Private Equity: How Much Should You Allocate?

What to know about the benefits and risks for your portfolio.

Recently, we have seen innovations that have made investing in private equity not only simpler but less costly.

One of the negatives of private equity was that investments were generally in the form of partnerships, with investors being limited partners who received Schedule K-1s at the end of the year. The K-1s typically arrived well after the April 15 filing date, requiring extensions. The preparation of the K-1s and the need to file extensions increased the costs of investing in these vehicles.

Another negative was that investors had to make commitments with capital calls coming at unknown dates, requiring them to keep liquid assets sufficient to meet the capital calls.

A third negative was the expense, typically 2% plus a carry (performance) fee of 20% once returns exceeded a hurdle rate (such as 7% with catch-ups for years when performance was below the hurdle). And a fourth negative was often very large minimums (such as $1 million or more).

Private Equity Made Easier

Today, fund families such as Voya VOYA, JPMorgan, and Pantheon (full disclosure: I have personal investments in JPMorgan Private Markets Fund and Pantheon) have introduced what are called “evergreen” funds. These funds typically have the following attributes:

- Smaller minimum investments. (For Voya, it’s just $25,000.)

- Use 1099s for tax reporting instead of K-1s.

- No capital calls. Investments can be made on a quarterly basis, as can requests for withdrawals (which are subject to limitations, typically 5% of total fund assets).

- Can provide diversification across multiple managers.

- To help minimize expenses, they typically have significant allocations to secondaries (usually bought at discounts ranging from 8% to 12%, or more in times of distress) and direct co-investments (avoiding the expenses of the originating private equity fund). For example, as of Oct. 31, 2023, almost 90% of Voya’s fund, Pomona Capital, were either secondaries or co-investments. (AMG Pantheon’s allocations were even higher.) Pomona’s I-shares had a management fee of 1.65% and total direct expenses of 2.4% (well below the typical 2% management fee/20% performance fee). Note that underlying manager fees do apply, but some of that is offset by the discounts available on secondaries. Even so, total costs should be well below those of a 2/20 structure.

With the recent innovations, how should investors determine their allocation to private equity?

Sizing the Private Equity Allocation

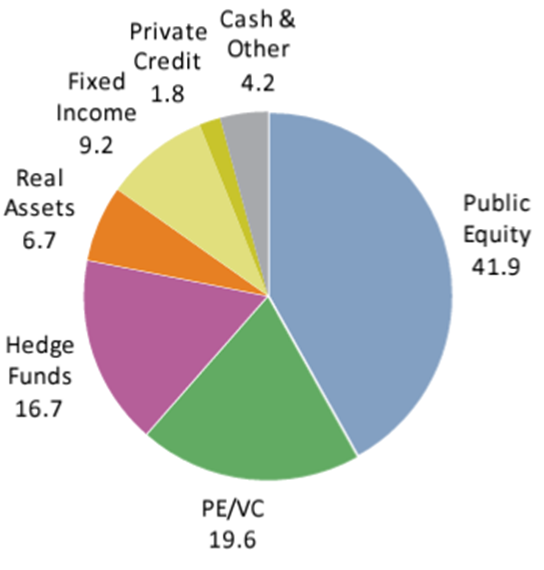

In its Fourth Quarter 2022 Endowments Quarterly, Cambridge Associates reported that about one third of endowments’ allocation to equities was in private equity (19.6% of total equity allocation of 61.5%). It also reported that endowments with more than $3 billion in assets had allocations to private equity of 27.2%.

Mean Average Asset Allocation

Is a one third of the equity allocation held by endowments (or even higher for large endowments) appropriate for individual investors? To answer that question, a good starting point is global market capitalizations—how investors collectively allocate capital. According to the World Federation of Stock Exchanges, there is $107 trillion in public equity market capitalization globally. According to McKinsey, private-markets assets under management are at $13 trillion. That suggests that unless investors view themselves as having a significantly different risk profile (including exposure to illiquidity risk), 10% of the equity allocation should be allocated to private equity. Those having a greater (lower) tolerance for illiquidity risk could consider a higher (lower) allocation.

There is one other consideration. Because private firms are typically smaller than public companies, investors seeking greater than market exposure to small companies could consider a higher allocation to private equity.

Investor Takeaways

The research shows that private equity is one asset class where there has been evidence of persistence in performance among both the top and bottom performers. However, this advantage has been true only in venture capital, not in leveraged buyouts.

In addition, because of the extreme volatility and skewness of private equity returns, it is important to diversify the risks. That is best achieved by investing indirectly through a private equity fund rather than through direct investments in individual companies. Because most such funds limit their investments to a relatively small number, it is also prudent to diversify by investing in more than one fund or in a fund that invests across multiple managers. And it’s worth considering investing in funds that focus on secondaries and co-investments to further reduce costs.

Finally, if you are willing to sacrifice liquidity to gain access to the asset class, you should require that a manager has a long history of persistent superior (top-quartile) performance and relatively low expenses compared with their competitors.

Larry Swedroe is the author, or co-author, of 18 books on investing. His latest is “Enrich Your Future: The Keys to Successful Investing.”

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BL6WGG72URAJJJCPC4376SZKX4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)