High-Quality Bond Funds Shine in Q3 2024

How some of our favorite managers fared as interest rates fell.

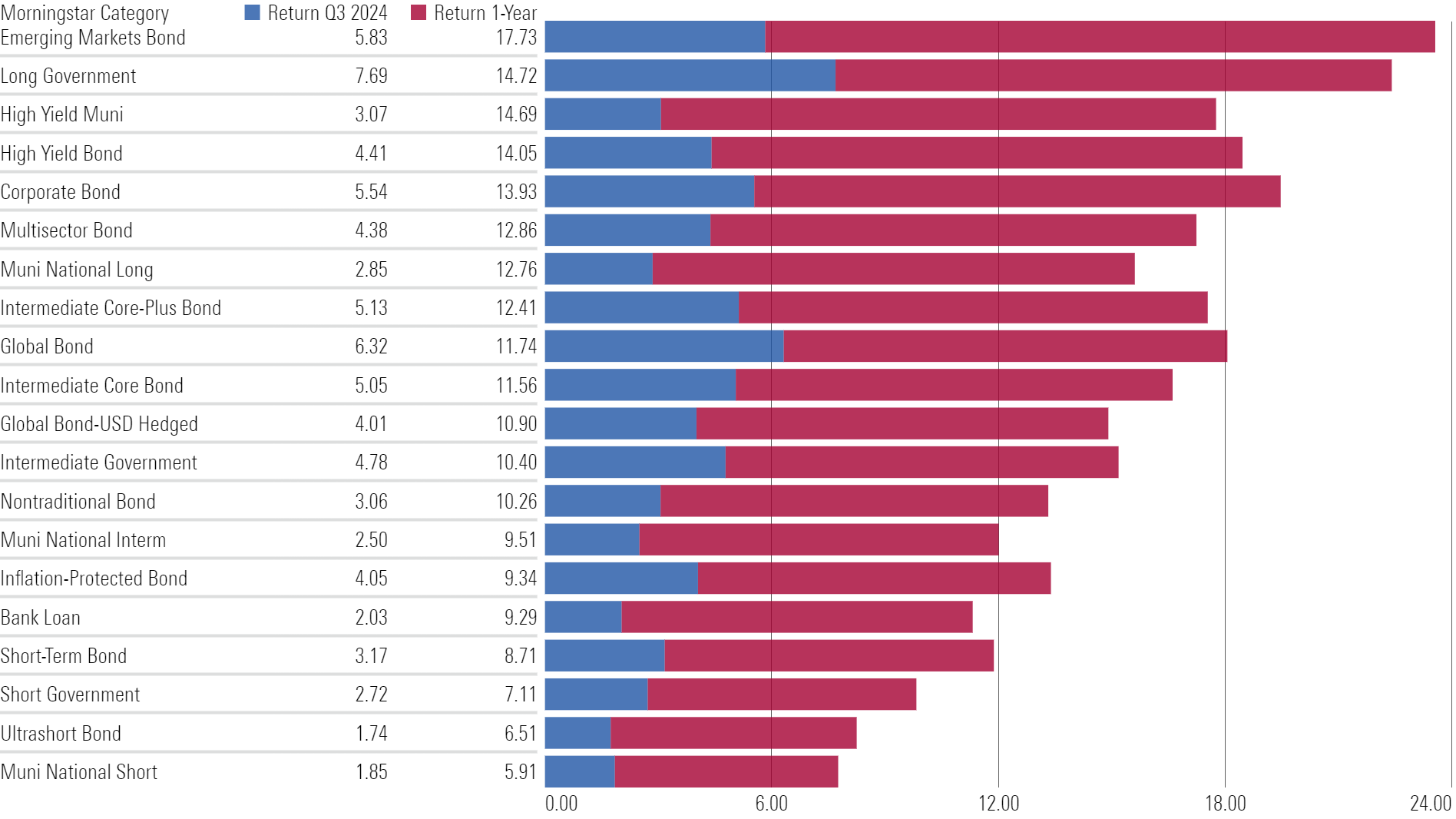

Bond investors had a lot to cheer about during 2024′s third quarter. The Morningstar US Core Bond Index, a proxy for the US-dollar-denominated investment-grade bond market, gained 5.15%, its second-best quarterly showing in more than two decades, and the median funds in all major fixed-income Morningstar Categories posted positive returns.

Median Returns for the Fixed-Income Morningstar Categories

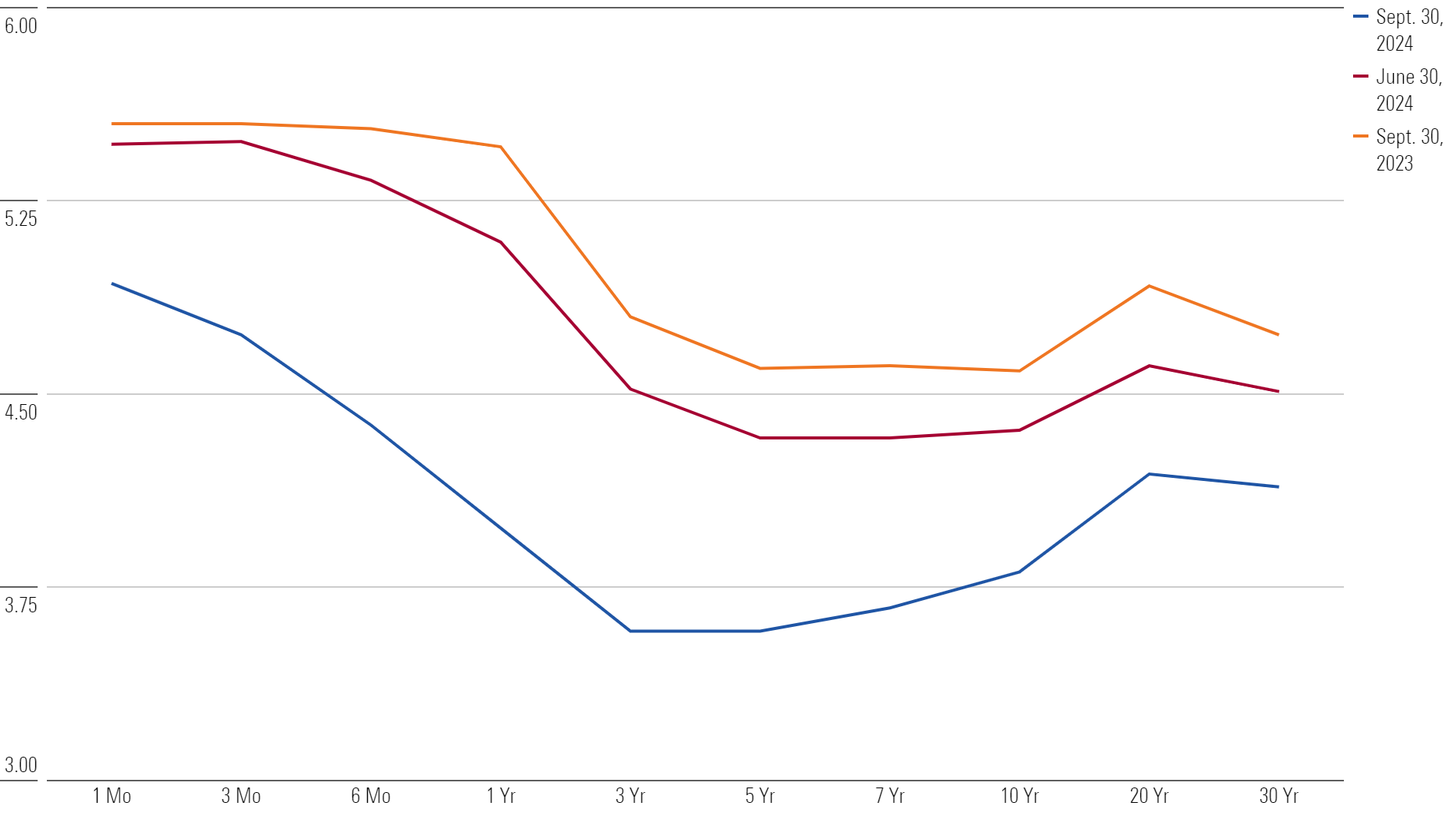

High-quality and long-duration bonds, like US Treasuries, agency mortgages, and investment-grade corporates, led the way during the quarter as the Federal Reserve changed its course and cut the target range for the short-term federal-funds rate by 0.5% on Sept. 18. Long-term yields followed short-term yields lower over the quarter, and bonds saw their prices increase. The median intermediate core bond fund, which invests in a mix of these high-quality bonds, gained 5.0% during the quarter.

Yields Decreased Across the Curve During the Quarter

Strong fundamentals and a healthy economy kept credit-sensitive assets, such as bank loans and high-yield bonds, solidly in positive territory as well. For the quarter, the median bank-loan and high-yield bond fund returned 2.0% and 4.4%, respectively, as these funds continued to reward investors who took more credit risks.

Even global bond funds, whose performance suffered as the US dollar strengthened alongside rising rates over the past few years, generated strong returns for investors. The average fund in the unhedged global bond category rose 6.4% as the US dollar weakened during the quarter.

Below, we dig into a few fixed-income categories and highlight how some of our favorite bond managers fared during the quarter.

Core-Plus Bond Funds Enjoy Falling Rates

Core-plus bond managers, who venture further out on the yield curve than their core and short-term bond counterparts, have faced many challenges during market volatility in 2022 and 2023. Some managers weathered the storm, while others struggled. But as interest rates reversed course during 2024′s third quarter, those who took more interest-rate risk finally reaped the rewards over managers who adhere to more cautious approaches.

Silver-rated TCW MetWest Total Return Bond’s MWTIX longer-than-peers duration, a measure of interest-rate risk, and its Bloomberg US Aggregate Bond Index weighed on returns as rates climbed. The team behind this approach typically lengthens duration when rates rise and cuts duration when rates fall. The portfolio’s 7.1-year duration, which stood nearly a year longer than its peer median and benchmark, helped deliver a 5.7% gain, which beat over 90% of its peers during the quarter.

Fidelity Total Bond FBND, an active exchange-traded fund with a Morningstar Medalist Rating of Gold, didn’t enjoy the same level of success during the period. The team typically doesn’t make large bets with its duration positioning, which helped as interest rates increased over the past few years. But in the third quarter, its 5.2% return landed roughly in line with the typical intermediate core-plus bond peer’s results.

Global Bond Fund Returns Climb

The US dollar weakened during the year’s third quarter, which provided a tailwind for investors who sought opportunities outside the United States. The unhedged version of the Morningstar Global Core Bond Index gained 6.9%, while the hedged version returned 4.2%.

Bronze-rated Hartford World Bond’s HWDIX team has taken a less adventurous approach to non-US dollar exposure in recent years. Its roughly 90% exposure to the US dollar helped in the first half of the year on the back of a strong US dollar, but the fund trailed nearly 90% of peers in the third quarter. Its 4.5% year-to-date return still beat 75% of peers, though.

Managers with more appetite for non-US dollar stakes stood to benefit this quarter. After sustaining a large blow to performance in the first half of 2024, Bronze-rated BrandywineGLOBAL Global Opportunities Bond GOBSX finally found success in the third quarter. Its 8.2% gain beat more than 85% of peers, but its less impressive year-to-date 0.4% return trailed over 90% of peers.

Investment-Grade Credit Tops Junk-Rated Debt

The Morningstar US Corporate Bond Index, a proxy for investment-grade US-dollar-denominated corporate bonds, returned 5.8% during the quarter and outperformed its lower-quality counterparts. High-yield corporate bonds, as measured by the Morningstar US High Yield Bond Index, gained 5.3%. Investment-grade corporate bonds typically carry longer durations than high-yield bonds and stood to benefit from falling yields.

Bronze-rated Invesco Corporate Bond ACCHX stood out from most rivals and ranked in the top quartile of its corporate bond peer group, which consists of funds that invest predominantly in investment-grade-rated corporate bonds. On the other hand, Bronze-rated Federated Hermes Corporate Bond Fund FDBIX trailed over 80% of peers, in large part because of the portfolio’s high-yield bond sleeve and relatively high allocation to cash.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KCFABA6O6ZCQLGMQW2TLYFEREE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)