Looking for Cheap Energy Stocks? Try Outside the U.S.

While many U.S. energy stocks are getting pricey, these non-U.S. energy names remain undervalued due in part to ESG concerns.

One of the best places for investors to be in this bear market has been in energy stocks. But as is often the case, with big gains have come expensive valuations.

But not everywhere. There’s an unusually wide gap between U.S. and non-U.S. energy stocks, and that could provide an opportunity for long-term investors.

The energy sector has posted stellar returns over the course of this year, beating the rest of the market by a wide margin. As of Dec. 7, the Morningstar US Energy Index has rallied 57.2% year to date, while the Morningstar US Market Index is down 17.6%.

But thanks to this year’s big rally, which came on top of strong returns in 2021, the energy sector has gone from among the most undervalued group of stocks into overvalued territory.

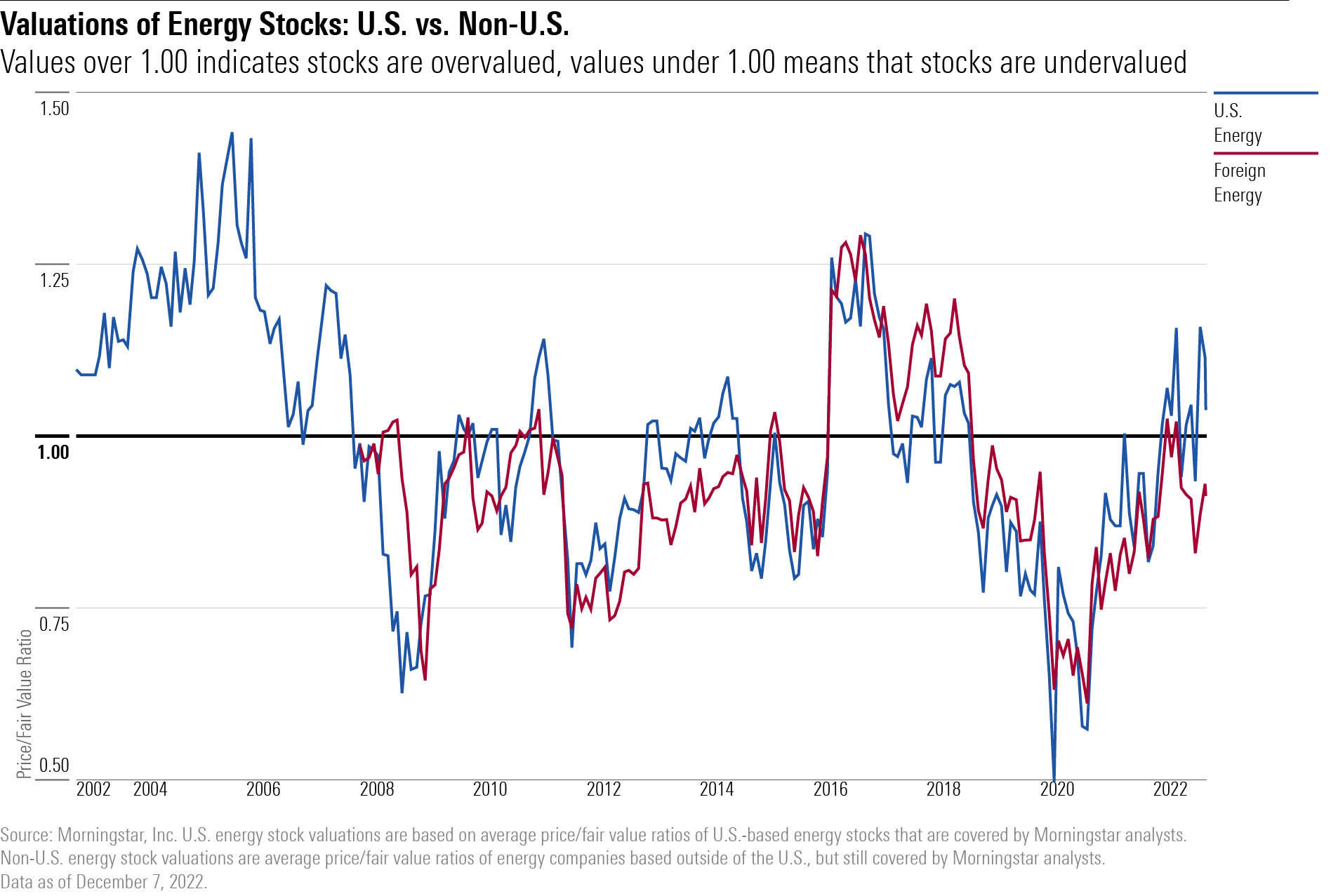

Up until recently, U.S. and non-U.S. energy company valuations have generally been closely aligned, with U.S. energy companies only being slightly more skewed toward the overvalued side of the spectrum. But in recent months that gap has become much more noticeable. That’s left a potential opening for investors looking to pick up a few energy stocks on the cheap.

As of Dec. 7, U.S. energy companies covered by Morningstar analysts trade at an average 2% premium to their Morningstar fair value estimates. Meanwhile, non-U.S. energy firms are about 10% undervalued, a roughly 12-percentage-point difference.

What’s behind the valuation gap? Are non-U.S. energy companies actually cheap, or is there something else going on under the hood?

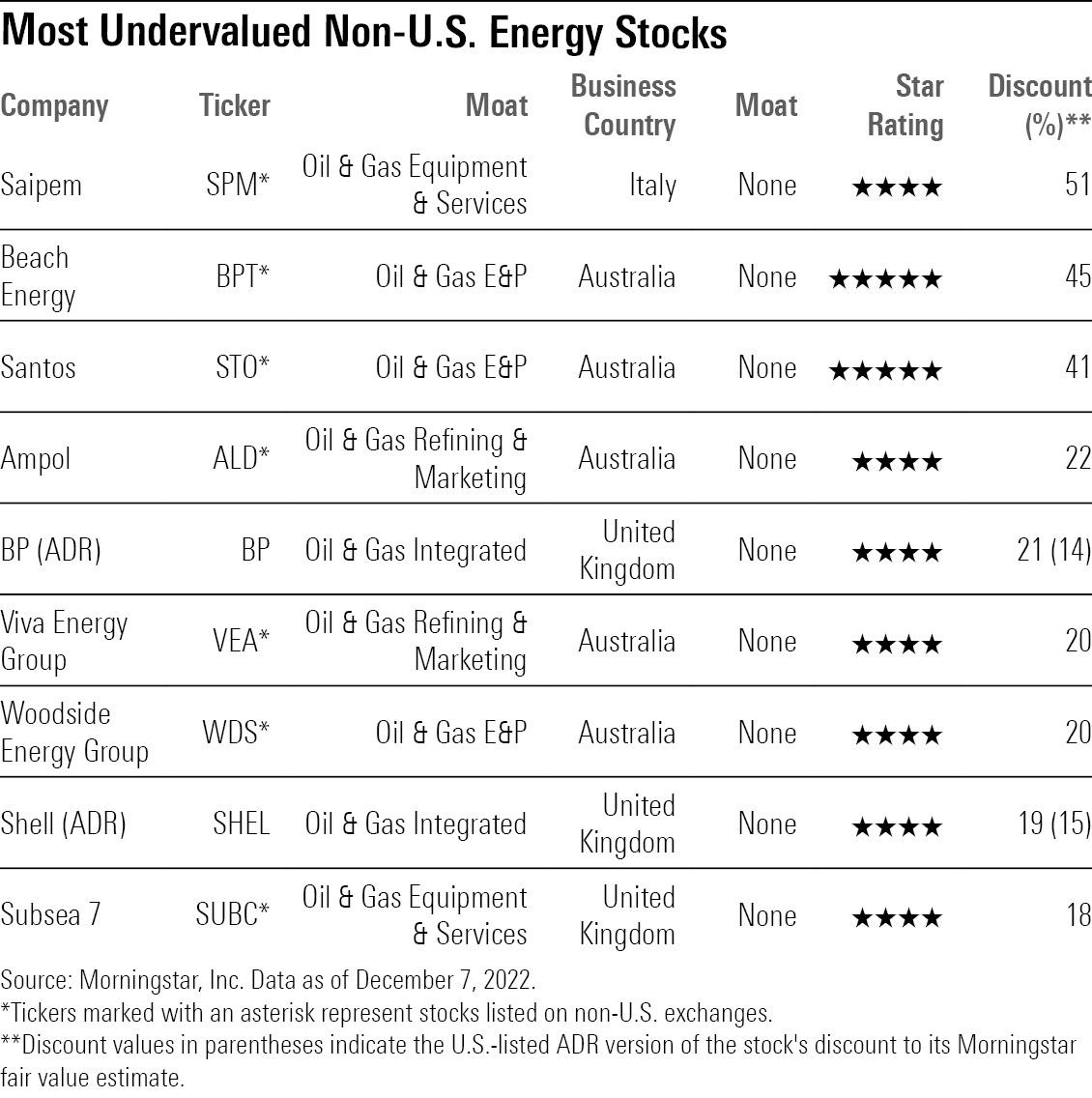

Among the non-U.S. energy stocks that are the most undervalued:

“There has always been some valuation gap between the two groups,” says Allen Good, Morningstar’s sector strategist for European energy. “What is unusual is the size of the gap, which has widened meaningfully since the pandemic after narrowing for the last two decades.”

Why Are Non-U.S. Energy Stocks Cheap?

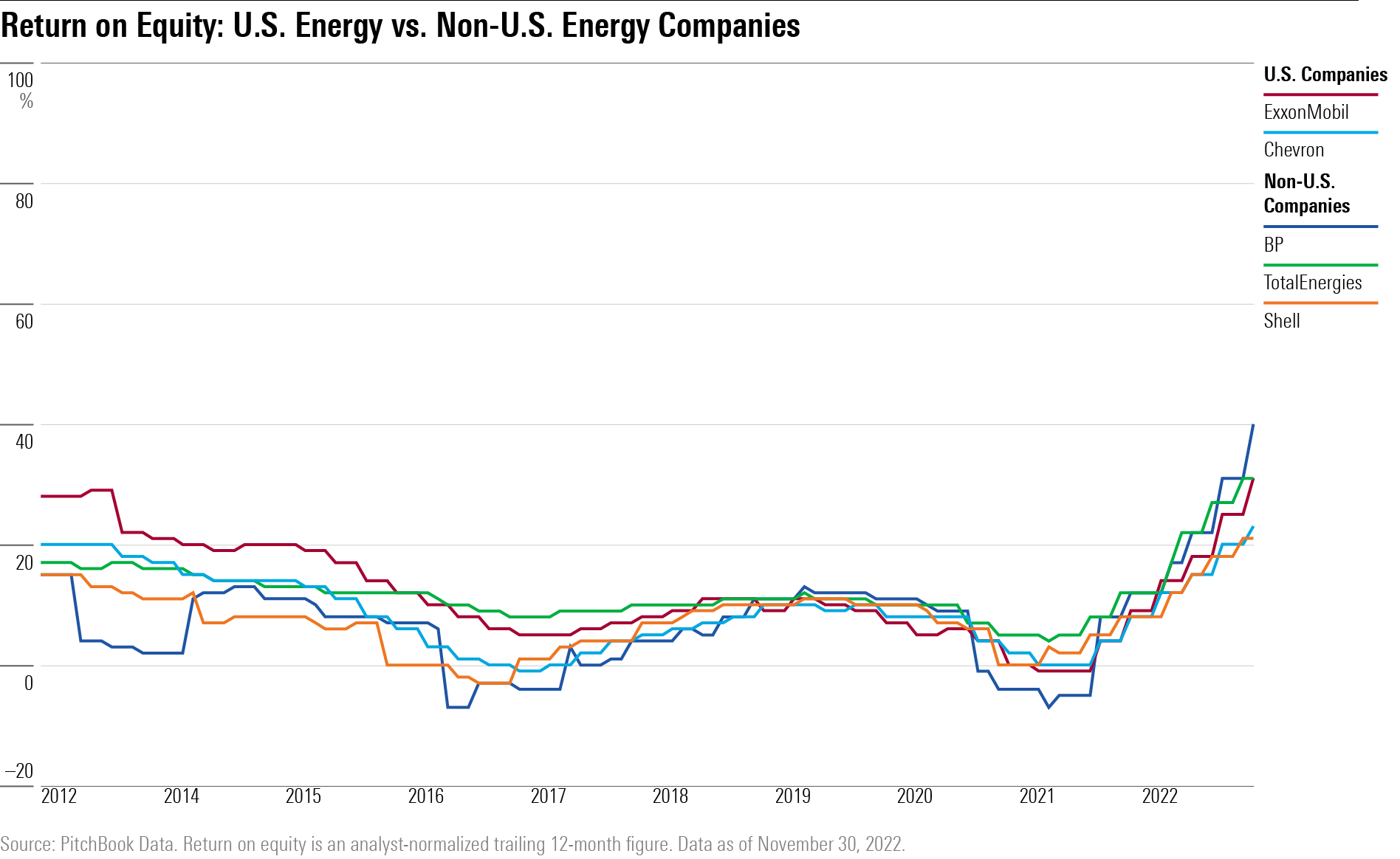

In terms of fundamental performance, both U.S. and non-U.S. companies have recovered at a similar pace from pandemic lows. Return on equity has soared past prepandemic levels for both groups, largely due to the higher price of oil in the last two years.

As a result, Good says that it appears that it’s not the underperformance of non-U.S. energy firms that contributes to the valuation gap between the two groups.

Instead, Good looks to environmental, social, and governance, also known as ESG, factors as part of the explanation in two ways.

First, he notes that there has been a greater amount of assets flowing to sustainable funds in Europe, which tend to underweight energy compared with the market. This means that despite earnings soaring for energy companies, they haven’t captured the influx of cash into sustainable funds.

Second, he notes that there’s a greater focus on sustainable investing in Europe that has prompted a more aggressive transition strategy for energy firms that requires investment outside pure-play fossil fuel companies. The Russia-Ukraine conflict, which highlighted Europe’s dependence on Russian energy, only emphasized the need to diversify away from fossil fuels.

Compared with U.S. firms such as Chevron (CVX) or ExxonMobil (XOM), European energy companies are investing in a broad number of low-carbon energy businesses, such as renewable fuels and power, hydrogen, carbon capture and storage, electric vehicle charging, and even retail/convenience. Meanwhile, Chevron and ExxonMobil have mostly just invested in renewable fuels, hydrogen, and carbon capture and storage, according to Good.

“This transition strategy has failed to attract sustainable investors who think it is not aggressive enough and turned off oil investors who have no interest in underwriting low-carbon investment,” Good says. For energy investors expecting oil prices to remain high, U.S. energy companies, which are comparatively more focused on oil profits, are more appealing.

Non-U.S. energy companies in developed countries also face more regulatory risk. “The European Union and individual European countries have explored various ways to combat the energy crisis and soaring prices. One way is windfall taxes on those companies benefiting from higher prices such as oil and gas producers and utilities,” says Good. The United Kingdom is one such country that has already introduced a windfall tax on oil production above $60 per barrel.

Australia, too, has been working on putting a cap on domestic gas prices in its efforts to lower high power costs, according to Mark Taylor, Morningstar senior equity analyst. “The plan is rumored to cap prices at between AUD 11 and AUD 13 per gigajoule and may include a requirement for guaranteed domestic supply from producers,” he says. Though he also notes that this cap would be immaterial to his current fair value estimates for Australian exploration and production companies.

Still despite these pressures, Morningstar analysts believe there’s substantial upside to several non-U.S. energy companies. To highlight these opportunities for investors, we ran a screen on 30 non-U.S. energy companies that are covered by Morningstar equity analysts for those that held a Morningstar Rating of 4 or 5 stars, which indicates that a stock is undervalued.

The screen resulted in nine undervalued non-U.S. energy stocks. Below, we’ve highlighted four of them, along with comments from Morningstar analysts. A full list of the results can be found at the end of this article.

Saipem

- Listed Exchange: Borsa Italiana

- Morningstar Rating: 4 Stars

- Moat: None

- Discount: 51%

“Saipem offers services in four distinct business lines: offshore engineering and construction, onshore E&C [engineering and construction], offshore drilling, and onshore drilling.

“Offshore E&C is historically one of Saipem’s larger segments, historically representing nearly half of the overall business. The high degree of engineering expertise required to win contracts in the offshore space partially protects Saipem and its peers from high competition, which helps protect pricing power. Offshore E&C tends to be a profitable segment, though its high reliance on fixed-price contracts introduce a good deal of operating risk. Increased investment in offshore oil and gas production will provide numerous opportunities for growth in this segment over the next five years, while Saipem’s internal measures (mainly reducing its high capital intensity) will improve margins over time.

“Onshore E&C is Saipem’s other largest segment, averaging about 43% of the overall business prior to the pandemic. The segment features much lower operating profits, averaging just over 2% prior to the pandemic. Saipem targets infrastructure contracts, mostly for downstream oil and gas projects. Recently, Saipem has targeted contracts that will provide longer-term revenue streams, including biorefineries and fertilizer plants. Expanding beyond traditional oil and gas end markets means Saipem will compete with generalist E&C providers, reducing its ability to command the same kind of pricing premiums enjoyed by its offshore E&C business.

“Overall, we expect Saipem’s profitability will improve over the next five years as capital expenditure expands in both onshore and offshore markets.”

— Katherine Olexa, equity analyst

Beach Energy

- Listed Exchange: Australian Stock Exchange

- Morningstar Rating: 5 Stars

- Moat: None

- Discount: 45%

“Beach Energy produces oil, gas, and gas liquids from multiple wholly owned projects and joint ventures in the onshore Cooper, Perth, and Eromanga basins, and offshore in the Otway, Bass, and Taranaki basins. Beach merged with Cooper Basin joint-venture partner Drillsearch Energy in March 2016, which increased equity production to about 10 million barrels of oil equivalent. This is now more than doubled to 23 million boe following the purchase of Lattice from Origin Energy in 2018. Lattice’s scale-enhancing incorporation, expanding Beach’s footprint across multiple basins and production hubs, resulted in an increase in EBITDA margins to over 70% from pre-Lattice 50% levels. But even with Lattice, our no-moat rating stands. Despite Lattice’s advantages, Beach does not have sufficient resource life beyond 15 years.

“Beach’s goal to double production and reserves in five years was achieved via the AUD 1.6 billion acquisition of Lattice, rather than from organic growth. But the priority remains to expand output from existing reserves, mainly in the Perth and Cooper/Eromanga basins. Beach also sees huge potential for unconventional shale gas in the Cooper and elsewhere. The new target is for 34-40 mmboe of production in the next five years.”

— Mark Taylor, senior equity analyst

Santos

- Listed Exchange: Australian Stock Exchange

- Morningstar Rating: 5 Stars

- Moat: None

- Discount: 41%

“Santos is the second-largest Australian pure oil and gas exploration and production company (behind Woodside Petroleum, ASX: WPL), with interests in all Australian hydrocarbon provinces, Indonesia, and Papua New Guinea. Well-timed East Australian coal seam gas purchases and subsequent partial sell-downs bolstered the balance sheet and set the scene for liquid natural gas, or LNG, exports. Santos is now one of Australia’s largest coal seam gas producers and continues to prove additional reserves. It is the country’s largest domestic gas supplier.

“Coal seam gas purchases increased reserves, and partial sell-downs generated cash profits, putting Santos on solid ground to improve performance. Group proven and probable, or 2P, reserves doubled to 1,400 mmboe, primarily East Australian coal seam gas. Coal seam gas has grown to represent more than 40% of group 2P reserves, despite partial equity sell-downs.”

“Overall, we see a happier future for Santos now that excess debt levels are addressed, aided via improved margins and earnings driven by Gladstone and PNG LNG. The company increasingly enjoys export pricing on its gas. In addition to Santos’ Gladstone LNG, several other third-party east-coast LNG projects conspire to drive domestic gas prices higher. As the largest domestic gas supplier, Santos can expect significant bang for its buck, with limited additional capital or operating cost required to capture enhanced prices. The group production profile is simplified with increased certainty in project life.”

— Mark Taylor, senior equity analyst

BP

- Listed Exchange: New York Stock Exchange (ADRs)

- Morningstar Rating: 4 Stars

- Moat: None

- Discount: 14%

“BP is transitioning from an integrated oil company to an integrated energy company to achieve its emission reduction targets and position itself for the energy transition while growing earnings and improving returns.

“Its strategy ranks as the most aggressive move away from hydrocarbons among its peers with plans to reduce production by 25% by 2025 and 40% by 2030 and refining capacity by 30% by 2040 through divestment. Exploration will be limited to countries where BP has existing hubs and investment will focus on capital-efficient tiebacks, infill drilling, and other near-hub options that leverage existing infrastructure. Despite lower volumes, BP expects to maintain earnings through 2030 through higher prices, higher-margin volumes, and reduced costs.”

“BP is leveraging existing assets to grow its fuels and lubricants business in emerging markets, sell more food in its retail stores and charge EVs. Embedded in this strategy are plans to grow retail sites in emerging markets sixfold by 2030, double retail locations that offer food, and grow EV charging points nearly 10 times all with modest increases in capital investment, while doubling EBITDA and returning of 15%-20%.”

— Allen Good, sector strategist

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)