Bank Loans Lead Bond Fund Performance in Q2 2024

How some of our favorite managers fared during another volatile period for the bond markets.

Bond market volatility lingered throughout 2024′s second quarter. The period rewarded investors who took on more credit risk, but those who ventured further out on the yield curve and accepted more duration risk, or sensitivity to shifting yields, didn’t reap the same benefits. The Morningstar US Core Bond Index, a proxy for the US-dollar-denominated investment-grade bond market, eked out a 0.2% gain during the quarter.

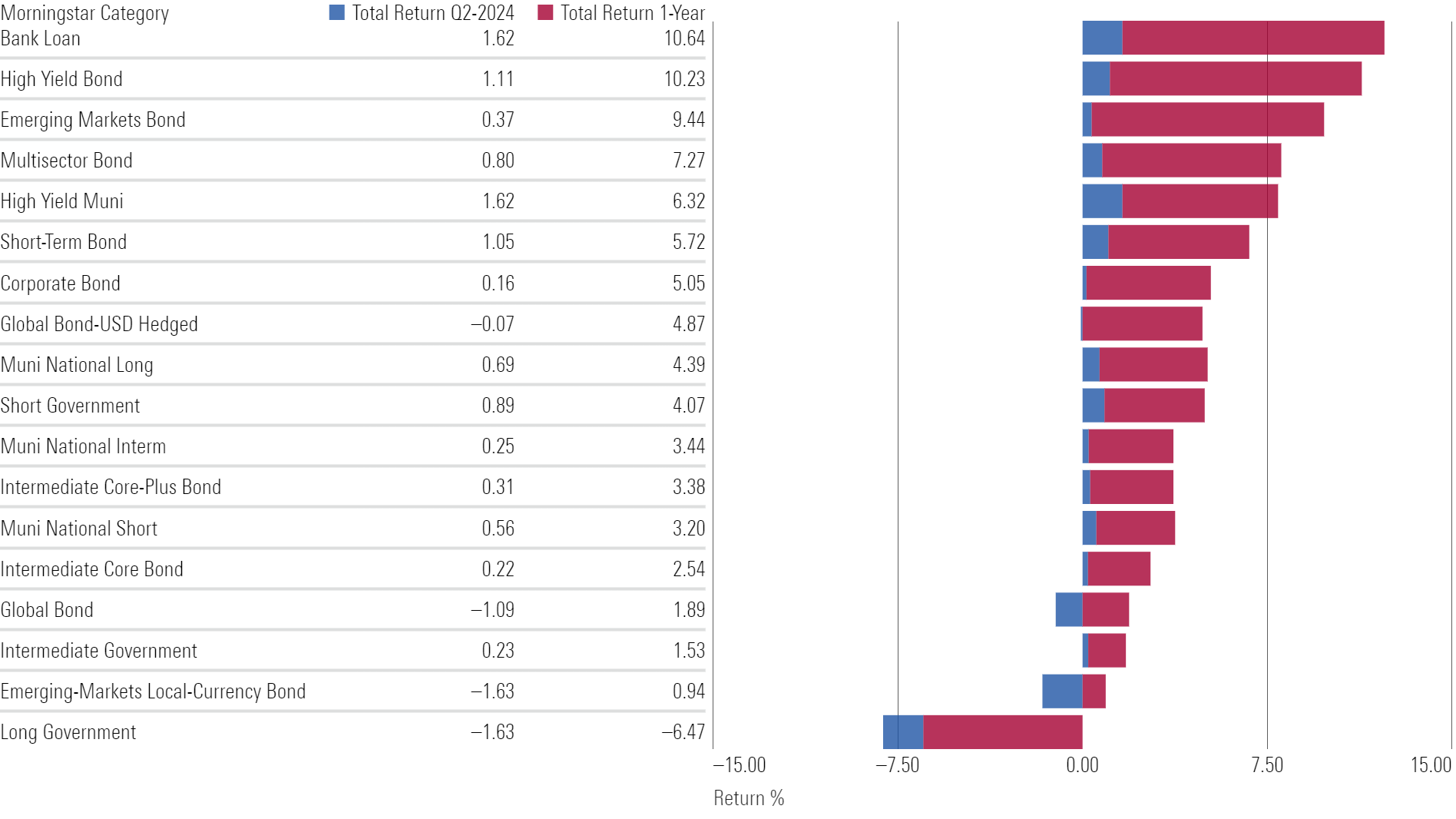

Results were mixed across fixed-income Morningstar Categories. Strong fundamentals and a healthy economy continued to provide tailwinds for credit-sensitive assets, such as bank loans and high-yield bonds. For the quarter, the median bank-loan and high-yield bond fund gained 1.6% and 1.1%, respectively, and over the one-year trailing period through June 2024, the former returned 10.6% and the latter 10.2%, thanks to their ability to cope with rising yields at most points on the curve.

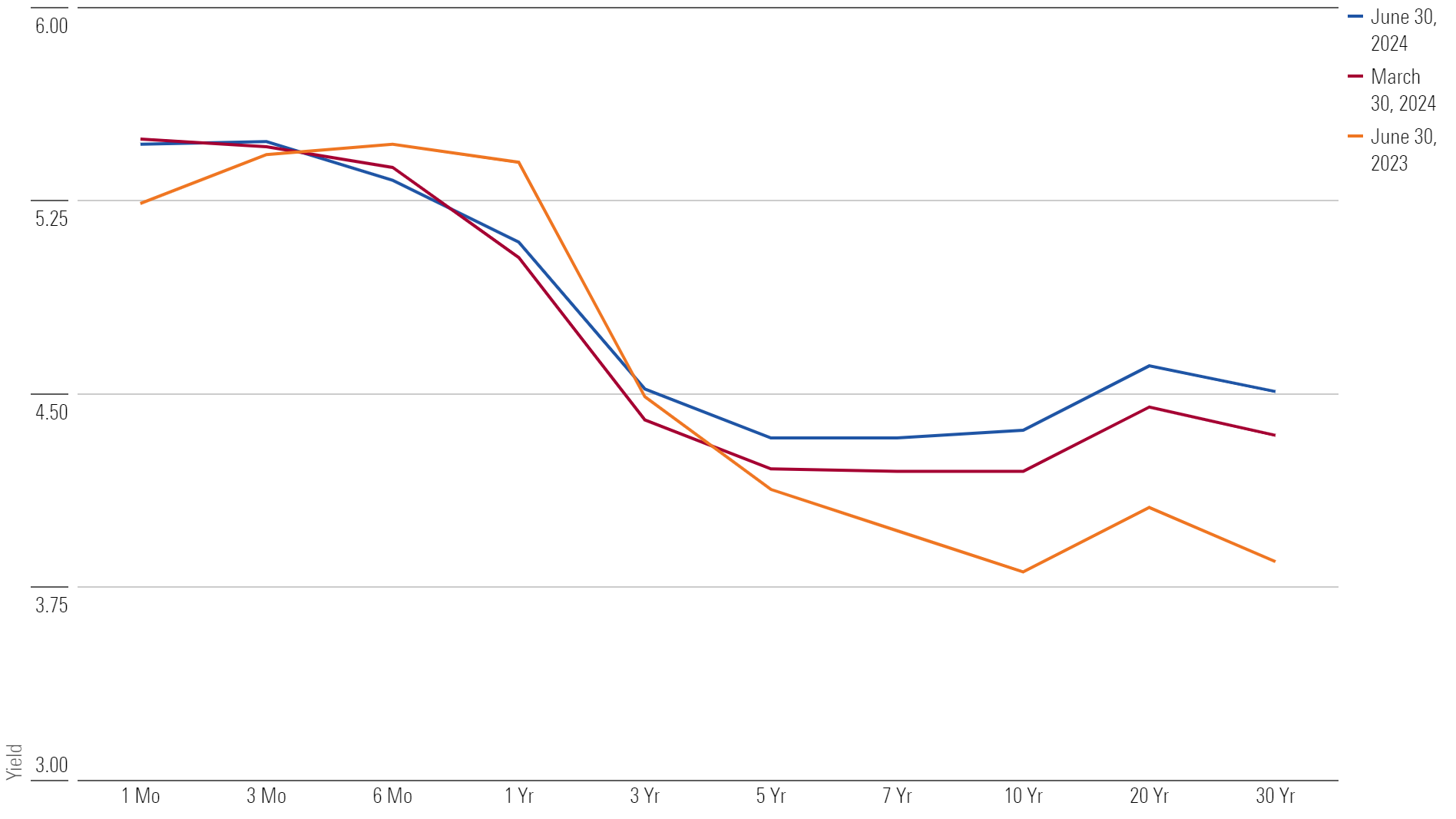

Long-Term Yields Increased While Short-Term Yields Remained Anchored During the Quarter

But it hasn’t been that rosy for every fixed-income sector. The US dollar continued to strengthen on the back of stronger-than-anticipated US economic data, which weighed down global-bond returns during the quarter. The typical unhedged global-bond fund lost 1.1% in the quarter and 2.5% for the year to date.

And while the Federal Reserve has seemingly ended its interest-rate-hiking campaign to tame inflation, yields shifted up and down over the quarter alongside changes in rate-cut expectations. Still, the typical intermediate core bond fund managed a 0.2% gain during the quarter, but performance looked more attractive on the front end of the yield curve; the typical short-term bond and ultrashort bond funds generated 1.0% and 1.3% returns, respectively. Taking more interest-rate risk in anticipation of rate cuts has yet to pay off in 2024, and investors were once again reminded about the difficulty of timing interest-rate changes.

Below, we dig deeper into a few fixed-income categories and highlight how some of our favorite bond managers fared during another volatile period for the bond markets.

Median Returns for the Fixed-Income Morningstar Categories

Bank-Loan Returns Continue to Climb

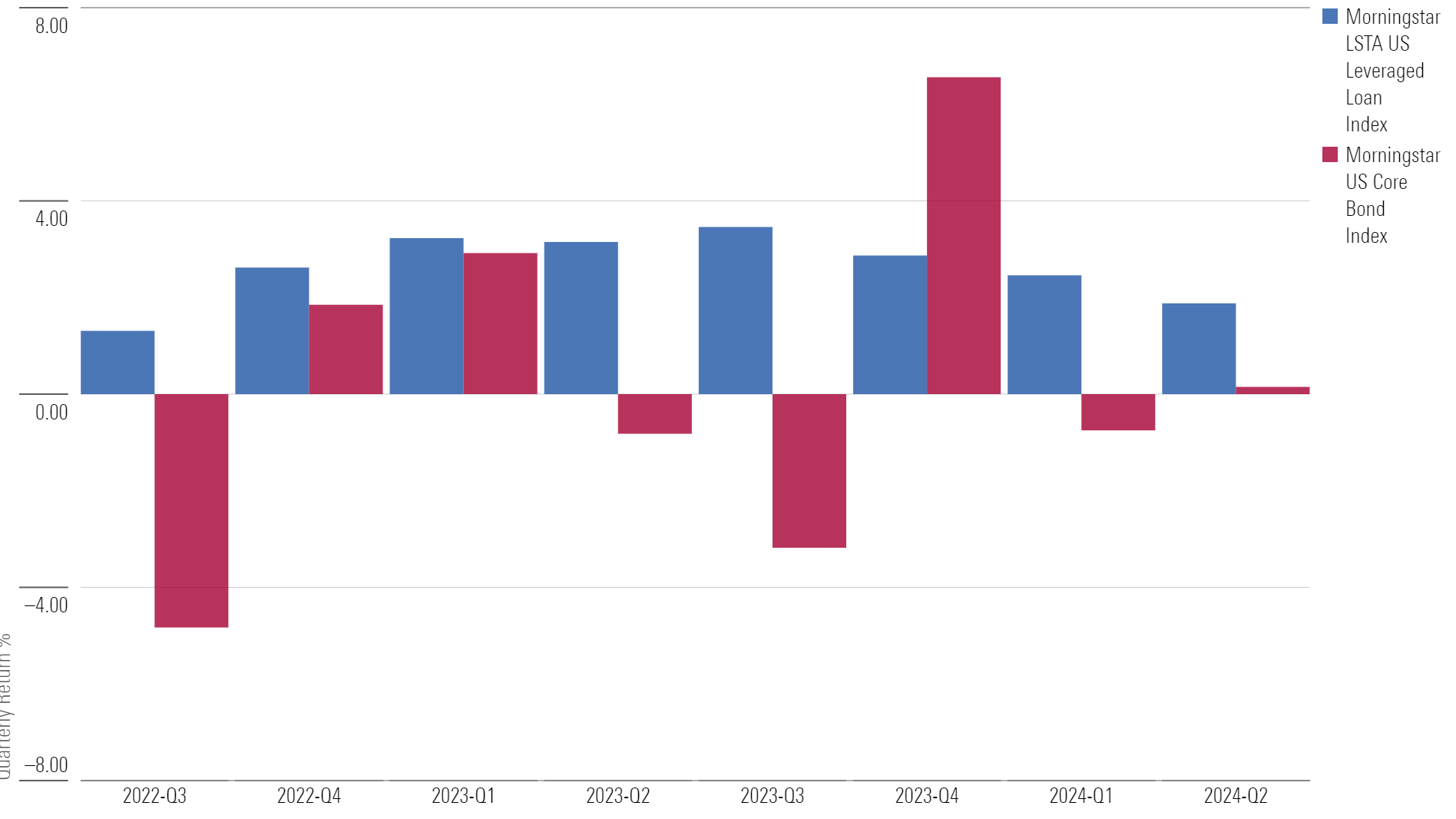

The Morningstar LSTA US Leveraged Loan Index gained 1.9% in 2024′s second quarter for its eighth consecutive quarter of positive returns while most fixed-income sectors suffered through some bouts of volatility. Nearly every bank-loan manager enjoyed the tailwinds provided by strong fundamentals and rising yields in recent periods, but some managers took advantage of the favorable environment better than others.

For example, T. Rowe Price Institutional Floating Rate RPIFX, which carries a Morningstar Medalist Rating of Gold, returned 2.2% and beat about 95% of its bank-loan peers during the quarter. The fund’s strong recent performance added to the team’s impressive track record. Diligent security selection, including an ability to avoid most defaults, and effective risk management have spurred its compelling short- and long-term results.

Gold-rated Fidelity Advisor Floating Rate High Income FIQSX, which is historically one of the most cautious bank-loan strategies, didn’t enjoy the same level of success. It gained just 1.4% and trailed nearly 80% of its bank-loan rivals as the period failed to reward its conservative approach.

Bank Loans Post Steady Returns Amid Bond Market Volatility

Taking Credit Risk in Munis Pays Off

The market also rewarded investors who took more credit risk in municipal bonds. The Bloomberg High Yield Muni Index returned 2.6%, while results for the Bloomberg Municipal Index, a proxy for the broad investment-grade-rated muni market, were flat during the second quarter.

Bronze-rated MFS Municipal High Income MMIIX finished toward the top of its high-yield muni peer group. Its 2.4% gain beat 90% of competitors, thanks mostly to the portfolio’s larger allocation to below-investment-grade and nonrated bonds than most peers.

On the other hand, Bronze-rated Pimco High Yield Municipal Bond PHMIX failed to keep pace because of its higher-quality tilt versus the typical peer—a longtime theme in the portfolio. The fund returned just 1.4% and underperformed two thirds of peers during the quarter.

Global-Bond Returns Slide

The US dollar continued to strengthen during the year’s second quarter and crushed global-bond returns. The unhedged version of Morningstar Global Core Bond Index fell 1.2%.

Bronze-rated BrandywineGLOBAL Global Opportunities Bond GOBIX, which stumbled out of the gates in 2024, continued to struggle in the second quarter. The fund’s 7.2% loss for the year to date through June trailed roughly 95% of global-bond peers because of the portfolio’s persistent underweighting in the US dollar, a long-standing bet on the Japanese yen, which weakened, and above-average duration.

But a select few global bond managers found some success. Bronze-rated Hartford World Bond HWDIX generated positive returns of 0.5% and 0.4% during the quarter and year-to-date periods, respectively. The strategy’s caution toward interest-rate, credit, and currency risks compared with most peers helped it weather the recent market stress.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)