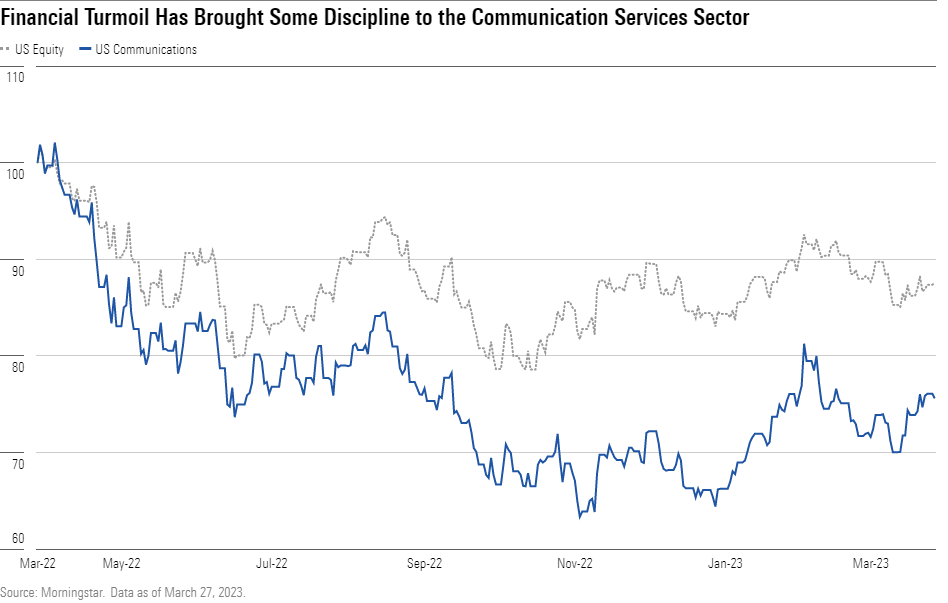

Communication Services Stock Outlook: Financial Turmoil Has Brought Some Discipline to Sector

Disney, Comcast, and Alphabet still lead pack as borrowing costs have jump, but some firms poised for short-term gains even amid recent pain.

Economic uncertainty and market turmoil have hit nearly every corner of the communication services sector. In the media business we’ve seen a rapid shift in focus to profitability from streaming customer growth at all costs. Notably, Disney now believes it is past the worst of the losses in its direct-to-consumer business (primarily Disney+) and that the segment will reach breakeven sometime in 2024.

The newly combined Warner Brothers Discovery has quickly cut costs, including production budgets, and expects to break even in its DTC business in early 2023 before dipping back into the red later in the year as it combines HBO Max and Discovery+ into one service. Both Paramount and Comcast’s NBC have committed to cutting streaming losses beyond 2023. Even Netflix has taken a more austere approach recently, walking away from proven hit-maker Nancy Meyers (”Father of the Bride”, “It’s Complicated”) when she requested a $150 million budget for her latest movie. While we expect competition for content will remain fierce, we believe the industry is moving toward a more rational marketplace for content and much-needed increased cost discipline.

Major telecom firms haven’t taken a direct hit from the economy or market, but the industry has still been affected. The smaller and more heavily indebted firms we cover have seen borrowing costs skyrocket over the past two months, which could force these firms to seek strategic alternatives. Lumen and Altice USA have seen yields on their bonds soar into the teens or higher, indicating that raising additional debt in the current market will be difficult or impossible. Neither firm faces immediate refinancing needs, but both may need to scale back network investment plans to placate investors at some point. To the extent restricted capital access slows network investment at smaller phone companies, the biggest cable companies like Comcast and Charter could see a modest benefit over the long term.

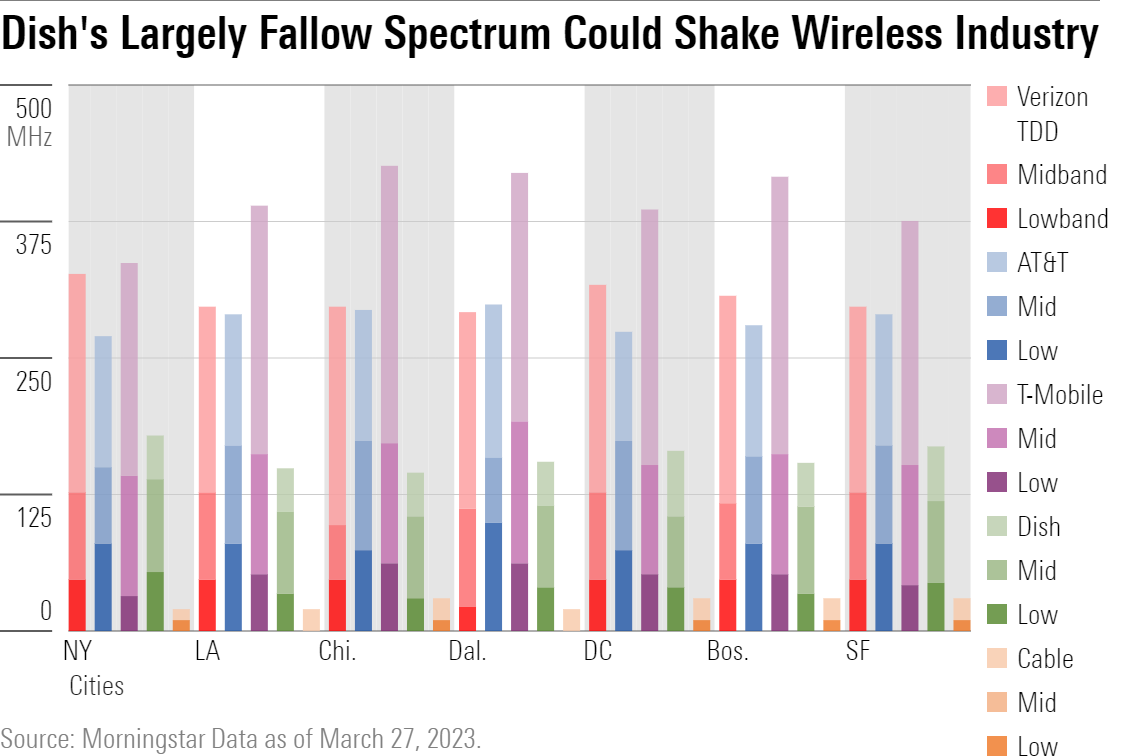

Dish Network has also seen its borrowing costs rise sharply following a cyberattack and system outage that has rightly cast doubt on the firm’s ability to execute its wireless expansion plans. Dish will need to raise capital later this year to fund network investment, which could push the firm to rethink its strategy. With a huge chunk of largely unused wireless spectrum licenses, Dish could partner with a cable company or tech firm to disrupt the emerging competitive balance in the wireless industry. We believe this is unlikely, given the operational challenges and Dish chairman Charlie Ergen’s reputation as a difficult partner. Not to be left out, sector giant Alphabet faces its own unique challenges, notably Microsoft’s OpenAI-backed Bing search engine. While Google is facing new AI-driven competition in search, we think the firm has the AI technology prowess to remain at the front of the industry.

Top Picks

Disney DIS

- Fair Value Estimate (USD): 155.00

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat: Wide

We believe the firm remains the best-situated traditional media firm to navigate the transition to streaming. The firm’s deep content library, teeming with major franchises, and its strong studios provide both Disney’s famous family-friendly fare and content suited for older audiences. We expect that fans will continue to flock to the firm’s parks and resorts. The cable networks, like ESPN, will likely continue to lose subscribers, but they generate cash flow to fund the firm’s streaming ambitions that will gradually displace traditional cable. We expect a greater emphasis on revenue growth and cost controls over the next year with the return of CEO Bob Iger, but the firm’s flagship streaming service Disney+ should continue to build momentum with audiences around the world.

Comcast CMCSA

- Fair Value Estimate (USD): 60.00

- Star Rating: 5 Stars

- Uncertainty Rating: Medium

- Economic Moat: Wide

We expect broadband customer growth will remain modest as the market is maturing and the phone companies will likely gain share as their fiber upgrades progress. But we still expect the firm will grow broadband revenue, primarily through solid pricing power. NBC Universal will need to invest to increase interest around Peacock, but we still like the firm’s position overall thanks to its solid stable of content franchises, strong theme parks, and highly profitable traditional television business. With a strong balance sheet, Comcast should be able to direct most of its free cash flow to shareholder returns (solid dividend and heavy share repurchases), which we believe add significant shareholder value at the current stock price.

Alphabet GOOG

- Fair Value Estimate (USD): 154.00

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat: Wide

Advertising demand has hit a wall and Alphabet isn’t immune—the firm’s ad revenue declined 3.6% during the 2022 fourth quarter, the weakest since the financial crisis in 2009 outside of the start of the pandemic in 2020.

However, improvement in the macroeconomic environment is expected to push Alphabet shares higher. The changes in Apple’s iOS policies regarding data privacy and security have not affected Alphabet as much as they had on Meta and Snap. The cloud business is also growing, making headway toward profitability, and reducing dependence on the ad market.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)