Advertising Uncertainty Is Weighing Heavily on the Communication Services Sector

However, opportunities abound.

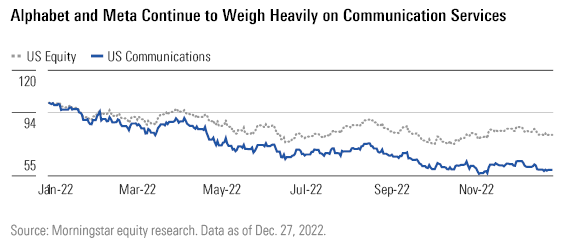

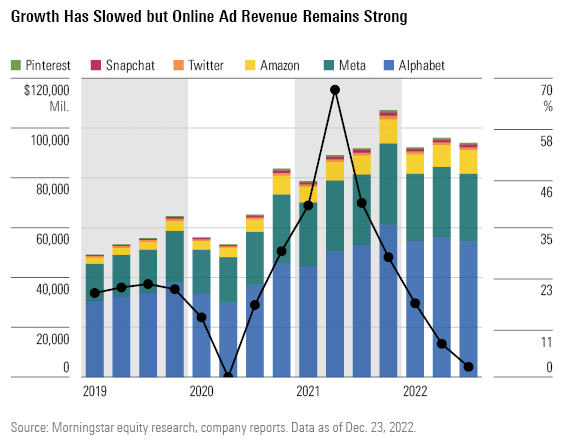

Several communication services stocks have rebounded modestly over the past three months, but Alphabet and Meta continue to overshadow the rest of the sector, comprising about 40% and 10%, respectively, of the Morningstar US Communication Services Index. Advertising generates about one third of aggregate sector revenue but is responsible for most sales at the two online giants. The market remains skittish about the outlook for advertising demand. Growth across the sector has slowed sharply and steadily throughout the past year, outside of a bump from political ad spending that mostly benefits television networks.

The pressure on advertising demand stems primarily from the ongoing impact of changing data privacy standards and economic uncertainty. As data restrictions have weakened the ability to target consumers online, advertisers’ willingness to pay has declined. Given that online advertising now accounts for about two thirds of total ad spending, according to Magna Global, shifting data standards have certainly hit the broader ad market and especially the two firms that dominate the online landscape.

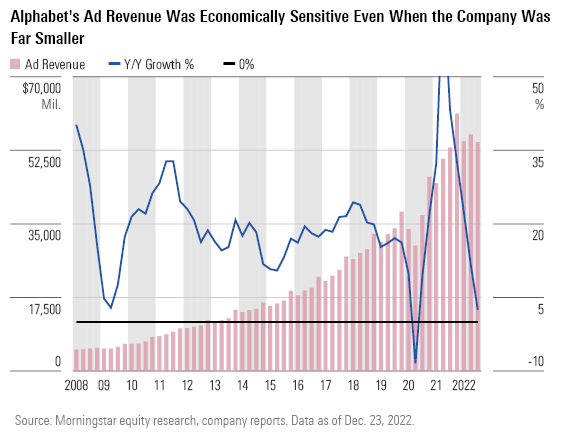

However, we suspect the economy is the far bigger of the two factors. Data privacy isn’t as big a factor in driving search advertising versus other digital formats as customers literally reveal what they’re seeking. Alphabet’s search ad revenue has been increasing around 20% annually in recent years, outside of pandemic-driven fluctuations, but increased only 4% during the third quarter. Search demand hasn’t grown that slowly at Alphabet since the global financial crisis in 2009, when the search ad business was one tenth of its current size.

Morningstar believes the odds of a recession in 2023 stand at only between 30% and 50%. We also expect economic growth will rebound strongly in 2024, which would bode very well for advertising demand overall.

As for data privacy, firms are augmenting the efforts to target consumers without compromising privacy. Companies like The Trade Desk and LiveRamp are building tools that anonymize data and then build consumer profiles. While targeting may not return to prior effectiveness, we expect online ads will remain the best way to find a desired audience. Nearly every firm with ties to advertising revenue has accepted that the market is not going to grow as fast in the coming years as it has recently, and they have taken steps to cut costs. Meta is the leading example of this trend. Less than two weeks after revealing 2023 expense targets in its third-quarter earnings, the firm announced that it would lay off about 13% of its employees. We remain concerned about the potential returns on Meta’s investments in the metaverse, but at least there is a limit to what the firm is willing to spend.

See our analysts’ Top Picks in the Communication Services sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)