5 Undervalued Stocks From Morningstar’s New LGBTQ+ Index

As we celebrate Pride Month, we examine mid- and large-cap companies with the most inclusive LGBTQ+ policies.

For many sustainable investors, picking companies may depend on how the firms approach diversity, equity, and inclusion. DEI is a cornerstone of the “social” pillar of environmental, social, and governance investing, which is often a synonym for sustainable investing. The new Morningstar Developed Markets LGBTQ+ Leaders Index addresses some of those needs. Below, we’ll describe the index and list some of its cheapest stocks that you may want to research further.

There are many benefits for corporations to have robust DEI initiatives. Embracing inclusivity helps companies attract a broader spectrum of talents and perspectives. Furthermore, firms with strong diversity and inclusion frameworks typically demonstrate superior risk-management strategies and have lower turnover rates and higher employee satisfaction.

Opportunities for investing centered on sexual orientation have been limited.

Morningstar launched the Developed Markets LGBTQ+ Leaders Index in June 2024. Its socially focused indexes also include the Morningstar Minority Empowerment Index, the Morningstar Gender Diversity Indexes, and the Morningstar Women’s Empowerment Index.

Creating the LGBTQ+ Leaders Index

To construct the index, Morningstar took the Morningstar Developed Markets Target Market Exposure Index and then screened using the following criteria:

- Must not have any revenue involvement in controversial weapons (essential or nonessential) or tobacco as measured by Sustainalytics product involvement screens.

- Must be compliant with the Principles of United Nations Global Compact criteria as measured by Sustainalytics’ Global Standards Screening.

- Must not have a severe controversy rating (or a level of 5) as measured by Sustainalytics’ Controversies Research.

- ·Must have a score of 3 or above on the ExecuPride Assessment Scale.

From there, Morningstar ranked and sorted the companies by their LGBTQ+ score, based on ExecuPride data, with the highest scores from each of the 11 sectors added to the index from three regions: North America, Europe, and Asia-Pacific. The index has 100 constituents, and constituents are capped at a 5% weight.

ExecuPride Methodology

To measure the LGBTQ+ inclusivity of a company, Morningstar used ExecuPride’s seven-level assessment scale. ExecuPride’s methodology uses publicly available data based on direct evidence of diversity and inclusion policies, initiatives, and support structures within a company.

Below is ExecuPride’s methodology, with 1 being the lowest score and 7 being the best.

| Score | Requirement |

|---|---|

| 0 | No effort or commitment found on the website or annual reports to integrate diversity and inclusion as a part of the company’s culture. |

| 1 | Some visible effort to evaluate diversity and inclusion. |

| 2 | A clear diversity and inclusion approach. |

| 3 | A clear diversity and inclusion approach, with a special mention for LGBTQ+ matters. |

| 4 | Having an LGBTQ+ employee resource group. |

| 5 | Be an official supporter of UN Standards of Conduct for Business Tackling Discrimination Against Lesbian, Gay, Bi, Trans, and Intersex People. |

| 6 | Senior leaders actively communicate their support for LGBTQ+ employees and employee resource group leaders are made public on company website or reports. |

| 7 | LGBTQIA+ person or ally in the executive team and all of the above. |

Top Returns This Year

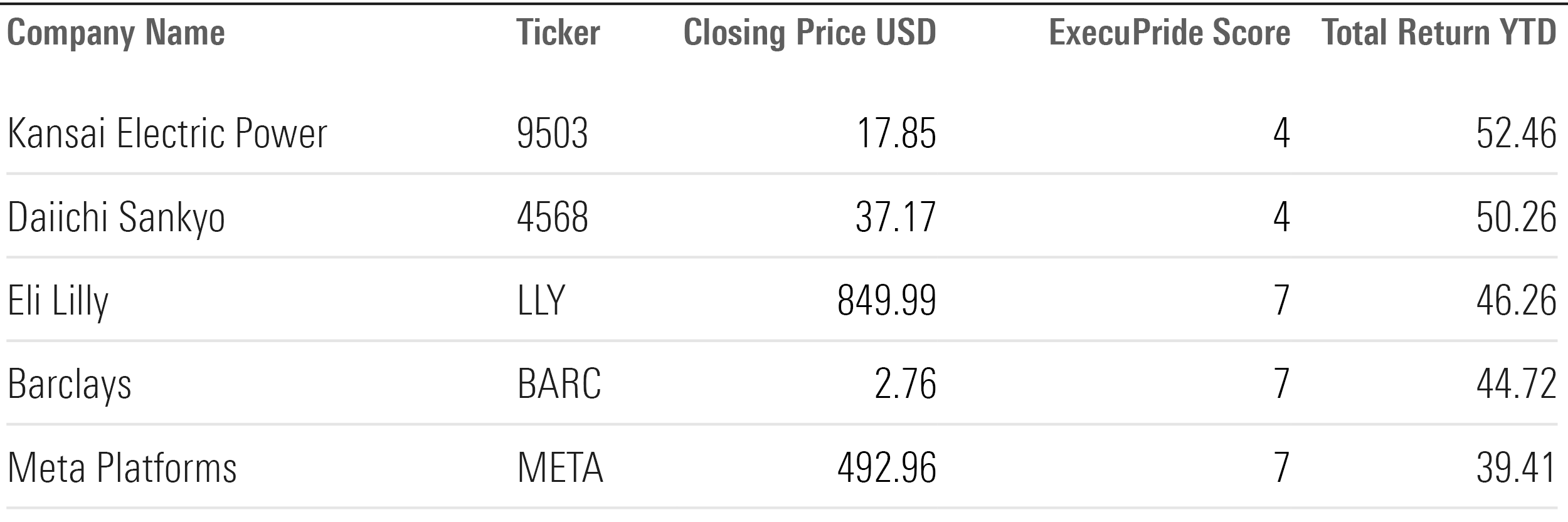

We sorted the data a few ways, which you’ll see below. Kansai Electric Power topped the list for stock price performers since Dec. 31.

The Index's 5 Top-Performing Constituents for the Year to Date

Worst Returns This Year

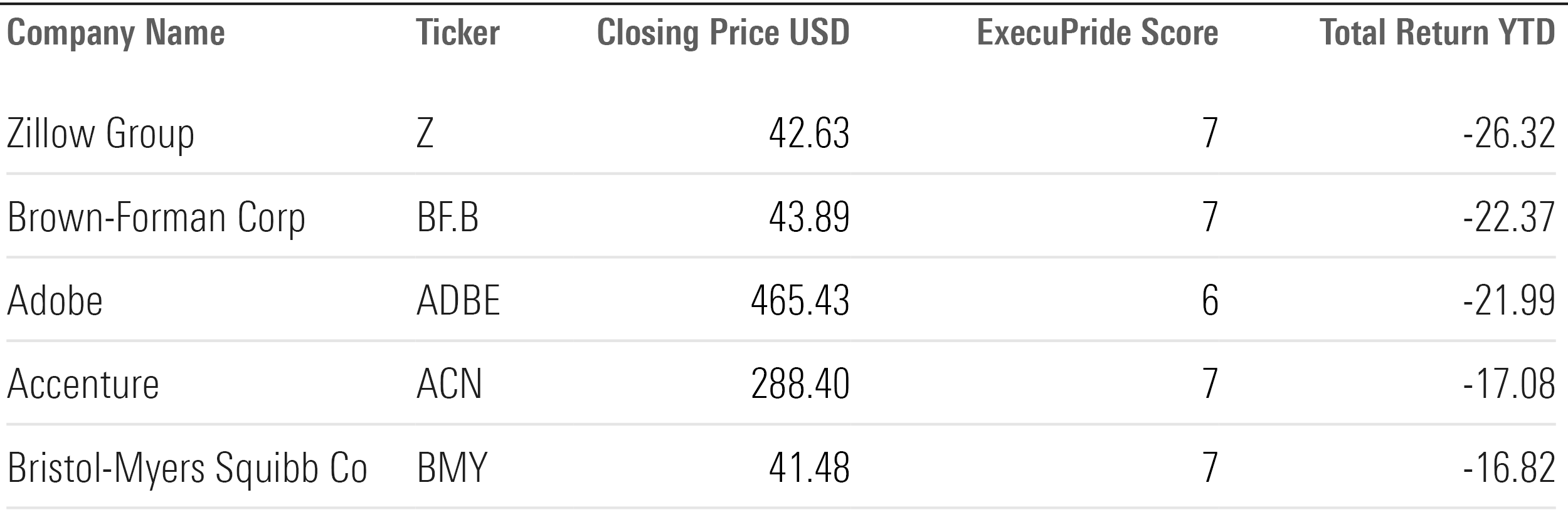

We also looked for the index’s worst performers this year. Zillow Z topped the group.

The Index's 5 Worst-Performing Constituents for the Year to Date

Highest-Yielding LGBTQ+ Index Stocks

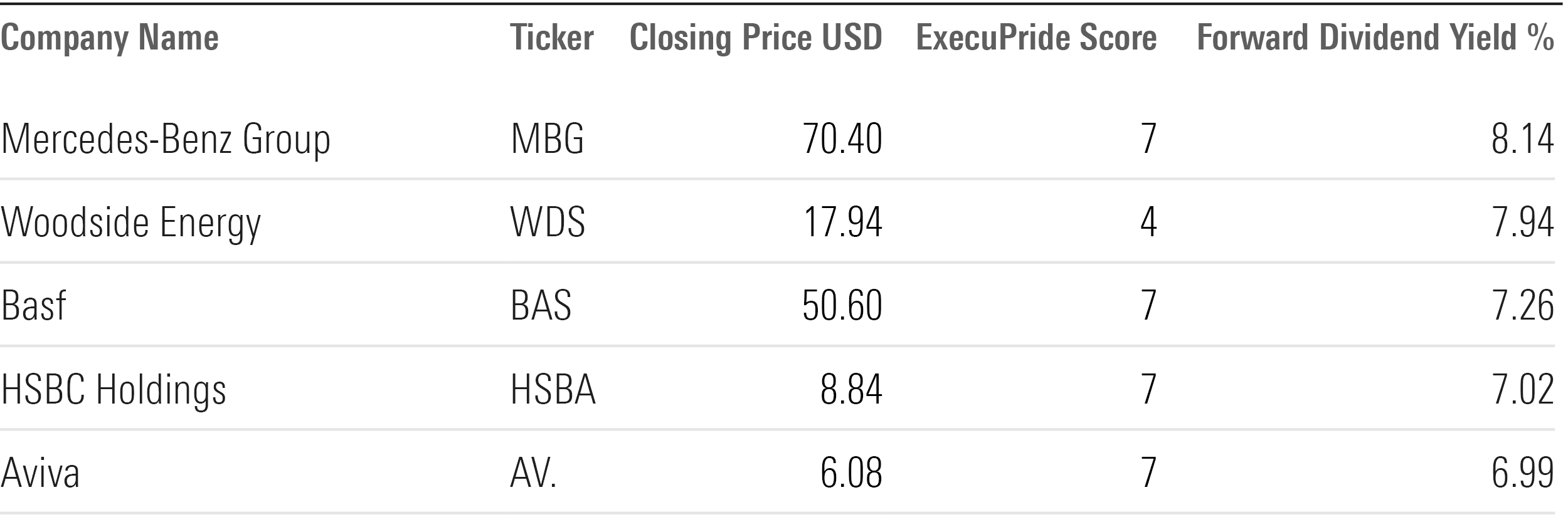

Top on this list was Mercedes-Benz, with a forward yield of 8.14%.

The Index's 5 Highest-Yielding Constituents

Cheapest Stocks in the LGBTQ+ Index

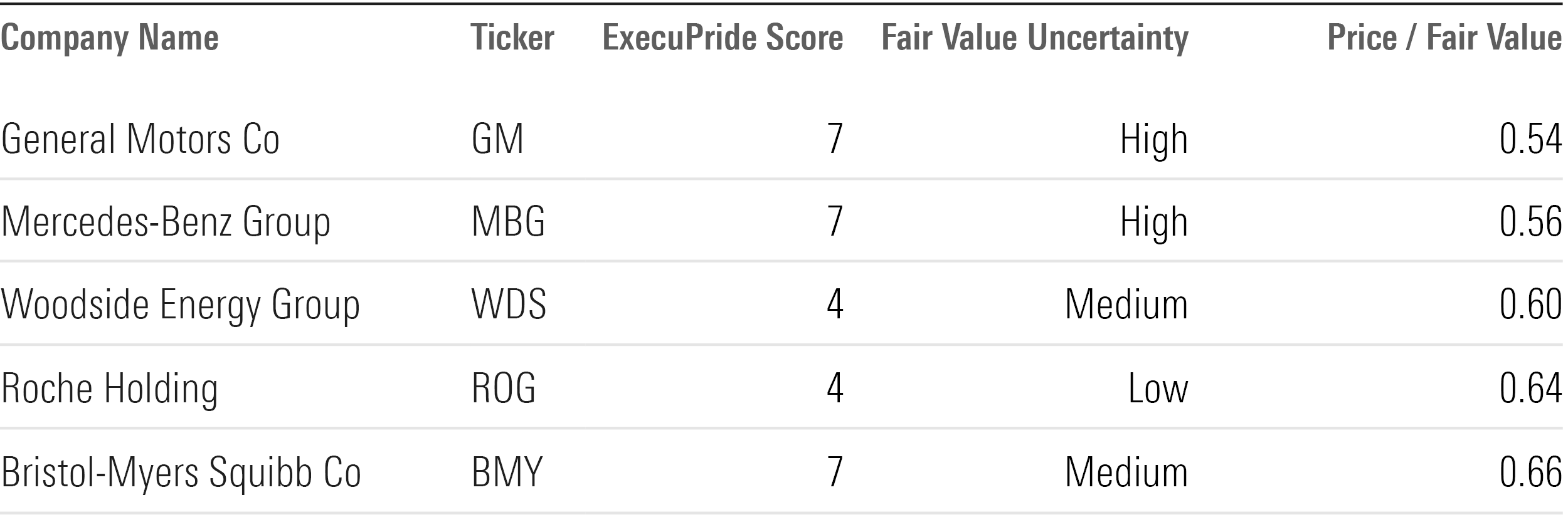

Finally, we also sorted the index in terms of cheapness. General Motors led the pack in terms of discount to fair value. You can read Morningstar’s write-ups below for the five stocks in the table.

The Index's 5 Cheapest Constituents Based on Price/Fair Value

General Motors GM

- Fair Value Estimate: $84

- Industry: Auto Manufacturers

The Detroit-based auto giant scores a perfect 7 on ExecuPride’s assessment for its LGBTQ+ inclusivity. Morningstar strategist David Whiston currently has the fair value of GM’s stock at $84 per share. GM’s stock was up 27.99% for the year to date as of June 7, 2024, and it is currently trading around $45 with a Morningstar Uncertainty Rating of High. This gives the stock a 5-star Morningstar Rating and the best value within the Morningstar Developed Markets LGBTQ+ Leaders Index.

Whiston writes that GM “started 2024 with good first-quarter results and raised 2024 guidance for earnings per share and adjusted earnings before interest and taxes, giving us no reason to change our $84 fair value estimate.”

Mercedes-Benz Group MBG

- Fair Value Estimate: EUR 117

- Industry: Auto Manufacturers

The Stuttgart-based auto giant also scores a perfect 7 on ExecuPride’s assessment for its LGBTQ+ inclusivity. Like GM, it also trades at a steep discount, with a 0.56 price/fair value ratio as of June 7. This ratio places Mercedes-Benz just inside the 5-star range. Mercedes-Benz’s stock is up 12.16% on the year so far. Mercedes-Benz has a 5-star rating with a narrow Morningstar Economic Moat Rating.

Morningstar analyst Krzysztof Smalec writes that Mercedes-Benz “reported disappointing first-quarter earnings as macroeconomic pressures had an impact on results, driving shares down roughly 5% intraday on April 30. First-quarter sales and earnings per share fell short of FactSet consensus estimates by 8.0% and 2.4%, respectively. Despite near-term headwinds, our long-term outlook is unchanged, and we reiterate our EUR 117 per share fair value estimate.”

Woodside Energy WDS

- Fair Value Estimate: AUD 45

- Industry: Oil and Gas Exploration and Production

Woodside Energy is Australia’s largest energy producer with operations encompassing liquid natural gas, natural gas, condensate, and crude oil. Woodside scores a 4 out of 7 on ExecuPride’s LGBTQ+ assessment, one of the highest in the energy sector. Woodside’s stock is down 9.69% year to date. This stock receives a 5-star rating.

Roche ROG

- Fair Value Estimate: CHF 379

- Industry: Drug Manufacturers—General

The Swiss biopharmaceutical and diagnostic giant scores 4 out of 7 on ExecuPride’s assessment for its LGBTQ+ inclusivity. Roche’s stock was up 3.32% for the year as of June 7. Roche has a wide economic moat, a price/fair value ratio of 0.64, and a 5-star rating.

Morningstar strategist Karen Andersen writes that Roche’s shares are undervalued as “we don’t expect to make any changes to our CHF 379/USD 55 fair value estimate for Roche following the company’s first-quarter results.”

Bristol-Myers Squibb BMY

- Fair Value Estimate: $63

- Industry: Drug Manufacturers—General

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. Bristol-Myers Squibb scores a 7 on ExecuPride’s assessment for its LGBTQ+ inclusivity. Its stock is down 17.27% for the year so far.

Morningstar director Damien Conover writes: “We are maintaining our $63 fair value estimate for Bristol-Myers Squibb after mixed first-quarter results. While total sales and earnings were largely in line with our expectations, new-product sales were slightly below our expectations, and more mature drugs like cancer drug Revlimid outperformed our expectations.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWOIHC3SK5CHJPXXNSL3RJ7VPQ.png)