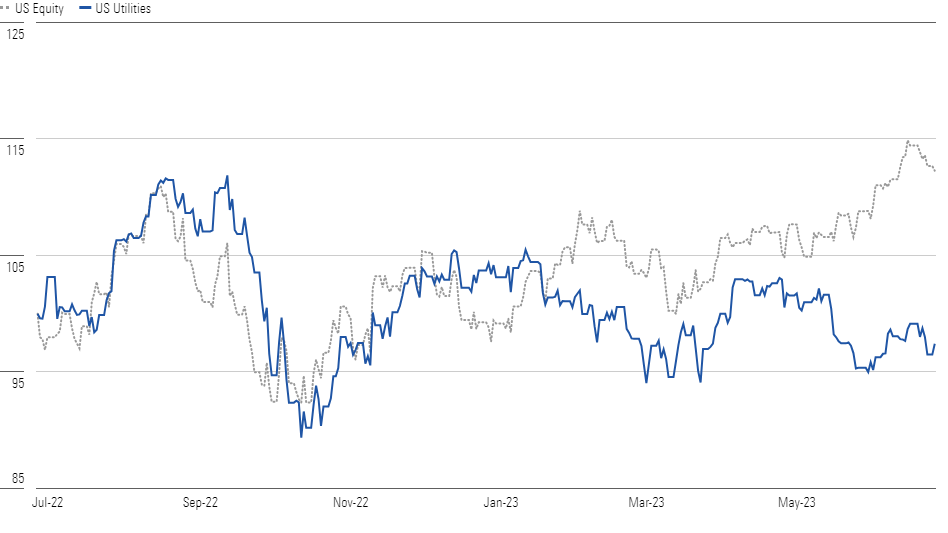

Utilities Stock Outlook: Still Running In Place

The sector has remained flat due in large part to a long-overdue valuation correction.

This article is part of Morningstar’s Q2 market review and outlook.

As the broader markets thrash, utilities are turning in another ho-hum year. Investors should be ready to settle into this trend, with headwinds and tailwinds keeping the sector idling.

Utilities have been mostly flat since their 2021 rally fizzled. Flat performance was a big relative win in 2022 when the U.S. market fell 19%, but it’s been a relative loss with the market climbing in the first half of 2023. The flat returns from utilities over the last 18 months constitute the sector’s worst absolute performance since the 2008-09 recession. This is due in large part to a long-overdue valuation correction. Utilities traded above our fair value estimates and the sector’s long-run average valuations for most of the last decade, peaking at 22% overvalued and 26 P/E in early 2020. The valuations have come down while earnings and dividends have grown and the stocks have been treading water.

Utilities Among Worst-Performing Sectors In 2023

We now consider the sector fairly valued, with more than half the utilities in our coverage trading below our fair value estimates. The sector’s 20 trailing P/E remains above the long-term average, but we think that’s justified given its strong financial health, long-term earnings growth potential, and upside to the clean energy transition. Utilities’ balance sheets are strong, dividends are well-covered, and we expect most companies can grow earnings 5%-7% annually for at least the next five years. That growth could last a decade or longer if the clean energy transition continues, including growth in renewable energy, electric vehicles, grid upgrades, and other clean technologies. This earnings growth plus dividend yields topping 3.5% suggest 8%-10% long-term returns for utilities investors now that valuations have corrected.

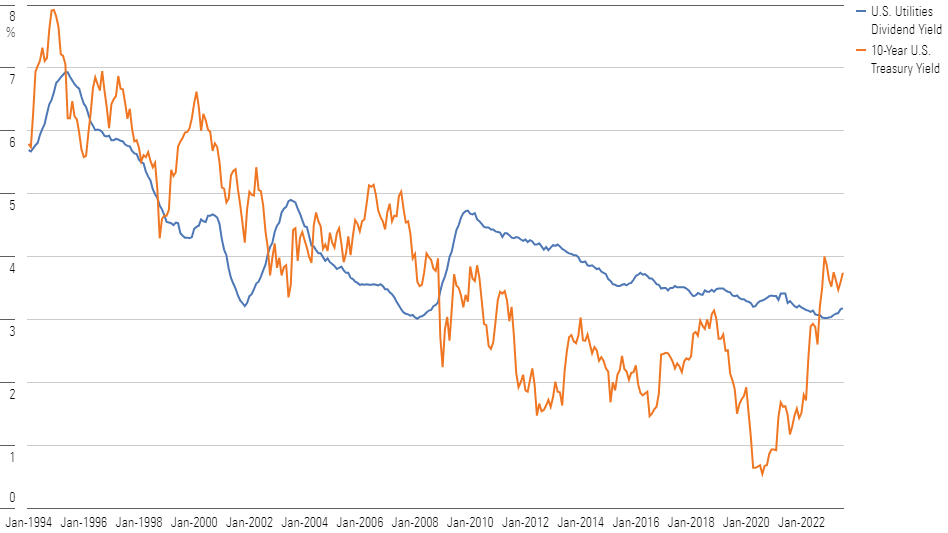

Utilities’ Dividend Yields Are Chasing Bond Yields

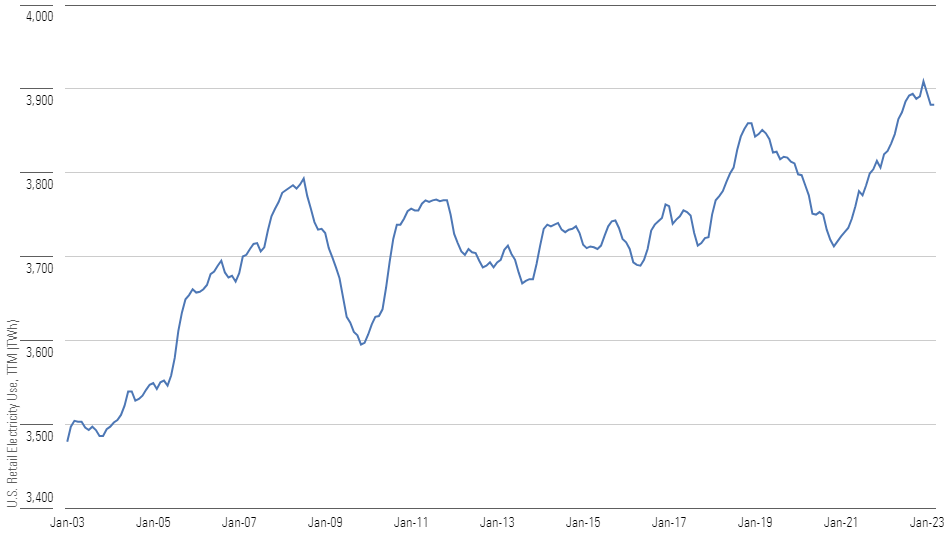

In the second half of 2023, we expect utilities to feel near-term pressure from higher interest costs, inflation, and less-favorable weather. Summer 2022 was one of the warmest ever for many utilities, boosting earnings and cash flow as U.S. electricity demand hit an all-time high. A cooler summer and warmer winter will reduce energy use and could hurt earnings this year for some utilities. Utilities that can maintain lean operations should outperform during the coming quarters.

Electricity Use Falling Off Record-Setting Pace In 2022

Top Utilities Sector Picks

Entergy ETR

- Fair Value Estimate: $120.00

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

Entergy’s 4% dividend yield and our outlook for 7% earnings growth represent one of the best total returns in the sector. Entergy shareholders also could benefit if the stock erases its current 15% valuation discount to peers. Above-average growth in electricity demand, clean energy investments, and reliability/resiliency network investments in the Southeast U.S. are core growth drivers. In addition, Entergy should benefit from investment opportunities related to reducing industrial carbon emissions, growing global energy demand, and green hydrogen development.

NiSource NI

- Fair Value Estimate: $33.00

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

We think NiSource is a high-quality utility trading at the same valuation as its lower-quality peers. The firm’s transition from fossil fuels to clean energy in the Midwest supports a decade of above-average growth. NiSource plans to close its last coal-fired power plant in 2028 and replace the generation with wind, solar, and energy storage. These investments and upgrades at its gas business could total as much as $30 billion of investment during the next 10 years, leading to 7% earnings and dividend growth. Blackstone’s recent investment in NiSource at a premium valuation supports our view.

Duke Energy DUK

- Fair Value Estimate: $105.00

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

After divesting its renewable energy business, Duke has a clear pathway to achieving management’s 5%-7% earnings growth target. Duke’s $65 billion capital investment plan for 2023-27 is focused on clean energy and infrastructure upgrades to reduce carbon emissions. New legislation in North Carolina supports the clean energy transition, and Florida offers opportunities for solar growth. Duke’s 4.4% yield is among the highest in the sector, but dividend growth will lag earnings growth, given the firm’s higher payout ratio.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)