Financial Services: Sector Doing Well Heading Into Rate-Cutting Cycle

Our favorite financial services stocks include US Bancorp, PayPal, and MarketAxess.

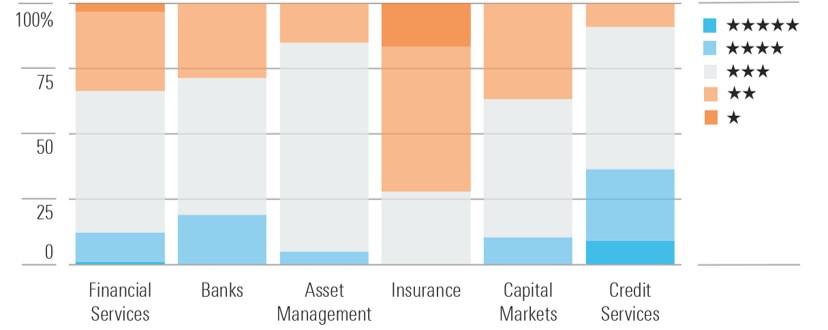

We assess that there are fewer undervalued companies in the financial sector after gains this year, and that it is increasingly a stock picker’s market. The undervaluation in companies we like is largely due to name-specific uncertainties, such as outsized exposure to potential regulations or eroding market share leading to questions about a company’s long-term growth or profitability.

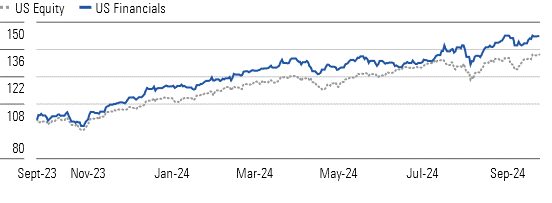

Financials Doing Well Heading Into Rate-Cutting Cycle

Undervalued Stocks Becoming Scarce in Financials

A catalyst and swing factor for certain stocks is the upcoming presidential election. We generally see a Republican sweep as more beneficial for financial stocks thanks to less strict banking regulation, historical comfort with approving mergers, and more positive sentiment on cryptocurrencies. A sweep in the legislature by either party would likely lead to higher deficits through either tax cuts or increased spending that could lead to more debt issuance and higher US interest rates. Higher interest rates would benefit many parts of the financial sector but are generally negative for stocks as a whole.

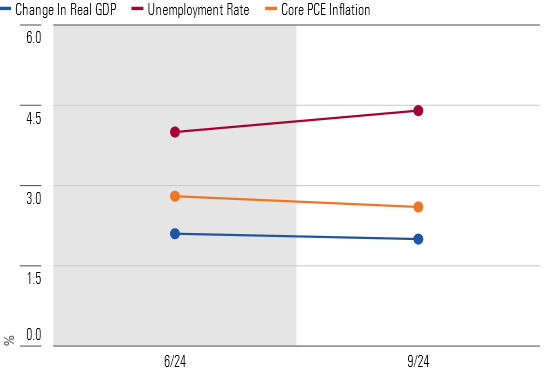

Inflation and Unemployment Risks Are More Balanced

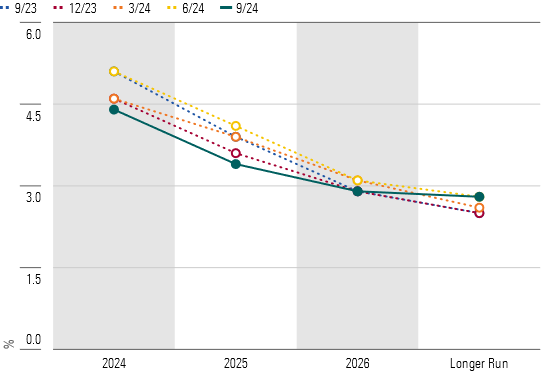

The Federal Reserve Open Market Committee decreased the target federal funds rate to a range of 4.75%-5.00% from 5.25%-5.50%. Over the previous months, market expectations had fluctuated between pricing in a 25-basis-point or 50-basis-point cut. Based on the September FOMC commentary and economic projections, the participants project that in 2024, GDP growth will be lower, inflation will be lower, and the unemployment rate will be higher than when it last made projections in June. This made risks to its mandate more balanced between inflation and unemployment than before, hence the larger interest rate.

FOMC Participants Expecting to Cut Rates Faster

Top Financial Services Sector Picks

MarketAxess Holdings

- Fair Value Estimate: $305.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We expect 2024 to be a better year for growth for MarketAxess MAX, as last year, the company faced dual headwinds from low corporate bond issuance levels and an unfavorable mix shift creating downward pressure on its average fees. While these are still a factor, the company is benefiting from higher trading volume industrywide, and as interest rates fall, it will see some relief for its average pricing. That said, MarketAxess continues to face significant competition in the electronically traded US corporate bond market from both Tradeweb Markets TW and the smaller Trumid, which has led its investment-grade bond market share to be relatively stagnant in recent years. We still see meaningful secular growth drivers for MarketAxess, but competition will impede volume growth.

PayPal Holdings

- Fair Value Estimate: $104.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

PayPal’s PYPL shares have fallen about 75% from their pandemic peak to a level materially below their prepandemic price. With market confidence in the firm at a low ebb, we see a potential long-term opportunity. While we recognize the headwinds it faces in the near term, in the long term, the company’s fate remains tied to the high-growth e-commerce space, with Venmo providing some additional upside option value. Historically, PayPal has demonstrated it can take shares in this area, and we think it continues to do so overall. We believe the company retains a strong competitive position.

US Bancorp

- Fair Value Estimate: $53.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We believe there are still some pockets of opportunity in the banking industry. The biggest risk to our top banking picks would be surprises on deposit and funding costs or the realization of a recession. US Bancorp USB has sold off like some regionals, but we see relatively lower risk for the company, given that it is the largest regional. The bank does have slightly higher-than-average unrealized losses on securities, but we view this more as an earnings problem (lower-yielding assets stuck on the balance sheet) and not a capital problem.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KXH3Z35EXJHUFKNLDATYCKICAQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)