In Communication Services, Negative Messages Abound

Amid heavy pessimism in the sector, our top picks are Disney and Comcast.

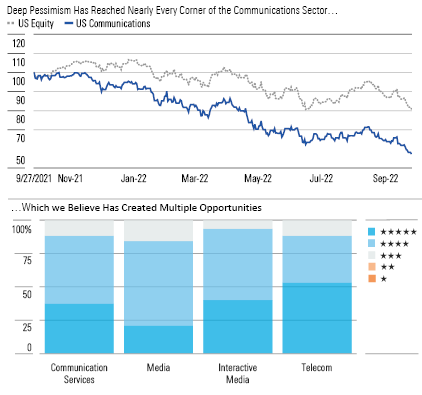

Large-cap telecom stocks piled on to Alphabet and Meta's struggles during the third quarter, dragging the Morningstar U.S. Communication Services Index down another 11%, leaving the sector index roughly 39% lower year to date versus a 24% drop for the market. We continue to see bargains among the carnage.

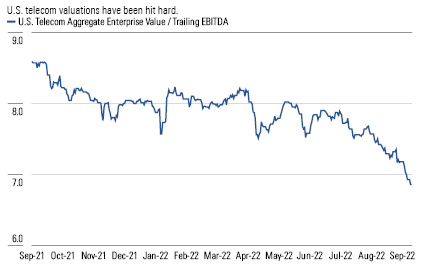

Comcast CMCSA , AT&T T , Verizon VZ, and Charter each declined 20% or more during the quarter, taking valuations across the telecom industry down to levels not seen in a decade. Only T-Mobile has held up within this group. Over the past year, these five telecom carriers have seen their aggregate market value drop from nearly $1 trillion to $640 billion, pulling their combined enterprise value (market cap and debt outstanding) down to 6.9 times trailing EBITDA versus 8.6 times. While the market has sharply soured on U.S. telecom, the firms remain more optimistic: Over the past couple weeks, Comcast increased its share repurchase authorization to $20 billion, T-Mobile initiated a $14 billion buyback, and Verizon increased its dividend 2%.

We believe the industry has reason for optimism. Growth opportunities for telecom carriers remain modest, but the industry structure remains favorable in our view. We expect the big three wireless carriers to remain focused on deploying recently acquired spectrum for the next couple years while taking an increasingly disciplined approach to promotional efforts. The cable companies have taken modest wireless share, but we expect their resale agreements with the major carriers will prevent them from becoming increasingly competitive on price. We believe the wireless carriers can gain modest home broadband market share but that they will avoid any activity that threatens the network experience of their lucrative smartphone customers. In short, we believe patience is needed with the telecom carriers as these slow-moving trends play out.

Source: Morningstar Analysts

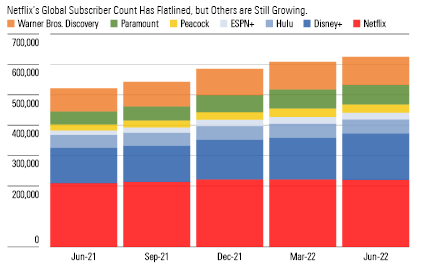

Pessimism around media stocks has also continued to grow as investors remained concerned about the streaming video business model. As we've discussed, subscriber growth at Netflix hit a wall in the first quarter. Despite beating very negative forecasts, second-quarter results at the streaming giant confirmed investor fears as the firm lost almost one million customers globally, two million net customer losses in the U.S. over the first half of 2022.

While Netflix management expects growth to rebound in the second half, the market seems to remain worried about the overall market opportunity and saturation in the U.S. for the firm and its competitors like Disney. Both Disney and Netflix are planning to launch ad-supported service tiers over the next six months, but we remain cautious on the impact in the near term as some growth could come from cannibalization of existing customers. As the market is beginning to appear crowded, inflation and the strong dollar are also weighing on the industry, both crimping consumers and elevating content creation costs. While both new and traditional players are restraining content spending growth, we don't expect that any firm could massively cut programming costs given the highly competitive landscape. Additionally, the higher inflation could limit streaming platforms' ability to push through subscription prices without harming customer acquisition. Despite these challenges, most streaming platforms continue to post solid customer gains, including the newly constituted Warner Bros. Discovery.

Source: Company filings. Morningstar. Data as of Sept. 26, 2022

Source: Company filings. Morningstar. Data as of Sept. 26, 2022

Top Picks

Walt Disney DIS Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $170 Fair Value Uncertainty: High

Disney remains the best-situated traditional media firm to navigate the transition to streaming, in our view. The firm's deep content library, teeming with major franchises, and its strong studios provide both the more family friendly fare Disney is famous for and content suited to older audiences. We expect that fans will continue to flock to the firm's parks and resorts as pandemic restrictions lift globally. The cable networks, like ESPN, will likely continue to lose subscribers, but they generate cash flow to fund the firm's streaming ambitions, including platforms like Hulu and ESPN+ that will gradually displace traditional cable. The firm’s flagship streaming service Disney+ also continues to build momentum with audiences around the world, providing the platform that will likely become the primary touchpoint with consumers over the long term.

Comcast CMCSA Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $60 Fair Value Uncertainty: Medium

Comcast faces a double whammy as concerns over slowing broadband customer growth have dogged the core cable business and fears surrounding increased content investments have hounded NBC Universal. We expect broadband customer growth will slow further as the market is maturing and the phone companies will likely gain share as their fiber upgrades progress. But we still expect Comcast will grow broadband revenue through the combination of modest customer additions and solid pricing power. NBC Universal will need to invest to increase interest around Peacock, but we still like the firm’s position overall thanks to its solid stable of content franchises, strong theme parks, and still highly profitable traditional television business. With a strong balance sheet, Comcast should be able to direct most of its free cash flow to shareholder returns, including a solid dividend and heavy share repurchases.

Alphabet GOOGL Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $169 Fair Value Uncertainty: High

We expect indications of improvement in the macroeconomic environment, whenever they surface, will push Alphabet shares higher. The firm’s search and YouTube platforms continue to attract various advertiser sizes and types - enterprises and small and medium businesses—offering broad based and direct response campaigns. Plus, Apple's iOS policies regarding data privacy and security have not affected Alphabet as much as they have hit the likes of Meta and Snap. The firm is also progressing toward reducing its dependency on advertising revenue as the cloud business continues to grow well and make headway toward profitability.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)