Catastrophe Bonds as Portfolio Diversifiers: Pros and Cons

They come with risks, but these bonds have low correlation with common asset classes.

The holy grail of investments is one with a risk premium that is uncorrelated with the economic cycle risks associated with traditional stocks and bonds. (Stock market crashes don’t cause earthquakes, hurricanes, or other natural disasters, and natural disasters tend not to cause bear markets, either in stocks or bonds.) Catastrophe bonds—commonly called cat bonds—fit that profile, providing diversification benefits with the potential for higher risk-adjusted returns with lower volatility.

Cat bonds are income instruments typically structured as floating-rate, principal-at-risk notes. Common sizes range from $50 million to $500 million, although the market has at times supported deals as large as $1 billion to $2 billion. Maturity tends to be in the one- to five-year range, with three to four years being the norm. Bond proceeds are commonly held in a dedicated collateral account within a special-purpose reinsurance vehicle, which protects counterparties from credit risk—the risk is the insurance risk from predefined catastrophes. Typically, the terms of the bond will allow the collateral to be invested in government-backed debt or other highly rated and highly liquid debt instruments. Market convention since the global financial crisis is to invest the collateral in US T-bill money market funds or floating-rate IBRD (World Bank) debt. The investors receive quarterly or monthly coupons for the term of the bond, made up of the return on the collateral plus the risk premium paid by the insurance company counterparty to transfer the risk.

An open-end mutual fund focused on cat bonds (such as Stone Ridge High Yield Reinsurance Risk Premium SHRIX, Ambassador EMPIX, and Pioneer Cat Bond CBYYX) invests in the liquid subset of the insurance-linked securities market (which includes quota share agreements generally found in interval funds that provide only quarterly liquidity). The more liquid subset of the asset class in a mutual fund structure offers an opportunity for investors who prefer daily liquidity.

Risks of Cat Bonds

Catastrophe bonds may cover specific or multiple perils in one or more locations. Coverage can be based on several different event definitions, such as “per occurrence” losses (exposure to a single event), “annual aggregate” losses (exposure to multiple events over the course of a year), or “frequency” losses (exposure once a specific second or third event has occurred within a defined risk period). Should any of the predefined events occur, assets are liquidated from the collateral account and paid to the sponsor to cover the insured loss claims, and coupon payments are reduced or ceased.

Most cat bonds do not have a binary trigger for the loss of principal. This means that bonds may be only partially impaired if an event occurs. Each bond has an attachment point (the loss amount which, when exceeded, triggers a payout from the bondholder) and an exhaustion point (the maximum loss amount for which the bondholder is liable). Most cat bonds come with an “extension period,” which the sponsor can use to extend the maturity of the bond when a qualifying event has occurred but the ultimate loss is not yet known. This allows time to receive third-party loss estimates or collect claims and calculate the final balance sheet impact. How quickly this process can be undertaken depends on the type and structure of the bond: It can be as long as three or four years but is typically quicker. An extension spread is paid over this period. Finally, at maturity, or following the extension period, the investor receives the principal remaining in the collateral account net of any payouts to the sponsor.

Cat Bonds’ Covered Perils

The cat bond market covers a wide range of defined perils. While this includes several non-natural perils, such as mortgage insurance risk, aviation, marine, extreme mortality, life, healthcare, and terrorist attacks, the majority cover damage from natural catastrophes. This includes windstorms, earthquakes, flooding, and wildfires. US wind-related risk represents a large proportion of the risk transferred into the cat bond market because US hurricane and earthquake exposure is the biggest risk on the insurance industry’s balance sheet. Regionally, Japan and Europe have the most coverage after North America.

Types of Cat Bond Triggers

Attractive Return Potential

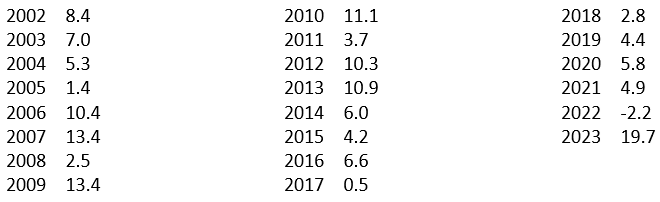

Cat bonds offer attractive potential risk-adjusted returns. Cat bond indexes have demonstrated annual positive returns in 21 of the past 22 years. The table below shows returns of the Swiss Re Global Catastrophe Bond Total Return Index, a noninvestable index of all natural catastrophe bonds in the market.

Yearly Returns (%) of the Swiss Re Global Catastrophe Bond Total Return Index 2002-23

The annualized return over the period was 6.7% (a premium over one-month Treasury bills of 5.4 percentage points), and the standard deviation of returns was just 5%. That combination produced a Sharpe ratio of 1.16, virtually double that of the Sharpe ratio of the Vanguard S&P 500 Index VFIAX of 0.49. Note that the strongest returns came after periods of weak returns caused by some significant natural disasters. The poor returns led to higher premiums and tighter underwriting standards (including larger deductibles).

Cat Bonds as a Diversification Tool

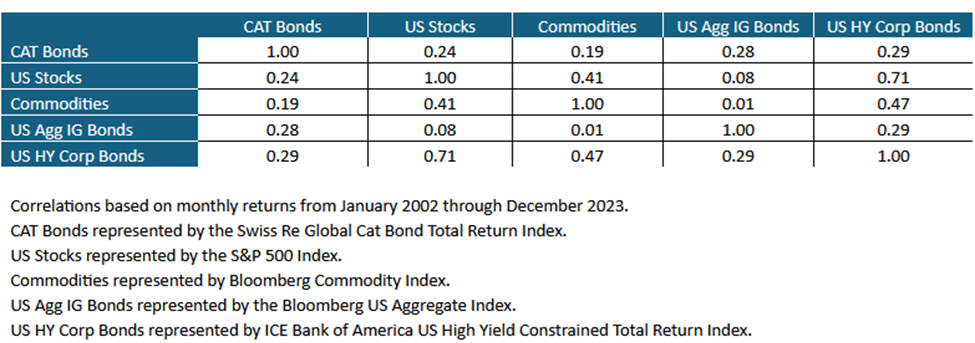

Cat bonds are outcome-oriented investments that have had low correlation to US equities, commodities, investment-grade bonds, and high-yield bonds, as their returns are driven mostly by nonfinancial events.

Diversification of Cat Bonds

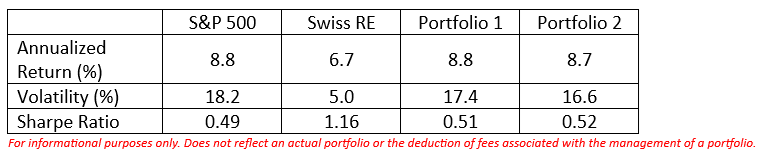

The diversification benefits can be seen in hypothetical portfolios combining cat bonds with an investment in the S&P 500 index. The table below shows the returns to the S&P 500 as well as the Swiss Re Global Catastrophe Global Bond Total Return Index. Portfolio 1 is a hypothetical allocation of 95% S&P 500 and 5% Swiss Re, and Portfolio 2 is 90% S&P 500 and 10% Swiss Re. Annual rebalancing was assumed.

Returns of the S&P 500 and Swiss Re vs. Two Portfolios, 2002-23

Note the improvement in the Sharpe ratio with the addition of the allocations to cat bonds.

Negative Feature of Cat Bonds

Cat bonds’ returns are negatively skewed, as positive returns are limited by the size of the premium and the interest on collateral, while losses could be as large as 100%.

Investor Takeaways

Cat bonds have provided investors with strong diversification benefits while providing equitylike returns (a risk premium of 5.4%), with volatility that has been less than one third that of equities. The result has been attractive risk-adjusted returns. Investors willing to accept the left tail risk associated with catastrophe risk should find cat bonds an attractive diversifier to the risks of traditional stock and bond portfolios.

With that said, it is worth noting that, for investors willing and able to forgo the daily liquidity provided by cat bonds, there is a more financially rewarding alternative in funds that provide exposure to quota shares as well as cat bonds. Quota shares are risk-sharing agreements with reinsurers that can be held in interval funds that provide limited quarterly liquidity—typically a minimum of 5% a quarter.

Given that investors prefer liquid assets, illiquid assets come with significant risk premiums. In addition, the interval fund is more diversified geographically and includes more perils. On the other hand, because it tends to have contracts that are less “out of the money” (it has lower deductibles), while the interval fund’s expected returns are higher, its risks are also higher. Thus, while the interval fund’s expected returns are higher, its risks are also higher.

Correction: A previous version of this article contained information that the author was not authorized to disclose. That information has been deleted.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-11-2024/t_a4a9c8e4b4944a9fab91f0fccfde5dcc_name_MIC_24_Jerome_Schneider_Speaker_1920x1080.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)