Competitively Advantaged Consumer Defensive Operators Look Poised to Weather an Inclement Period

The alcoholic beverage space continues to look undervalued to us.

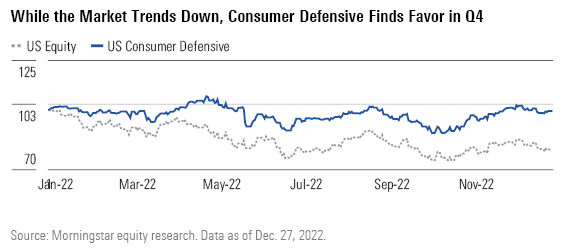

The Morningstar US Consumer Defensive Index outpaced the overall market in the fourth quarter, chalking up a 13.07% return versus the U.S. equity market’s 6.91% increase, as of Dec. 27, 2022. Undervalued ideas remain scant within our consumer defensive coverage, with the median stock in the sector trading at a 2% premium to our fair value estimates. For investors interested in the consumer defensive space, we’d point to alcoholic beverages, where shares trade at a 15% discount to our intrinsic valuations, and consumer packaged goods, or CPG, where nearly 40% of our coverage trades in 4- or 5-star territory. In our view, investors’ reluctance to embrace shares in these alcoves stems from concerns surrounding inflation combined with a lack of appreciation for the product innovation and brand prowess that ultimately creates pricing power in the sector.

Inflation shows little sign of easing, and even after multiple rounds of price hikes over the past several quarters, further price increases are likely to manifest into 2023. As such, we think consumers may increasingly alter their purchasing patterns, which could spawn greater tradedown to lower-priced private-label fare.

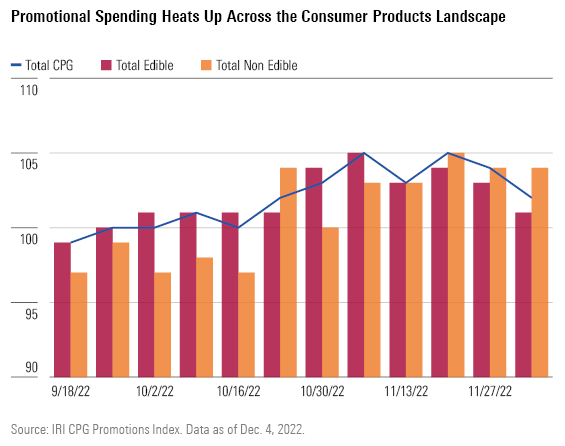

To blunt this shift, we’re beginning to see promotional spending edge up, as evidenced by the IRI CPG Promotions Index, where a reading of more than 100 showcases increasing promotions. However, we don’t believe this is conducive to supporting economic moats in the sector. Rather, we surmise investing in consumer-valued innovation and marketing will prove imperative for competitively advantaged CPG firms to cement their standing with retailers and consumers in the long term.

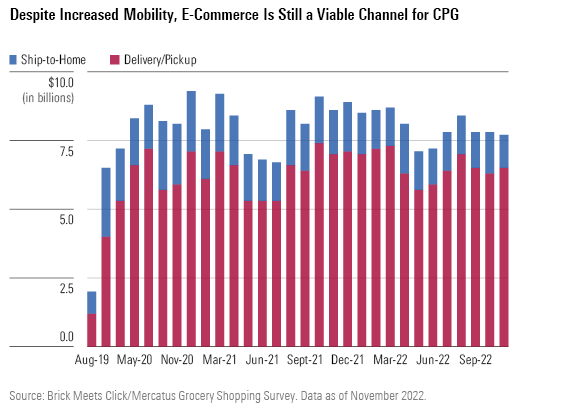

Even as concerns surrounding the pandemic have faded and consumers have resumed visiting multiple outlets to fulfill their CPG needs, they haven’t abandoned the e-commerce channel. In our view, the pandemic jump-started consumers’ acceptance of purchasing online, and investments to enhance retailers’ digital infrastructure over the past several years has afforded the opportunity to meet this demand. We surmise that retailers that differentiate their experiences and offer convenient omnichannel options stand to retain the shoppers they’ve gained since the pandemic began despite stepped-up competitive intensity.

See our analysts’ Top Picks in the Consumer Defensive sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)