What Is the Fed’s TSP Mutual Fund Window Good For?

With its $150 annual fees, for many workers, not much.

The US federal government’s Thrift Savings Plan ended April 2024 with $872 billion in assets serving more than 7 million participants—or one in every 25 workers in the United States. Our series of articles answers some of the most frequently asked questions we’ve received from investors in the world’s largest retirement savings plan. Send your TSP questions via our TSP feedback survey.

Question: How should I use the TSP mutual fund window? Is it worth it, or is it better to stick with the regular TSP funds?

Answer: There could have been a lot to like about the federal Thrift Savings Plan’s mutual fund window. First launched in June 2022, the window allows TSP participants to invest some of their retirement savings into almost 4,500 mutual funds.

More hands-on investors who wanted to augment their holdings beyond the TSP’s svelte lineup of five individual funds and 10 target-date funds could finally get some exposure to high-yield or international bonds or build dedicated allocations to REITs or Treasury Inflation-Protected Securities, which are commonly offered in the core investment lineups of large employer retirement plans. Other benefits include access to great investors and niche products, like sector-specific funds. Studies have shown too many investment options can overload and paralyze retirement plan participants, but the TSP’s lineup is unusually small. The mutual fund window could have been a good outlet for investors who wanted more choice.

High Annual and Trading Fees

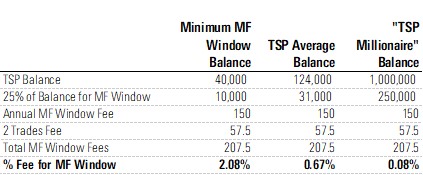

Despite the benefit of access, high annual fees and onerous account restrictions make the TSP mutual fund window a nonstarter for many participants. TSP participants must pay $150 each year merely to have a mutual fund account, and they pay an additional $28.75 each time they buy or sell a holding. In addition, participants may only invest up to 25% of their TSP savings in the mutual fund window and must initially transfer a minimum $10,000 into the window.

Just to open a TSP mutual fund account with the required minimum investment of $10,000, participants would need a $40,000 TSP account balance. Assuming only two transactions a year, participants would incur more than 2% in fees on that $10,000 balance, and that’s before layering on the expense ratios for the actual mutual funds. As a reference point, out of the more than 23,000 mutual funds available to US investors, fewer than 200 have net expense ratios higher than 2%.

The odds look marginally better for investors with higher account balances. For example, the average TSP participant had about $124,000 invested in the plan at the end of April 2024, allowing for up to $31,000 to be invested in the mutual fund window. At that level, the 0.67% fee on the mutual fund window balance is a marked improvement, though still a high hurdle when layered over mutual fund net expense ratios.

Even higher balances make the TSP mutual fund window’s fees look smaller. At the end of 2023, the TSP had about 117,000 “TSP Millionaires”—those with at least $1 million in their TSP account. At that level, with at least $250,000 invested in mutual funds, the 0.08% in added fees looks more realistic. The exhibit below summarizes the fee calculations for these three hypothetical TSP participants.

Fees for TSP Mutual Fund Window Are Too High for Many Investors to Overcome

Another Reminder: Fees Matter

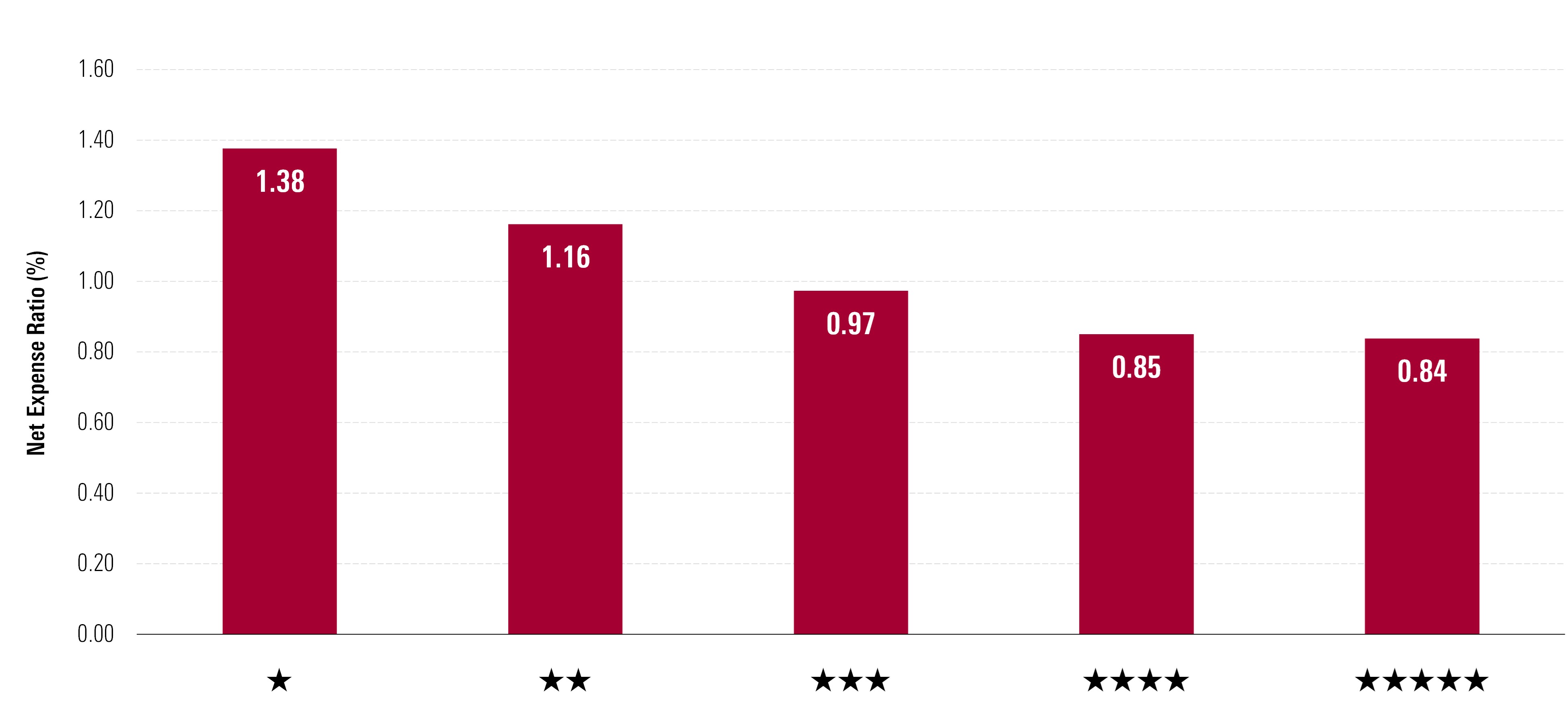

Many Morningstar studies have proved the benefits of low fees (including here, here, and here). The next exhibit is another reminder that funds with lower fees tend to outperform those with higher fees. Layering on an additional 0.67% to 2.00% in annual fees, as TSP mutual fund window users must, stacks the odds against success.

Lower Mutual Fund Fees Improve Investor Outcomes

Sure, TSP’s current system ensures that participants who do not participate in the mutual fund window do not bear the administrative costs of offering it. Still, the TSP’s mutual fund window fees look egregious in an age when, outside the program, its participants can find brokerages with no annual fixed charges and single-digit online transaction fees, not to mention more investing choices, like single securities and exchange-traded funds. The window fulfills the letter of Congress’ 2009 authorization of it, but it seems doubtful that legislators intended for the option to benefit only a small and comparatively well-off slice of its participants.

What the TSP Mutual Fund Window Gets Right

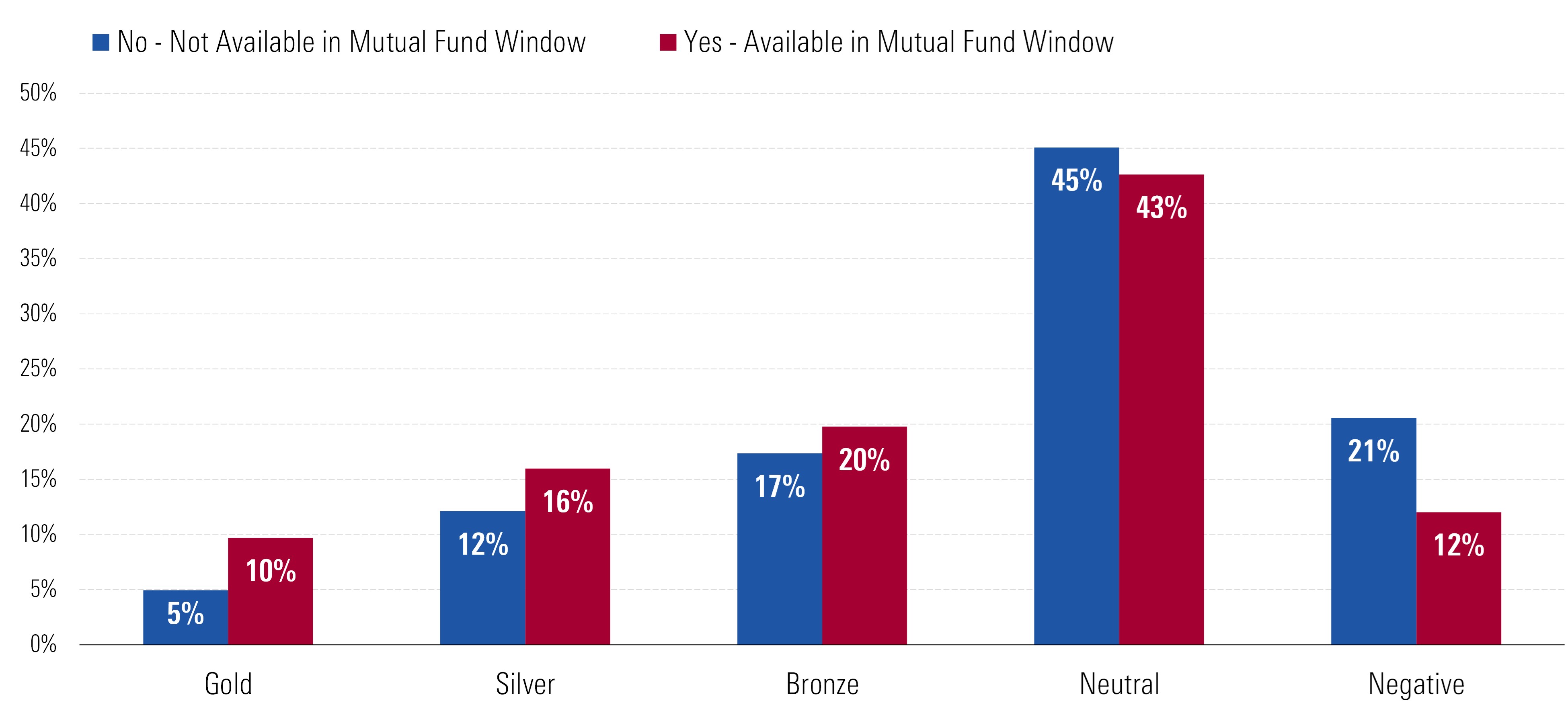

There is one notable area where TSP has wielded its size and negotiating power effectively: TSP winnows the universe of available mutual funds available to participants by, for the most part, offering the fund’s cheapest share class. That allows, for instance, TSP investors to access the cheapest R6 share class of American Funds target-date retirement series of mutual funds (RFETX, RFGTX, RFITX, RFUTX), which have a Morningstar Medalist Rating of Gold and which are usually only available on the core investment menus of the largest retirement plans. TSP investors can also get into the institutional share classes of funds like Silver-rated Pimco Total Return PTTRX, which often have minimum investments of $1 million or more.

The next exhibit shows that picking a fund’s lowest-cost share class also results in a pool of more highly rated funds, as measured by the Morningstar Medalist Rating, which means we think they have a good shot at outperforming their indexes after fees. So, TSP’s lower-priced funds have a built-in advantage. Whereas 10% of TSP mutual fund window offerings are Gold-rated, for example, only 5% of funds not offered by TSP have Gold ratings.

TSP Mutual Fund Window Skews Toward More Highly Regarded Investments

Improving the TSP Mutual Fund Window

For most investors, the TSP mutual fund window doesn’t fulfill its potential. Eliminating or at least lowering the annual account maintenance and administrative fees would make it more viable for more investors. So would cutting trading fees closer to the single-digit norms of most online brokerage firms. And while it’s not uncommon for private sector employers to limit the share of 401(k) assets that can be invested through brokerage windows, the TSP’s 25% cap is low and further limits the window’s usefulness. Allowing investors to purchase individual securities and ETFs also would bring it more in line with the private sector. Accomplishing one or any combination of the above would go a long way toward making the TSP’s mutual fund window the world-class offering it could be.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ES7BXTSJ6N4RT5GG2X7PQAHRLI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)