What the Great Resignation Does and Doesn’t Mean for Economic Recovery

In this labor market update, we outline how we expect the factors contributing to the unusually high number of job openings to fade over the next year.

The labor market presents a minor puzzle in the economic recovery, with the increase in employment in recent months seeming somewhat slow given the record rate of job openings.

While we don't see much evidence of a "Great Resignation" involving people leaving the workforce, we do see an elevated rate of job hopping, which is helping to put moderate upward pressure on wages. Additionally, several temporary factors are probably weighing on the return to work, including childcare, coronavirus risk, and accumulated savings from unemployment and stimulus. That said, we expect each of these factors to diminish in impact over the next year and beyond.

What’s Going on in the Labor Market?

It doesn't look yet like the labor market is a main factor in holding back the economic recovery, with other supply-side constraints playing a bigger role in the third quarter's weak gross domestic product growth--only 2% annualized, the slowest rate so far in the economic recovery.

Nevertheless, the labor market will ultimately be the most important factor in how far the economy can recover. Our bullishness on GDP growth through 2025 is driven mostly by our expectation for further recovery in the labor market, specifically the labor force participation rate. Additionally, a tight labor market is the most plausible reason we could see for sustained high inflation.

We do see clear signs of the labor market tightening, with the starkest sign being the quits rate reaching its highest on record in September 2021. Strong demand is pushing businesses to hire new workers to expand their output. This has led to a surge in job openings, which in turn has enticed workers to switch jobs at an extraordinary rate.

While the rate at which people are rejoining the workforce has slowed, we don't think the supply of new workers is drying up entirely, which would put an end to the economic recovery. We expect the unemployment rate to fall to its pre-pandemic level (3.6%) by the fourth quarter of 2022, and tight labor markets should help push up labor force participation in 2022 and beyond, just as was occurring before the pandemic.

Job Growth Has Been Fairly Consistent Since Early 2021

The prevailing narrative surrounding the health of the labor market has often swung wildly depending on the latest month's nonfarm payrolls (the most common monthly measure of the labor market), which have been quite volatile in 2021.

However, the volatility in nonfarm payrolls is much diminished if we adjust for a couple of factors: the seasonal pattern of hiring in education, and the Delta variant’s impact on hiring in industries such as hospitality in August and September. With these factors in mind, nonfarm hires have actually proceeded at a fairly consistent pace in 2021.

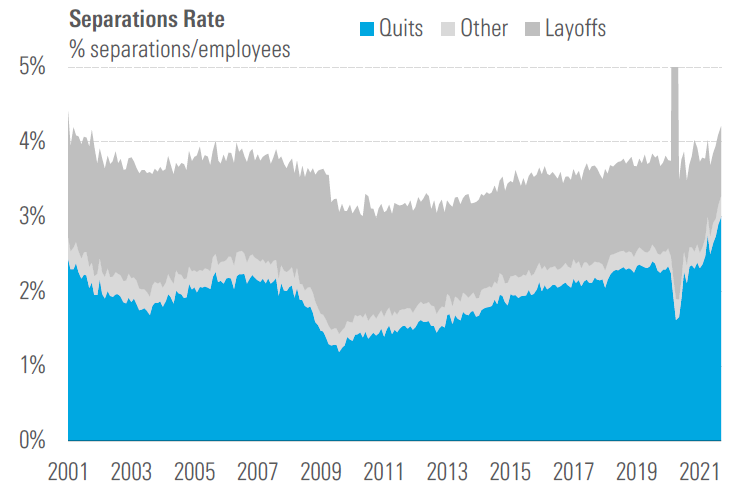

Gross hiring has been proceeding at a very fast pace; however, this has been greatly offset by increased job separations (which includes both resignations and terminations). As shown below, job separations have been propelled higher by the rate at which workers are leaving their current jobs. This rate has soared to 3%, not only ahead of the pre-pandemic rate (2.3%) but the highest level since the data began in 2001.

Exhibit 1: Separations Rate Has Been Driven Higher by Record High Quits Rate

- source: Bureau of Labor Statistics, Morningstar.

There Is No Great Resignation, but Instead a Great Reshuffling

Though the surge in the quits rate has led to many dubbing this period the "Great Resignation," we believe this is a misnomer if it implies that workers are quitting the workforce entirely (as many media articles have framed it).

But rather than leaving the workforce altogether, many workers are switching to other jobs at an increased rate. And the record high quit rate is entirely unsurprising given the record high rate of job openings, which are enticing workers to switch jobs for better pay and other benefits. Also, the labor market flows data shows no increase in the rate at which people are leaving the workforce compared with pre-pandemic levels.

The main puzzle is why more people out of the workforce haven't rejoined it given record high job openings. The unemployment rate in September 2021, 4.6%, was unusually high given record high job openings--a number we’d expect to fall more around 3%, based off of the historical relationship between the unemployment rate and the number of job openings. The discrepancy between unemployment and job openings compared with their historical relationship has existed throughout the pandemic.

Labor Market Has Yet to Fully Recover, but Permanent Impairment Is Unlikely

In addition to the unemployment rate remaining above pre-pandemic levels, labor force participation has also yet to fully recover. As of October 2021, lower labor force participation actually accounts for most of the hit to the adult employment/population ratio.

The hit to labor force participation is somewhat concerning, as the recovery in participation after the Great Recession was very slow.

However, we don't think that labor force participation will see a large permanent impairment from the pandemic. From a mechanical perspective, the decline in labor force participation is well explained by the elevated unemployment during the pandemic. The steady state labor force participation rate (which the actual participation rate gravitates toward) has been driven lower by a higher exit rate among people in the labor force. In turn, the higher exit rate is attributable to a higher unemployment rate (six-month moving average), as unemployed people are many times more likely to leave the labor force in a given month than the employed.

With the unemployment rate low and falling further, this should exert upward pressure on the labor force participation rate in the near term.

4 Temporary Factors Affecting Labor Force Participation

We think several temporary factors are weighing on the return to work, causing unemployment to be elevated and labor force participation to be depressed:

- Childcare responsibilities have remained elevated, owing to reduced daycare availability and inconsistency of in-person instruction in schools. It's difficult to gauge the impact of this factor, as we don't see a lower rate of employment for parents compared with nonparents (which is probably because parents also have less discretion to choose not to work).

- Concerns around coronavirus risks at work may still be high, although the vast majority of people highly concerned about coronavirus risk have been vaccinated.

- Accumulated savings from heavy unemployment benefits and other stimulus during the pandemic may be keeping some former workers on the sidelines for now.

- There may simply be an intrinsic "speed limit" in how quickly employment can recover. The early phase of the pandemic jobs recovery was merely a matter of recalling workers back to their prior employer. However, now virtually all jobs being added are new matches between workers and firms, which is inherently a longer process.

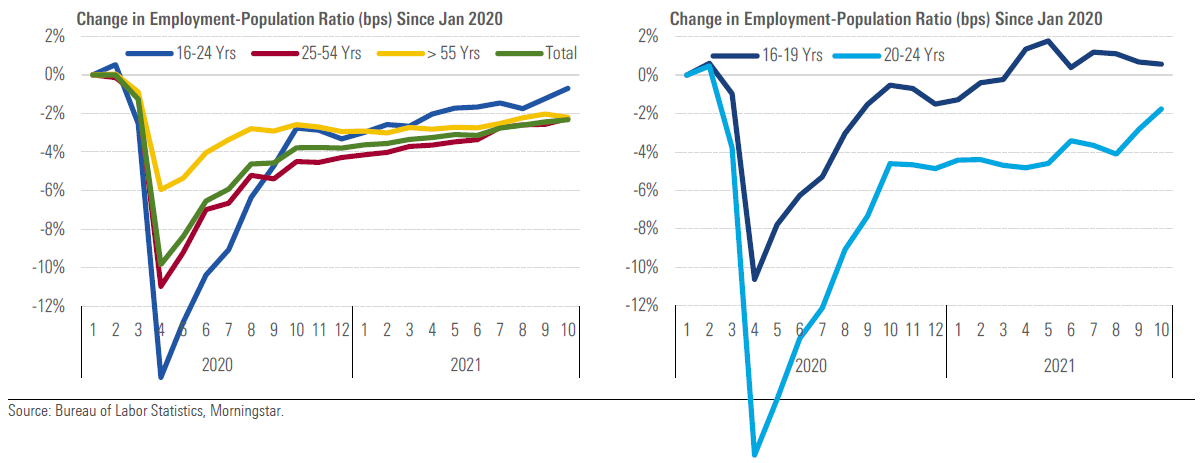

One way to gauge the impact of these factors is to examine the employment-to-population ratio across age groups, as we do below. Youth employment has outperformed since early 2021, which suggests a prominent role for the childcare and coronavirus concerns factors.

Exhibit 2: Age-Specific Employment Rates…. Left: Younger people have returned to work to greatest degree. Right: Teen employment rate is actually exceeding pre-pandemic rates.

Additionally, teen employment (ages 16-19) has performed the best, and actually exceeds pre-pandemic rates. Because few of today's 16- to 19-year-olds have received unemployment benefits or stimulus checks, this suggests a strong role for unemployment benefits and stimulus in the unusually high number of job openings.

Still, we expect the impact of these factors to fade over the next year or so as life continues to normalize after the pandemic. Accumulated savings from stimulus will soon run out, and childcare issues and coronavirus risk perception should gradually fade.

One factor that may prove more enduring, if not quite permanent, is the effect of increased retirements. Data from the Bureau of Labor Statistics has found that retirements were about 2 million above normal during the pandemic, accounting for all of the decline in labor force participation among workers aged 55 and older.

However, retirements have been heaviest among workers over age 70, which is probably just a pulling forward of retirements that would've occurred within the next few years anyway. Additionally, retirement status isn't as sticky as one might think: Prior to the pandemic, around 2% of erstwhile retirees decided to rejoin the labor force in a typical month. Also, we haven't seen an uptick in applications for Social Security benefits, one key marker of whether retirement is likely to be permanent.

Based on the above evidence, we think the bulk of the impact from retirements will fade by 2025. Nevertheless, we have shaved our expectations for 2025 labor force participation by 20 basis points compared with our prior forecast (or about 0.5 million people), owing chiefly to the enduring impact of early retirements.

The U.S. Is an Outlier in Labor Force Participation

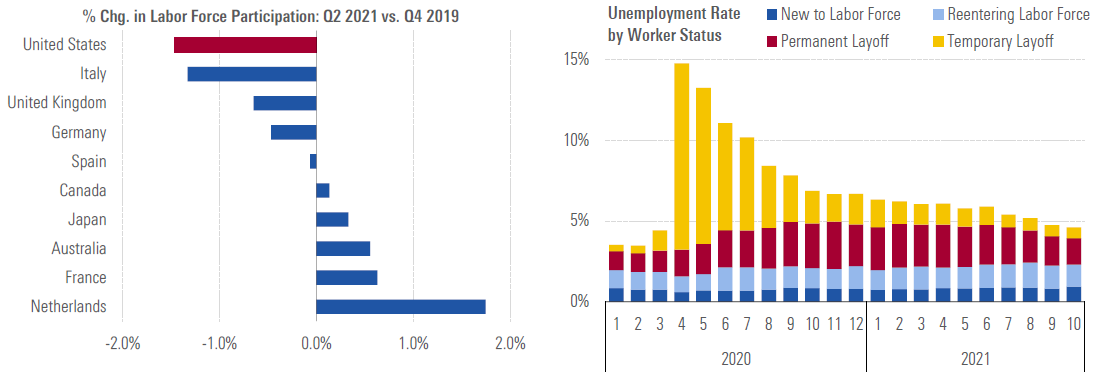

Finally, as shown below, it's worth noting that the United States is an outlier in terms of its large decline in labor force participation compared with most other advanced economies. Several countries have even seen an expansion in the labor force compared with pre-pandemic levels.

Exhibit 3: The U.S. Is an Outlier in Terms of Labor Force Participation, but Probably Due to Temporary Factors Left: U.S. labor force participation has fallen more than other major economies. Right: U.S. unemployment scheme probably led to more permanent layoffs.

- source: Morningstar, Organization for Economic Cooperation and Development, U.S. Bureau of Labor Statistics.

We can't imagine any long-term structural factors that would explain the divergent results among countries in terms of labor force participation. Instead, the more likely explanation is that job retention schemes widely deployed in other countries (but not the U.S.) kept more workers tied to their existing employers. Indeed, the fall in the U.S. unemployment rate decelerated markedly once the pool of workers on "temporary layoff" dried up. Other countries differed in maintaining a large share of unemployed workers on temporary layoff (or reduced hours).

The drawback of the U.S. approach is that matching workers to new firms is a lengthy process that will delay the labor market recovery. However, if this story is correct, it bolsters our view that the hit to U.S. labor force participation from the pandemic will be mostly temporary. In other words, the hit doesn't reflect a large, permanent reduction in desire or ability to work among U.S. adults.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/d10o6nnig0wrdw.cloudfront.net/07-02-2024/t_6b25eabdd47c4e2bb51fbb816a658179_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)