Obesity Drug Stocks: Where to Invest Now

Eli Lilly and Novo Nordisk have staged big rallies. Here’s how investors can approach this potentially huge opportunity.

Pharmaceutical investing has seen huge moves in the industry’s stocks over the past year, with one area grabbing particular attention: obesity drugs.

Since the end of 2022, the booming market—and potential for massive growth—for obesity drugs has led to big rallies for the stocks of the two manufacturers leading the race to market: Novo Nordisk NVO, producer of Ozempic and Wegovy, and Eli Lilly LLY, which manufactures Mounjaro and Zepbound. Both stocks are posting their biggest gains when it comes to year-to-date performance since 1997.

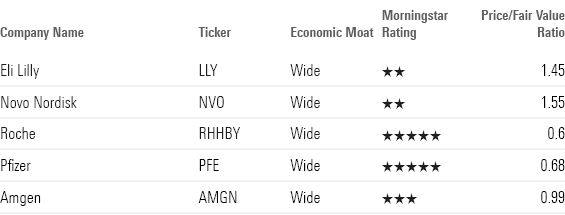

The challenge is that both stocks currently trade in overvalued territory, according to Morningstar analysts. Investors looking to put new money to work in companies developing products in this potentially significant market must decide which of the more attractively valued competitors are best positioned to muscle their way in.

And with a new stream of studies being published, like Wegovy’s longest clinical trial to date, comes increased tensions between the drugmakers.

“We think current share prices do not properly account for expected price declines and competition, let alone the risk of patients discontinuing therapy due to tolerability, cost, or long-term safety issues,” says Karen Andersen, healthcare strategist at Morningstar.

Other Big Pharma companies looking to gain traction with their own obesity drugs include Roche RHHBY, Pfizer PFE, and Amgen AMGN.

Key Obesity Drug Stocks and Their 12-Month Performance

Novo Nordisk: 60.6%

Eli Lilly: 78.1%

Pfizer: negative 17.9%

Amgen: 44.7%

Roche: negative 14.7%

Obesity Drugs’ Big Impact on Pharma Stocks

Amid the obesity epidemic in the United States, pharmaceutical companies have been attempting to develop effective treatments for years. “I don’t think we’ve ever seen this sort of level of innovation,” says Damien Conover, director of healthcare research for Morningstar. “Historically, obesity has been an area of a lot of failed drug development. It’s always dangerous to say, ‘This time, it’s different.’ But this time, it really does seem different.”

Andersen adds: “So it was a sort of slow realization after the data, approval, shortages … and then it took off. I think we had all been expecting less, given that the launch of Novo’s previous obesity drug, Saxenda, wasn’t very successful—albeit with about 5% weight loss.”

However, investors have now definitely taken note, changing the landscape of pharma stocks. That came in part as Lilly has seen unparalleled efficacy in its weight-loss drug therapy, and its stock reflects that progress with its big 2023 rally. Meanwhile, Novo has become the largest company in Europe as measured by market capitalization.

Stock Performance of Obesity Drug Developers

Obesity Drug Market Potential

Underlying these gains are expectations of massive growth for these drugs. Conover and Andersen project that the global market for obesity drugs will be $120 billion by 2031 and most of the market will be relatively split between Novo and Lilly. The overall market for the kinds of treatments employed in these medications—which are known as GLP-1s and are also used to treat Type 2 diabetes—is seen as even larger, at some $170 billion.

Conover and Andersen forecast that over 25% of obese Americans and 15% of overweight Americans will receive treatment in 10 years, and the vast majority will receive branded GLP-1 therapies. They predict the bulk of those sales will go to Novo and Lilly.

Global Projection of Diabetes and Weight Loss Drug Developer Sales

Obesity Drug Stock Variables

With new gates being opened for these drugs, investors have multiple variables to consider when it comes to stocks that can benefit.

One of the biggest factors will be pricing—both the prices manufacturers can charge and what end consumers pay after insurance. Both Lilly’s Zepbound and Novo’s Wegovy have a listed monthly price over $1,000. But this is not necessarily reflective of what the typical consumer will be billed; the net payment could be discounted by as much as 79%. Such pricing could make a big difference in sales.

“It’s such a big market that you don’t need to change the penetration levels that much and you would have substantially different projections,” says Conover.

Meanwhile, already-intense competition is being fueled by a steady stream of studies of drug effectiveness. The first-of-its-kind clinical trial examining the long-term effects of Novo’s Wegovy found that people on the drug maintain weight loss for up to four years, on top of reducing the risk of heart disease. These findings could act as a catalyst for insurance companies and governments to cover Wegovy more liberally.

That competition is part of the reason Conover and Andersen expect a substantial pricing decline over time. They estimate companies are currently charging an average of $7,000 for obesity drugs, but that will likely decline to under $3,000 by 2031.

“Competition and efforts to expand commercial—private payer—reimbursement contracts tend to lead to lower prices at bigger volumes,” Andersen says.

Although many unforeseen corners could lie ahead, one thing is clear: Lilly and Novo revolutionized the weight-loss landscape through years of continual therapy improvements. “They had been on this steady path until they got to the point where this obesity data came out,” Andersen explains. “It had somehow broken through this barrier for prior obesity drugs, since their efficacy was undeniable, and it really turned a corner.”

Which Obesity Drug Stocks Should You Buy Now?

“Novo and Lilly are kind of doing their own thing in the stock market, and really in innovation,” says Conover. “They are bringing out some of the most powerful new drugs for sales generation, in our estimation.”

Andersen says, “I think we’re at a point in this market where it’s accepted that Novo and Lilly are both strong players and poised to benefit incredibly. I think it would be tough to really take down either, unless there was some drastic reduction in supply or a massive safety issue that we somehow didn’t see until now.”

However, for investors, there are valuations to consider. Lilly is currently trading at a price/fair value ratio of 1.45, meaning it is 45% overvalued compared with Conover’s fair value estimate of $540. Meanwhile, Novo has a price/fair value ratio of 1.55, based on Andersen’s fair value estimate of $86.

Price/Fair Value Ratios of Obesity Drug Developers

“We expect Lilly to partly elevate capacity constraints for Mounjaro and Zepbound in the second half of the year,” Conover says. “Lilly expects to increase the drugs’ production by 50% by the end of the year. With demand outstripping supply, we expect Lilly to sell what it can produce.”

Pfizer has been considered a significant contender, but recently it provided lower-than-expected 2024 guidance, which brought its Morningstar fair value estimate for the company’s stock from $47 to $42 per share. The company’s 2024 projection “included covid-19 product guidance of $8 billion, which was $5 billion lower than our expectation,” Conover says.

However, Pfizer’s diverse line of drugs and vaccine provide for a steady cash flow, and the market is still significantly undervaluing its stock price, with the last closing price being $28.50.

Another aspirant is Amgen. “They are committed to entering the obesity market—either with the lead candidate (similar to Lilly’s Zepbound, it is targeting GLP-1 and GIP hormones) or additional drugs that are in phase 1 and preclinical studies,” says Andersen. “We expect phase 2 data from the lead AMG133 program in the second half of 2024. The key selling point so far, based on phase 1 data, could be that it requires less frequent administration—it could be administered monthly, instead of the weekly Zepbound—and may lead to longer maintenance of weight loss after stopping therapy.”

In addition, Andersen says Amgen’s offering has showed “compelling” speed of weight loss. “It will be interesting to see longer-term data to see the final plateau of weight loss.” She adds that, given the minimal data so far from the company, “Amgen is sort of a wild card, as it could either be best-in-class or encounter issues with tolerability or safety that make it less compelling.”

In the first quarter, Amgen’s sales grew 22%, raising its fair value estimate to $317. Amgen’s stock is also undervalued, currently trading at $314.54.

Then there is Roche, which in 2023 entered the fray with the acquisition of private biotechnology company Carmot, which has three clinical-stage obesity drugs in the works. “Investors might be better served by taking a less focused approach toward investing in obesity stocks and consider a firm like Roche, where we like the overall portfolio and investors get some exposure to new obesity drug development,” Conover says.

Here’s a look at Morningstar’s take on key obesity drug developers and their stocks:

Obesity Drug Maker Stocks

Eli Lilly LLY

- Fair Value Estimate: $540.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We are raising our Eli Lilly fair value estimate to $540 from $500 following stronger-than-expected first-quarter results. In particular, pricing drove 10 percentage points of the 26% top-line growth seen in the quarter, which is expanding gross margins faster than we expected. We believe the strong pricing power of weight-loss drug Mounjaro supported a major part of the pricing gains. While Lilly expects a deceleration in pricing gains in the second half of the year as discounts related to saving cards annualize, the robust pricing power showcases the strength of Lilly’s wide moat.

Read more of Damien Conover’s analyst notes here.

Novo Nordisk NVO

- Fair Value Estimate: $86.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Novo Nordisk reported constant currency sales growth of 24% in the first quarter, in line with the 25% constant currency sales growth assumption we had built into our model for 2024. First-quarter growth was heavily driven by GLP-1 sales growth in diabetes (32%, mostly from Ozempic) and obesity (42%, mostly from Wegovy).

Management increased constant currency sales growth guidance for 2024 by 1 percentage point (from a range of 18%-26% to a range of 19%-27%), and we’ve increased our sales growth assumption to 26%. We think operating income growth could be slightly higher at 29%, also at the high end of management’s updated guidance. This increased our fair value estimate from DKK 570/$84 to DKK 600/$86, but share prices are still 45% higher than our increased valuation.

While we continue to see Novo Nordisk as a wide-moat firm, with strong intangible assets surrounding its cardiometabolic business, we think the high obesity drug demand and scarcity of supply have driven share prices above their intrinsic value. We assume that Novo Nordisk is capable of growing GLP-1 sales across indications from roughly $24 billion in 2023 to nearly $75 billion by 2031, prior to the patent expiration for semaglutide, the molecule in Ozempic and Wegovy. We think current share prices do not properly account for expected price declines and competition, let alone the risk of patients discontinuing therapy due to tolerability, cost, or long-term safety issues.

Read more of Karen Andersen’s analyst notes here.

Roche Holding RHHBY

- Fair Value Estimate: $55.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

We don’t expect to make any changes to our CHF 379/$55 fair value estimate for Roche following the company’s first-quarter results. Roche’s pharmaceutical and diagnostics divisions each grew at a 2% rate at constant currency, with 7% underlying constant-currency growth after removing the headwind from reduced covid-related antibody and diagnostic sales.

Management maintained its guidance for mid-single-digit constant-currency sales growth and core earnings per share growth for the full year. We expect covid and foreign-exchange headwinds to subside for the remainder of the year, allowing Roche’s underlying growth to become more apparent to investors. While this is not a year for significant new launches, we expect significant pipeline data amid a pipeline reshuffling that prioritizes higher-impact programs in immunology (Roivant’s TL1A) and obesity (Carmot’s CT-388).

Beyond 2024, we think Roche is capable of mid- or even high-single-digit annual growth (and core operating margins remaining in the mid-30s), with higher growth possible if these in-licensed programs—or in-house programs like Alzheimer’s disease drug candidate trontinemab or oncology drug candidate tiragolumab—reach the market. We think Roche’s pharmaceutical innovation and diagnostics dominance support a wide moat.

Read more of Karen Andersen’s analyst notes here.

Pfizer PFE

- Fair Value Estimate: $42.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We are holding steady to our fair value estimate and wide moat rating for Pfizer following first-quarter results that largely matched our expectations. The company is tracking well to meet its goal of $4 billion in cost cuts by the end of 2024, which should improve operating margins. We believe the market is underappreciating the margin expansion based on the cost cuts, and we view Pfizer as undervalued.

Following overinvestment during the pandemic, Pfizer is reducing costs to adapt to the slowing demand for covid products. While we still expect a tail of close to $8 billion annually for Pfizer’s covid vaccine Comirnaty and treatment Paxlovid, this is down from the over $50 billion sold in 2022. Following the cost-cutting, we expect operating margin to return to over the 30% range more typical of Pfizer before the pandemic.

Read more of Damien Conover’s analyst notes here.

Amgen AMGN

- Fair Value Estimate: $317.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Amgen’s first-quarter product sales grew 22%, or 6% excluding the October 2023 acquisition of rare-disease firm Horizon Therapeutics, slightly ahead of our expectations. Management narrowed its top- and bottom-line guidance for the full year. In conjunction with earnings, Amgen announced that it has completed an interim analysis of a phase 2 trial of obesity drug candidate maritide (AMG 133). Although Amgen did not disclose many details, management was encouraged enough to announce that the program will move to phase 3 in obesity, obesity-related indications, and diabetes, an area where theoretical concerns about blood sugar effects of the drug had previously made development less appealing. We think the most likely scenario is that interim data showed manageable tolerability, solid safety, efficacy that rivals the top drug candidates in development (around 25% weight loss), and a differentiated dosing profile (monthly or perhaps quarterly dosing).

We had previously included a 30% probability of approval and $4 billion in probability-weighted sales by 2033 in our Amgen valuation. Given this confirmation of positive phase 2 results, we’re raising our probability of approval to 60%, which raises our sales estimate to $8 billion by 2033. We’ve also included higher capital expenditures beginning in 2025 to support a 2027 launch; we see Amgen’s strong experience with antibody manufacturing as lending credibility to its ability to supply the market. In addition, if dosing is in fact quarterly instead of the once-weekly dosing for current obesity treatments, manufacturing could be less demanding.

Read more of Karen Andersen’s analyst notes here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)