Our Ultimate Stock-Pickers' Top 10 Dividend-Yielding Stocks

We take a closer look at four high-quality healthcare firms with solid dividend yields.

By Joshua Aguilar | Associate Equity Analyst

The vast majority of our

have never been mistaken for dividend investors. That said, a handful of them--

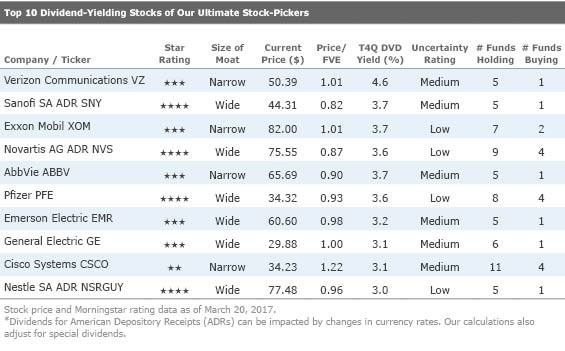

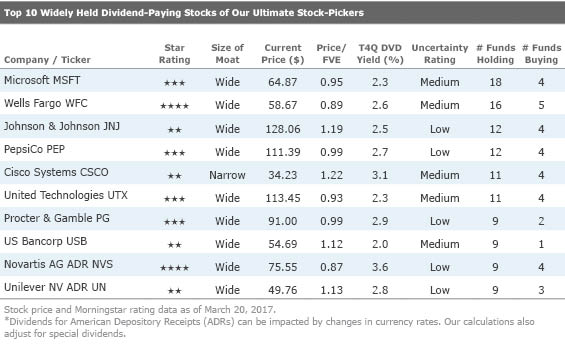

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to hone in on the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have competitive advantages, which, in our view, should allow them to generate the excess returns they'll need to maintain their dividends longer term. We also look for firms where there is lower uncertainty on our analysts' part regarding their future cash flows. We accomplish all of this this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, represent firms with Wide or Narrow economic moats, and have uncertainty ratings of either Low or Medium.

Once our filtering process is complete, we create two different tables--one that reflects the top 10 stocks with the highest dividend yields, and the another that represents the stocks that are the most widely held by our top managers while also paying dividends in excess of the S&P 500. In our view, finding stocks that are yielding more than the benchmark index and operate in more stable industries where there is less uncertainty surrounding their future cash flows should offer some downside protection for investors. With markets at or near all-time highs and interest rates still at lower than normal levels, many investors are left searching for yield wherever they can find it. We should note, though, that the dividend yield calculations in each of these two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that three names--wide-moat rated Wells Fargo,

Top 10 Dividend-Yielding Stocks of Our Ultimate Stock-Pickers

Despite all the volatility we've seen in the market this past year--from the drop in the markets following the Brexit vote to the post-election market rally in the United States on anticipated business-friendly reform--the S&P 500 TR Index has risen over 20%. While not all stocks have recovered--with mostly Healthcare stocks still trading at slight discounts to our analysts' fair value estimates--many have rallied, with several sectors that have traditionally been associated with yield and/or safety--like Utilities and Consumer Defensive--continuously being bid up in the process (with certain exceptions). Searching for yield in this type of environment can be fraught with risks, including everything from price risk to the risk that a firm cannot meet its commitment to its dividend. In an effort to offset some of these risks, we eliminate stocks with higher uncertainty ratings from our screening process. Even after doing this, we're still looking at six out of our top 10 dividend-yielding names that are trading at 95% or more of our analysts' fair value estimates, which, if bought at today's prices, would potentially diminish the opportunity for outsized total returns for long-term investors. With that in mind, we expect to focus on the names that have both a solid yield and a more favorable price to fair value ratio, which, not surprisingly, points us to names from the Healthcare sector.

Top 10 Widely Held Dividend-Paying Stocks of Our Ultimate Stock-Pickers

Looking more closely at the list of top 10 widely held securities that met our criteria for dividend-paying stocks this time around, there was less overlap with our list of top 10 dividend-yielding stocks, with only wide-moat rated

With valuation and safety being a top concern for investors, especially with markets again hovering near all-time highs relative to normalized interest rates, we continue to believe that the best way for investors to protect their capital is to invest in quality businesses trading at attractive prices. As such, we focus on names from the beaten down Healthcare sector that appear on our two top 10 lists and that are currently the most undervalued--a list that includes wide-moat rated Sanofi, Novartis,

Sanofi

SNY

Sanofi is the cheapest name on a price to fair value basis on both of our lists as well as the second-highest yielding stock. The stock trades at 82% of our analyst's $54 per share fair value estimate. Morningstar Sector Director of Healthcare Damien Conover believes that Sanofi benefits from a wide and robust lineup of branded drugs and vaccines that create strong cash flows. In a recent post earnings note, Conover wrote that he still views the stock as undervalued. He believes Sanofi's existing product line boasts several top-tier drugs, including long-acting insulin drug, Lantus. The drug's ability to work effectively for an entire day differentiates it from other insulins. Conover further believes that given the complexity in marketing and manufacturing insulin, he doesn't expect the typical major generic competition following its 2015 patent loss.

Conover also believes that the market continues to underappreciate Sanofi's non-diabetes business. He argues this portion of the company will help offset the top-line pressure in its diabetes business coming from

Conover is also positive on Sanofi's existing pipeline of drugs. Sanofi has compiled a strong group of late-stage pipeline products that should prove both complementary and help mitigate patent losses. Specifically, Conover lauds Sanofi's efforts in the multiple sclerosis area, including the potential with blockbuster hopefuls Aubagio and Lemtrada after their respective emergence from the late-stage pipeline. Additionally, Conover believes immunology drug Dupixent looks well positioned to gain share in the eczema market, with sales potential of over $1 billion.

Lastly, Conover believes that there is strong potential for growth from targeting emerging markets. Armed with a history of acquisitions and resilient operating cash flow, Conover believes that Sanofi could take advantage of further growth opportunities through external collaborations or through outright acquisitions. He expects Sanofi to begin making acquisitions once again in the branded pharmaceutical and biotechnology markets after a lull for the past a few years.

Pfizer

PFE

Pfizer is one of two wide-moat, low uncertainty rated stocks we are profiling and one of the few with at least four funds buying into the name. Conover, who also covers this name, believes that Pfizer's foundation remains solid, based on strong cash flows generated from a basket of diverse drugs. He believes that the company's large size confers significant competitive advantages in developing new drugs. Pfizer's size enables it to have one of the largest economies of scale in the pharmaceutical industry. One of the biggest expenses is research and development. The pharmaceutical industry is a business where new drug development is often unsuccessful, therefore you need a lot of shots on goal to be successful. Conover believes that Pfizer has both the financial resources and the established research power to support the development of additional new drugs. After many years of languishing, Conover points out that Pfizer is now launching several potential blockbusters in cancer, heart disease, and immunology. Developing the drugs is only half the battle, the other half is marketing and actually selling them. Here, Conover points out that the firm's vast financial resources support a leading salesforce and favorably position the firm in emerging and developing markets. He also lauds Pfizer's commitment to data collection surrounding the sales process and using this data to empower the firm's salesforce for its various marketing campaigns. Conover concludes that the firm's unmatched heft, combined with its broad portfolio of patent-protected drugs, has helped Pfizer build the wide moat around its business.

While the company's fourth-quarter results dipped slightly below Conover's expectations, he does not expect any major changes to his $37 per share fair value estimate. Conover continues to view the stock as slightly undervalued. The key variables affecting his view of the future include the degree of success of the branded drug pipeline along with the magnitude of market pressures for currently marketed drugs. While the unknown magnitude of biosimilar competition to a key drug known as Enbrel weighs on his valuation's certainty, Conover continues to believe that the market underappreciates the earning power and growth potential of the firm's current drugs and pipeline. Conover lends support to his argument by citing steady gains in the quarter from Pfizer's broad drug portfolio, up close to 4% operationally when adjusting for fewer selling days. He also adds that Pfizer's acquisition of the pharmaceutical company Wyeth back in 2009 still helps insulate the firm from generic competition pressures due to patent losses. The low volatility of cash flows from a diverse product portfolio with inelastic demand leads him to his low uncertainty rating.

AbbVie

ABBV

AbbVie appears to have largely emerged from the politically charged healthcare storm that affected most of our drug manufacturers during the past year. The firm has appreciated over 17% in market value since early November. Conover, who also covers this firm, believes the shares are still modestly undervalued right now, trading at 90% of his $73 per share fair value estimate. AbbVie is armed with the best-in-class immunology drug Humira, which generates more than 50% of total sales and an even higher portion of earnings because of the high margins earned on the drug. Conover believes Humira is well positioned to continue growing at a double-digit rate the next few years, driving the majority of AbbVie's performance. However, by 2019 he expects the drug to start seeing revenue declines due to patent losses and increased competition. Even as Humira begins to decline, the company's cancer drug Imbruvica should be poised to become the next biggest sales contributor. Strong clinical data in several forms of blood cancer should lead to peak sales above $6 billion for Imbruvica.

Beyond these two powerhouse drugs, AbbVie's remaining portfolio is largely mature with patent expirations long past, but many of the drugs have manufacturing or specific dosing complexities that make generic competition less likely. Looking ahead, AbbVie's pipeline is weighted more heavily toward new cancer drugs (especially blood cancer drugs where it should have a strong competitive position). Conover also thinks that a new hepatitis C drug launch should help stabilize the infectious disease segment in late 2017. While Conover acknowledges that the firm continues to lose share in this market, he expects that the launch of its doublet will be either equally or more competitive than its counterparts. He further thinks that this launch should allow AbbVie to gain close to a quarter of the market with $3 billion in annual sales. As for the company's dividend, Conover notes that AbbVie's cash flows exhibit low volatility due to a diverse and inelastic product portfolio, leading him to assign a medium uncertainty rating to the firm. Also, despite the high dependence on one key drug, AbbVie has a strong balance sheet and should produce robust cash flows over the next several years, supporting its current dividend.

AbbVie, recently reported fourth-quarter results largely in line with both Conover's and consensus expectations. The 10% operational sales growth expected in 2017 and driven by Humira gains fits well within his thesis. Conover continues to view the stock as undervalued despite his below consensus sales expectations of $11 billion for Humira by 2020 (versus $19 billion for consensus). He continues to believe that the combination of well-positioned, currently marketed drugs, along with a strong pipeline, garner the firm a narrow economic moat. He also stands firm in his judgment that the firm's moat is secure in spite of the biosimilar headwinds facing Humira over the next few years.

Novartis

NVS

Novartis is the other wide-moat, low uncertainty rated name we are profiling. Like Pfizer, four funds were buying up shares. Conover also covers this firm and believes that Novartis' strong intellectual property, current product line, and an abundance of late-pipeline products support his moat and uncertainty ratings. He thinks that the firm's diversified operating platform, which includes branded pharmaceuticals, generics, eye-care products, and consumer products, gives the firm a unique advantage. While the majority of the firm's competitors focus solely on the high-margin branded pharmaceutical segment, Novartis runs several complementary operations that reduce its overall volatility and create cross-segment synergies.

While Novartis operational setup is advantageous, Conover acknowledges that recent patent losses on cardiovascular drug Diovan and cancer drug Gleevec are causing a drag on sales, with the latter drug creating a drag to the firm's overall sales by nearly 6%. Conover, however, believes this headwind will largely dissipate by 2018, and Gleevec's successor drug, Tasigna, showed close to a 10% gain in its most recent quarter, helping balance some of the losses. Conover also reasons that Novartis' generic business, Sandoz, serves to a grab a portion of the billions of dollars in competitive-branded products losing patent protection over the next decades. This should notably extend the life cycle of in-house products as patents expire.

On the pipeline side, he expects increased and accelerating sales from Novartis' new cardiovascular drug Entresto and over $3 billion dollars in annual sales from the firm's new psoriasis drug Cosentyx by 2020. The strong offsets to patent losses should enable the firm to continue to invest in research and development, helping to set up a stable lineup of next-generation drugs. Novartis' decision to evaluate the potential divestiture of the ophthalmology device focused Alcon unit, which he views as likely, doesn't affect his outlook for the company's moat, as the majority of the firm's strength lies with the drug group. Conover notes that Novartis' diverse platform of products should translate into steady cash flows, enough to easily service debt requirements and provide plenty of excess capital to fund its dividend, which represents close to 60% of the company's normalized earnings. He expects continued dividend increases, but at a slower rate over the next two years.

The company's most recent earnings report was largely in line with Conover's and consensus expectations, and Conover does not expect any changes to his fair value estimate. He had previously reduced his fair value estimate to $87 from $89, largely based on the phase 3 failure of Fovista. However, Conover continues to view the stock as undervalued, even in spite of flat sales growth in the quarter and flat 2017 sales guidance. He believes that the company's pipeline looks strong enough to drive mid-single-digit sales growth starting in 2018, with faster bottom-line growth as efficiency gains should continue to improve margins.

Disclosure: Except for Berkshire Hathaway (BRK.B), Joshua Aguilar has no ownership interest in any of the securities mentioned here. Eric Compton has no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KXH3Z35EXJHUFKNLDATYCKICAQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)