Technology: A Top Sector With New Buying Opportunities

We remain confident in secular tailwinds like cloud computing, artificial intelligence, and rising semiconductor demand.

After a tumultuous 2022, the tech recovery that began in the first quarter of 2023 and continued in the second quarter seemed to pause during the third. Macro concerns such as interest rates are once again taking center stage. Despite modest underperformance versus the broader market throughout the third quarter, tech remains the best-performing sector by a wide margin over the last 12 months. While mega-cap stocks were driving performance earlier this year, the sector has broadened such that we see diversity in market caps and tech industries among the best performers. We remain confident in secular tailwinds in technology, such as cloud computing, artificial intelligence, and rising semiconductor demand. We still see some select buying opportunities in semiconductors and software, despite macroeconomic uncertainty.

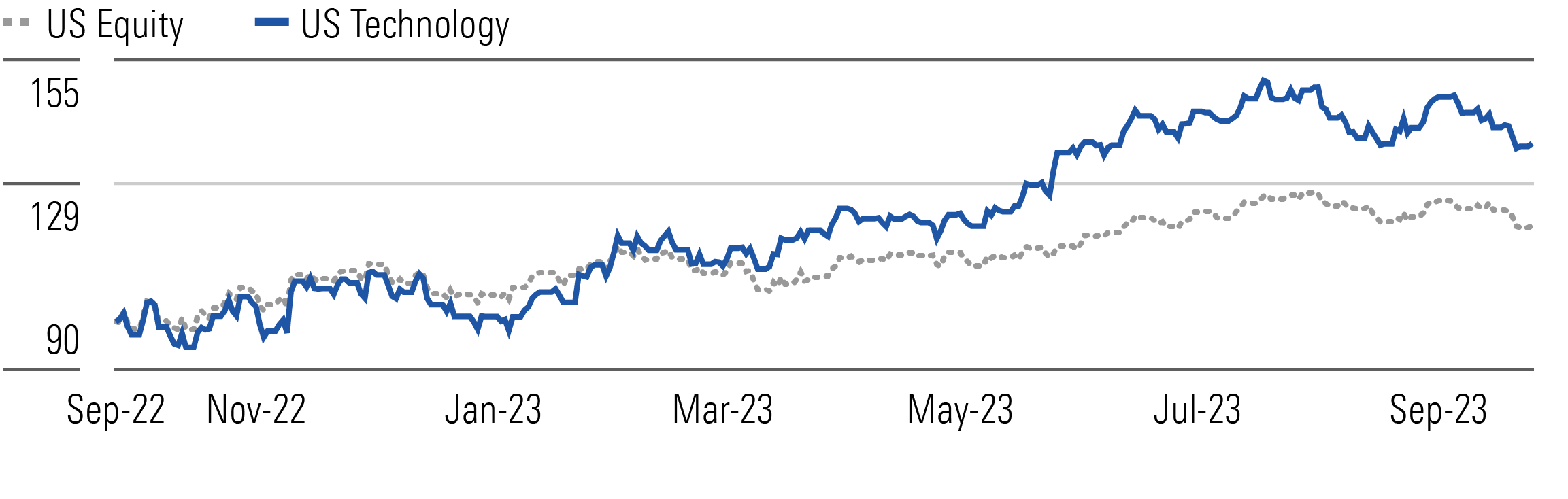

Technology Has Been a Strong Outperformer In 2023

Currently, the most important catalyst across technology is generative artificial intelligence. Software companies are developing and incorporating next-generation AI capabilities within their solutions, while cloud providers are introducing new services and ramping up capacity, and semiconductor firms, notably Nvidia NVDA, are experiencing surging demand for AI and data center chip applications.

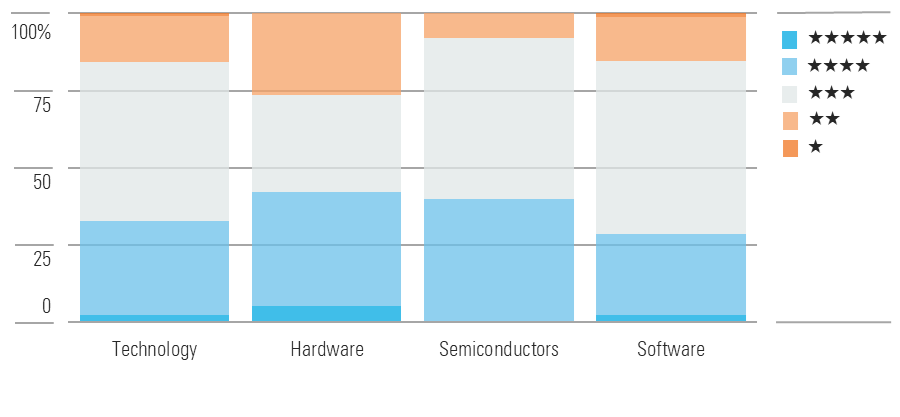

We See the Majority of Technology Stocks as Approximately Fairly Valued

The Morningstar US Technology Index is up 37.4% on a trailing 12-month basis, compared with the U.S. equity market being up 20.3%. Over the past quarter, both were down slightly but effectively flat. The median U.S. technology stock is 8% undervalued, and we see less of a margin of safety than when these stocks were 20%-25% undervalued nine months ago. We see the median hardware, software, and semis stocks as approximately fairly valued.

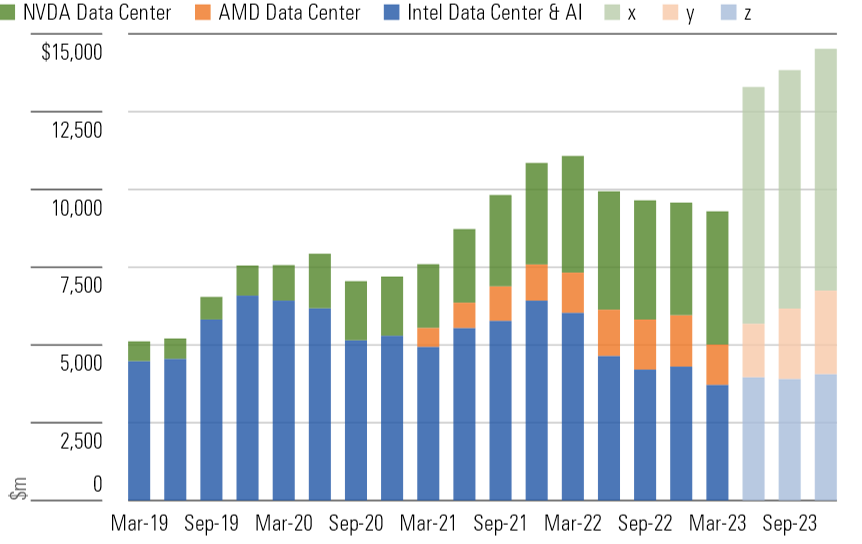

Nvidia Is Poised to Dominate the Data Center/AI Chip Space In 2023

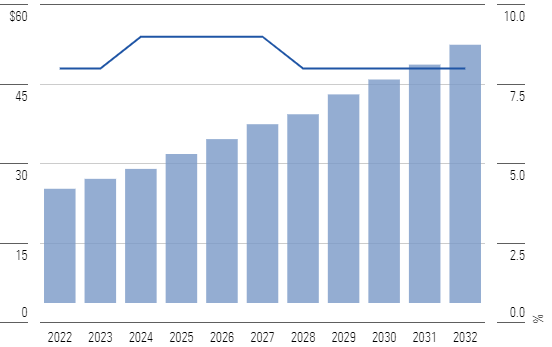

Few companies are as well-positioned to capitalize on the burgeoning AI market as Nvidia, which posted exceptionally strong results in each of its last two quarters. With limited direct competition and surging demand, we expect the company to experience explosive near-term growth for data center applications. Separately, we think software for computer-aided design, or CAD, and product lifecycle management, or PLM, is very sticky and offers attractive returns for investors. We also believe growth in these niches is more stable (if less robust) than in some other areas within software. We see the CAD and PLM market growing in the high single digits to $52 billion in 2032.

We See the CAD and PLM Market Growing to $52 Billion by 2032

Top Technology Sector Picks

Snowflake

- Fair Value Estimate: $231.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

In our opinion, Snowflake SNOW is well-positioned to capitalize on the data explosion and the underlying data needed to make AI a reality. We think the market is significantly discounting the company’s potential by underestimating three key areas: datasphere (the total data in existence) growth, how differentiated the firm’s technology is, and the powerful potential of its small but mighty data marketplace. This leaves a meaty opportunity for investors, thanks to what we believe is a lack of understanding of this complex space and our expectation that Snowflake will grow significantly over the next five years.

Cognizant Technology Solutions

- Fair Value Estimate: $94.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

We think Cognizant CTSH will continue to push its reputation past being a back-office outsourcer to emphasize its higher-value technical offerings—like digital engineering and AI solutions—as well as digital transformation consulting. In our view, smaller IT providers for digital transformation services will be squeezed out because of the consolidation of accounts with larger vendors like Cognizant. We bake in a five-year revenue compound annual growth rate of 8%, an acceleration of 5% over the last five years.

Teradyne

- Fair Value Estimate: $157.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Teradyne TER is a chip-testing behemoth that uses its large research and development budget to produce top-tier automated test equipment and attain a leading market share, all while posting better profitability than its peers. Teradyne boasts especially strong relationships with Apple AAPL and Taiwan Semiconductor Manufacturing TSM, but we think the breadth and depth of its capabilities across many chip types and end applications represent impressive intangible assets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)