Fed Meeting Preview: Will Powell Disappoint the Markets?

Expectations for Fed rate cuts could ride on the ‘dot plot’ and Powell’s outlook.

It’s been a banner fourth quarter for both stocks and bonds, with big rallies pinned on hopes that the Federal Reserve is done raising interest rates—and more importantly, that rate cuts will come soon.

This means that when the Fed announces its latest decision about interest rates on Wednesday afternoon, investors need to assess whether the central bank thinks market participants have gotten ahead of themselves. If so, that could throw sand into the gears of the recent rallies that have taken stocks to new highs for the year and bond yields back to levels seen in late summer.

For investors, that means paying especially close attention to Fed chair Jerome Powell’s press conference on Wednesday afternoon, along with the so-called “dot plots,” which show forecasts from Fed officials for interest rates and the economy.

Treasury Yield and Federal-Funds Rate

Fed Seen Holding Rates Steady This Week

The Fed started raising rates in March 2022 (when the funds rate was effectively zero) to cool off the economy and combat inflation, which had hit 40-year highs. Now, as 2023 winds down, inflation has declined significantly but remains above the Fed’s 2% target. The economy has turned out to be stronger than expected, although economists believe growth is now moderating and will slow in 2024.

At this week’s policy-setting meeting, Fed officials aren’t expected to make any changes, keeping their target range for the federal-funds rate at 5.25-5.00%. That would mark the third straight meeting at which the central bank has held rates steady, with the last increase having come in July.

The bigger question is what the officials will suggest about the outlook. They are currently seen to be signaling that they are “data dependent,” meaning they don’t have a predetermined course and will instead respond carefully to economic data. However, investors seem confident that the Fed is done raising rates after this stretch of its most aggressive tightening of monetary policy in its history.

At the same time, the bond market is currently priced for the Fed to change gears and start lowering rates as soon as May, according to the CME Fedwatch Tool. Last week, those expectations were pushed back from a March pivot in the wake of a stronger-than-expected November jobs report.

However, the bond futures market, where traders place bets on the direction of interest rates, is still priced for four rate cuts in 2024 lowering the funds rate target by 1 percentage point.

Federal-Funds Rate Target Expectations

When Will the Fed Cut Rates?

Kathy Jones, chief fixed income strategist at Charles Schwab, notes that the bond market has been wrong several times about the timing around the Fed ending rate hikes and then lowering rates. “This market has had a pattern of having to backtrack. This is something like the fourth time,” she says. “It’s like the definition of insanity—continuing to do the same thing and expecting the outcome to be different.”

The expectation of multiple Fed easings in 2024 has been a key factor driving the reversal in the bond market. Since Oct. 19, the yield on the U.S. Treasury 10-year note has fallen from a nearly 17-year high of roughly 5% to a low last week near 4.2%. Not only is that a significant decline, but it also reversed the bulk of the big rise between the end of July (when the 10-year bond was yielding 4%) and mid-October.

“Looking at the change in sentiment in the Treasury market, we have basically over the last three months done a complete 180,” says Kevin Flanagan, head of fixed income strategy at WisdomTree. “This plummet in Treasury yields now needs to be validated” by confirming that multiple rate cuts could be in the cards next year.

But Flanagan notes that Powell has been saying the opposite. In comments made on Dec. 1, the chair was still leaving the door open for rate hikes, not cuts. “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease,” Powell said. “We are prepared to tighten policy further if it becomes appropriate to do so.”

Flanagan says: “This is going to be the challenge for Powell and the Fed. If they don’t agree with the market’s movement, they need to push back.”

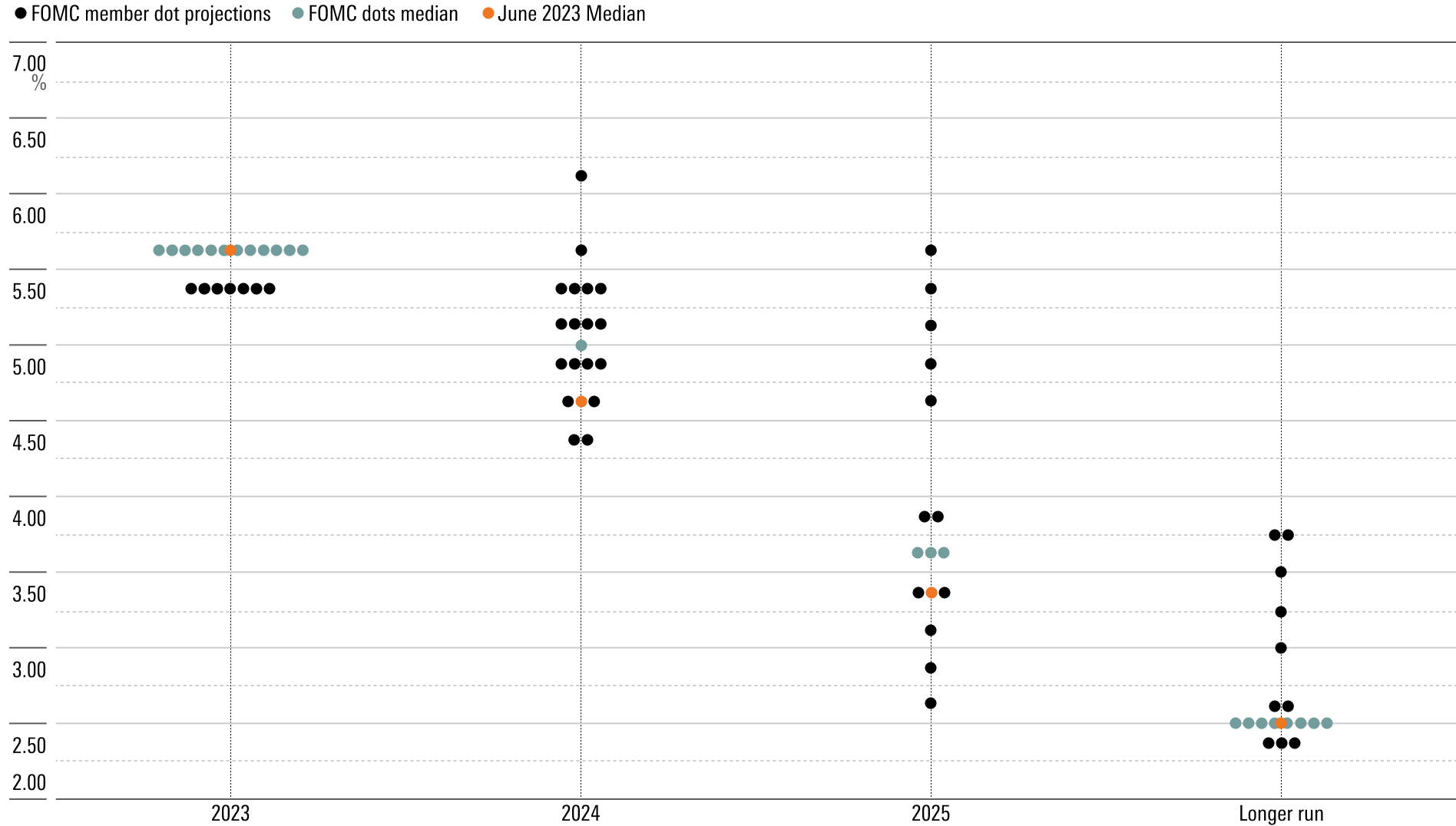

Watch the Dot Plot

Jones says she will be paying close attention to the dot plot presenting Fed officials’ forecasts for rates. When the most recent predictions were published in September, they showed that on balance, Fed officials expected one more rate hike in 2023 and just two in 2024.

The new forecasts will likely take any additional hikes off the table, Jones says. At the same time, she believes the forecasts won’t show the kind of aggressive rate cuts the bond market has been looking for.

Jones is predicting three rate cuts in 2024, starting around mid-year. Because the Fed was so far behind the curve on raising interest rates and the economy has been holding in strong, she believes officials want “to be certain to get back to their target” of 2% inflation. “So rather than cut earlier as inflation comes down, which they might have done in a previous cycle, they’re more likely to cut later once the evidence is really strong. I think the dots will probably reflect that,” she explains.

The Dot Plot: Federal-Funds Rate Target Level

Powell’s View of Financial Conditions

One open question is how Powell will treat the “financial conditions” that dominated the market chatter ahead of the last Fed decision on Nov. 1. This technical term covers a wide range of markets—stocks, different kinds of bonds, currencies, and more—where swings in prices and rates can potentially affect the economy beyond the Fed’s official moves.

Last time around, bond yields were surging, and the belief was that higher market rates (the foundation for mortgage rates and other consumer and business lending) would substitute for an additional Fed tightening. Now that dynamic has reversed. Bond yields have fallen back, stocks have rallied, and the U.S. has weakened—factors that contribute to an easing of financial conditions.

Chicago Fed National Financial Conditions Index

Flanagan notes that on Nov. 1, after the last Fed meeting, Powell was discussing tighter financial conditions. “You would think the Fed cut rates over the last month because financial conditions have completely reversed course,” he says. “They need to address that.”

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RMBMMBAVABHL5O5JI2WDI44I3U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MJ3FSXZXVFDYPHHGXT7LMKSZD4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)