A Way to Protect Your Portfolio Against Bond Price Drops

Two bank-loan funds to consider when interest rates rise.

Recent Morningstar research suggests investors should consider bank-loan funds in their bond portfolios. Below-investment-grade companies typically issue bank loans, also known as leveraged loans, at floating interest rates. Their benefits come with more default risk but can also help protect against bond price drops when rates rise.

The Federal Reserve’s repeated 2022 rate increases to combat inflation, for example, clobbered US stocks and investment-grade bonds, which shed nearly 20% and 13%, respectively. The Morningstar LSTA US Leveraged Loan Index, however, fell only 0.8% that year, and it has been one of the better-performing fixed-income asset classes for more than a decade.

Owning bank-loan strategies requires perspective. Index funds are not a default option as in many other asset classes. A strong active option may be better even though most managers struggle to beat the benchmark. Here’s a look at why the benchmark is difficult to beat, why passive funds aren’t appealing, and two active bank-loan strategies to consider.

A Difficult Benchmark

Bank-loan strategies lagging the index is not a new phenomenon. Indeed, the average actively managed bank-loan fund lagged Morningstar’s leveraged loan index in nine of the past 10 calendar years.

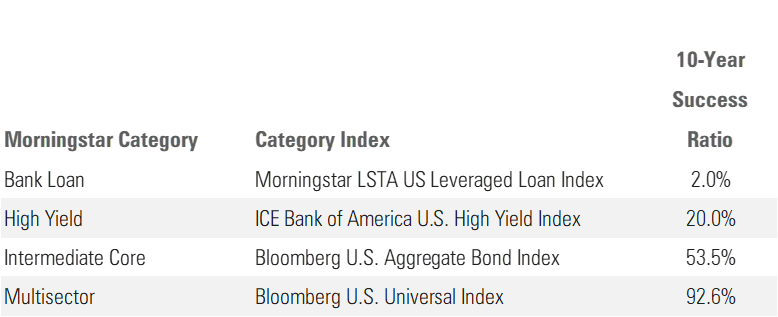

Many above-average actively managed bank-loan funds also struggled against the benchmark. Only 2% of them beat the index after fees over the trailing 10 years through February 2024. By contrast, the success ratio for high-yield, intermediate core, and multisector funds against their respective benchmarks over the same period was 10 to 46 times higher.

10-Year Success Ratios

What Makes Indexing Loans Different?

Indexes receive full allocations to loan deals at par value without sacrificing any additional cost and stay fully invested in the asset class, something that would court considerable risk for active managers. That’s because bank loans aren’t regulated in the same way as stocks and bonds, and trades can take over 20 days to settle, versus one to two days for typical cash bonds.

Holding loans through a fund mitigates those longer settlement times, but the asset class is also more vulnerable to narrow market shocks. In fact, most bank-loan managers keep between 10% and 15% of assets in bonds and cash to offset loans’ inherent liquidity mismatch.

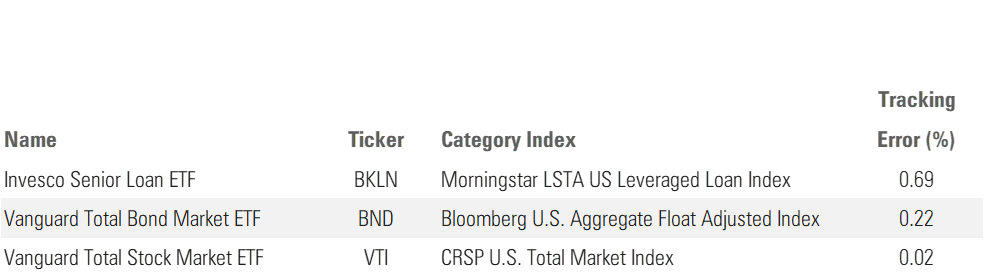

The sole passive bank-loan option available, Invesco Senior Loan ETF BKLN, faces those challenges, too. With an expense ratio of 0.65% per year, it is pricier than many actively managed strategies. BKLN tracks the more constrained Morningstar LSTA US Leveraged Loan 100 Index, which has consistently underperformed its broader counterpart, and its tracking error over the past decade versus its benchmark was more than 3 times greater than a typical investment-grade bond exchange-traded fund and more than 30 times greater than a typical broad-market stock ETF.

10-Year Tracking Error

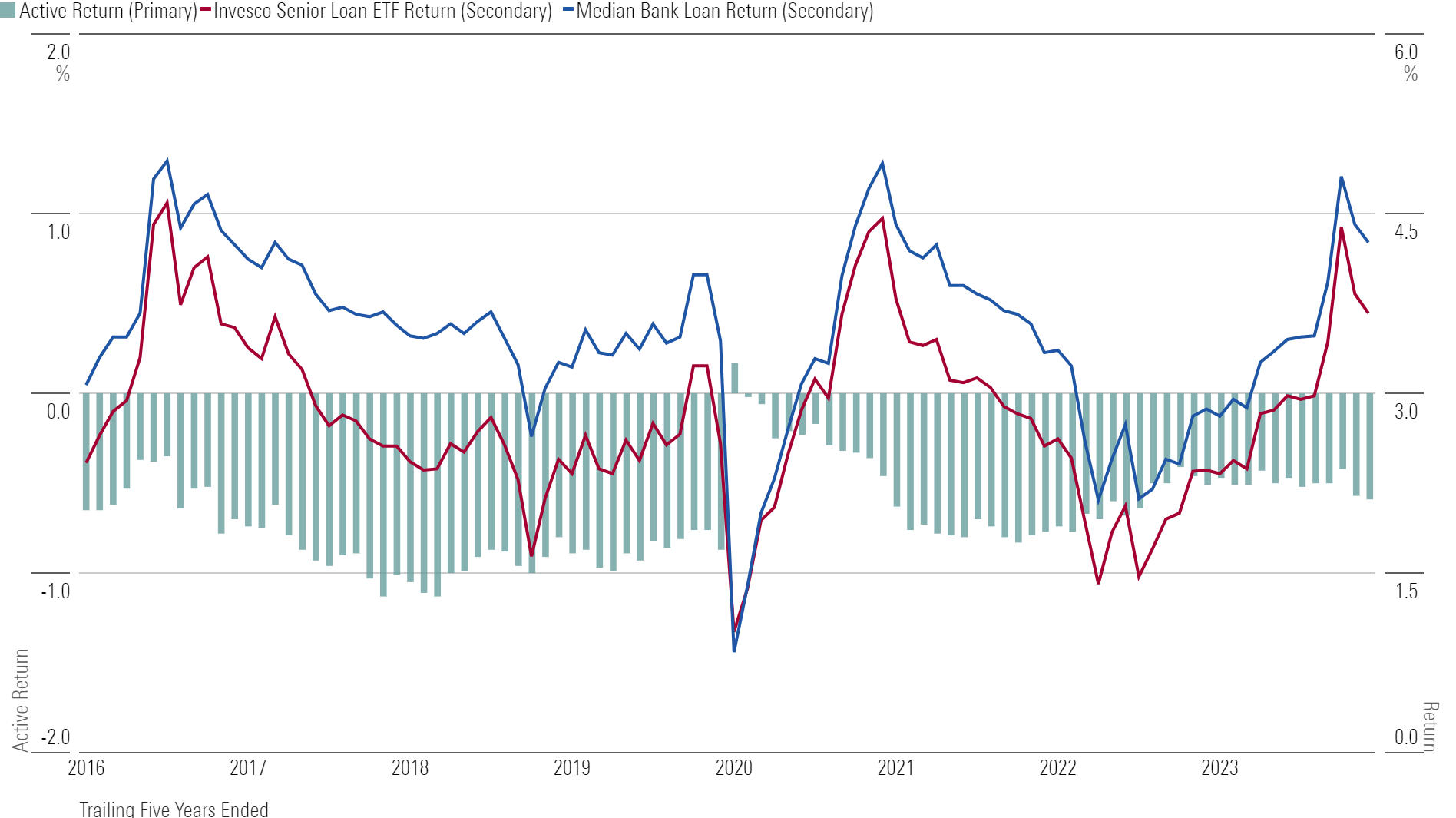

Invesco Senior Loan ETF also has a subpar record within the bank loan Morningstar Category. In the 96 rolling five-year periods from the ETF’s 2011 inception through February 2024, it lagged the distinct peer median in all but one of them. Risk-adjusted results weren’t much better.

Rolling Five-Year Returns

Two Best-in-Class Actively Managed Bank-Loan Funds

Picking the right actively managed bank-loan fund isn’t merely a matter of choosing the top performer over a recent trailing period. That’s true of any asset class, but especially for funds holding leveraged loans since a top performer in one period may have taken too much risk to get there.

Here are two standouts that have earned High People and Process Pillar ratings and Morningstar Medalist Ratings of Gold for their cheapest share classes because of their credit research and liquidity management, among other strengths.

T. Rowe Price Institutional Floating Rate’s RPIFX sensible guidelines and high-powered research bench help it stand out. Paul Massaro, a manager here since 2008, draws upon a stable bench of 20 high-yield and bank-loan researchers. Massaro emphasizes BB and B rated loans but will add CCC rated loans when their valuations look good. The team’s size, experience, and long relationships with private equity sponsors give it access to opportunities that many rivals miss, such as second-lien CCC loans. Retail investors can bypass the fund’s $1 million minimum initial investment with the ETF version of the strategy, T. Rowe Price Floating Rate ETF TFLR, which launched in November 2022.

Fidelity Advisor Floating Rate High Income’s FIQSX scale and research depth make it among the category’s most compelling options. Veteran Fidelity manager Eric Mollenhauer has guided the effort for over a decade, but he hasn’t done so alone. He and comanagers Kevin Nielsen and Chandler Perine all rose through Fidelity’s high-yield research ranks, a group that typically totals over 20 specialists. At over $13 billion in assets under management, by far the category’s largest, this strategy also has strong relationships with private equity sponsors that give it access to harder-to-source deals.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f490381f-5450-44be-b474-313f03204bfb.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-11-2024/t_a4a9c8e4b4944a9fab91f0fccfde5dcc_name_MIC_24_Jerome_Schneider_Speaker_1920x1080.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f490381f-5450-44be-b474-313f03204bfb.jpg)