September Jobs Report Forecasts Call for Another Month of Strong but Moderating Growth

A stronger-than-expected report could tilt the Fed toward another rate hike.

Forecasts call for the September jobs report to show another month of strong hiring, though the gains are likely to decelerate compared with the last few months.

This year’s strong pace of new job creation and a continued tight labor market have been key factors leading the Federal Reserve to signal its “higher for longer” stance toward interest rates. In fact, at the central bank’s most recent policy-setting meeting in September, officials suggested they could still raise interest rates one more time before the end of this year.

However, with September’s jobs report expected to show that the pace of hiring is moderating, expectations in the bond market are that Fed officials will keep its target for the federal-funds rate at its current 5.25%-5.5% range. But some say there remains a chance that the Fed will lift that target by a quarter-point in November.

“The job market is slowing, but it’s still very strong,” says José Torres, senior economist at Interactive Brokers. “The Fed is meeting on Nov. 1, and this month’s data on jobs and inflation will be critical.” In his latest commentary, Torres writes that Friday’s data—as well as the following week’s Consumer Price Index and Producer Price Index inflation readings—may lay the groundwork for the Fed to issue one more rate hike.

“The jobs report has a lot of potential to come in hot,” Torres says, citing strength in the latest Job Openings and Labor Turnover Survey report. “The odds of another rate hike in November are higher than what the market thinks.”

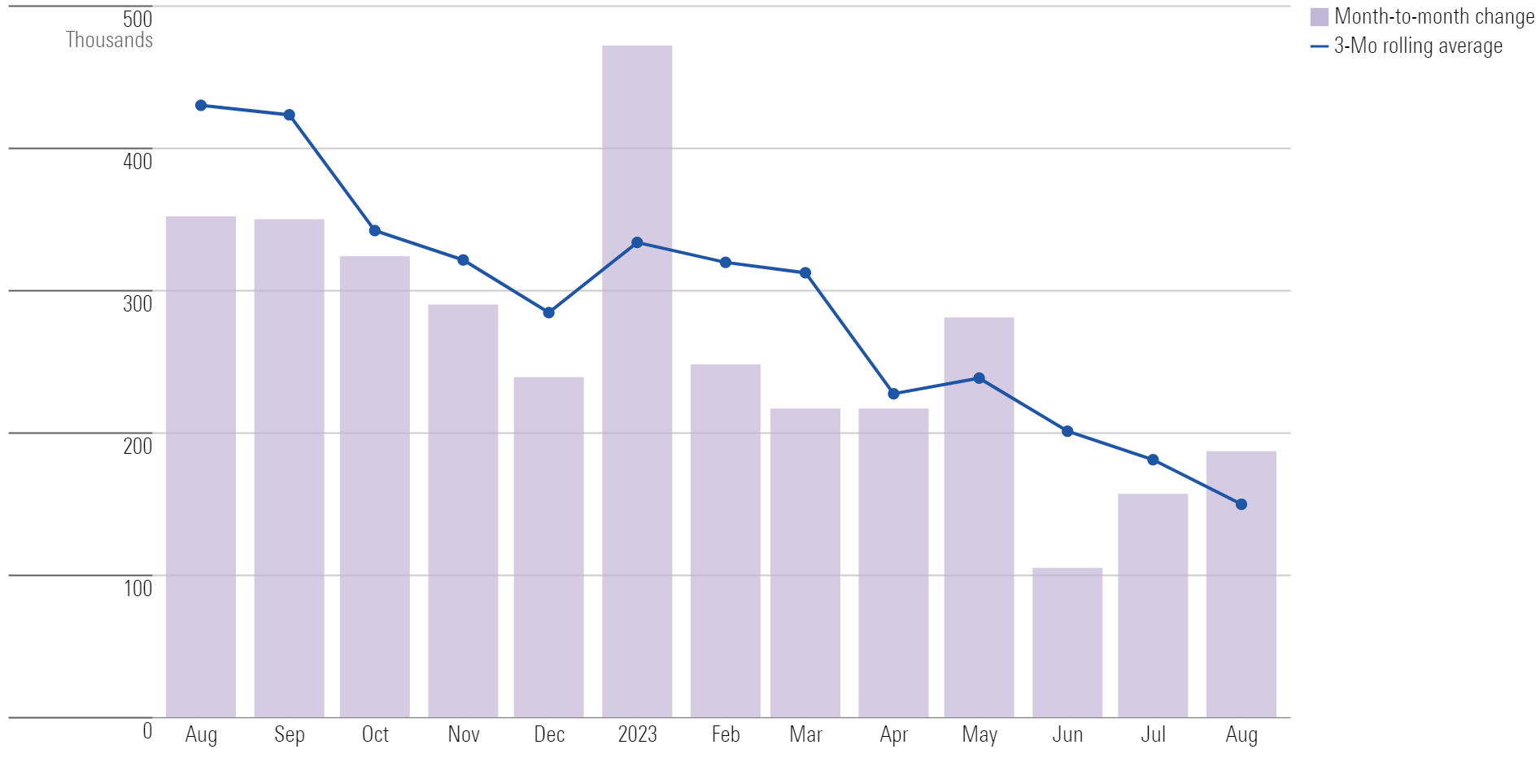

Jobs Growth Expected to Slow In September

After the August jobs report showed strong gains in the U.S. economy, economists expect another round of similar (though slightly moderated) gains. For the month of September, nonfarm payroll employment is expected to rise by 159,000, according to FactSet’s consensus estimate. That’s slightly below the 187,000 jobs added per month in July and August.

Monthly Payroll Change

September Jobs Report Consensus Estimates

- Nonfarm payroll employment to rise 159,000 versus the 187,000 increase in August.

- Unemployment rate to fall to 3.7% from the prior month’s 3.8%.

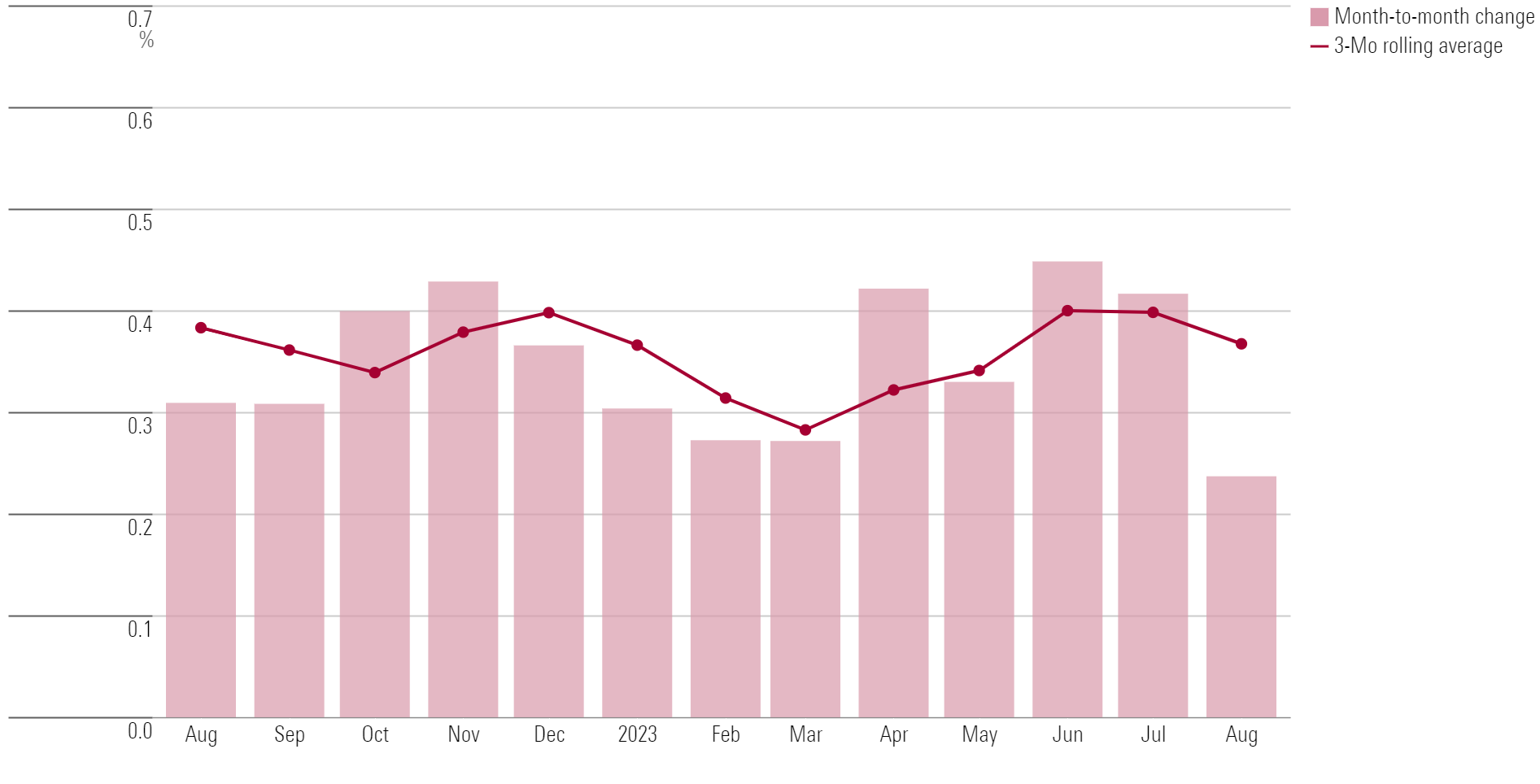

- Hourly earnings to rise 0.3%, an uptick from 0.2% in August.

For Friday’s report, Torres expects to see above-consensus headline payroll growth of 180,000. He forecasts hourly earnings to rise by 0.4%, and for the unemployment rate to hold steady at 3.8% for the second month in a row. Within the report, Torres will focus on wage growth and look at which sectors drove September job gains for insight into the Fed’s next policy move on interest rates.

Cyclical Jobs Growth Likely to Weaken Further

“I expect non-cyclical areas to drive gains for September,” Torres says. “Cyclical areas—construction, manufacturing, retail—should show another month of weakness.” He thinks new jobs are likely to come mainly from resilient categories like healthcare and government, extending the August trend.

Torres believes the jobs market will remain resilient, even as he sees the potential for a mild recession in 2024, which would cause an “affordability pinch” (a decrease in consumer spending) but not a “job pinch.” He believes businesses’ investments would tick down, but that they would likely not let go of their labor forces. “Many companies had trouble replenishing their high-quality labor after many chose to retire early in the wake of COVID-19,” he adds. “At this juncture, businesses want to keep the good employees that they have and continue to hire, even if profitability is a bit weaker.”

Wage Growth Could Drive Inflation

“Rising wages could really have implications on inflation, against the backdrop of labor strikes going on across the country,” Torres says. In particular, he points to potential ripples of United Auto Workers simultaneously striking against GM GM, Ford F, and Stellantis STLA for the first time ever.

“If the UAW strikes lead to a really good deal for workers, that will set a precedent across the country for other strikes,” Torres says. “That could cause a wage-price spiral,” he says, making it harder for the Fed to bring inflation down to its 2% long-term target. “Wage growth levels in the upcoming months will be pivotal for the Fed.”

If wages rise meaningfully, Torres says, consumer spending would likely rise. “In an already tight labor market, that could cause problems.”

Monthly Wage Growth

Will the Fed Raise Rates Again?

Torres says there’s a 50% chance the Fed will raise rates by 0.25 percentage points to a range of 5.50%-5.75% at its Nov. 1 meeting. That’s hawkish compared to expectations in the market for just a 21% likelihood that the Fed will hike rates by 0.50 percentage points, according to the CME FedWatch tool as of midday Wednesday.

The remaining 79.00% of market participants expect the Fed to hold the rate at its current range of 5.25%-5.50% come November. Morningstar senior U.S. economist Preston Caldwell is in that camp, and he also believes job growth will begin to slow in 2024, with the Fed ultimately cutting rates aggressively next year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RMBMMBAVABHL5O5JI2WDI44I3U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MJ3FSXZXVFDYPHHGXT7LMKSZD4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)