Why Bother With Small-Cap ETFs?

How the investment case has changed.

Double-digit returns for some small-cap exchange-traded funds have not been enough to close the gap on their larger counterparts so far in 2024. As mega-cap stocks grab headlines and hit fresh highs, small caps are increasingly relegated to the periphery and contradict the investing proverb: Higher risk = higher return.

As one of Eugene Fama and Kenneth French’s original three investment factors, small companies should offer investors reliable outperformance thanks to heightened risk. This proved true in their extensive backtests. Over the years, numerous small-cap mutual funds and ETFs launched, hoping to latch onto this outperformance. Some did better than others, but as time passed, it became clear that small-cap stocks were not the panacea some hoped they would be.

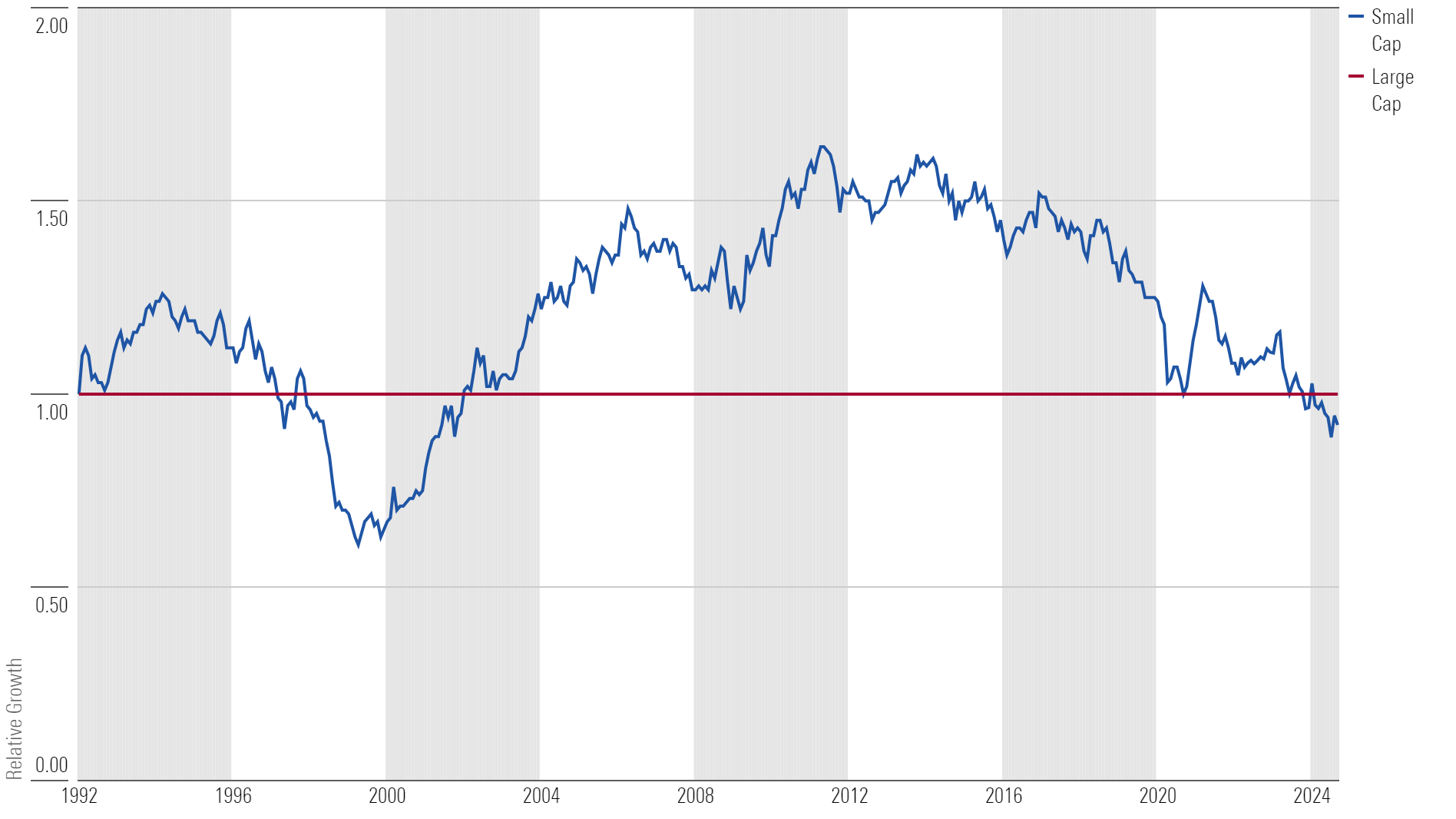

Small-Cap Outperformance Comes in Waves

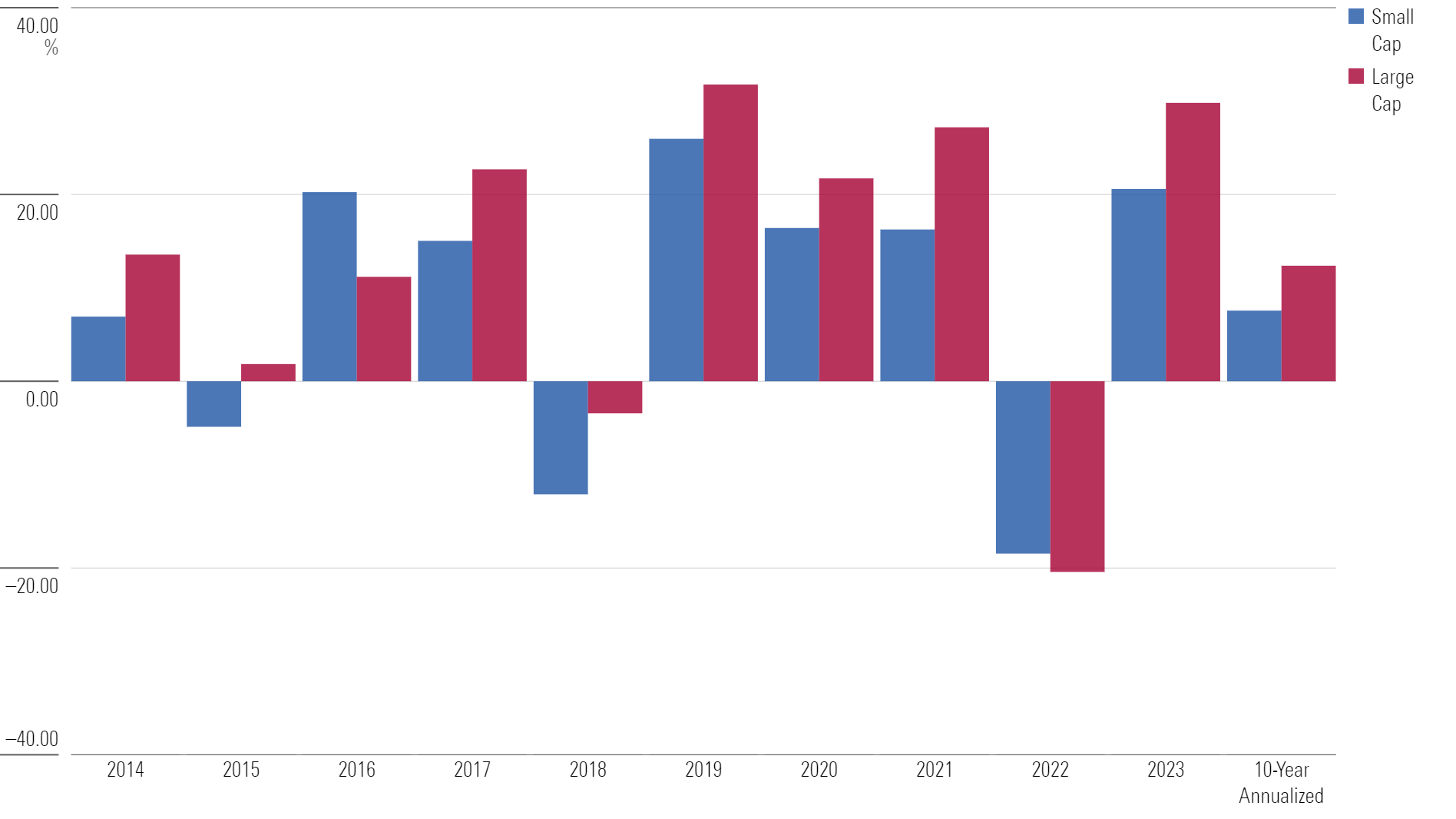

The above chart shows the relative performance of the Morningstar US Small Cap Index against the Morningstar US Large Cap Index since 1992 (as far back as data goes). The below chart shows annual returns of each index over the last 10 years, a period when the small-cap index underperformed the large-cap index by almost 5 percentage points annualized, with greater volatility.

Annual Returns of Small- and Large-Cap Stock Indexes

As small-cap stocks continue to underperform their larger peers, small-cap ETFs increasingly look like a contrarian bet. Maybe that’s for a reason.

Small-Cap Stocks Are Changing

Part of the appeal of small caps is that some will go on to become mid- and large-cap stocks—they will grow their revenues and earnings, and investors will bid their share prices out of small-cap territory. Some won’t, but that’s the risk. Small-cap investors benefit from a firm’s growth as their business improves and expands. And by investing in a portfolio of these businesses, such as through a small-cap ETF, risk and opportunity is spread across hundreds or even thousands of stocks.

Microsoft MSFT was once a small-cap stock. It had to start somewhere, after all, and public markets were viewed as the best option for promising young firms to raise capital in the 1980s. Microsoft went public in 1986 with a market cap of $777 million, or around $2.2 billion in today’s dollars. Its market cap crossed the $3 trillion mark in January.

For small-cap investors, the worry is that tomorrow’s Microsoft may never be a public small-cap company. Many of the most promising young companies now choose to stay private for longer, seeking growth capital from private shareholders instead of entering public markets. As a result, much of their growth accrues as a private firm before they’re subject to the scrutiny and regulation that comes with being publicly traded. Uber Technologies UBER went public in 2019 with a valuation of $82 billion after 10 years as a private company. Today, its market cap measures around $140 billion. Solid growth, but not the sky-high returns many public investors had hoped for.

One of the most promising companies right now, OpenAI, will likely fetch a $150 billion valuation in an upcoming financing round led by venture firm Thrive Capital. A $150 billion market cap would place OpenAI firmly in large-cap territory, bypassing small caps and mid-caps altogether. The table below shows the evolution of S&P’s size constraints for its suite of US stock indexes, which underpin trillions of dollars of ETF assets.

Market-Cap Guidelines for S&P US Equity Indexes

OpenAI would rank well inside the largest 100 companies in the S&P 500 with a $150 billion market cap. OpenAI is just one company, but it represents much more. If companies go public with increasingly large market caps, the universe of small-cap stocks will atrophy, and a core thesis of small-cap growth investing will be moot: “Tomorrow’s big stocks are today’s small stocks.”

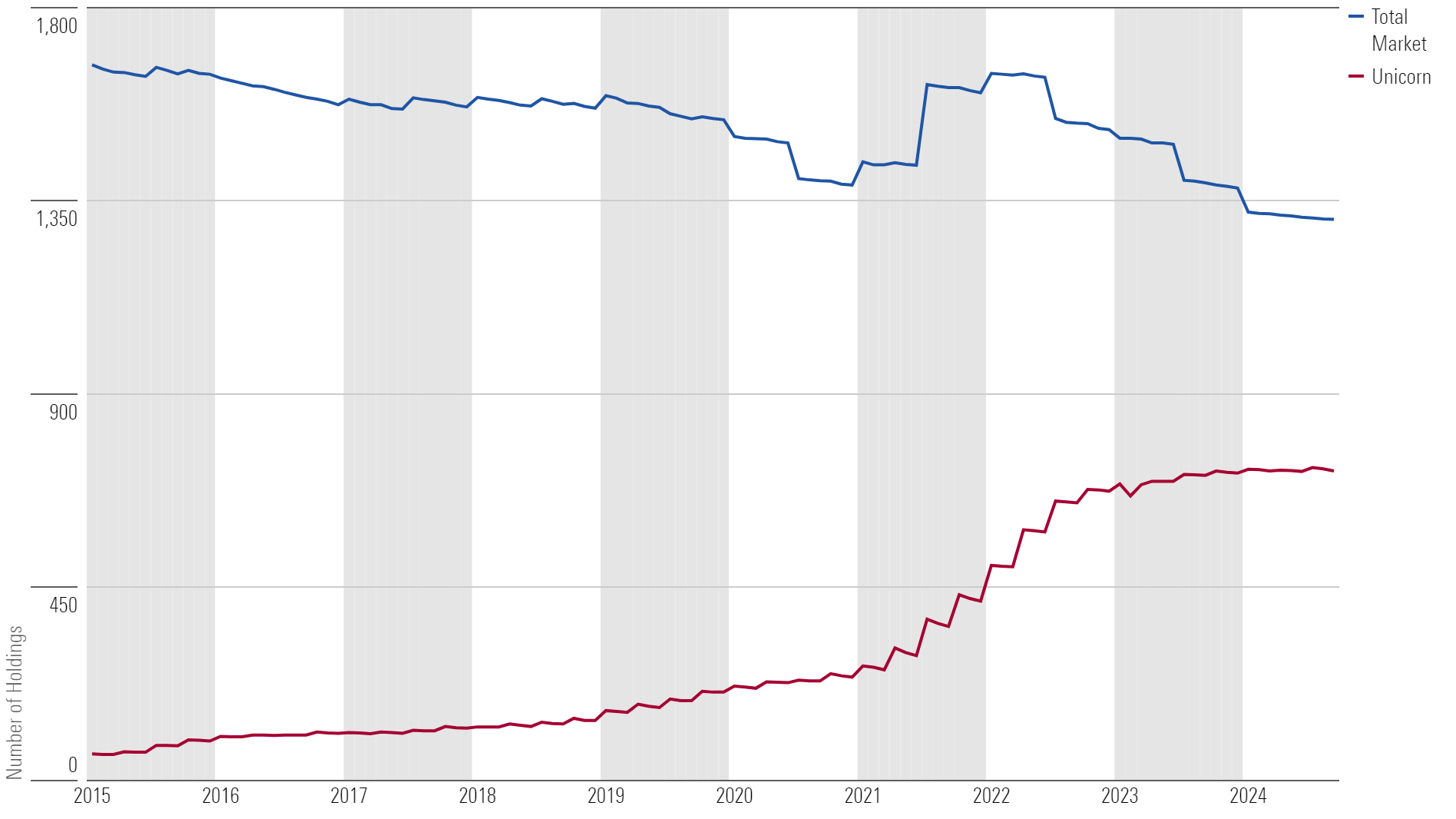

Rise of Unicorn Companies

The Morningstar PitchBook US Unicorn Index tracks privately held, late-stage venture-backed US companies with valuations of at least $1 billion. While a public offering may not make sense for many of these firms, surely some could be considered IPO-eligible. Yet many choose to stay private long after their valuations cross $1 billion. The number of unicorns rose by more than 1,100% since 2014. Meanwhile, the number of stocks in the Morningstar US Market Index—a broad benchmark that includes the largest 97% of US stocks—fell by 22%.

More Private Companies, Fewer Public Companies

If fewer companies go public with small market caps, it raises the question of what types of companies remain in the small-cap universe. Conventional investment theory posits that investors bid up stocks they think will grow future cash flows. It’s the expectation of future growth that drives stock returns. Unicorns and other promising young companies offer this potential, captivating investor interest, driving their stocks higher—this is why venture capitalists invest. But without those firms in small-cap indexes, small-cap ETFs lose some of their excitement and potential. Since stock investing revolves around potential, fewer investors are interested and willing to bet on the current crop of small companies. Larger ones, like Microsoft, are perceived to have greater potential, despite its 13-figure market capitalization. This dynamic likely contributes to the recent underperformance of small-cap indexes and ETFs.

Opportunities for ETF Investors

Several small-cap ETFs have amassed billions from investors hoping to profit from one of Fama and French’s original three factors. Highly rated ones effectively control for many of the risks associated with smaller public companies: volatility and illiquidity. While the ones we like do address those issues and should perform well relative to the category, they do not address the existential concerns raised here. Should investors even bother with small caps?

Bottom line is that small caps are risky. They’ve always been risky, but those risks are amplified by the shifting structure of the market. Still, under the right circumstances, small-cap ETFs can boost returns and improve diversification.

Small-cap valuations remain far below the US market average and may present an opportunity for ETF investors to buy low. This group of stocks is also more sensitive to interest rates than their larger counterparts, so it could benefit most if the Federal Reserve proceeds with rate cuts.

Here are five undervalued small-cap ETFs to consider taking off the shelf:

| Name | Ticker | Price/Fair Value | Fee | Medalist Rating |

|---|---|---|---|---|

| Invesco FTSE RAFI US 1500 Small-Mid ETF | PRFZ | 0.88 | 0.39% | Silver |

| iShares Core S&P Small-Cap ETF | IJR | 0.92 | 0.06% | Silver |

| Schwab Fundamental U.S. Small Company ETF | FNDA | 0.92 | 0.25% | Silver |

| Schwab US Small-Cap ETF | SCHA | 0.93 | 0.04% | Silver |

| Vanguard Small-Cap Value ETF | VBR | 0.94 | 0.07% | Gold |

A version of this article first appeared in the May 2024 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)