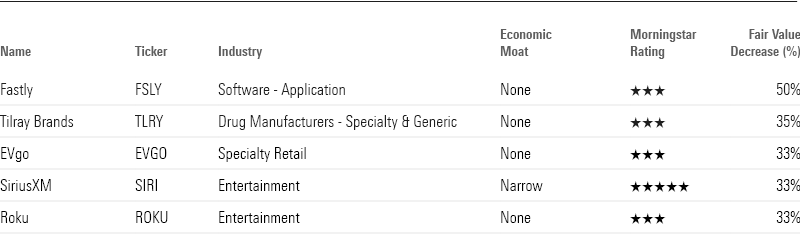

5 Stocks With the Largest Fair Value Estimate Cuts After Q1 Earnings

Fastly and Tilray Brands are among those with the deepest reductions to their valuation estimates.

While first-quarter earnings results were largely positive for the 875 US-listed stocks covered by Morningstar analysts, some companies had their fair value estimates slashed.

Among the stocks on Morningstar’s list, the average change in fair value estimates was a 0.66% increase, below the 10-year average increase of 1.48% per earnings season.

Of those 875 stocks, about 3% saw their fair value estimates cut by a meaningful amount of 10% or more.

Three of the five stocks with the largest fair value cuts, SiriusXM SIRI, Roku ROKU, and Fastly FSLY, are all in the content delivery business. SiriusXM delivers audio content via streaming and satellite; Roku delivers video streaming content; and Fastly provides infrastructure for media platforms to deliver their content to users.

Morningstar senior equity analyst Matthew Dolgin, who covers all three companies, notes that first-quarter earnings were not bad for any of these firms. However, slower long-term growth outlooks prompted him to reduce their fair values.

Stocks With the Largest Fair Value Estimate Cuts

- Fastly FSLY: $10 from $20

- Tilray Brands TLRY: $2 from $3.10

- EVgo EVGO: $2 from $3

- SiriusXM SIRI: $5 from $7.50

- Roku ROKU: $50 from $75

Here’s what Morningstar’s analysts had to say about these cuts.

Fastly

- Fair Value Estimate: $10

- Fair Value Decrease: 50%

- Morningstar Uncertainty Rating: Very High

- Morningstar Economic Moat Rating: None

Fastly had the largest fair value estimate cut, going to $10 from $20. “Fastly’s first quarter was fine, but its bleak second-quarter outlook, big cut to full-year guidance, and the reasoning behind the weakness creates concern that Fastly is at a competitive disadvantage that will seriously weigh on performance,” says Dolgin. “Major enterprises use multiple providers for their content delivery network needs. The biggest enterprises are now paying Fastly lower prices without giving Fastly more traffic, and it appears the reduced traffic is not the result of less demand but rather a shift to other providers. We have long seen the traditional content delivery business as commoditized, deflationary, and unattractive. Still, we thought Fastly’s more modern approach, with fewer servers and better responsiveness, and its edge computing capabilities gave it an edge. This does not seem to have come to fruition.”

Fastly is trading near its new fair value estimate and has a Morningstar Rating of 3 stars.

Investors can find more of Dolgin’s take on Fastly here.

Tilray Brands

- Fair Value Estimate: $2

- Fair Value Decrease: 35%

- Morningstar Uncertainty Rating: Very High

- Morningstar Economic Moat Rating: None

Cannabis producer Tilray Brands saw its fair value estimate slashed to $2 from $3.10. The company “issued disappointing (February-ended) fiscal 2024 third-quarter results, including slower revenue growth and margin contraction,” says equity strategist Kristoffer Inton. “Changes to our forecast alone imply a valuation reduction roughly in line with the ensuing market price decline of about 21%. In addition, we’ve removed all contribution to our fair value estimate from Tilray’s ownership of US multistate operator Medmen’s senior secured convertible notes, as a complete write-off of the investment seems inevitable. The asset had composed about 20% of our fair value estimate.

Tilray Brands is trading near its new fair value estimate and has a Morningstar Rating of 3 stars.

Read Inton’s full take on Tilray Brands here.

EVgo

- Fair Value Estimate: $2

- Fair Value Decrease: 33%

- Morningstar Uncertainty Rating: Very High

- Morningstar Economic Moat Rating: None

Electric vehicle charging company EVgo saw its fair value estimate reduced to $2 from $3 in early April. “The primary driver of our decreased valuation is lower assumed long-term market share in electric vehicle fast charging,” says Morningstar equity analyst Brett Castelli. “While we think EVgo is demonstrating improving economics of its charging network as utilization rates rise, our bigger concern is the company’s funding runway. The owner-operator EV charging business model is capital-intensive, and EVgo is relatively balance sheet constrained ($209 million of cash at year-end). We expect players with deep pockets, such as auto manufacturers or oil and gas companies, to increasingly participate in the buildout of fast-charging stations over the coming years. As a result, we expect this will weigh on EVgo’s long-term market share as competitors build out stations at a faster pace than the company is able, given its balance sheet.”

EVgo is trading near its new fair value estimate and has a Morningstar Rating of 3 stars.

Take a deeper dive into Castelli’s outlook for EVgo.

SiriusXM

- Fair Value Estimate: $5

- Fair Value Decrease: 33%

- Morningstar Uncertainty Rating: Medium

- Morningstar Economic Moat Rating: Narrow

Radio and media streaming firm SiriusXM saw its fair value estimate cut to $5 from $7.50, due to a slower long-term growth forecast. “SiriusXM’s first quarter was not bad, but revenue remains stagnant, and the SiriusXM subscriber base has continued to contract,” says Dolgin. “Total revenue was up 1% year over year, as 7% growth at Pandora—driven by a jump in advertising revenue—was mostly offset by a slight decline in subscriber revenue in the much larger SiriusXM segment. With investment in content and technology to improve the SiriusXM streaming app and integration into vehicles, management expects subscriber growth to pick up.”

SiriusXM is trading at a 45% discount to its new fair value estimate and has a Morningstar Rating of 5 stars.

Dolgin has more about SiriusXM’s stock here.

Roku

- Fair Value Estimate: $50

- Fair Value Decrease: 33%

- Morningstar Uncertainty Rating: Very High

- Morningstar Economic Moat Rating: None

Television streaming company Roku saw its fair value estimate slashed to $50 from $75. “Roku had a very good first quarter, with impressive user engagement driving strong revenue growth and EBITDA that is tracking better than our full-year forecast,” says Dolgin. “However, we’ve taken a deeper look at Roku, and we’re concerned that its customer acquisition costs must remain elevated for the account base to continue growing at a healthy clip. The 19% devices revenue growth was accompanied by a negative 5% gross margin, and similar to last year, management expects the devices margin to worsen throughout the year as it focuses on selling Roku-branded televisions. In our view, Roku needs devices revenue to either become profitable or grow much more slowly than platform revenue, but we think either scenario would crimp platform growth, as we think Roku needs to continue getting cheap devices into consumer hands to add accounts.”

Roku is trading near its new fair value estimate and has a Morningstar Rating of 3 stars.

The rest of Dolgin’s take on Roku can be found here.

Stocks With the Largest Fair Value Cuts

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)