The Best Balanced Funds

Morningstar analysts’ top picks for hands-off investors.

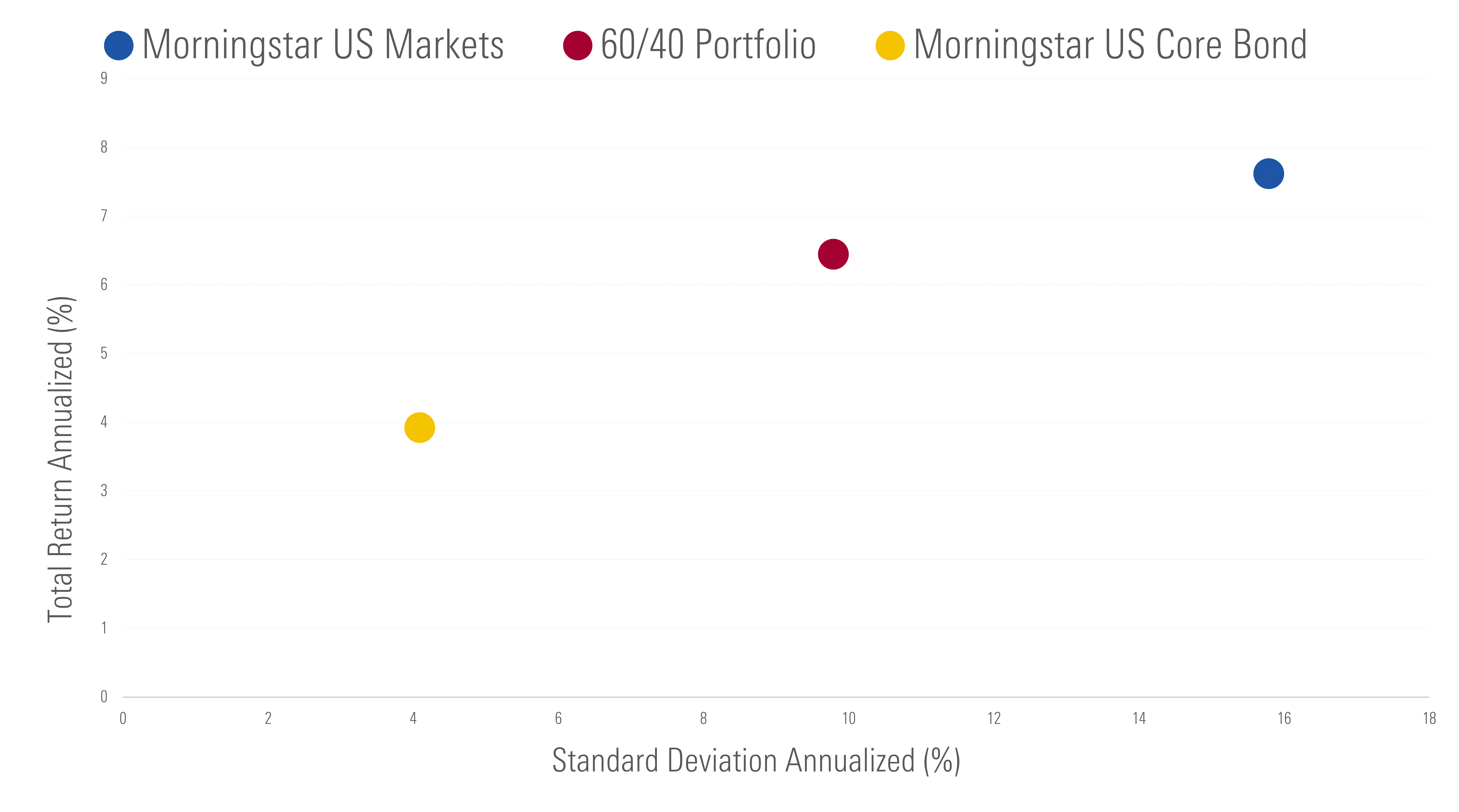

The 60/40 portfolio is back at all-time highs after a tumultuous stretch that started in 2022. The Morningstar US Moderate Target Allocation Index, which resembles a typical diversified balanced fund, has gained more than 6.3% for the year to date through mid-June, and despite continued pessimism from some market observers, the outlook isn’t as grim as some soothsayers say.

A Return to Form for 60/40 Portfolios

What Is a Balanced Fund?

Balanced funds make diversification easy for investors by sticking close to a classic mix of 60% stocks and 40% bonds. Investors can find these funds in the moderate-allocation or global allocation Morningstar Categories, depending on the portfolios’ exposure to international markets.

A balanced fund’s goal is to provide a smoother ride than an all-stock portfolio by including bonds, which offer better returns than cash and are less likely to lose money than stocks. Even when stocks and bonds both lost money in 2022 (not seen before since the 1960s), investors in balanced funds were still better off than those investing 100% in stocks.

Over the long term, balanced portfolios have provided a Goldilocks-like solution for investors who can’t stomach the volatility of only owning stocks but require higher returns than fixed income to meet their objectives. The exhibit below shows annualized returns and standard deviation for US stocks, bonds, and a 60/40 portfolio of both since January 2000.

Striking the Right Balance

Are All Balanced Funds the Same?

Despite the common 60% stock and 40% bond starting point, balanced funds come in all shapes and sizes. Some stay close to the classic split between stocks and bonds, while others venture tactically around that anchor. Some use all passive funds as the building blocks, some stand by active management funds, and others use a blend of both. Sustainability-focused investors can find tailored offerings, too.

Perhaps the most important distinction between balanced funds is their willingness to invest outside the United States. That’s been the biggest single factor in performance differences between balanced funds over the past decade.* To simplify things, we can group balanced funds into one of three buckets:

- US-Focused: These funds have consistently invested less than 10% of the portfolio outside US stocks and bonds.

- Diversified: These funds have consistently invested between 11% and 39% of the portfolio outside the US.

- Global: These funds typically invest more than 40% of assets outside the US.

The exhibit below shows the growth of $10,000 invested in custom benchmarks representing each of the three buckets over the past decade.

US-Focused Balanced Funds Have Been Tough to Beat

US-focused funds handily outpaced more globally diversified peers over the past 10 years, but there’s no guarantee the run can continue for another 10 years. A reversal in fortunes for US stocks relative to the rest of the world would result in the chart flipping.

Which Balanced Funds Are the Best?

Whether you favor sticking with the US, embracing the globe, or taking a more middle-of-the-road view, good options exist.

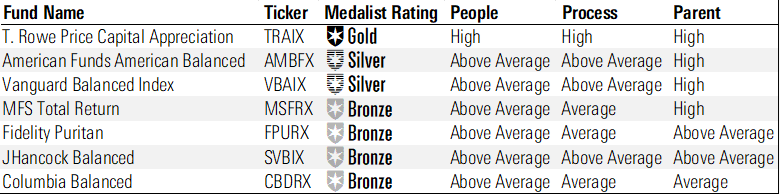

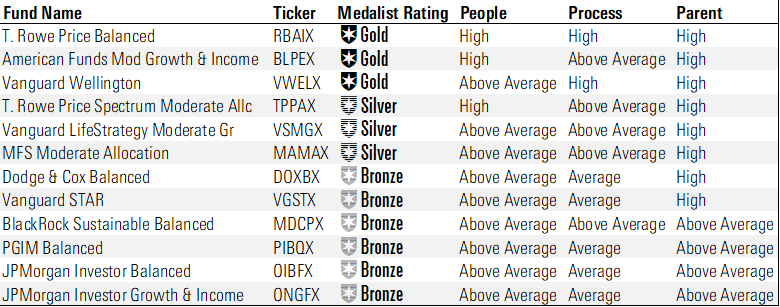

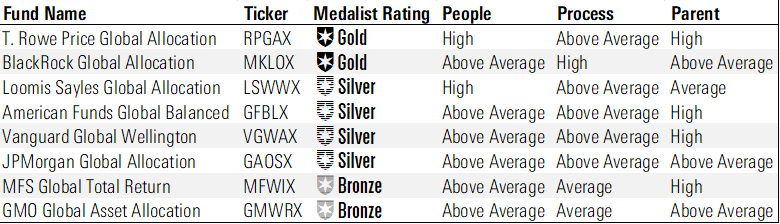

These following funds are Morningstar Medalists with 100% analyst coverage. The tables below show the highest-rated share class for each fund. More expensive share classes may not earn as much conviction. We’ve excluded allocation funds that are better suited as supporting holdings, like multi-asset income or diversified real assets.

The Best US-Focused Balanced Funds

The Best Diversified Balanced Funds

The Best Global Balanced Funds

Given their high Morningstar Medalist Ratings, we expect the top-rated mutual funds on our list to outperform peers and their respective Morningstar Category indexes over a full market cycle.

Who Should Invest in a Balanced Fund?

A balanced fund’s appeal is its simplicity. Using a 60/40 fund as a core holding or even a total portfolio saves investors from worrying about choosing individual underlying strategies or keeping up with rebalancing.

But that doesn’t mean balanced funds are right for everyone. Having 50% to 70% of a portfolio in stocks still courts drawdown risk, even when bonds are performing well. During the global financial crisis, for example, the Morningstar US Moderate Target Allocation Index lost 31% from the market peak in October 2007 through the bottom in March 2009. With that near-doomsday scenario in mind, balanced funds are not good candidates for short-term savings. Morningstar’s Role in Portfolio framework suggests investors in a balanced fund should be prepared to hold on for between six and 10 years.

* The U.S.-Focused portfolio is 60% Morningstar US Markets Index and 40% Morningstar US Core Bond Index. The Diversified portfolio is 45% Morningstar US Markets, 15% Morningstar Global Markets ex US Index, and 40% Morningstar US Core Bond. The Global portfolio is 60% Morningstar Global Markets Index and 40% Morningstar Global Core Bond Index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/06-27-2024/t_128e5b2b1e35443e99302bd249d3a5d5_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)