Despite Gains in 3Q, Consumer Cyclical Still Offers Compelling Opportunities

Travel volume remains resilient and Gap and Bath & Body Works among top retail picks

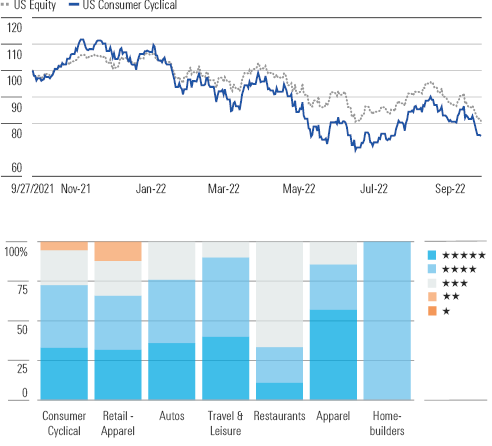

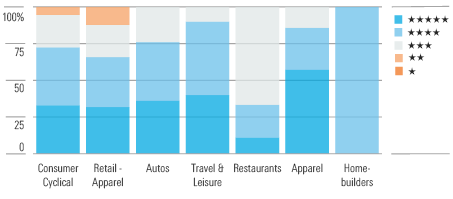

The consumer cyclical sector recouped prior 2022 losses in the third quarter by garnering roughly a 5% return, outperforming the U.S. equity market’s 3% decline, as of Sept. 27. Still, the consumer cyclical sector trades at a 25% discount to our fair value estimates, with 72% of stocks in our sector coverage trading in 4- or 5-star territory. We surmise the lingering pessimism stems in part from near-term concerns over consumer willingness to spend, given persistent inflation, rising interest rates, and plunging personal savings rates. However, we think this is more than baked into the shares, rendering travel and leisure and apparel retail as two of the more undervalued spaces, at 35% and 33% discounts to our intrinsic valuation, respectively.

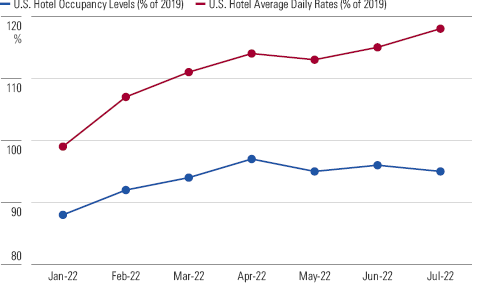

To buoy our stance, improving U.S. hotel occupancy levels quantitatively suggest travel volume remains resilient. Particularly, average daily rates, which more than fully recovered in the second quarter of 2022, reaching 114% of 2019 levels, showcase hotel operators’ stout pricing power thanks to the pent-up desire to travel, wallet share shift to service consumption, and incremental trips from remote work flexibility. While heated inflation could further pinch consumer pocketbooks and curb discretionary spending (including on travel), we do not expect to see softening travel demand in aggregate over the near term. Rather, a recovery in business and international trips that have been lagging the rebound in leisure trips should invigorate the travel industry ahead, in our view.

Consumer Cyclical Stocks Chalked Up Robust Gains in the Quarter

Source: Morningstar Equity Research, Data as of Sept. 27, 2022.

However, Each Consumer Cyclical Subsector Still Offers Opportunities

Source: Morningstar Equity Research, Data as of Sept. 27, 2022

Despite Sector Gains in Q3, Consumer Cyclical Still Offers Compelling Opportunities

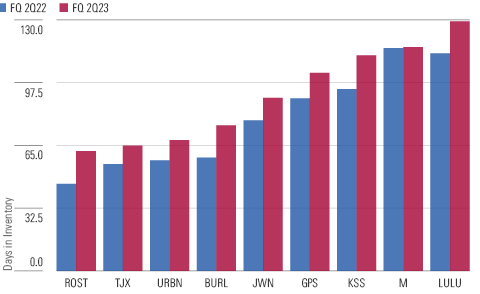

As for apparel retail, the amalgamation of shifting consumer purchasing decisions and supply chain disruption that led to bare shelves during the last holiday season left retailers with a conundrum of estimating appropriate inventory positions. Specifically, early ordering to cope with supply chain constraints coupled with sales declines in some categories amid inflation resulted in elevated inventory levels. However, as retailers act to curtail inventories at the shelf ahead of the upcoming holiday season (through aggressive markdowns, order cancellations, and assortment changes), we expect inventory levels to improve over the next few months, positioning apparel retailers for a better 2023.

Demand for travel persists even amid macro challenges.

Clothing retailers’ inventories pilling up, but firms not sitting still.

Sources: Smith Travel Research. Company filings. Morningstar. Data as of Sept. 22, 2022

Top Picks

Hainesbrands HBI Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $24 Fair Value Uncertainty: Medium

We believe narrow-moat Hanesbrands, currently trading at a 67% discount to our $24 per share fair value estimate, offers a good opportunity for investors. Although higher costs, freight delays, and unfavorable currency movements are expected to impact near-term profitability, we remain confident in the company's long-term strategic plan, Full Potential. We view the plan favorably, particularly its emphasis on widening the athleisure brand Champion, and we think the firm is in capable hands under former Walmart executive Steve Bratspies, who took over as Hanes' CEO in August 2020.

Bath & Body Works BBWI Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $82 Fair Value Uncertainty: Medium

Exxon plans to double earnings from 2019 levels by 2025 and double cash flow by 2027 on a combination of structural operating cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments. Exxon estimates that under the current plan, it will generate about $100 billion in surplus cash, after funding investment and paying the dividend, during the next five years. Combined with currently higher than expected commodity prices, its current repurchase program of $30 billion through 2023, is likely just the beginning.

Gap GPS Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $25 Fair Value Uncertainty: High

No-moat Gap offers a compelling investment opportunity, trading roughly at a 64% discount to our $25 fair value estimate. We contend the market is overly concerned with the recent merchandising and supply chain woes, while overlooking Gap’s efforts to regain relevance. In this context, we believe Gap’s recovery from the pandemic and its Power Plan may unlock value. Specifically, we think Gap’s focus on growing brands that align with market trends (Old Navy and Athleta), while downsizing and fixing struggling brands (Gap Global and Banana Republic) should allow profitability upside, ultimately reaching a 7.5% operating margin by 2025.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)