Meme Stock Performance: Did Active or Passive ETFs Fare Better?

Active managers may be able to capitalize on meme stock mania, but that doesn’t mean they managed to do it.

Late last year, my colleague examined the aftermath of the 2021 meme-stock mania for exchange-traded funds with big bets in GameStop GME and found that many didn’t realize gains despite large positions in the stock. This article extends the scope of this question to the active/passive debate: Did active ETF managers do a better job capitalizing on meme-stock mania than passive ETFs?

It is supposedly in these one-off, extreme events that active managers can show their edge over passive funds. Broad-market index ETFs typically include most of these buzzing stocks by virtue of their wide scope. But two pain points linger for these ETFs: sizing and exit strategy. Market-cap-weighted ETFs hold positions in many stocks, unlike active managers who can proactively take large bets to position themselves for a rally. Cap-weighted ETFs typically maintain the same relative position in the stock, meaning they passively watched GameStop go to the moon and back. These ETFs typically wind down the stakes as prices come crashing back to Earth. Active managers have the discretion to cash out at the peak of the rally, if they can predict it correctly.

But just because they can, didn’t mean they managed to do it. It’s surprisingly hard to be active when the market is not being sensible. Few active ETFs latched onto the GameStop train throughout 2021, and fewer saw meaningful gains from it.

Active ETFs With Skin in The Game

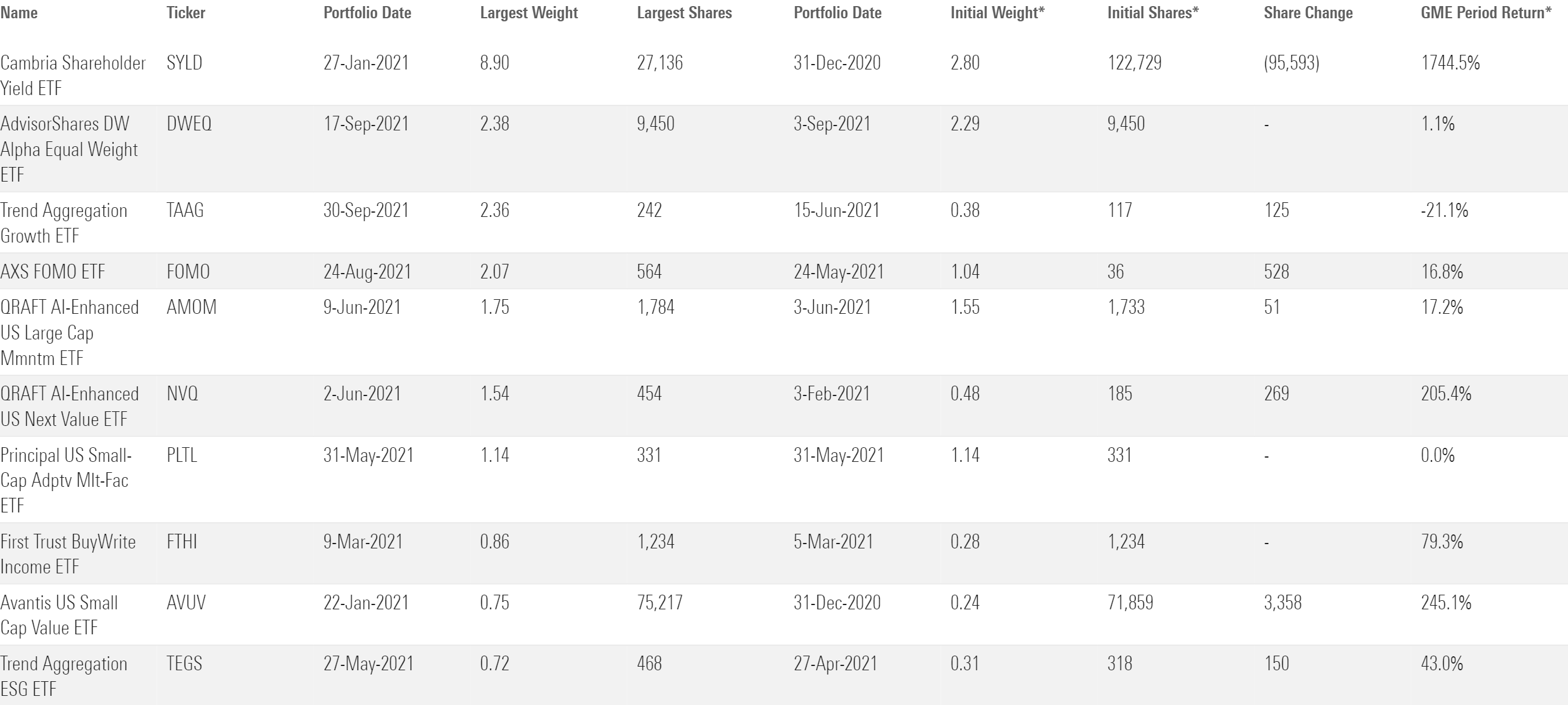

Exhibit 1 displays 10 active ETFs with the biggest bets on GameStop throughout 2021, and the difference between their initial bet and largest bet. Most of these ETFs are quantitative model-based strategies with varying levels of manager discretion. They largely kept their GameStop exposure under 2% even at the largest, despite some having fairly concentrated portfolios.

Top 10 Active ETFs With the Biggest Bets on GameStop

Cambria Shareholder Yield ETF SYLD appeared to be an outlier, with a nearly 9% position on Jan. 27, 2021. This figure is a tad misleading, as it was heavily influenced by GameStop’s price jump on that day. The ETF had started to trim its stake earlier that month to avoid hitting a 5% position cap and continued to drastically slash its exposure as GameStop’s price rocketed throughout January. The weight constraint helped the ETF cash out when the stock was at its peak. After starting the year with 122,729 shares, Cambria Shareholder Yield ETF ended January 2021 with a mere 10,000 GameStop shares just before the stock’s price dropped over 80% within the next few days. The fund enjoyed a great first month to the year, outpacing the Morningstar US Mid Value Index by nearly 16 percentage points. The managers eventually cut the stock off completely at the end-of-March rebalance.

One other ETF on this list picked up GameStop before January 2021: Avantis US Small Cap Value ETF AVUV. Like the Cambria ETF, it also sits on the value side of the Morningstar Style Box. Searching for cheap stocks led both funds to gold, though the Avantis fund exited much earlier, on Jan. 22. Given the managers’ focus on fundamentals and profitability, they likely did not expect GameStop’s sentiment-fueled rally to extend that far.

The rest of the list is dominated by momentum and trend-based funds. These ETFs generally got a late start, as their models took time to digest information from the first few months of the year. Most captured a modest, though still impressive in absolute terms, sliver of GameStop’s 2021 returns. Both the Trend Aggregation Growth ETF TAAG and the Principal US Small-Cap Adaptive Multifactor ETF PLTL bought higher than they sold, however, losing money by the time they fully cashed out.

Interestingly, Vanguard US Momentum Factor ETF VFMO picked up GameStop much earlier than other momentum funds, though it did not make the top 10 list with its minimal 0.15% stake. The fund bought into GameStop in December 2020 and promptly zeroed out before the end of January 2021.

Of the nearly 500 active US ETFs that existed in 2021, only 25 dabbled in the game retailer’s stock. Eight of them have gone out of business since, and many of those had some of the largest stakes in GameStop. Whether their GameStop trade worked didn’t seem to matter; the liquidated funds were already struggling to attract investors.

Passives Hold Everything

Similar to active ETFs, only a fraction of passive ETFs available in 2021 had exposure to GameStop stock. They were typically broad index ETFs that captured a full size or sector segment of the market. Most had exposure prior to 2021, except for mid-cap ETFs that added GameStop after the stock migrated out of small-cap territory in mid-2021. Thus, most passive ETFs sat out GameStop’s rise and fall during the meme-stock craze.

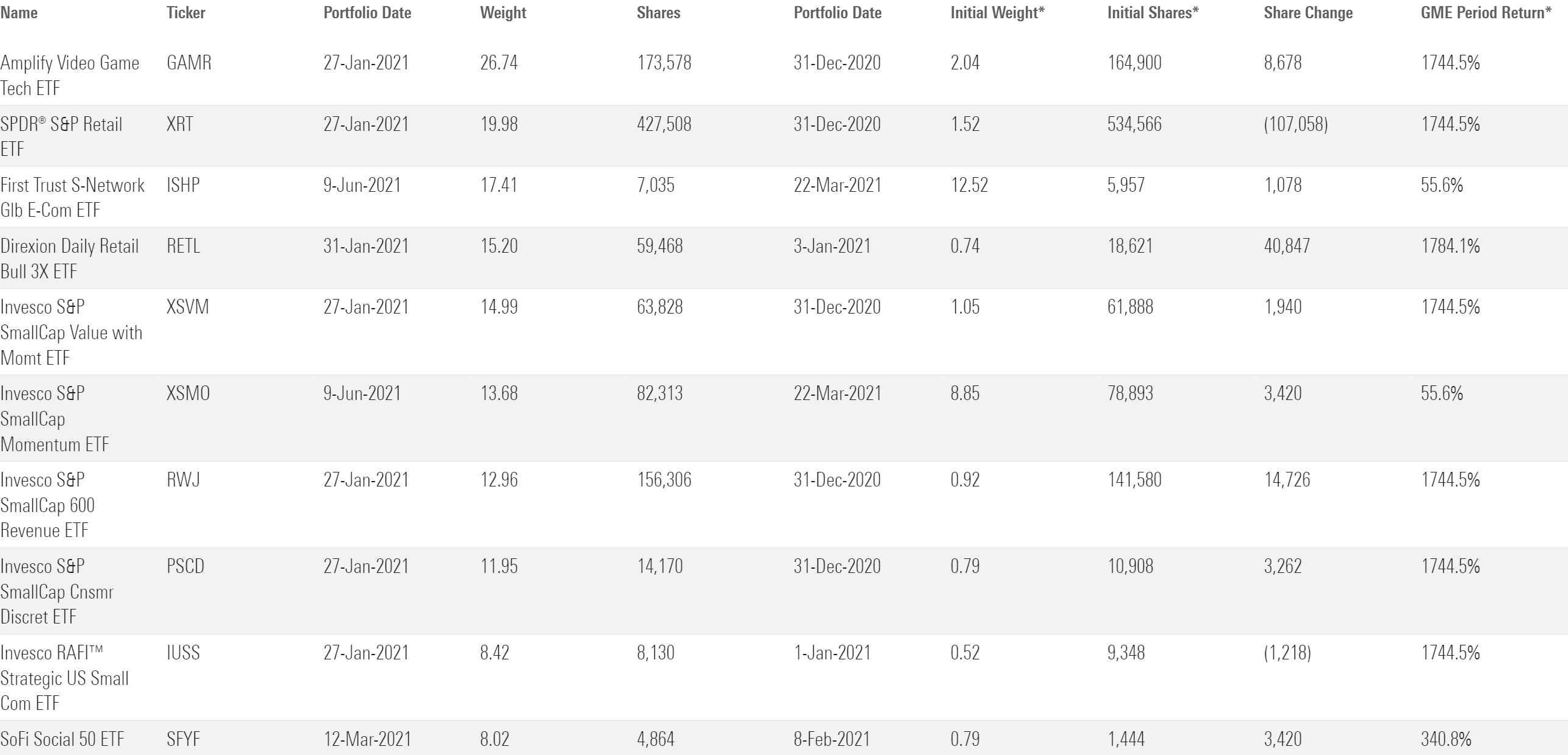

Exhibit 2 displays 10 passive ETFs with the largest stakes in GameStop and the difference between their initial and largest positions. Take these with a grain of salt, as this doesn’t mean the ETFs started selling after the positions reached their peak. As GameStop’s stock topped out, its size in these portfolios likely dwindled alongside its market cap. In addition, the price jump on Jan. 27, 2021, also doubled the stock’s size in many portfolios without a position cap.

Top 10 Passive ETFs With the Biggest Bets on GameStop

By virtue of being broad and holding everything, these ETFs did not cash out much of their gains. Most passive ETFs held on to GameStop through the end of 2021. (Again, except for small-cap ETFs that shed the stock as its market cap ballooned.) Still, a cost basis in the single digits is very hard to beat. Even at its recent worst in April 2024, GameStop’s share price still hovered at double its prerally level. That’s a nearly 25% annual return over the span of just three years, not much worse than a broad equity index.

It’s also important to note the volatility that comes with unconstrained exposure to these types of names. Broader portfolios with a larger lineup can better mellow out concentration risk, especially in the small-cap market, where market darlings can balloon overnight.

Investing Isn’t Usually All Fun and Games

Fundamental-driven managers avoided meme stocks, often for good reason. When the market divorces itself from reality, timing market sentiment is nearly impossible. Systematic active ETFs with a good selling discipline or position-size guardrails might still be able to harvest these lightning deals, like was the case for Cambria Shareholder Yield ETF and Avantis US Small Cap Value ETF. Nonetheless, passive funds will always be a safe bet in these irrational scenarios: It’s hard to miss the big shots if you own everything.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/06-27-2024/t_128e5b2b1e35443e99302bd249d3a5d5_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)