Our Ultimate Stock-Pickers Top 10 Dividend-Yielding Stocks

Our top managers' focus on high-quality dividend-paying stocks remains pertinent as yield is difficult to find in a period of historically low interest rates.

By Eric Compton | Stock Analyst

The vast majority of our

have never been mistaken for dividend investors. That said, a handful of them--

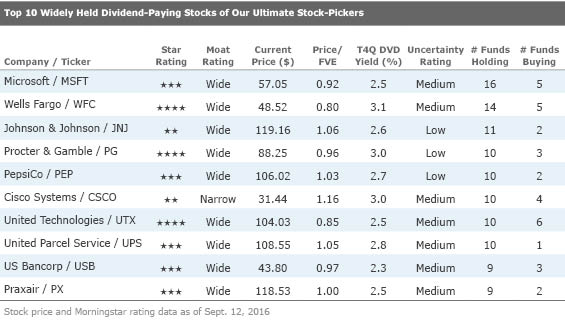

As you may recall from our last dividend-themed article, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to hone in on the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of more than 500 different dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and narrow it down by focusing on firms that we believe have competitive advantages, which, in our view, should allow them to generate the excess returns they'll need to maintain their dividends longer term. We also look for firms our analysts believe to possess lower uncertainty regarding future cash flows. We accomplish all of this this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, represent firms with wide or narrow economic moats, and have uncertainty ratings of either low or medium.

Once our filtering process is complete we create two different tables, one that reflects the top 10 dividend-yielding stocks of our Ultimate Stock-Pickers, and the other one representing stocks that are paying dividends in excess of the S&P 500 that are widely held by our top managers. In our view, finding stocks that are yielding more than the benchmark index but are operating in more stable industries, where there is less uncertainty surrounding their future cash flows, should offer some downside protection for investors. With markets at or near all-time highs and interest rates likely to stay lower for longer, many investors are left searching for yield wherever they can find it. We should note, though, that the dividend yield calculations in each of these two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from

,

we note that three names--wide-moat rated

Despite all of the volatility we've seen in the market this year, from the global sell-off in January/February to the drop in the markets following the Brexit vote, the S&P 500 TR Index is up mid- to high-single-digits. While not all stocks have recovered (plenty of Healthcare and Financial Services stocks are still trading lower than they were at the start of 2016) many have rallied, with several sectors that have traditionally been associated with yield and/or safety--like Utilities and Consumer Defensive--being bid up in the process. Searching for yield in this type of environment can be fraught with risks, including everything from price risk to the risk that a firm cannot meet its dividend commitment, weighing on investors' minds. In an effort to offset some of these risks, we eliminate stocks with higher uncertainty ratings from our screening process. Even after doing this, we're still looking at six out of 10 names that are trading at or above our analysts' fair value estimates, which if bought at today's prices would diminish the amount of total return for long-term investors. With that in mind, we expect to focus on the names that have both a solid yield and a more favorable price to fair value ratio, which, not surprisingly, points us to names from the Healthcare and Financial Services sectors.

Examining the list of top 10 widely held securities that met our criteria for dividend-paying stocks, there was some overlap with our list of top 10 dividend-yielding stocks, as wide-moat rated Wells Fargo and

, the majority of names on our list of top 10 widely held securities were held by 11 or more funds, whereas now the majority are held by 10 or less. This, no doubt, is the result of our top managers being net sellers for much of the past two quarters.

With valuation and safety being top concerns for investors, especially with markets again hovering at/near all-time highs, we continue to believe that the best way for investors to protect their capital is to invest in quality businesses trading at attractive prices. As such, we will only focus on the names that appear in our two different lists that are currently trading at 90% or less than our analysts' fair value estimates--a list that includes narrow-moat

AbbVie

ABBV

Most of the drug manufacturers have been caught up in a politically charged healthcare storm during the past year, and AbbVie has not been immune to this environment. Morningstar analyst Damien Conover believes the shares are modestly undervalued right now, trading at 88% of his $73 per share fair value estimate. AbbVie is armed with the best-in-class immunology drug Humira, which generates more than 50% of total sales and an even higher portion of earnings because of the high margins earned on the drug. Conover believes Humira is well positioned to continue growing at a double-digit rate the next few years, driving the majority of AbbVie's performance. However, by 2019 he expects the drug to start seeing revenue declines due to patent losses and increased competition. Even as Humira begins to decline, the company's cancer drug Imbruvica should be poised to become the next biggest sales contributor. Strong clinical data in several forms of blood cancer should lead to peak sales above $6 billion for Imbruvica. Beyond these two powerhouse drugs, AbbVie's remaining portfolio is largely mature with patent expirations long past, but many of the drugs have manufacturing or specific dosing complexities that make generic competition less likely. Looking ahead, AbbVie's pipeline is weighted more heavily toward new cancer drugs (especially blood cancer drugs where it should have a strong competitive position). As for the company's dividend, Conover notes that AbbVie's cash flows exhibit low volatility due to a diverse and inelastic product portfolio, leading him to assign a medium uncertainty rating to the firm. Also, despite the high dependence on one key drug, AbbVie has a strong balance and should produce robust cash flows over the next several years, supporting its current dividend.

Novartis

NVS

Novartis is the only other healthcare name on our two lists trading at 90% or less than our analyst's fair value estimate. Morningstar analyst Damien Conover also covers this firm and believes that patents, economies of scale, and a powerful distribution network support his wide-moat and low uncertainty ratings for Novartis. The company's patent-protected drugs carry strong pricing power, allowing it to generate excess returns and give the company time to develop its next generation of drugs before generic competition arises. Novartis' operating structure also allows for cost-cutting following patent losses to reduce the margin pressure that comes from losing high-margin drug sales. And while Novartis does have a diversified product portfolio, there is some product concentration, with the company's largest drug, Gleevec, representing 9% of total sales. This is important to note, as during the next three years, the company's major patent losses primarily include the cancer drug, as well as the cardiovascular drug Diovan. Despite seeing more than 10% of its revenue impacted by patent losses the next three years, Conover expects the company's strong pipeline, combined with stable currently marketed drugs, to lead to flat total growth over the period. On the pipeline side, he expects well over $1 billion in peak annual sales from Novartis' new cardiovascular drug Entresto and new psoriasis drug Cosentyx. The strong offsets to patent losses should enable the firm to continue to invest in research and development, helping to set up a stable lineup of next-generation drugs. Conover notes that Novartis' diverse platform of products should translate into steady cash flows, enough to easily service debt requirements and provide plenty of excess capital to fund its dividend, which represents close to 60% of the company's normalized earnings. He expects continued dividend increases but at a slower rate over the next two years.

Wells Fargo & Co

WFC

Wells Fargo was the cheapest name on a price to fair value basis on both of our lists, trading at 80% of our analyst's $62 per share fair value estimate. Morningstar analyst Jim Sinegal recently raised his fair value estimate for the bank following a deeper dive on the interest rate environment. While interest-rate expectations have swung dramatically in recent months, Sinegal expects technological-driven downward pressure on real interest rates to persist over the long run. The resumption of borrowing by U.S. consumers and businesses, the decline of emerging-market savings, and the normalization of monetary policy will put upward pressure on rates, however, which should help to drive U.S. short-term rates above 2% by 2020. This would have the effect of boosting net interest income for the banks in the long run. With almost half of revenue coming from a diverse range of fee-generating businesses, though, Wells Fargo has been relatively insulated from the interest rate drama the past few years and is unlikely to see a huge boost from rising rates longer term. Sinegal also notes that while the bank's profits have been essentially flat during the past 12 months as provisioning for loan losses more than doubled (due to weakness in energy portfolios and expansion of the company's allowance for car and auto loans), he does not think investors should read too much into these short-term trends, believing the size and direction of rate changes will have a bigger impact. In the meantime, Wells Fargo's charge-offs remain negligible, nonperforming loans are falling, and the bank's home lending group has benefited from lower rates as more people have either bought houses or refinanced existing mortgages. Sinegal notes that investing in banks is not easy right now and that Wells Fargo has its own share of headwinds to navigate. While the shares are not quite as cheap as they have been at times during the first and second quarters of 2016, Sinegal believes that they represent good value for long-term investors. As for the dividend, he notes that Wells Fargo plans to eventually return a significant majority of earnings to its owners in the form of dividends and repurchases, but that the amount that the firm can return to shareholders is limited by the Federal Reserve's periodic stress tests.

United Technologies

UTX

United Technologies is the third most undervalued firm on our two different lists of dividend-paying stocks, trading at 85% of Morningstar analyst Barbara Noverini's $122 per share fair value estimate. The company designs, manufactures, and sells various products in multiple industries, from elevators to aircraft engines to temperature control units for buildings, with more than 40% of its annual revenue actually coming from the high-margin recurring aftermarket services it provides for these products. Noverini believes that secular tailwinds, such as worldwide urbanization and economic growth in emerging markets that should only add to the expansion of commercial aircraft as well as commercial building development, should support longer-term expansion in all four of United Technologies' operating segments. That said, the pace of global economic growth will remain a dominant driver of value for the firm. Both the aerospace and building-focused segments depend on GDP expansion to support the secular tailwinds that benefit each of the businesses. While this lends itself to some cyclicality, the firm's ability to generate a large amount of its profits from its aftermarket services helps bring stability to the business, leading to Noverini's medium uncertainty rating. This aftermarket service revenue is either mandated or necessary for safe operations, making it very reliable once United Technologies has established a product base with a client. As such, during periods of slow equipment sales, Noverini expects top-line volatility to be tempered by the recurring revenue stream of services performed to maintain, repair, or upgrade the existing installed base. This, as well as a solid balance sheet, should help support the dividend well into the future. While it has been a volatile ride for the shares since mid-2015, the company's stock has recovered somewhat since the beginning of 2016, although still trading with a slight margin of safety for long-term investors.

Emerson

EMR

Emerson is the second most undervalued name from our two top 10 lists, trading at 84% of analyst Barbara Noverini’s fair value estimate of $62 per share. The firm is involved in an extensive array business lines, primarily related to the automation, HVAC, and electrical products equipped to support small- and large-scale systems in a variety of end markets. Emerson’s primary competitive advantage occurs in the business lines where it meets a customer’s need for a total system solution with proprietary Emerson equipment and engineering expertise, leading to stronger customer relationships. This dynamic allows Emerson to rise above commodity producers of parts and equipment in the competitive landscape. After the firm’s most recent earnings, Noverini noted that her overall thesis for the firm remains intact. Demand has taken longer than expected to pick up in some of Emerson’s end markets, however, Noverini believes this is more than accounted for in the current share price. From a strategic perspective, Noverini believes Emerson is on the right track. The firm is in the process of divesting several of its segments while acquiring Pentair’s valves and controls business to transform itself into a more concentrated group of businesses. Noverini believes this will help the firm to continue to consistently out-earn its cost of capital even amid continued slowness in some cyclical end markets. Emerson’s diverse makeup of businesses also helps to reduce cash flow volatility and mitigates some of this cyclicality. The firm remains in solid financial health and has a long history of returning capital to shareholders, which should help Emerson remain a steady dividend payer for years to come.

Disclosure: Eric Compton has an ownership interest in Procter & Gamble. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KXH3Z35EXJHUFKNLDATYCKICAQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)