstar US Market index rising 1.6% over the week. Within the US market, technology companies showed the greatest gains as investor enthusiasm for AI was further kindled by the release of Chat GPT’s latest model. The stock prices of Nvidia NVDA, Microsoft MSFT and Apple AAPL all rose over the week pushing the Morningstar US technology index up 2.97%. Nvidia is likely to be back in the spotlight this week as it releases it latest financial results on Wednesday. Find out what Morningstar’s Nvidia analyst Brian Colello is expecting here.

Meme Stocks are Back

The so-called ‘meme stocks’ were back in the headlines last week as GameStop GME rose 271% before falling back 57% to end the week up 58%. For those who prefer their rollercoaster rides to be confined to the theme park rather than their portfolio, I recommend this excellent article by Morningstar portfolio manager John Owens who likens picking stocks to a visit to the grocery store.

A Lot of Fed Comment, But Investors Can Tune Out

Despite improved inflation data and falling bond yields, expectations for a near term cut in interest rates remain stable according to CME FedWatch. This may change this week as a paucity of economic data coupled with a surfeit of comments by Federal Reserve officials may encourage investors to alter their expectations. While this can help the folk of Wall Street pass the time, it has little to do with investing and can be safely ignored by those focused on reaching their financial goals

Highlights of This Week’s Market and Investing Events

- Tuesday, May 21 - Corporate Earnings from Macy’s M, Lowe’s LOW

- Wednesday, May 22 - Corporate Earnings: Nvidia NVDA, Snowflake SNOW, Target TGT, Minutes from the April Federal Open Market Committee meeting

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

Stats for the Trading Week Ended May 17

- The Morningstar US Market Index rose 1.54%.

- The best-performing sectors were technology, up 2.93%, and real estate, up 2.44%.

- The worst-performing sector was industrials, down 0.38%.

- Yields on 10-year US Treasury notes fell to 4.42% from 4.50%.

- West Texas Intermediate crude prices rose 0.21% to $79.98 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 457, or 65%, were up, one was unchanged, and 245, or 35%, were down.

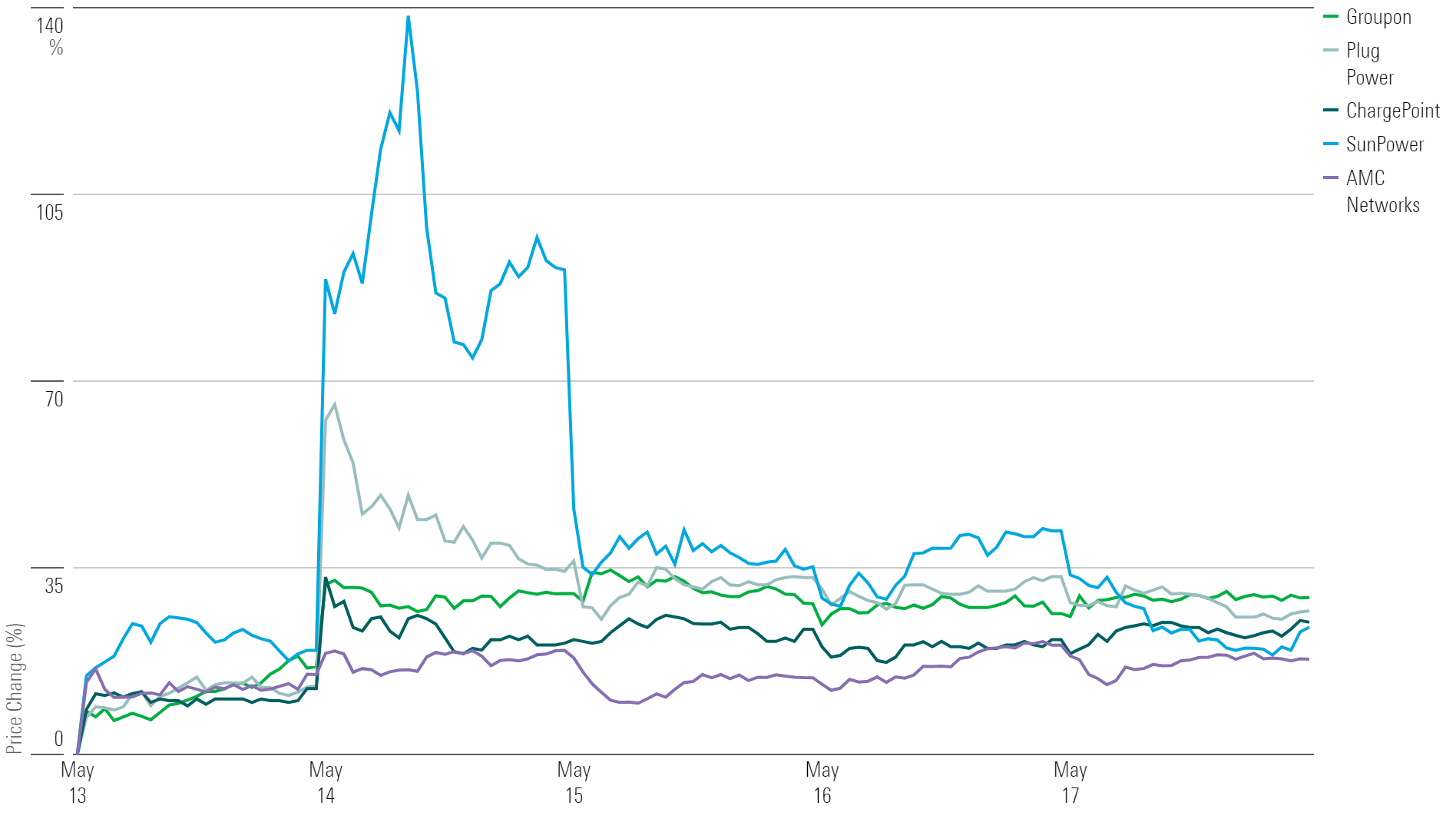

What Stocks Are Up?

Groupon GRPN, Plug Power PLUG, ChargePoint CHPT, SunPower SPWR, and AMC Networks AMCX.

Best-Performing Stocks of the Week

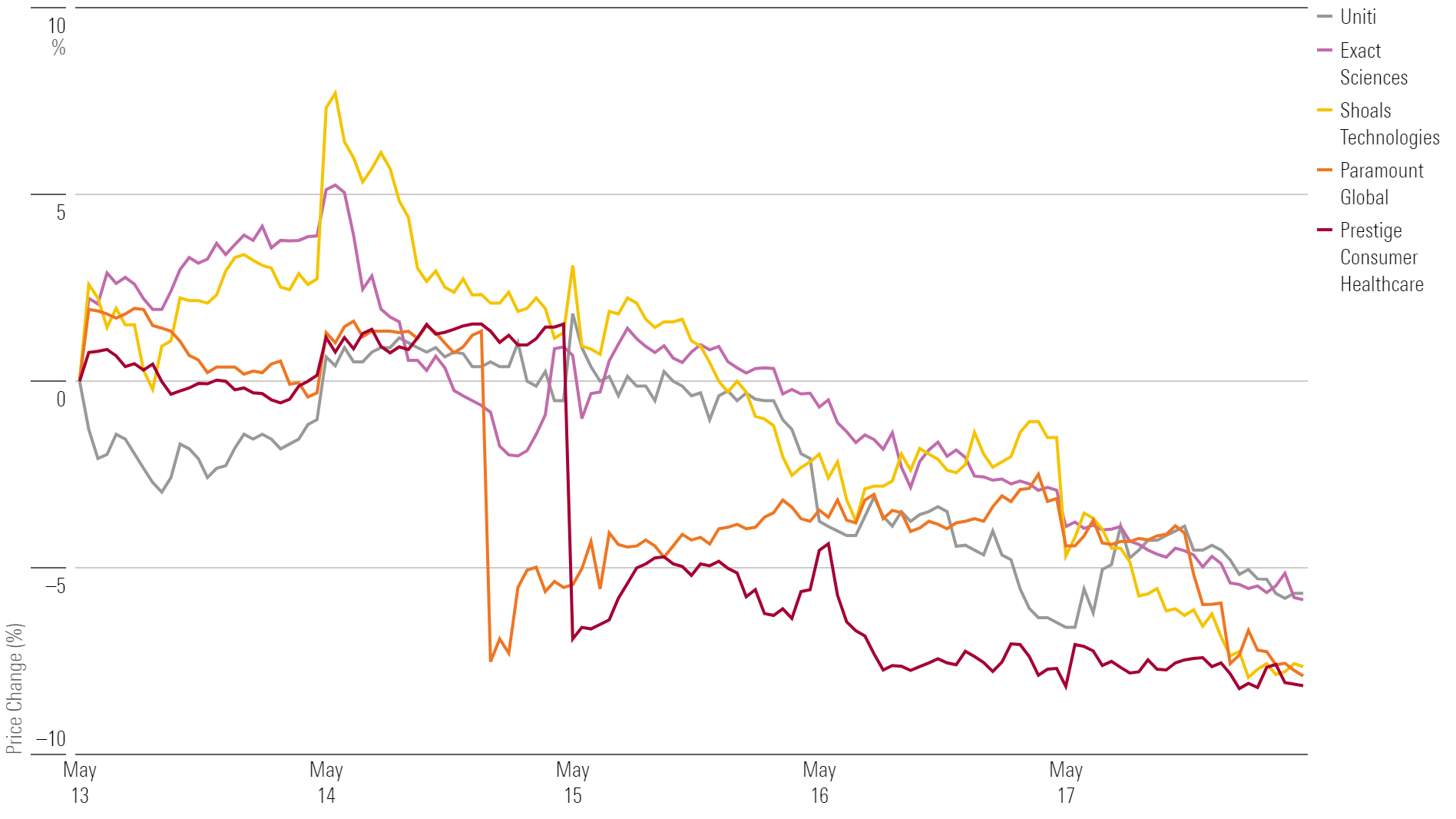

What Stocks Are Down?

Prestige Consumer Healthcare PBH, Paramount Global PARA, Shoals Technologies SHLS, Exact Sciences EXAS, and Uniti Group UNIT.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MMHQLYAKXBAGNG7XEYXPX4Y4S4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)