Interval Funds: Are They Worth What You Give Up?

Investors can access strategies that would otherwise be out of reach, such as private credit.

Capital Group’s plans to partner with KKR in launching two interval funds in 2025 is only the latest sign of interest from two well-known asset managers in this increasingly popular structure. To help investors navigate interval funds’ strengths and weaknesses while considering their role in a portfolio, Morningstar manager research analysts recently published an extensive guide to interval funds. This article draws from that report to help investors make informed decisions about interval funds.

What Are Interval Funds?

Interval funds combine features of both open- and closed-end fund structures, offering regular investors and advisors access to assets and strategies that would otherwise be out of their reach. The currently booming private credit market is one example.

In fact, both bond and equity issuance has been moving from the public markets into the private markets, and so the opportunity set for public-only strategies (most mutual funds and exchange-traded funds) is not meaningfully growing and is in some cases shrinking. The ability to invest across both public and private markets in a single vehicle drastically increases the opportunity set available to both asset managers and investors. As capital markets evolve, so do the ways in which investors access them.

Investors can purchase interval fund shares any day the market is open, but they have only limited freedom to sell them. This limitation, however, grants interval funds a key strength: the ability to invest in assets with significant long-term return potential but that are too illiquid for mutual funds or ETFs. It’s axiomatic that investors should expect a higher return than is available from publicly traded securities for bearing liquidity risk, which typically comes in the form of a liquidity premium, such as a higher yield (in the case of bonds) or a higher expected return (in the case of equity). Given the wave of baby boomers entering retirement age—more Americans are set to turn 65 this year than any other time in the nation’s history—the demand for assets that meet significant retirement income needs is likely only to grow.

Interval fund fees may be competitive if not cheap compared with most private equity or credit funds, which may levy as much as a 2% annual asset-based charge and take 20% of the profits, but they are high relative to ETFs and open-end funds. The current average prospectus adjusted expense ratio across all interval fund share classes is 2.49%, versus 0.58% and 0.99% for ETFs and mutual funds, respectively. Without very strong returns, that kind of price tag could still eat up a chunk of the liquidity premium expected from assets in an interval fund.

Sourcing, assessing, and monitoring the private assets that most interval funds hold may be costly. Yet, interval funds have avoided the price competition from passive options that has caused so much fee compression in the mutual fund world. Asset managers have noticed interval funds’ potential to earn them higher fees as well as their broadened investment universe that could justify those fees, at least for the best-in-class options.

Growth of Interval Funds: Slowly, Then All at Once

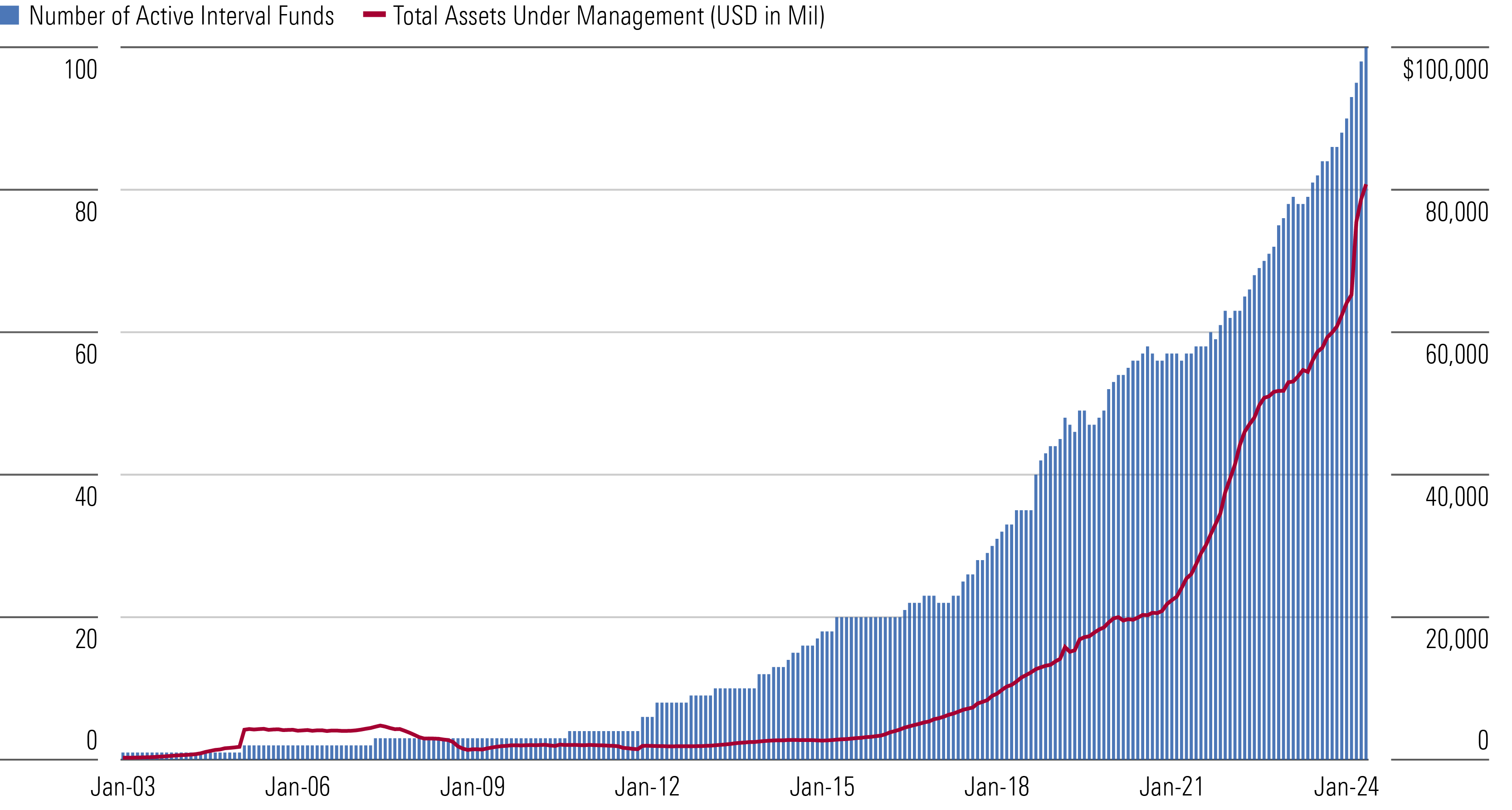

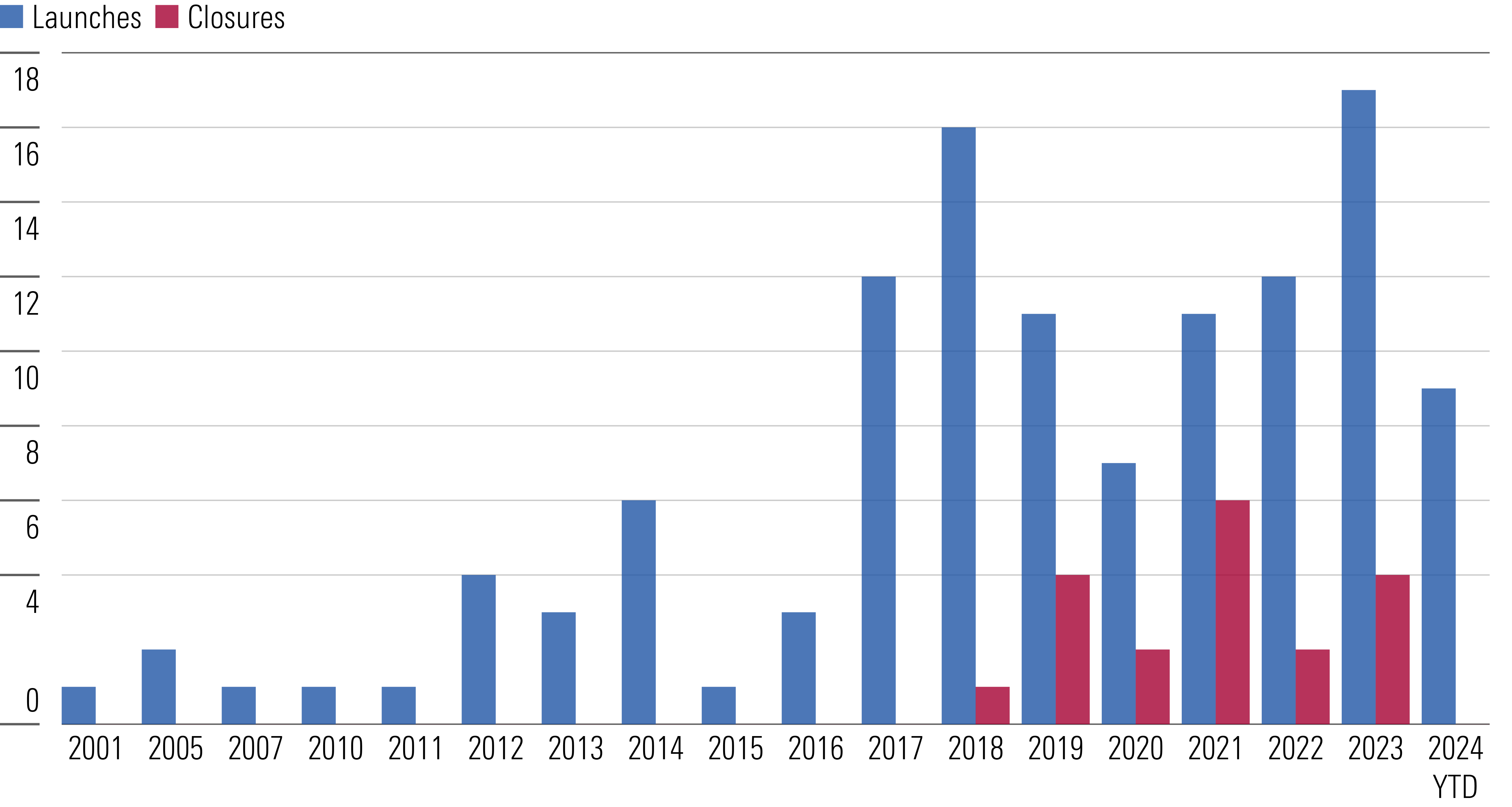

New interval fund launches hit double digits in 2017 and have averaged 12 per year since then through 2023, while 2024 is on track to see the most launches yet. Meanwhile, interval funds’ assets under management have grown almost 40% per year to $80 billion over the past 10 years through May 2024.

Exhibit 1: Growth of Interval Funds

Exhibit 2: Interval Fund Launches and Closures

Capital Group’s entrance into the market might act as a “the water’s fine, come on in” signal to other asset managers, especially those that have thus far stood on the sidelines. Barring a bursting bubble in the private debt and equity markets, all signs point to continued interval fund growth.

How the Interval Fund Structure Works

The interval fund structure is likely new to most investors and advisors, and some may find that its complexity and restrictions outweigh its benefits. The industry standard cadence for interval funds’ periodic redemption (or repurchase) offers is quarterly, with some offering monthly opportunities and others only semiannual.

Not only must shareholders wait for a repurchase window to sell their shares back to the fund company, but most also limit the number of shares they can collectively redeem to 5% in a single window. If shareholders together try to redeem more than the offered number of shares, the fund will execute sales on a pro rata basis.

Shareholders may therefore find it difficult to sell all their shares at once, especially if there is a market panic or an event that prompts a rush for the exits. Interval funds might be good vehicles for investing in illiquid assets, but they should also be considered illiquid themselves.

Still, letting shareholders sell shares periodically, even with limitations, means the amount of illiquid assets interval funds can responsibly own is also limited. Assuming the industry standard of quarterly repurchase offers for 5%, an interval fund manager should plan to be ready for potential withdrawals of up to 20% each year.

Landscape of Existing Interval Funds

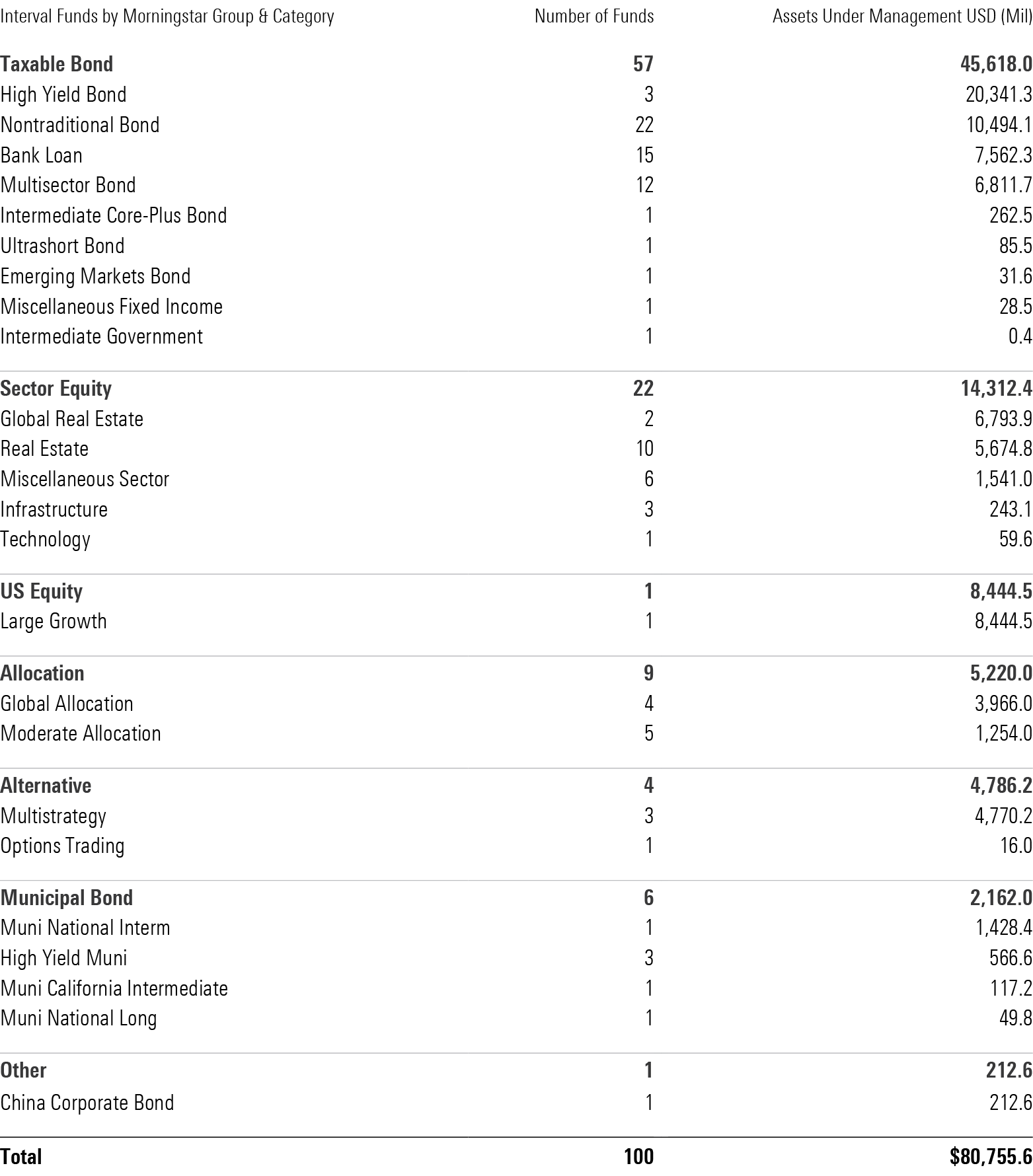

Given their need to periodically meet redemptions, the interval fund structure seems to work best with assets that generate regular income or can be sold in weeks or months, such as bonds, floating-rate loans, and structured credit. Asset managers have recognized that as well—64 of the 100 interval funds in Morningstar’s database land in a bond category.

Exhibit 3: Interval Funds by Morningstar Group and Category

On the other hand, several interval funds invest in private equity, venture capital, or niche markets like fine art. Private equity and venture capital investments, whether made directly or through private funds, can take years before they bear fruit, and they generally can’t be sold at all outside of special circumstances or an active secondary market.

If the interval fund accesses those markets by purchasing private funds, then the interval fund is often on the hook to make additional future investments when called upon. Those capital calls can put additional demands on an interval fund’s cash, often at the same time shareholders are asking to withdraw their money, leading to potentially damaging outcomes.

In one instance, the Wildermuth Fund WEIFX was forced to halt both purchases and redemptions and instead begin to liquidate its portfolio. The fund had primarily made direct equity investments in private companies but operated with very little cash, and shareholders withdrew the maximum amount (5%) for at least four quarterly repurchase windows in a row between April 2022 and January 2023.[i] The fund entered liquidation in June 2023 and is still in liquidation as of this writing. According to a January 2024 letter to shareholders, the fund’s manager expects the liquidation to take several more years.

Separate the Good From the Bad

The Wildermuth Fund saga is a cautionary tale. Interval funds put investment strategies and assets that were historically the purview of institutions and high-net-worth investors within reach of the broader investing public. But they are best utilized by investors who do not need access to their capital for a long time.

Even if investors have the means and circumstances to accept the long holding periods that successful interval fund investing likely requires, the degree to which they are likely to enhance long-term portfolio returns is at least open to debate. Less liquid assets such as private credit and private equity are still credit and equity—they will perform poorly in the same kind of market as high-yield bonds or small-cap equity. If all an investor is looking for is amplified return, then it might be best to stick with funds focused on public securities that charge low fees.

In the end, the decision to own an interval fund is best made for specific reasons, such as their contribution to retirement income or as an uncorrelated asset that improves an investor’s total wealth. Most investors, however, can succeed in achieving their financial goals without recourse to this investment vehicle, its attractive features notwithstanding.

[i] For the April 2022 offer, shareholders requested to redeem 27.36% of shares outstanding; for July 2022, 27.9%; for October 2022, 32.8%; and for January 2023, 38.4%. Most of those requests went unfilled.

Correction: This text was corrected to note that interval funds’ assets under management grew almost 40% per year to $80 billion over the past 10 years through May 2024, not April 2024.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BL6WGG72URAJJJCPC4376SZKX4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)