Can Innovation Offset Biopharma Firms’ Losses From Patent Expiration?

And how we expect the U.S. biopharma industry to react to new regulations on drug pricing.

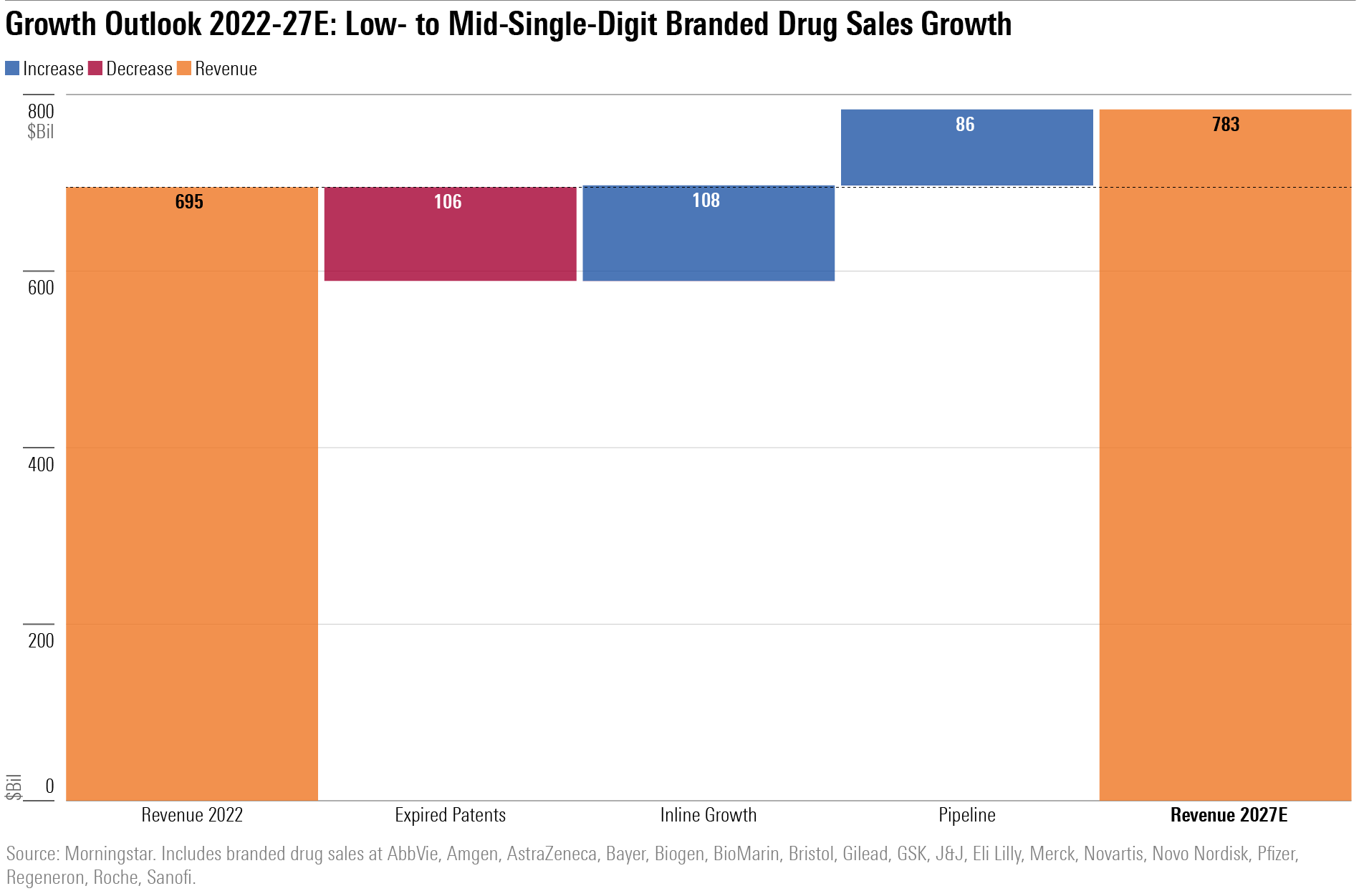

Excluding COVID-19 vaccine and drug sales, we expect revenue at the top 18 biopharma firms in our coverage to expand at a 3.5% compound annual growth rate through 2027.

Though several profitable older drugs are approaching patent expiration, we expect this to be more than countered by growth from newer products and launches of new drugs from the pipeline. Particularly, drugs in the fields of immunology and oncology are facing these headwinds, but they are also among the biggest drivers of approved product sales growth over the next five years.

Growth Outlook: Low- to Mid-Single-Digit Branded Drug Sales Growth

The top 18 biopharma firms under our coverage reported almost $700 billion in global branded drug sales in 2022, including more than $50 billion in COVID-19 vaccine and antiviral sales at Pfizer PFE.

Over the next five years, we expect erosion in sales from expired or expiring patents to result in a $100 billion headwind. We do think this loss will be roughly matched by growth of other approved drugs as they expand market share and gain approval in new indications. Growth will be determined by the contribution from pipeline products.

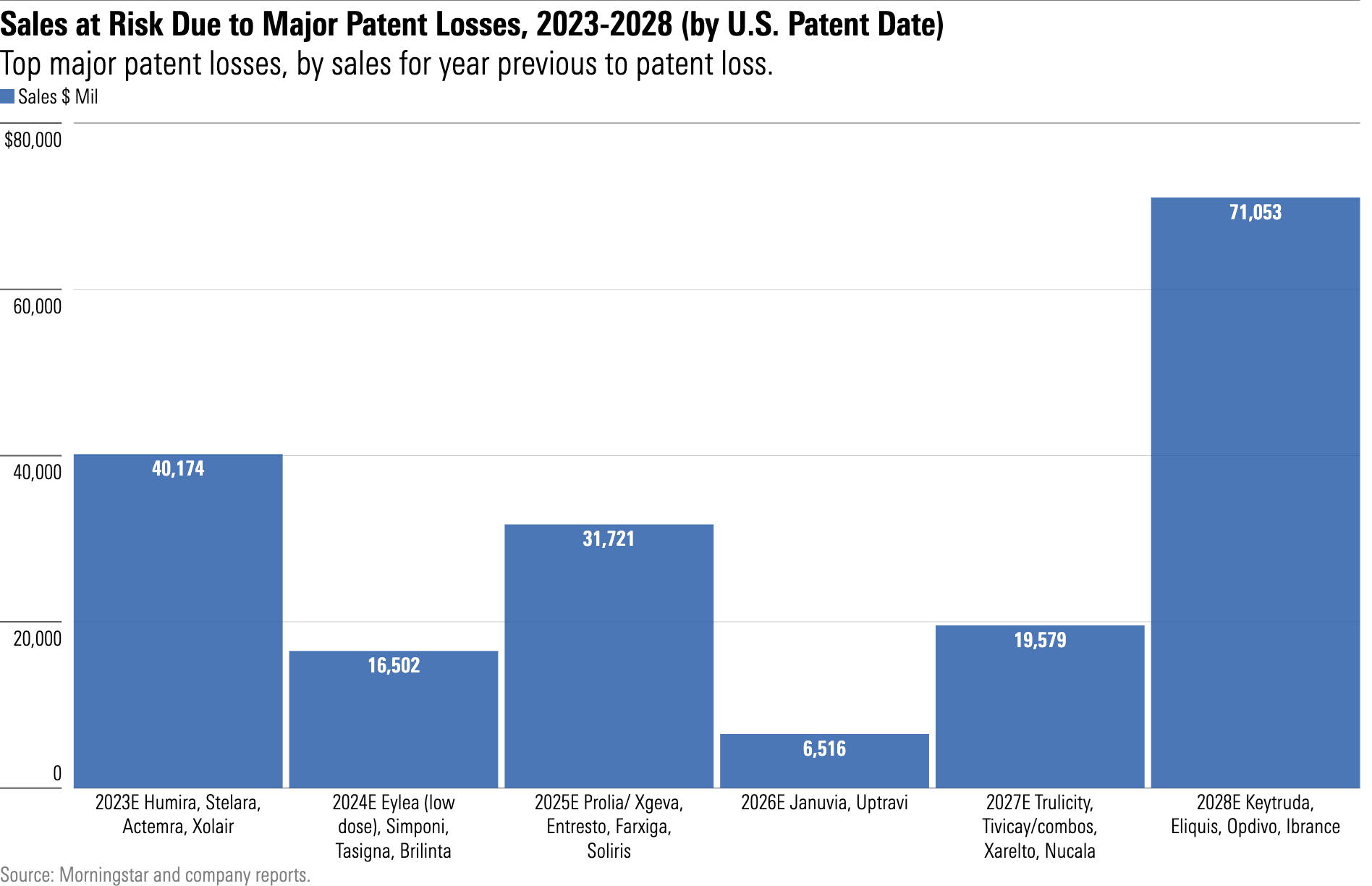

The outlook ahead for patent losses is moderate except for 2028, which will bring one of the heaviest patent loss years since the patent cliff of 2012-14.

AbbVie’s ABBV immunology drug Humira is by far the biggest potential patent cliff, with biosimilars entering the U.S. market in 2023 and contributing to a $17 billion sales decline over the next five years.

Bristol-Myers Squibb’s BMY oncology drug Revlimid is also facing the continued stage launch of generic competitors, and broader launches beginning in 2026 are poised to create a $10 billion headwind for the firm. And Merck’s MRK oncology drug Keytruda will expire in 2028, though we forecast strong growth until then.

That said, our forecast for sales declines from patent losses could fluctuate if weaker patents hold up in court.

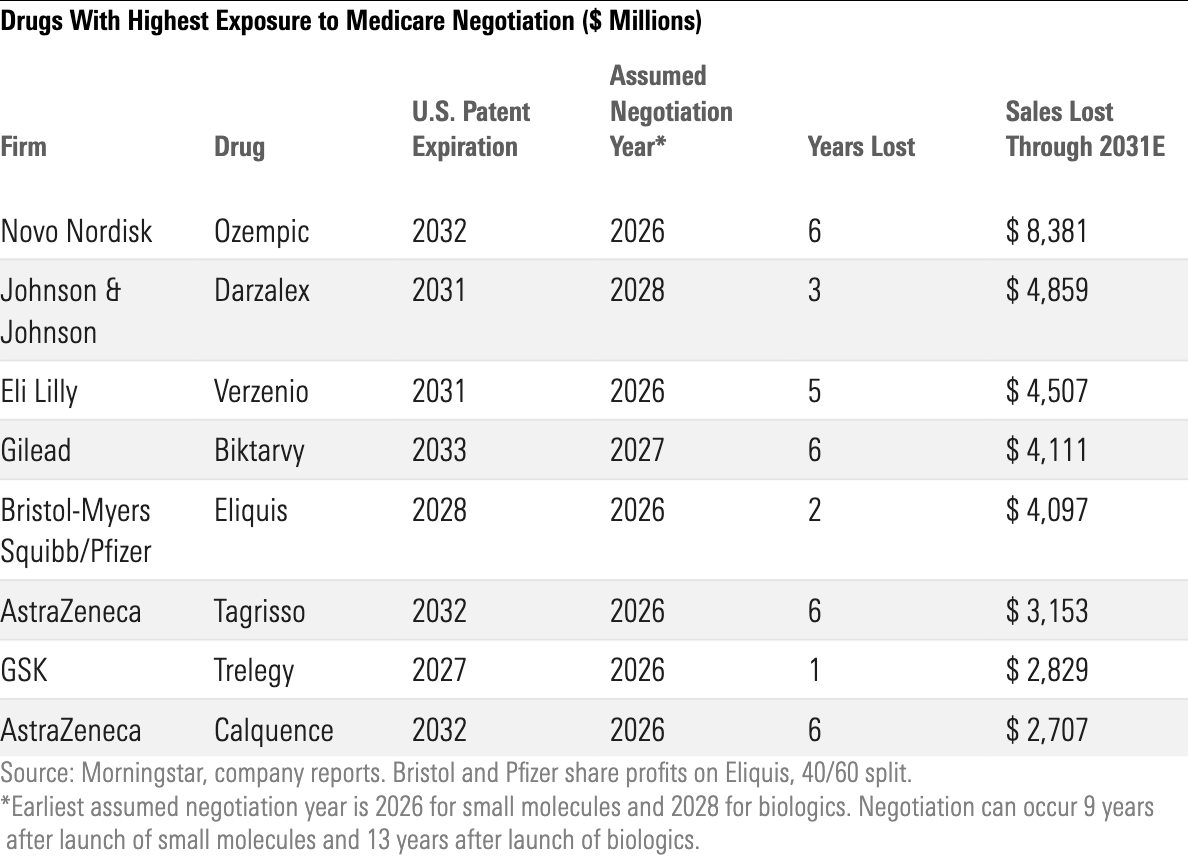

Impact of Inflation Reduction Act on U.S. Drug Pricing

We expect the Inflation Reduction Act to have three main impacts on biopharma firms:

- Price increases were capped across Medicare channels at the start of 2023. We expect this to reduce U.S. biopharma sales by 2% by 2031.

- Out-of-pocket spending caps that were included in the Inflation Reduction Act should help seniors afford drugs and consequently boost demand. We expect Part D costs to shift away from the government and toward payers and drug firms with more expensive drugs, leading to a 1% reduction to sales by 2031.

- Medicare drug price negotiation is on track to begin in 2026 for certain drugs that have had extended patent protection. We see a 4% reduction in U.S. biopharma sales by 2031 from this measure, with several blockbuster drugs standing out as most vulnerable, based on the timing of their approval and patent expirations.

Inline Drugs in Oncology and Immunology Drive Strongest Growth

Within the nearly $90 billion in additional annual global branded drug sales by 2027 from the pipelines at the biggest biopharma firms, oncology remains the biggest growth driver, mirroring the growth we forecast for inline drugs. However, we see rare diseases and neurology as the next biggest growth drivers, ahead of immunology.

The biggest individual pipeline drivers include:

- Eli Lilly’s LLY Alzheimer’s disease drug candidate donanemab (data expected mid-2023).

- Novo Nordisk’s NVO oral semaglutide for obesity (data expected in the first half of 2023).

- Bristol’s Sotyktu (approved in September 2022).

In addition, big biopharma firms are poised to potentially launch three RSV vaccines in 2023-24 that together could see more than $2.5 billion in sales annually by 2027.

In oncology, industry investment has been high owing to significant unmet need and strong pricing power. IQVIA forecasts oncology as the fastest-growing area of drug spending, with double-digit growth pushing spending up to $377 billion in 2027 (from $193 billion in 2022). Innovation in oncology is stemming not only from progress with new antibodies but also from novel types of treatments like modified antibodies, cell therapy, and gene-based therapies.

Key areas of development include:

- Checkpoint inhibitors, which prevent cancer cells from silencing the immune system. We think multiple novel oncology drug launches and the use of current drugs earlier in treatment should push oncology drug spending substantially higher. Merck’s Keytruda has been the main driver of growth in this area, and we forecast continued strong growth through the drug’s patent expiration in 2028.

- Breast cancer drugs. Drugs from Pfizer, AstraZeneca AZN, and Novartis NVS have become standard treatment for hormone-receptor positive breast cancer (the most common form of breast cancer). With positive trial results, Eli Lilly’s Verzenio has been extended to earlier-stage patients, and we expect sales to peak around $14 billion in 2028, prior to key patent expirations.

- Blood cancer drugs, which are seeing expanding use in the area of CAR T-cell therapies. Gilead’s GILD CD19-targeting Yescarta/Tecartus saw nearly $1.5 billion in sales in 2022, and sales are growing as earlier-stage lymphoma patients gain access. Drugs from Novartis and Bristol also compete in this first-generation market.

In neurology, we’re seeing significant drug spending in multiple sclerosis, Alzheimer’s disease, and migraines. There’s also continued development in treating respiratory diseases, HIV, and diabetes.

We expect the nearly $100 billion vaccine market to contract in 2023 because of less need for COVID vaccines but then steadily increase. Despite the remarkable speed to market for COVID vaccines, vaccine development tends to take several years longer than drug development, and manufacturing is much more complex, which generally leaves only one or two vaccines per market.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)