Real Estate: Performance Continues to Be Driven by Interest-Rate Movements

Kilroy, Healthpeak, and Sun Communities are our top picks in the real estate sector.

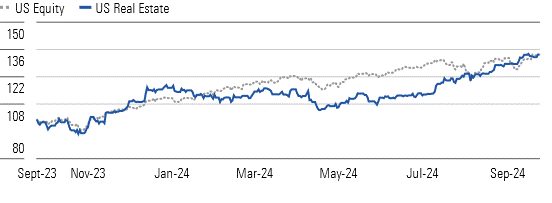

The Morningstar US Real Estate Index was up 22.5% over the trailing 12 months, slightly below the 24.3% gain seen by the broader US equity market over the same period. However, the real estate sector significantly outperformed the market in the third quarter as the market rotated into value stocks. The sector’s performance is negatively correlated with interest rate changes. As rates fell in late July into August, this drove real estate’s strong performance.

After a Strong Third Quarter, Real Estate Performance Nearly In Line With US

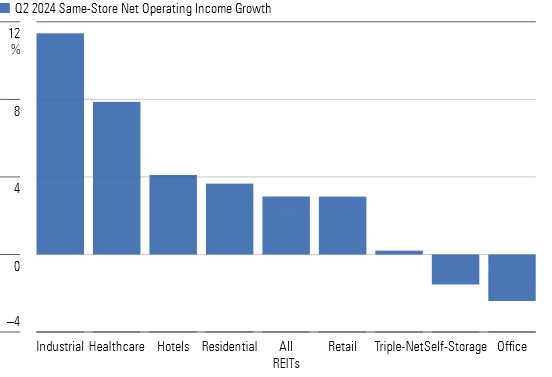

Same-store net operating income growth continues to decelerate across most real estate subsectors from the historic highs seen in 2022, though many are now producing growth around their long-term historical averages. Management teams generally provided conservative initial guidance for 2024, and as a result of solid results, many raised 2024 guidance on their second-quarter earnings calls.

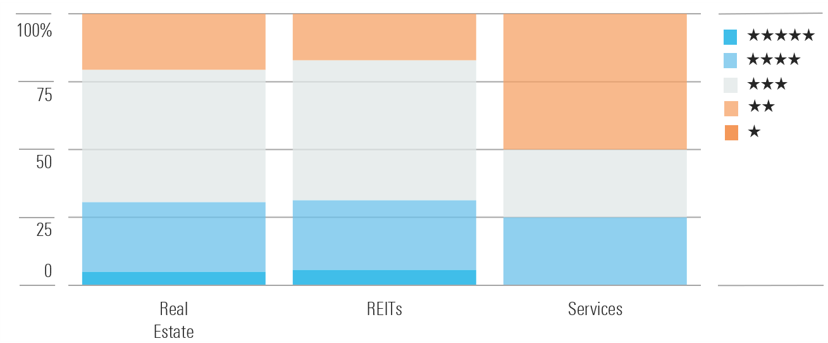

Real Estate Sector Currently Trading at Slight Discount to Fair Value Estimate

The median stock in the sector is trading slightly below our fair value estimates. Currently, 5% of the sector under our coverage is trading in the 5-star range, 26% is in the 4-star range, 49% is in the 3-star range, 20% is in the 2-star range, and none are in the 1-star range.

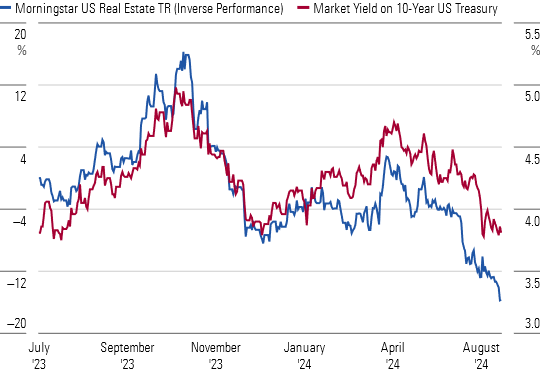

UST Rate Movements Have Been the Driving Factor Behind REIT Performance

The performance of the US Real Estate Index has been in line with interest-rate movements over the past 12 months, moving inversely to the 10-year US Treasury bond. Additionally, while growth in same-store net operating income is decelerating for most sectors, on average, REITs reported growth around the historical average of 3%. While self-storage and office saw declines in same-store performance, healthcare and industrials continue to produce strong growth, well above the historical average.

Several REIT Sectors Produced Solid Same-Store NOI Growth in Q2

Top Real Estate Sector Picks

Kilroy Realty

- Fair Value Estimate: $59.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

Shares of Kilroy KRC have fallen since the onset of the pandemic, even as the company’s NOI has increased materially due to the completion of development properties and acquisitions. We recognize the uncertainty surrounding the future of office real estate and believe that the environment will remain challenging in the near to medium term. Still, we believe the selloff has been overdone and the market is not recognizing the value of the company’s non-office-related assets and land bank. Kilroy has a high-quality portfolio with an average building age of 11 years, compared with 34 years for other office REIT peers. The company should be a prime beneficiary of the flight-to-quality trend in offices. Further, it has a strong balance sheet with the lowest leverage within our office REIT coverage.

Healthpeak Properties

- Fair Value Estimate: $30.50

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Healthpeak’s DOC management team strategically focused the company around the medical office and life science portfolios. These sectors should provide steady and recession-resistant revenue growth for the company. The company’s development pipeline should also produce yields above its cost of capital even amid higher interest rates, producing additional cash flow growth for shareholders. Healthpeak sold off due to rising interest rates, but we believe the current market-implied cap rate undervalues the company’s portfolio of stable assets.

Sun Communities

- Fair Value Estimate: $172.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Sun SUI owns a portfolio of manufactured housing communities, recreational vehicle communities, and marinas in desirable locations for second homes or vacation properties. Most of Sun’s segments have produced strong same-store NOI growth over the past five years, with many nearing historical highs. Management continues to make progress in converting transient business into annual memberships, which produces more stable revenue and tends to have higher growth over the long term. We believe Sun will produce same-store NOI above the residential REIT average over the next several years and that the market will recognize the strong internal growth story when interest rates stabilize.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JCN26JDJBFA5BYKGBL2ATIHCU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)