Can Utilities Maintain Growth Against Macroeconomic Headwinds?

Growth prospects are our biggest concern going into 2023.

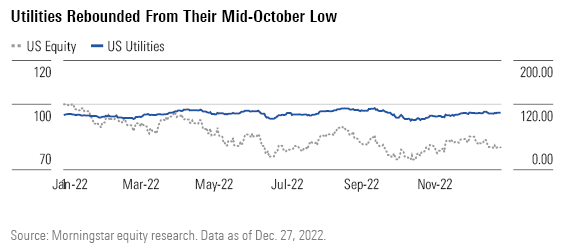

Throughout 2022, utilities faced mixed market signals that created an unusual amount of volatility for a sector prized for its stability. The bad news for utilities investors: Near-term certainty remains elusive. Expect a volatile start to 2023 for utilities stocks.

U.S. utilities stocks are set to finish 2022 with a slight gain, including dividends. Investors might cheer this outcome given the market’s downturn. Utilities are set to outperform the U.S. market by the largest margin since 2000. But performance from utilities stocks in 2022 is hardly worth celebrating: Utilities have averaged better than 8% annual returns for the past 30 years with double-digit returns in 18 of those 30 years.

Utilities’ relative outperformance in 2022 while the market frets about the economy suggests that utilities remain a defensive haven. Utilities also outperformed ahead of the 2001 and the 2007-09 recessions. However, we think utilities’ weak total returns in 2022 should concern investors. For the first time in a decade, the tailwinds supporting utilities’ earnings growth and premium valuations (low inflation, low interest rates, and low energy price) are reversing.

Utilities’ growth prospects are our biggest concern going into 2023. Utilities no longer offer a yield premium as bond yields climbed to their highest level in 15 years. Without that yield premium, the only advantage utilities offer investors is earnings growth. This is why high inflation and rising interest rates loom large for utilities in 2023. Inflation, including higher energy prices, will raise customer bills and could force utilities to re-evaluate their growth plans. Higher interest costs will sap cash flow and make infrastructure investments more expensive.

For now, many utilities continue to execute and expand their growth plans. Utilities like Xcel Energy, Alliant Energy, and DTE Energy recently increased their long-term growth plans, in large part to support clean energy investments. At current stock prices, we think utilities that can maintain 5% annual growth will produce fair total returns for investors. But utilities with less favorable regulation, flagging energy demand, or resistance to clean energy investments might have to dial back their growth plans. For those utilities, another year of flat returns in 2023 might be the best outcome.

See our analysts’ Top Picks in the Utilities Sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)