6 Utility Stock Dividend Leaders and Laggards

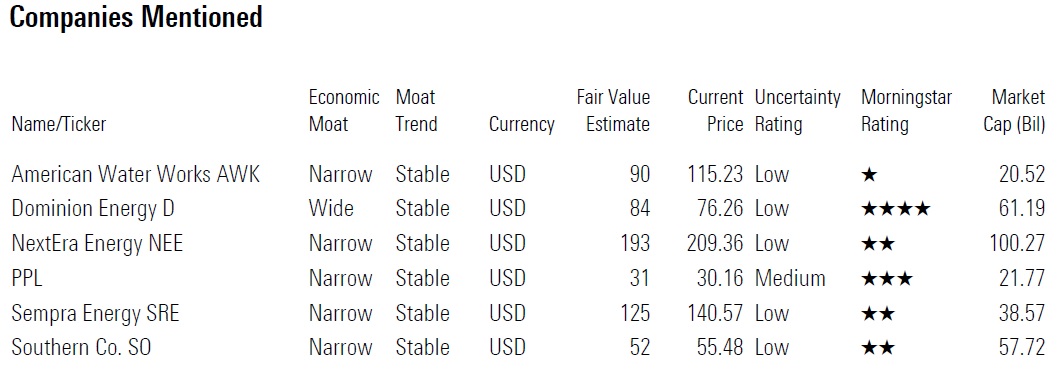

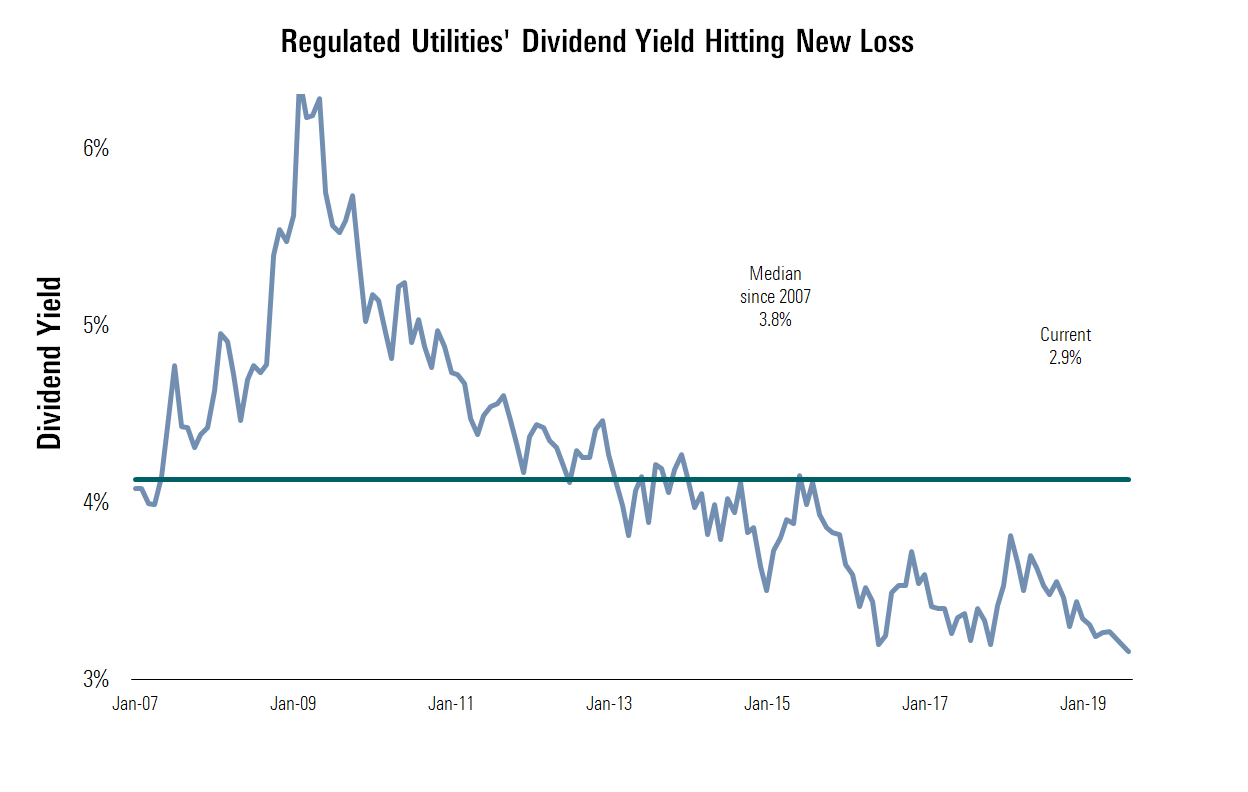

Just over halfway through 2019, utilities continue to impress, with good growth prospects, secure dividends, and sound balance sheets. Investors have taken note, with the U.S. utilities we cover trading at a median 12% premium to Morningstar's fair value estimates as of the end of July. That means investors' long-term capital gains are at risk even if utilities make good on their 5%-7% earnings and dividend growth potential.

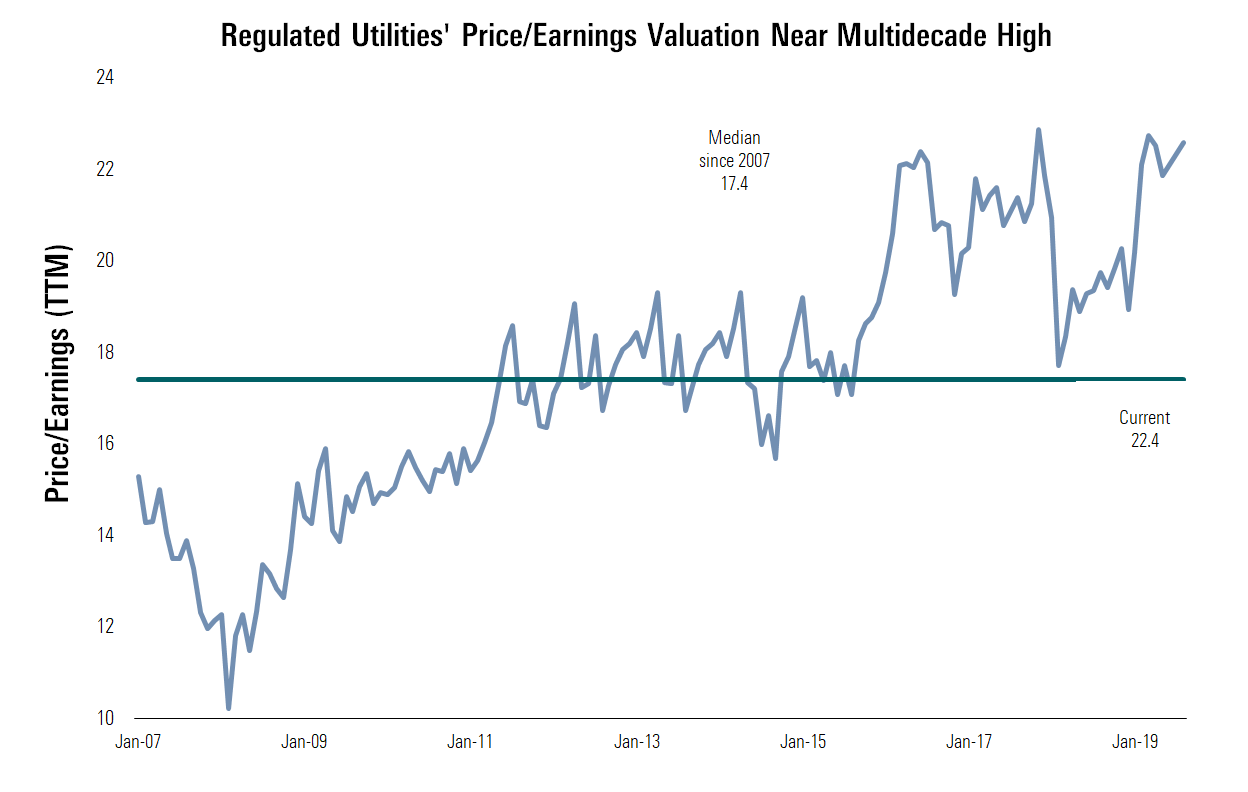

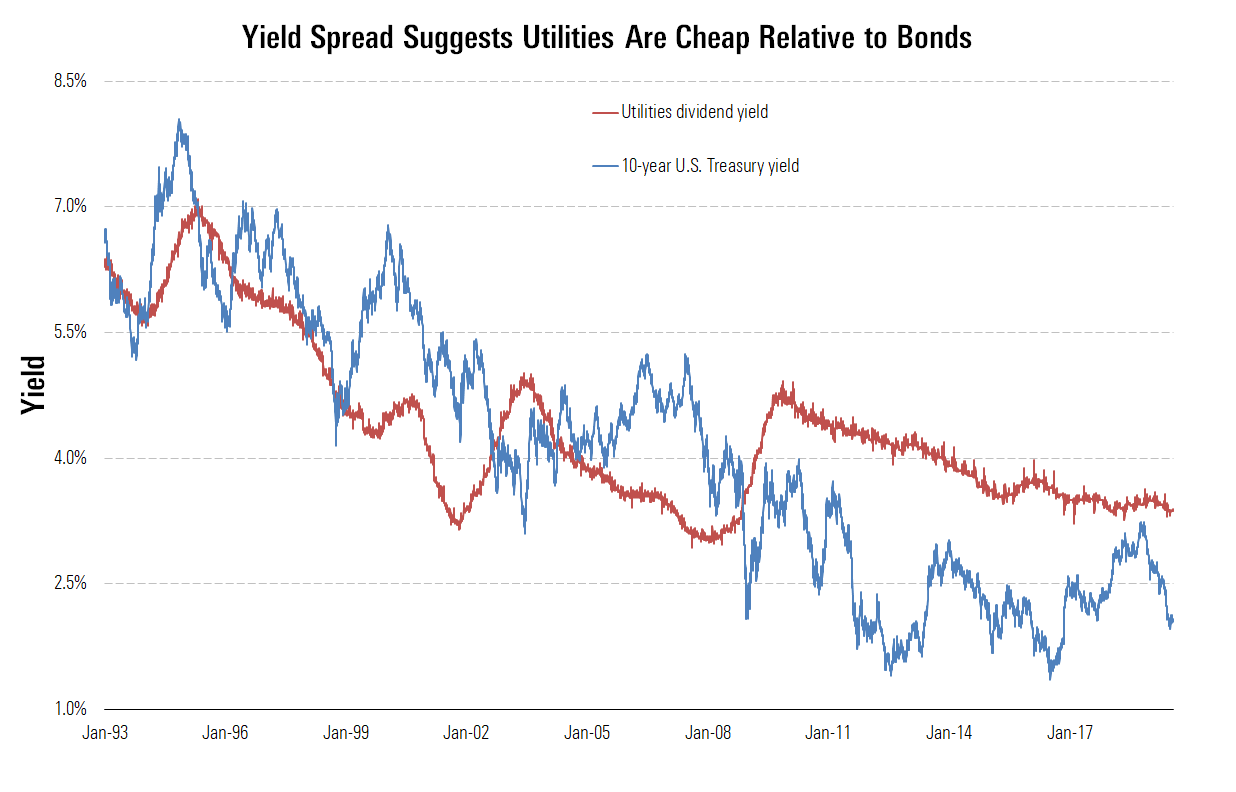

However, utilities remain an attractive source of yield for income investors. Even with elevated equity valuations, the spread between utilities' dividend yields and the 10-year U.S. Treasury yield remains above historical levels.

We think NextEra Energy, Sempra Energy, and American Water Works have the highest dividend growth potential, driven by strong capital growth opportunities and relatively low payout ratios. We forecast Southern Co. and Dominion Energy will be dividend growth laggards, constrained by high payout ratios and capital investment needs. Finally, PPL's struggles in the United Kingdom will probably result in no dividend growth and could lead to a dividend cut after the RIIO-ED2 regulatory outcome.

Morningstar Direct clients can find the full report, "Analyzing Utility Dividend Leaders and Laggards", here. In this article we summarize the industry outlook and provides highlights on the six dividend leaders and laggards. (Click images for better viewing)

Valuation Metrics Make Utilities Look Expensive

The U.S. utilities sector is 12% overvalued based on our fair value estimates and market prices as of late July. The sector hit fair value for the first time in three years at the beginning of 2019 but has rallied 16% through the first half of the year, including dividends. This has matched the S&P 500 and inflated valuations to levels we last saw in late 2017.

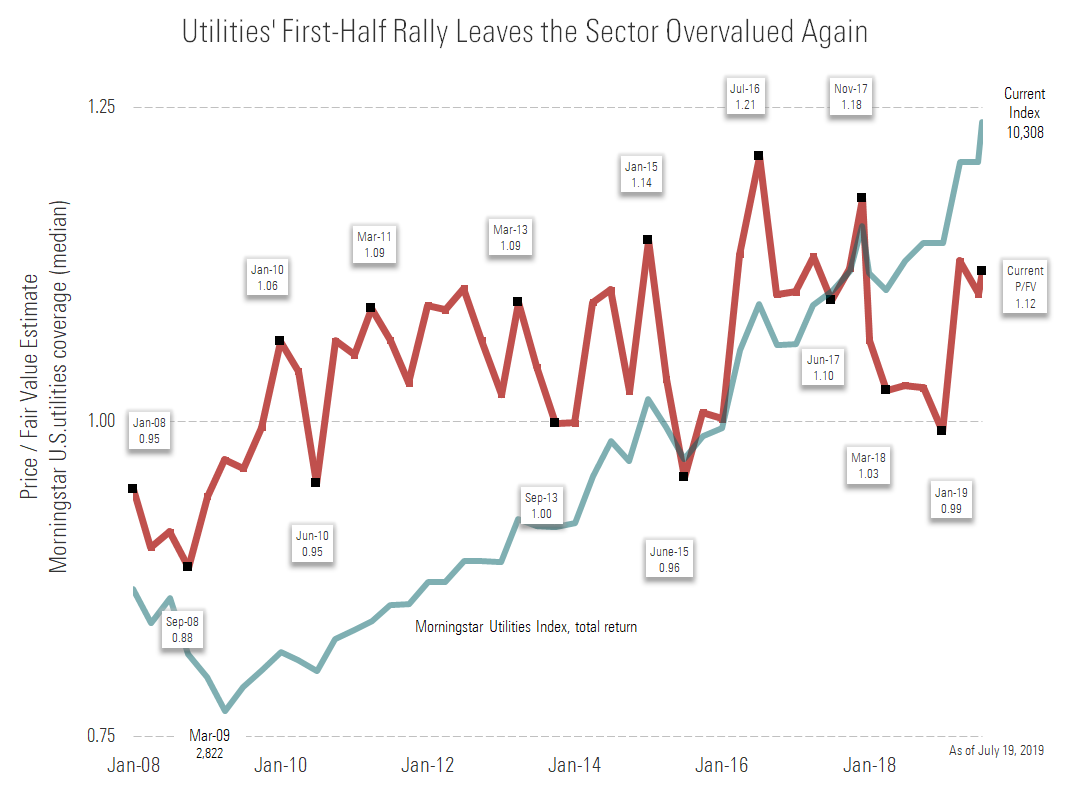

Regulated Utilities Are Particularly Rich

All of the conventional valuation metrics using earnings, book value, and dividend yield suggest utilities are overvalued. This is particularly true for the 21 fully regulated utilities we cover, which trade near multidecade highs and a premium to their less-regulated peers.

Utilities Look Attractive Versus Bonds

It's difficult to recommend utilities as a total-return investment, but their current yields are historically attractive compared with bond yields. Climbing bond yields in 2018 nearly erased the interest-rate yield premium that utilities' investors had enjoyed for more than a decade. But continued dividend growth and falling bond yields once again make utilities look cheap relative to bonds.

Utilities Dividends Supported by Strong Growth Prospect

s

We think that utilities that can increase their dividends faster than peers offer investors the best income potential. This group is buoyed not only by low payout ratios from years of focusing on internal growth opportunities, but also from forward earnings growth well above the 5%-7% peer average.

One of the main trends fueling dividend growth is the continued utility investment opportunities in aging infrastructure, including distribution infrastructure, transmission, and renewable generation. The industry shows no signs of slowing. Our expectation for low long-term natural gas prices provides ample room for utility investment with minimal impact on customers' bills.

In 2018, electric utilities spent approximately $127 billion on capital investment, well above the 10-year inflation-adjusted average of $105 billion. We take our in-depth knowledge of each company to come up with a consolidated view of capital expectations between 2019 through 2022. In 2019, we forecast $142.9 billion capital, with our four-year forecast expectations of $547.6 billion. For more in-depth analysis of our capital expenditure outlook, see Capital Investment Drives Utilities' Growth, but Valuations Are Rich.

Utilities' investment plans typically drive earnings growth, assuming consistent and constructive regulation. Earnings growth then typically drives dividend growth adjusting for funding needs for its maintenance and growth capital investments. We think the top utilities that combine growth investment with constructive regulation will support the highest dividend growth (Exhibit 6).

Dividend Leaders

NextEra Energy, Sempra Energy, and American Water Works are the clear dividend growth winners in our analysis. These utilities have large capital investment programs that support sector-leading earnings and dividend growth. Like the rest of our coverage, these utilities aren't cheap and trade well above our fair value estimates. However, long-term income-oriented investors can benefit from owning these stocks, given their earnings and income potential.

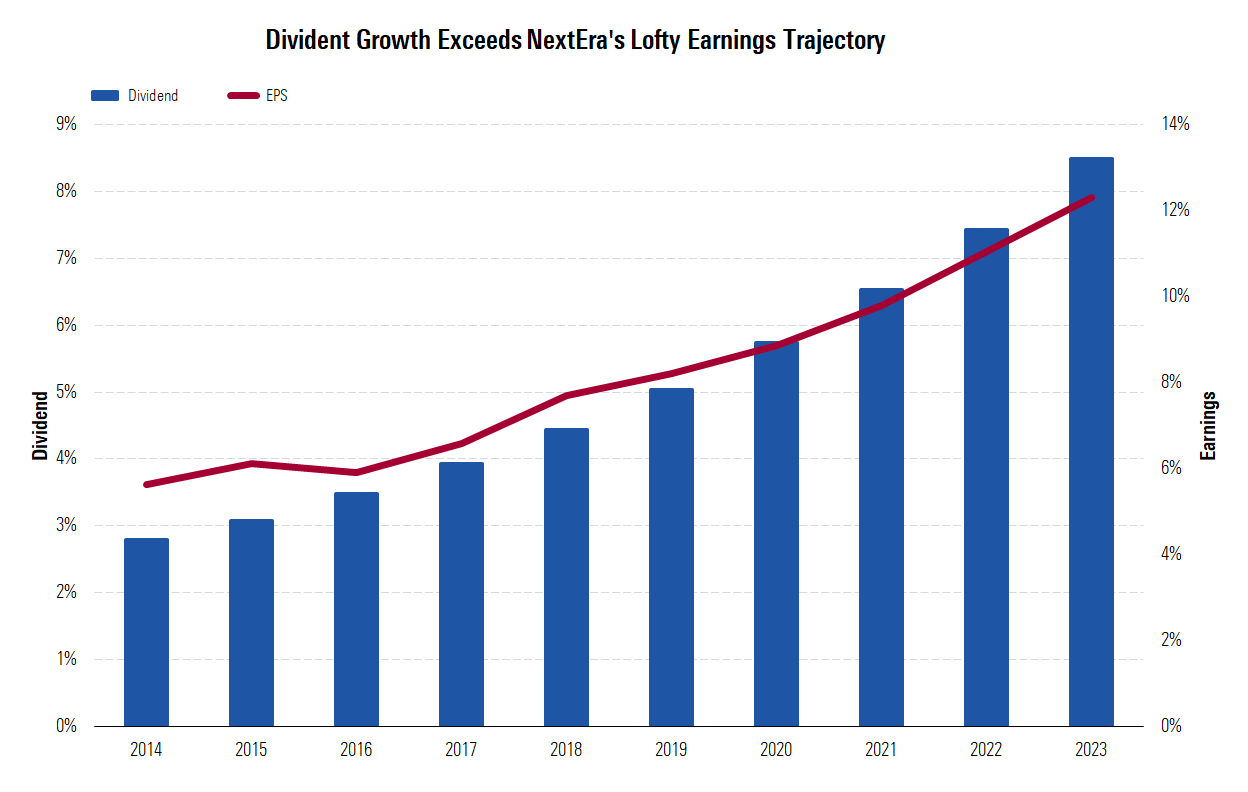

NextEra Energy has two growth drivers supporting our 9.8% earnings growth outlook and above-average dividend growth: its regulated Florida utility and its energy resources subsidiary that focuses on renewable energy development.

We forecast that NextEra Energy can grow dividends 14% annually over the next five years, well above its peer group average and the highest in our coverage. Additionally, NextEra's 61% payout ratio— slightly lower than peers'—gives it greater flexibility to increase its dividend as cash flows become more stable at NextEra Resources with long-term renewable energy contracts and the divestiture of its unregulated thermal generation.

Market Is Pricing in NextEra Energy Growth Prospects Even at Our Premium Valuation

NextEra Energy trades at a 9% premium to our $193 per share value estimate as of late July. We incorporate an 8.5% annualized growth rate through 2023. Our valuation implies a 2020 price/earnings multiple of 21.8 times and an implied terminal multiple of 18.9 times in 2023, both a premium among the companies we cover. We estimate that NextEra will invest more than $60 billion through 2023.

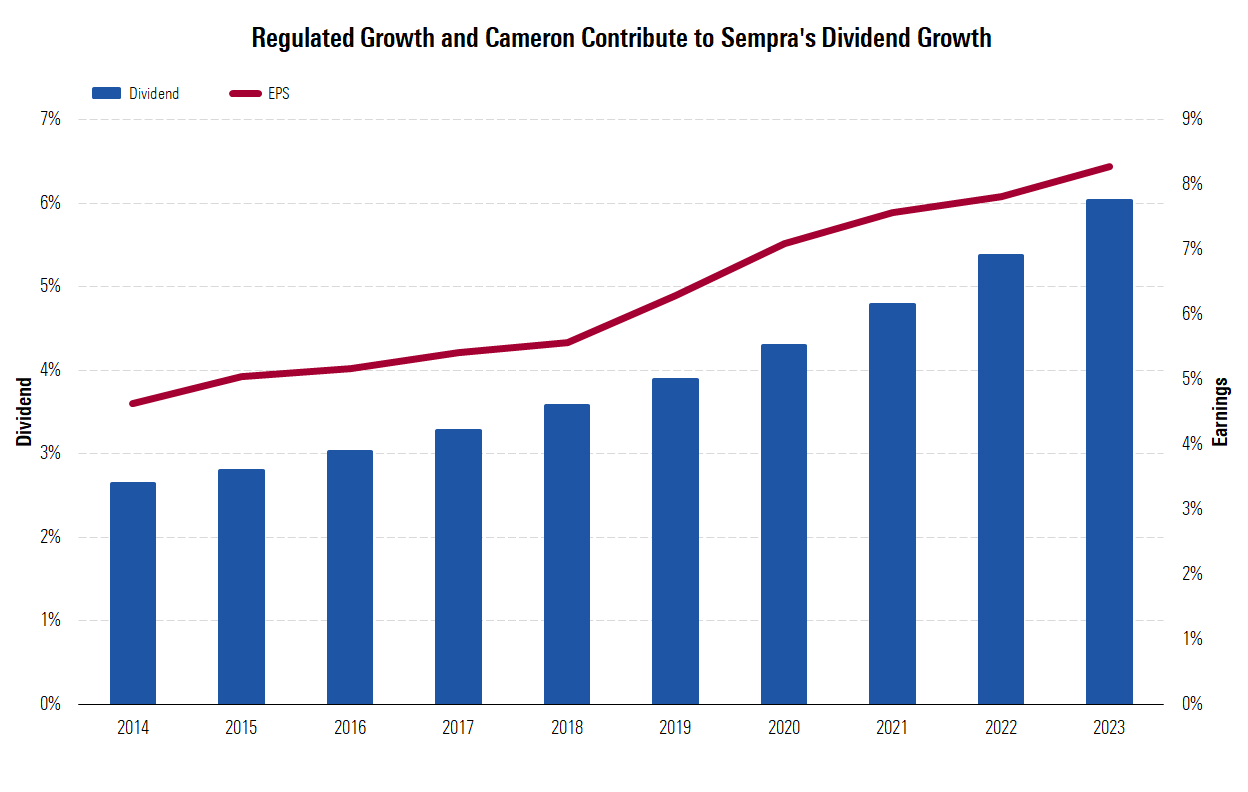

Sempra has long maintained a diversified portfolio of traditional regulated utilities and unregulated energy operations, which constrained its ability to drive dividend growth, given the cash flow volatility from the unregulated operations. However, Sempra has begun to derisk its portfolio, focusing on regulated distribution and transmission utilities that are the keys to its healthy capital investment plan. This portfolio pivot, lower payout ratio, and contracted Cameron LNG Trains 1-3 earnings contribution will allow Sempra to increase dividends 11% annually over the next five years, exceeding our 10% annualized earnings forecast during this period.

Investor Excitement Over Portfolio Transition Leads to Frothy Valuation

Sempra Energy trades at an 11% premium to our $125 fair value estimate as of late July. We project that the utilities and new North American gas infrastructure will drive 10% earnings growth and 11% dividend growth through 2023. Our fair value estimate assumes $25 billion in capital expenditures from 2019 to 2023. Over 80% of investment is at the utilities and should drive strong annual rate-base growth during the same period.

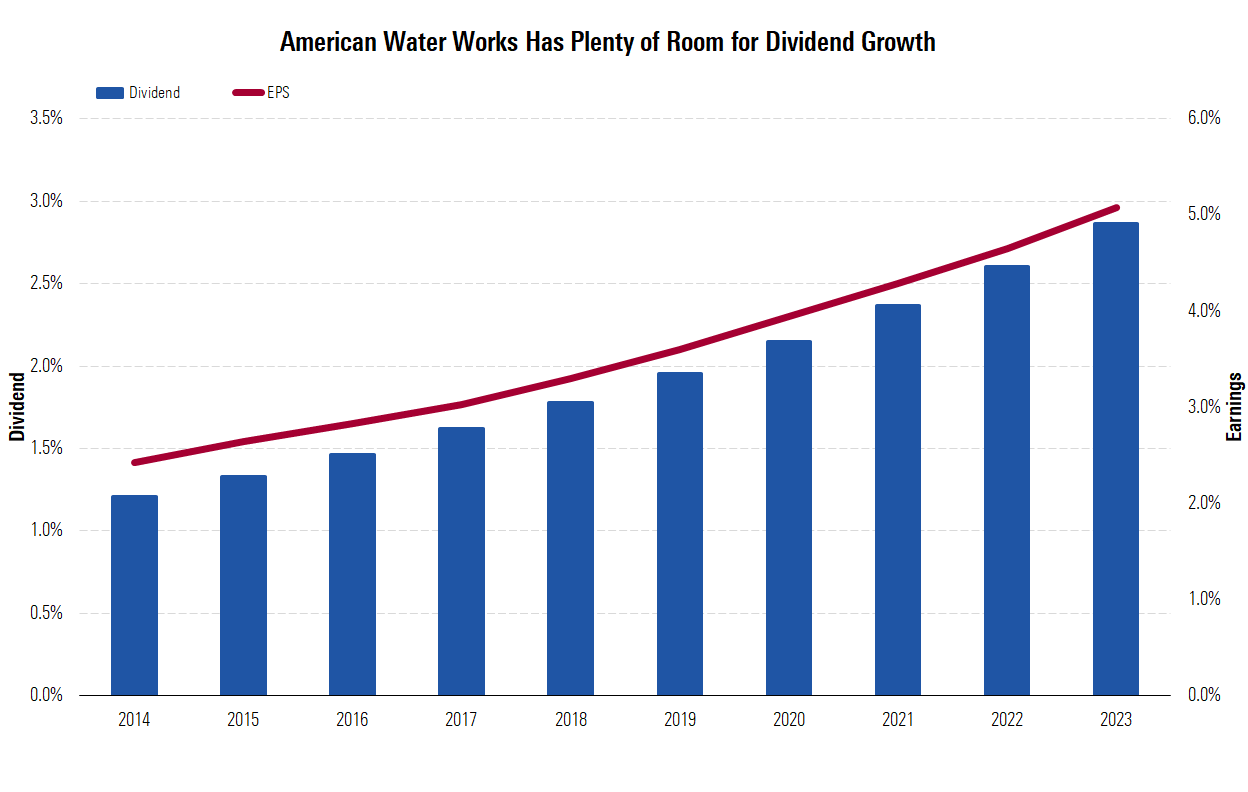

Since its IPO in April 2008, American Water Works has increased earnings at a low-double-digit pace, topping most of its regulated peers. The earnings growth has rewarded investors with a total return of almost 500% in the 11 years since the spin-IPO by German utility RWE. Management historically focused on growth opportunities over its dividend payout, but management recently renewed its focus on dividend growth. American Water Works has now begun accelerating its dividend increases, averaging over 10% per year over the past few years. We expect an annual dividend growth rate of 10% for the next five years. The company's 54% projected payout ratio based on adjusted 2019 earnings is low for the sector, leaving plenty of room to increase the dividend faster than our 9% earnings growth forecast.

American Water Works' strong growth potential doesn't come cheap for investors.

The stock trades at a 28% premium to our $90 fair value estimate, making it one of the most expensive utilities we cover. Our fair value estimate is driven by exceptional growth at its market-based segment and solid performance from its regulated utilities. Our fair value estimate for American Water Works implies a 23 times multiple on 2020 earnings. This ratio is roughly 30% above regulated electric utility peers, but American Water has traded at a premium to electric utility companies for many years and has more long-term growth opportunities. American Water management expects annual earnings per share growth to be in the top half of its 7%-10% target, consistent with our 9% forecast.

Dividend Laggards

On the opposite end of the spectrum are those utilities we think will struggle to grow dividends in line with earnings, though they are among the most attractive on a price/fair value perspective. Southern Co. is constrained by a high payout ratio from operational mishaps at Kemper and Vogtle. Dominion Energy's material equity issuances have pushed its payout ratio higher, limiting growth over our five-year outlook. Finally, PPL's U.K. headwinds will create dividend uncertainty, resulting in no growth for several years and the potential for up to a 10% dividend cut in a worst-case scenario.

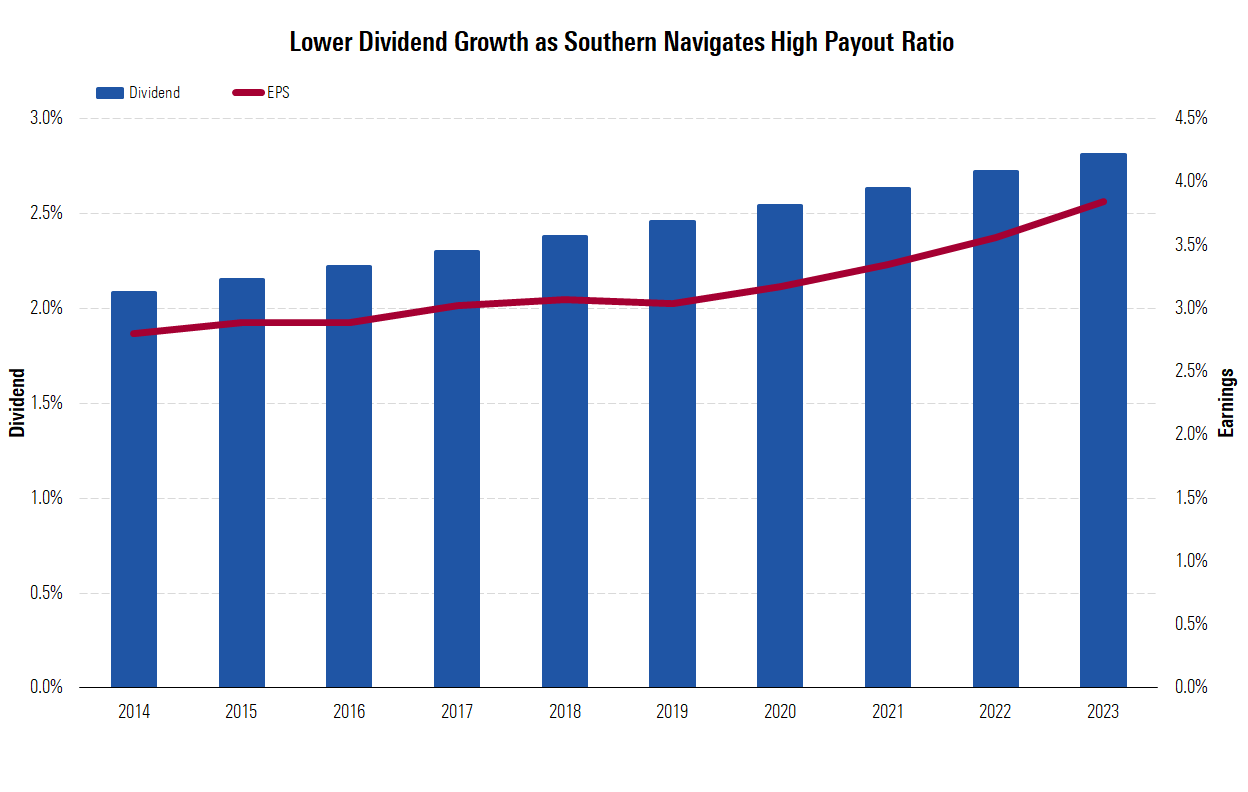

Southern has long been a consistent dividend growth machine, providing investors with annual dividend increases of about 3.5% for the past 10 years. We expect increases to continue at this rate, but that makes it one of the lowest growth rates among peers. We estimate Southern's dividend payout ratio on 2019 adjusted earnings will be near 80%, making it difficult for Southern to continue to increase dividends in line with our earnings growth projections. Still, we think the dividend is secure. Although Southern's payout ratio is higher than the sector average, Southern's earnings power is spread over several jurisdictions, and the diversity increased with the AGL acquisition. We expect its payout ratio to fall into the mid-70% level over the next five years as earnings growth outpaces dividend growth

Southern Remains Rich, but It's Trading at a Discount to Peer Group

Southern's stock trades at a 7% premium to our $52 fair value estimate as of late July. Our fair value estimate represents a16 times multiple on our 2020 earnings estimate, a discount to peers currently trading near 19 times. We suspect the discount is due to the problems at Vogtle and should disappear once the plant is completed.

DOMINION

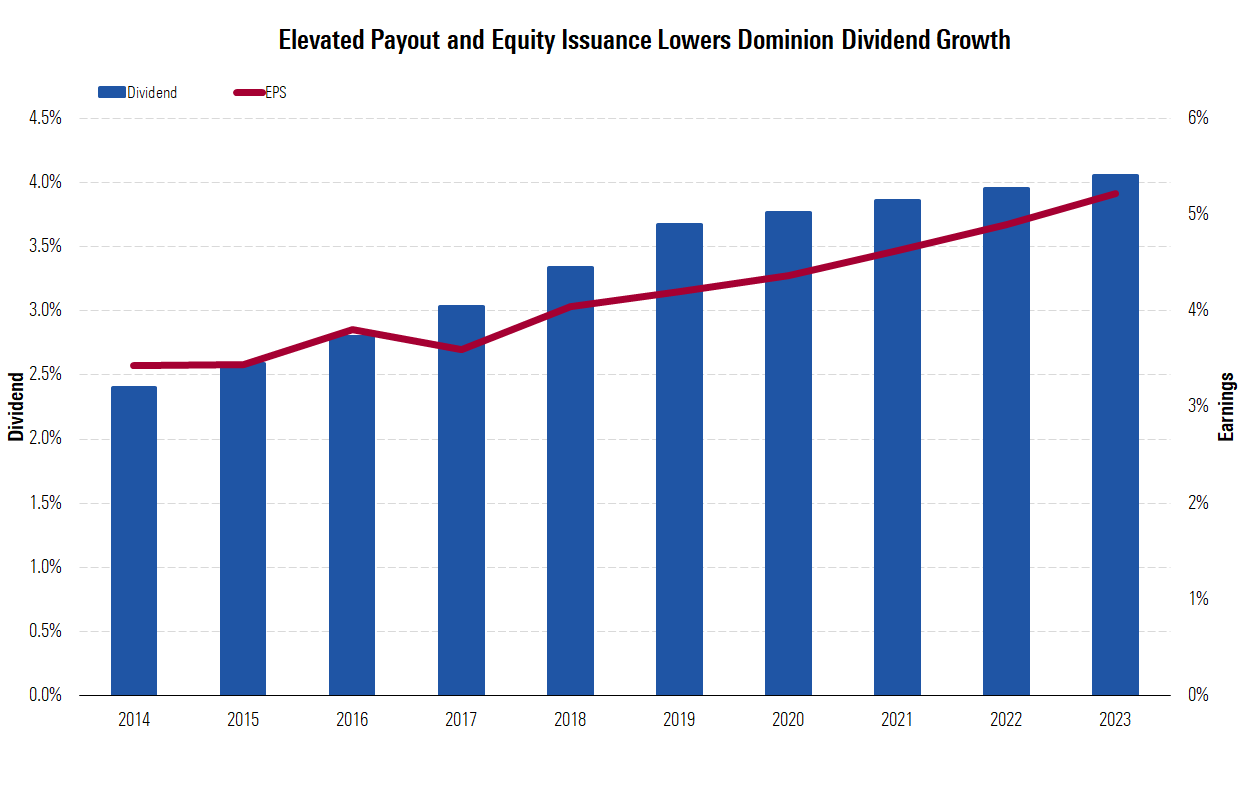

Although annual dividend increases have averaged 9% over the past five years, we believe the currently attractive yield, elevated payout ratio, and an estimated 178 million more common shares outstanding (28% increase) by 2019 year-end versus 2017, will likely result in the board reducing dividend growth to low single digits.

Reducing dividend increases to 2.5% per year would lower the payout ratio to about 78% by 2023. Although we are now less bullish on dividend increases, we still think the dividend yield and earnings growth could deliver low-double-digit returns through the next decade.

Despite Lackluster Dividend Growth, Dominion Energy Remains Top Pick

Our $84 per share fair value estimateis an8% discount to the stock price asof late July. Our fair value estimate is almost 18 times our 2021 EPS estimate, a modest premium to the 17 implied P/E multiple of peers based on time-value-adjusted fair value estimates and normalized earnings estimates. However, we believe Dominion's premium is warranted given Virginia'ssolid electricity growth and constructive regulatory framework as well asDominion's opportunities to expand its gas infrastructure businesses.

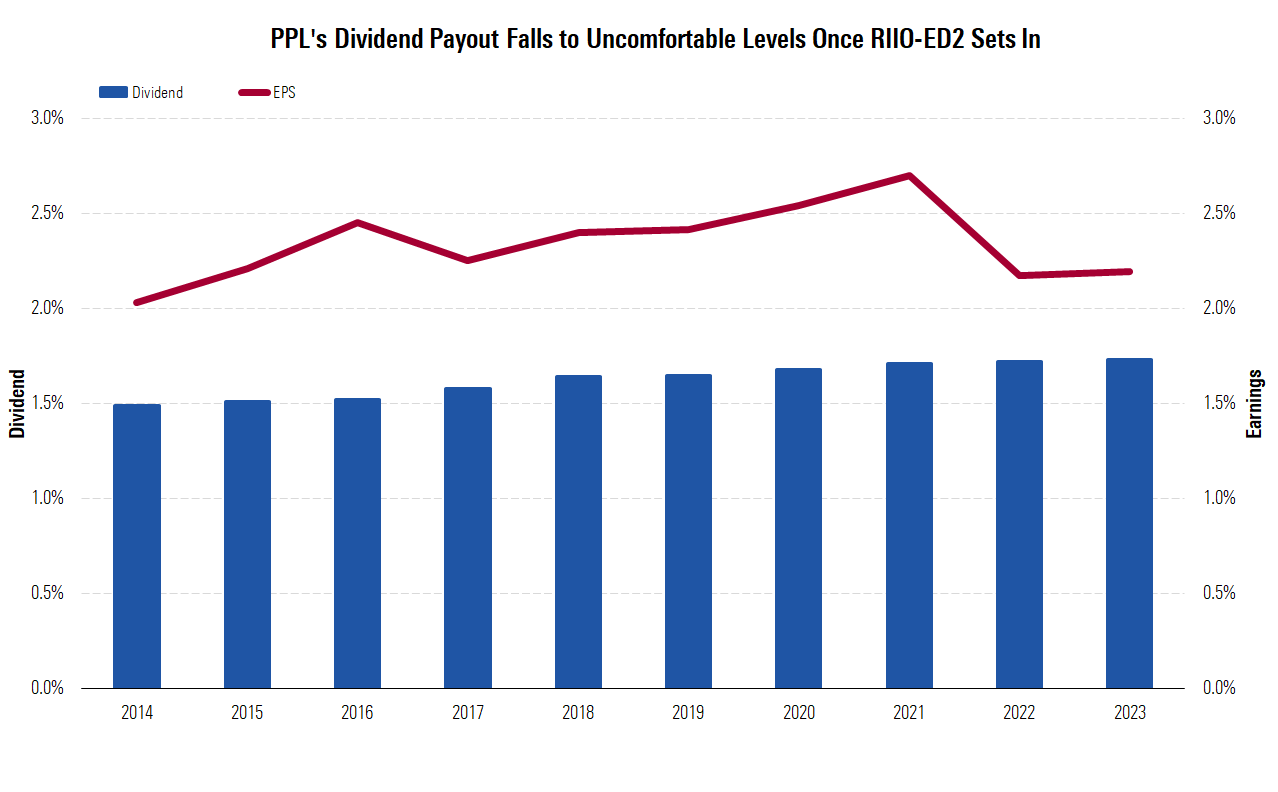

While the near term for PPL has attractive regulated growth opportunities that could produce 5.5% annual rate-base growth through 2021, it is the uncertainty around its U.K. operations that leaves PPL the only utility on our list at risk for a dividend cut beyond 2021.

We project roughly 1% dividend increases annually through 2021 as management cautiously readies itself for a U.K. regulatory outcome, with no increase in 2022 and 2023. Our dividend payout ratio rises to an uncomfortable 79% in 2022, as we forecast just 4% allowed returns for the RIIO-ED2, in line with what U.K. regulators recently proposed for gas distribution, gas transmission, and electricity transmission utilities. Best-case scenario, we think there will be no dividend growth in 2022 and 2023 as PPL manages the earnings headwinds. Additionally, PPL's regulated cash flows should allow management to navigate a high payout ratio.

PPL Trades at Fair Value, but Risks Require a Larger Safety Margin

Our $31 per share fair value estimate is in line with the market. We expect 5% consolidated earnings growth and 1% dividend growth in 2020 and 2021. We forecast no dividend growth in 2022 and 2023. At the U.K. utility segment, we include approved inflation-adjusted cost allowances and expected growth investments under the current RIIO-ED1 regulatory construct. We also forecast PPL will continue earning performance incentive awards.

For more articles and research on dividend investing, click here.

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L5GEZ3AZXJFKNI7D64TOPM3RK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/P627737FXRBCJMMKIHW7537BJU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)