How to Invest in Nuclear Energy

A look at the companies, funds, and ETFs that could benefit from the move to nuclear energy, which doesn’t produce direct carbon emissions.

Nuclear energy is enjoying a revival in popularity after the European Union decided to include it in the EU’s sustainable-finance taxonomy. In July, the Joint Research Centre—the European Commission’s science and knowledge service—said its analysis prior to its decision “did not reveal any science-based evidence that nuclear energy does more harm to human health or to the environment than other electricity production technologies already included in the taxonomy as activities supporting climate change mitigation.”

This turn of events shows how much the EU wants to encourage investment in the nuclear industry in order to accelerate the shift away from solid or liquid fossil fuels, including coal, toward a net-zero-emissions future, in addition to achieving greater energy independence from Russia.

The Pros of Nuclear Energy

“In terms of clean and reliable energy generation, nuclear power has no equal,” says Cindy Paladines, senior vice president ESG at TCW. Like renewables, nuclear power produces no direct carbon or greenhouse gas emissions. “However,” Paladines adds, “when evaluating the emissions costs of different power generation options over their lifecycle, nuclear power clearly wins.”

Nuclear power offers a number of advantages over other clean energy technologies: It provides a clean and constant base load (the minimum level of demand on an electricity grid over a period of time), which renewables may struggle to offer. It can reliably supply energy at any time of day and regardless of weather conditions, and it requires less material than other transition technologies, which also lowers associated carbon emissions.

And the Cons of Nuclear Energy

For many reasons, nuclear energy remains controversial, in part because of nuclear accidents, use of uranium in nuclear weapons, and the high costs of plant construction. “Radioactive waste and a number of accidents that have marked the collective memory, such as the Chernobyl disaster and the more recent Fukushima disaster, have made the public suspicious of this technology,” says Jess Williams, sustainable investments analyst at Columbia Threadneedle Investments. Still, Williams adds, “both of these examples are somewhat site-specific and are unlikely to occur at other nuclear plants.”

Enriched uranium also has applications in nuclear weapons, which is why nuclear programs conducted by countries such as North Korea, Iran, and, of course, Russia worry Western governments. In addition to these considerable fears, it must be borne in mind that the cost of nuclear power is high and that projects are often implemented late and over budget, although some Asian regions seem to be bucking the trend.

“However, the positive factors seem to outweigh the negative ones,” Williams continues, “which has encouraged a return of emphasis on nuclear power in Europe, as governments look for ways to improve energy security and meet ambitious emission reduction targets.”

What Opportunities Does Nuclear Energy Present for Investors?

“Europe would have faced an energy crisis during the energy transition process even if the conflict between Russia and Ukraine had not occurred,” says Niall Gallagher, European equity investment director at GAM Investments. “We also believe that the transition to net zero is unlikely to happen without significant investment in nuclear power.” Thus, in much of Europe, nuclear power has its fans. Gallagher expects to see investments in solutions like modular nuclear reactors that can be adapted and industrialized for power generation.

The European and even largest global nuclear company is Electricité de France SA EDF. It is currently building four new nuclear reactors in France and in the United Kingdom. “Due to its large footprint in those two countries, it is well positioned to benefit from their high nuclear ambitions in coming decades,” explains Tancrede Fulop, senior equity analyst at Morningstar.

The French government is nationalizing the power company, partly because of its debt burden and its high funding needs to build 14 French nuclear reactors by 2050. The board of directors issued a positive recommendation on the offer from the French government last Thursday.

Now, the French government only needs the green light from the French stock exchange watchdog, the AMF. After that, it will have 10 days to launch the offer.

Engie SA ENGI, the other big French utility, owns and operates six nuclear reactors in Belgium previously scheduled to close at the end of 2025. “Still, the Belgian government recently decided to extend the useful life of two of those reactors, Doel 4 and Tihange 3, by 10 years,” Fulop says. “This could boost Engie’s earnings but will have a limited valuation impact as we believe incremental cash flows will be offset by additional investments needed to extend the useful life of the plants.”

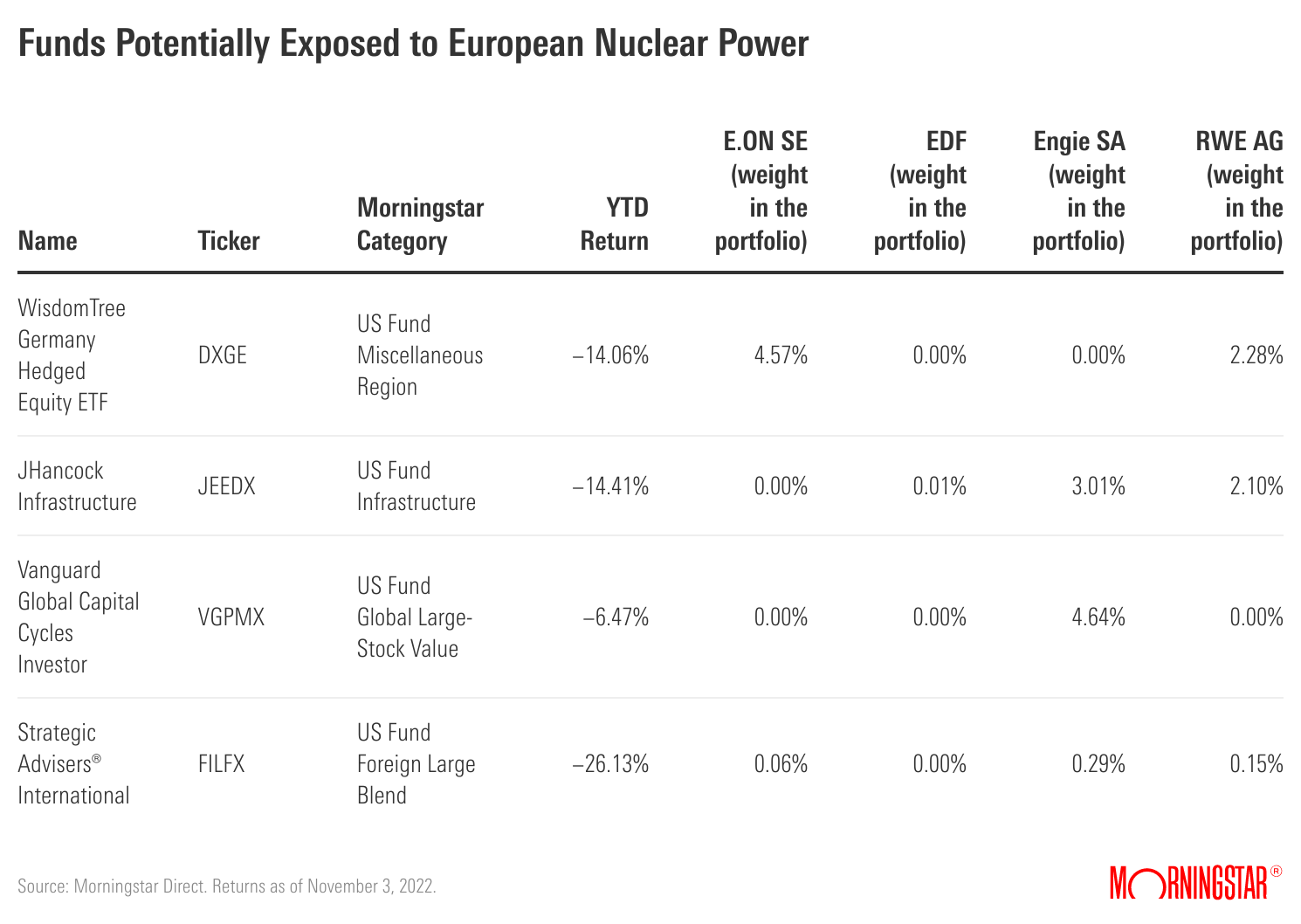

At the same time, the German government has decided to postpone the closure of the last three nuclear plants from year-end 2022 to April 2023 to alleviate tension on the grid this winter. “This could slightly boost the short-term earnings of the three plants’ operators: RWE AG RWE, E.ON SE EOAN, and EnBW Energie Baden-Wuerttemberg AG EEGBF,” concludes Fulop.

Below are the mutual funds most exposed to these three securities among those distributed in the United States.

You can also use Morningstar’s product involvement tools to see whether your fund has nuclear exposure. Learn more about it here.

The EU is moving more rapidly toward sustainability as an economic and strategic priority. According to Morgane Delledonne, head of investment strategy for Europe at Global X, “for investors, these moves are likely to deepen the European ESG landscape with more opportunities in markets such as cleantech, renewable energy, and uranium in the medium to long term.”

A New Life for Uranium?

Uranium is a chemical element used as fuel in nuclear power plants. Because of its toxicity, it has never enjoyed a great reputation with the public, but it is obviously a commodity directly linked to the development of nuclear energy. Kazakhstan is the world’s largest producer of uranium, accounting for more than 40% of the global production. Following Kazakhstan are Australia, Namibia, and Canada, albeit with a large difference in market share to the former (13%, 11%, and 8%, respectively).

The uranium market surged significantly last year, with demand outstripping supply, driving up prices. “This is because after 10 years of a bearish market, there has been a depletion of supply, accompanied by a lack of investment in new mining supplies and a reduction in inventories, accelerated by the recent launch of physical unit trusts, similar to those seen for other metals,” explains Tal Lomnitzer, senior investment manager on the global natural resources team at Janus Henderson Investors.

“In light of the classification of nuclear as sustainable energy in the EU, we may see a new surge in demand for fuels such as uranium, and this could create some interesting investment opportunities. The increase in demand must be met through responsible supply,” says Lomnitzer.

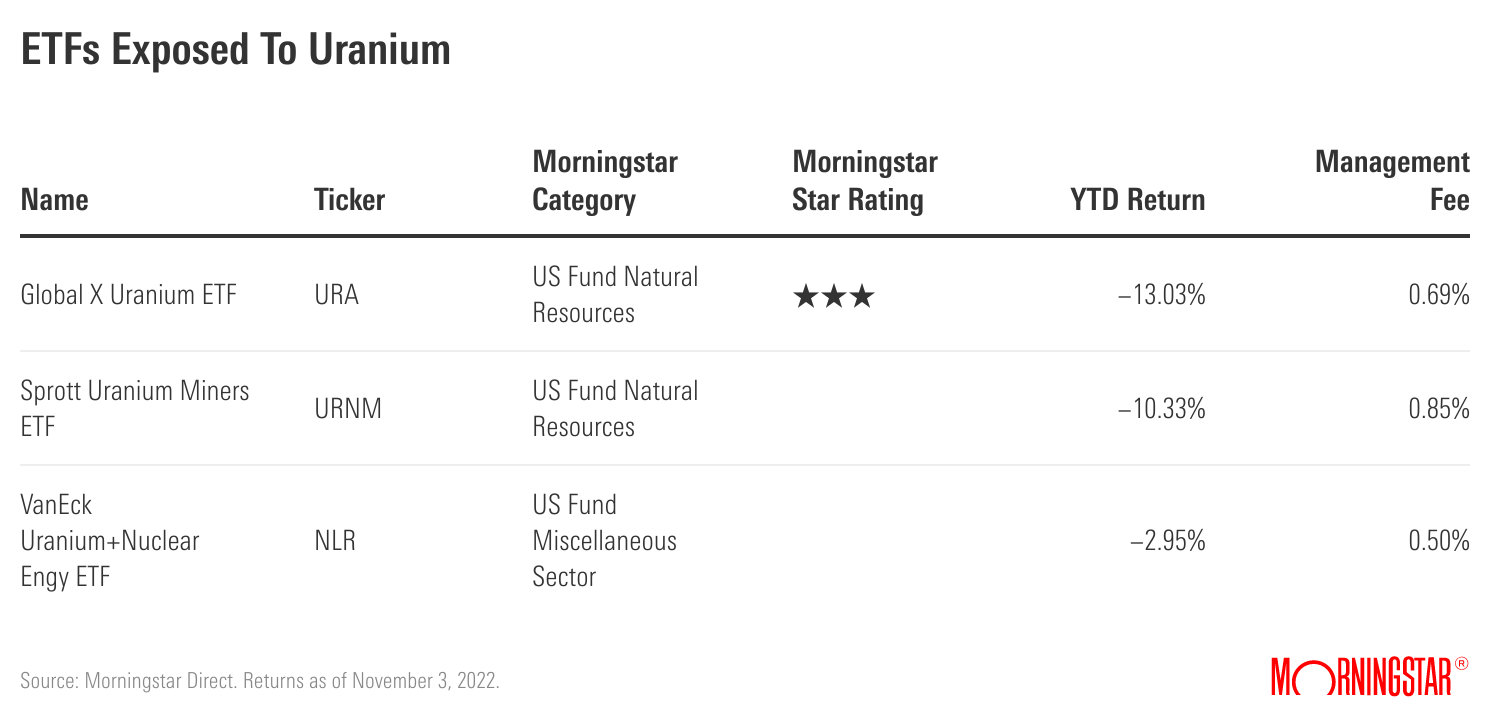

Available to investors in the U.S., there are three exchange-traded funds directly exposed to the value of uranium.

A Global Trend

France, Europe’s leading country in terms of nuclear energy production, is likely to be the market that will benefit the most from this EU decision. Indeed, President Emmanuel Macron plans to modernize the 58 reactors already in place. He has also announced his intention to build at least six new ones, with the possibility of increasing this to 14.

Across the English Channel, the U.K. is preparing to finance seven new power stations by 2050. Indeed, London has made the development of nuclear power one of the priorities of its energy strategy. Many of its 15 reactors are at the end of their lifecycle, and the only plant currently under construction, Hinkley Point C, a project also led by EDF and China’s CGN Mining Co. Ltd. CGNMF, has seen its costs rise and will not open until 2027.

“Europe is not the only region betting on nuclear power,” explains Yun Bai, Vontobel’s head of factor investing research. “At the 2021 UN Climate Change Conference (COP26), China, the world leader in solar, wind and hydropower, announced the construction of 150 new reactors by 2035. This is a huge investment of around $440 billion, which will move the country towards its goal of moving from a coal-intensive to a carbon-neutral economy. To give an idea of the size of the Chinese investment, consider that there are currently 440 reactors in operation worldwide.”

The U.S., where 93 reactors already operate, is also investing further in nuclear power. Two reactors are currently under construction, and last month, the Biden administration launched a $6 billion program to keep current reactors operating. In addition, the U.S. plans to invest $600 million to test the potential of small modular reactors and advanced nuclear reactors.

Most of the nuclear power plants that exist today are third-generation plants that use mainly pressurized water reactors, which are relatively inefficient in using the energy stored in the feedstock, as they typically only utilize 5%-8% of the available energy, thus generating a large amount of waste. Fourth-generation nuclear reactors, on the other hand, consist of a group of different technologies, such as advanced heavy-water reactors and molten-salt reactors, and can utilize 95%-98% of the available energy in fuel, although they are still far from commercialization.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWOIHC3SK5CHJPXXNSL3RJ7VPQ.png)