Fed Meeting Preview: The End of Rate Hikes?

Powell will likely signal that future rate moves will be data-dependent.

It’s widely expected that when Federal Reserve officials wrap up their two-day meeting on Wednesday, interest rates will be held steady for the second consecutive month. More significantly, the bond market is now clearly signaling that with inflation trends moving in the right direction, the Fed is most likely done raising interest rates for this economic cycle.

While the economy is still posting solid growth and inflation is above the Fed’s target, since changes in interest rates take time to filter through to the economy, economists say the central bank will want to hit the pause button. Fed chair Jerome Powell may hedge on such a message by saying the policy-making Federal Open Market Committee is “data-dependent” and prepared to raise rates further if needed.

In contrast, investors will be watching for any signals about what it would take for the Fed to start lowering rates in 2024. One key area of focus will be new forecasts for economic growth and inflation, along with the Fed’s “Dot Plot” of expectations for interest rates.

September FOMC Preview Highlights

- Rates are not expected to change

- Powell is still talking tough on inflation

- Watch the Dot Plot

According to the CME FedWatch Tool, which reflects bets that bond traders place on the direction of interest rates, there is a 99% chance that the Fed will keep its federal-funds rate target at 5.25%-5.5%. This would be the first time since the central bank started raising rates in March 2022 that it has kept rates unchanged at two consecutive meetings.

“The market’s pricing in ‘no hike’ this week with 99% probability, which I agree with,” says Preston Caldwell, senior U.S. economist at Morningstar. “Inflation is trending down quickly enough that the Fed has no need to hike further for now.”

Treasury Yield and Federal-Funds Rate

Caldwell notes that a recent rise in longer-term bond yields will act as a brake on economic activity and will essentially substitute for an official rate hike. The yield on the U.S. Treasury 10-year note—which serves as a benchmark for most mortgages—has risen by roughly half a percentage point in the past two months.

Powell to Stress a ‘Data-Dependent’ Fed

Underlying the Fed’s outlook is an economy that has defied expectations. A widely expected recession has not materialized in 2023, the economy has picked up steam, and the jobs market remains healthy.

The Federal Reserve Bank of Atlanta’s GDPNow forecast is predicting that the economy will show a 4.9% rate of growth in the third quarter. That’s more than double the pace seen in the second quarter and would be the strongest showing for the economy since the end of 2021.

At the same time, inflation pressures have cooled, and despite a pop higher in August thanks to rising gas prices, the trend is generally seen to be lower.

However, with the economy as strong as it has been, economists say the Fed won’t want to risk making a definitive statement about ending rate hikes. Instead, at a press conference following the Fed decision, Powell will likely stick with his stance that whether the Fed raises interest rates again will depend on what the data shows, according to Quincy Krosby, chief global strategist for LPL Financial. For example, she says, a mention of the 1970s oil and inflation crisis could indicate Powell is still more concerned about inflation than recession.

“They won’t know, from this meeting, what they’re going to do [next],” Krosby says. “There’s a bit of time and an abundance of data between now and the December meeting.”

Krosby is in the camp that there is still a “50/50″ chance the Fed will raise interest rates one more time. “They would like to be finished, but if the prices that are inching higher don’t level off, it’s going to be difficult for them.”

Doves—those in the Fed who are more inclined to stop raising rates and ready a pivot to lowering rates—acknowledge that inflation is too high, but they believe the lagged effects of rate hikes are still unfolding in the broader economy. But hawks—officials biased toward raising rates or keeping them high—suggest such changes are no longer in effect.

Krosby explains: “The big question for the market is: Is it going to be a hawkish pause, or is it going to be a dovish pause?”

Federal-Funds Rate Target Expectations

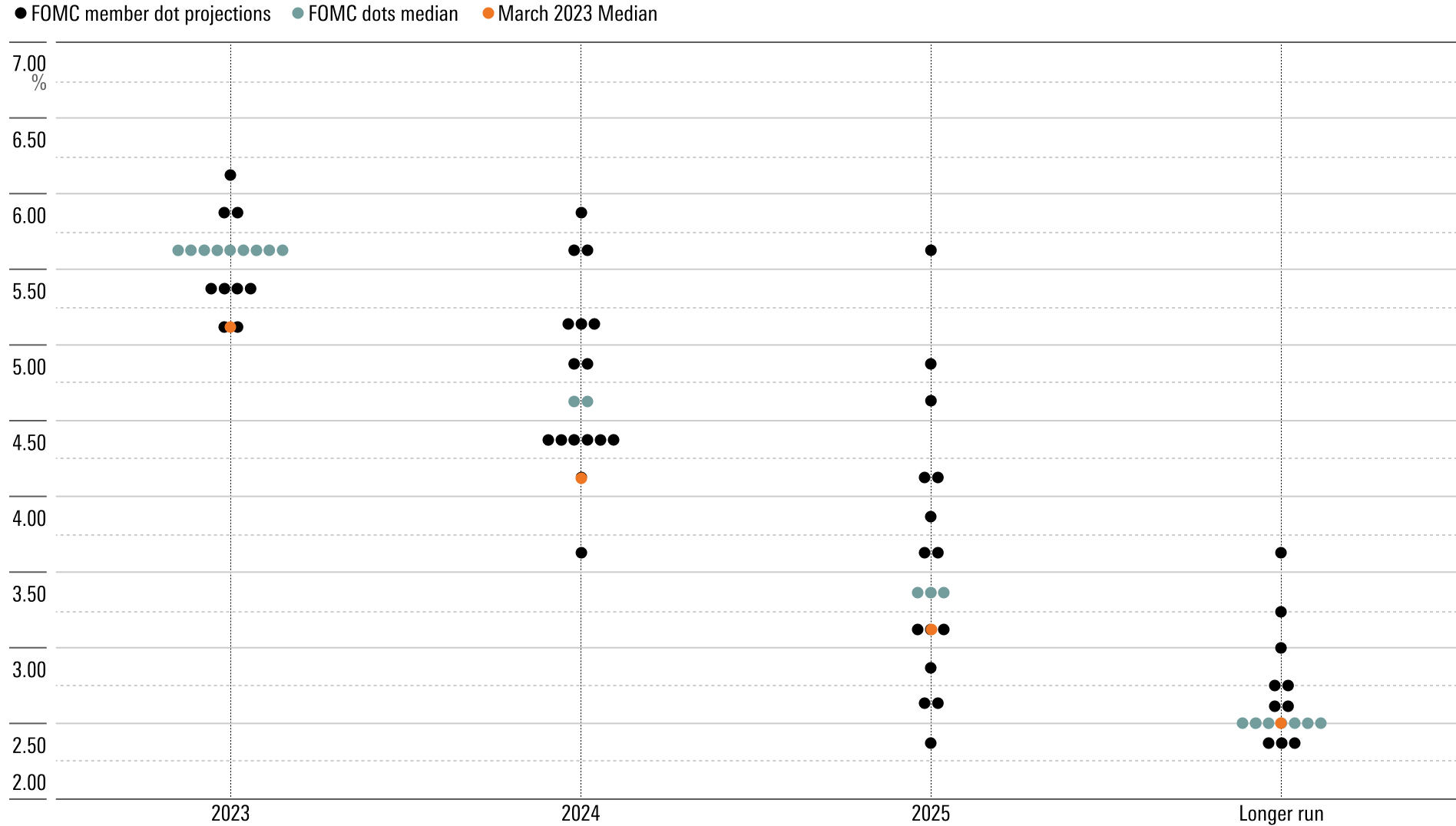

Fed Dot Plots

Analysts will be looking for clues about the Fed’s inclination in its release of new economic predictions and its “Dot Plot” of forecasts for interest rates. In part, these forecast revisions will likely reflect the trends toward stronger growth and softer inflation seen since the last estimates were published in June. At that time, the Fed forecast GDP growth of just 1.0% for 2023, a year-end unemployment rate of 4.1%, and a 3.9% rise in personal consumption expenditures excluding food and energy (its favored inflation indicator). In August the unemployment rate stood at 3.8%, and core PCE rose 4.2% in July, but economists believe that number will be headed lower in the coming months.

The Fed “probably will lower their unemployment rate forecasts, lower the core PCE inflation forecasts, and increase GDP growth forecast for this year, especially given the recent data,” says Qian Wang, global economist at Vanguard.

At the same time, investors will closely watch the Fed’s own projections for the funds rate target. At the June meeting, the median forecast among Fed officials was for the funds rate to stand at 5.6% at year-end, which would imply there is still one more interest rate increase to come this year. From there, the Fed’s forecast suggested it would cut the funds rate by 1 percentage point over the course of 2024.

The Dot Plot: Federal-Funds Rate Target Level

Wang doesn’t expect a material change in the Fed’s rate forecasts. “We think the Fed at this moment is … in a good position,” she says. “They are very happy with the balance of risk at this moment … and they will continue to keep that one additional rate hike in that Dot Plot, just maintaining that kind of hawkish bias.”

The Fed “wants to show the market that they are being patient and will continue to be data-dependent. This is a good position, and I don’t think they want to risk doing anything to change the market perception or expectations materially,” says Wang. “It’s going to be about the message the Fed is trying to send.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RMBMMBAVABHL5O5JI2WDI44I3U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MJ3FSXZXVFDYPHHGXT7LMKSZD4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)