Upgrade for a Vanguard Fund That Offers Inflation Protection

Plus, a look at a downgrade and a fund new to coverage.

Vanguard Short-Term Inflation-Protected Securities Index ETF VTIP recently earned a Process Pillar rating upgrade to High from Above Average. In addition to solid fundamental merits like low fees and sensible portfolio construction, the fund’s focus on tracking short-term U.S. Treasury Inflation-Protected Securities provides better inflation protection than broader maturity peers. The pillar upgrade gave the fund’s cheapest share classes a Morningstar Analyst Rating of Gold, while its more expensive share class received a boost to Silver from Bronze. Here’s a closer look at the reasons behind the upgrade, as well as other Morningstar Analyst Rating activity highlights from October.

Superior Protection

There are many things to like about Vanguard Short-Term Inflation-Protected Securities Index ETF: Rock-bottom fees, limited portfolio turnover, and sensible portfolio construction are just a few of the reasons that make it an appealing option for investors. What makes it especially compelling, though, is that its short-term focus offers superior protection in an environment of soaring interest rates and unexpected rampant inflation. Here are some of its other top draws:

1. TIPS outperform when inflation ends up being higher than expected, as they offer a direct hedge against inflation by linking their principal to the Consumer Price Index. The value of TIPS’ principal and coupon payments increases as the CPI increases, making them less vulnerable to the eroding forces of inflation.

2. Credit risk is virtually nonexistent with TIPS, as they are backed by the U.S. government.

3. Indexing makes sense here. TIPS are a homogeneous and liquid sector of the bond market, and the market does a decent job pricing them. The potential for active managers to distinguish themselves is extremely limited within the sector; as such, the strategy’s market-value weighting approach is efficient and cost-effective.

4. Less exposure to interest-rate risk, better inflation protection—This fund’s focus on TIPS with less than five years until maturity gives it an edge in today’s environment. Short-term interest rates are more correlated with inflation than long-term rates, so funds that hold TIPS with longer maturities are more exposed to interest-rate risk. This fund, with an average effective duration that is much shorter than its typical inflation-protected bond Morningstar Category peer, has provided superior protection during periods when actual inflation exceeded market expectations.

Muted duration, however, can curb return potential. TIPS make the most sense during periods when inflation estimates turn out to be too conservative. This fund has proved itself to be an effective inflation hedge, and there’s plenty to like about that.

Here’s some other Analyst Rating activity highlights from last month.

Tactical Mistakes

A history of implementing thoughtful adjustments has garnered the JPMorgan SmartRetirement Blend mutual fund series solid scores, but some recent tactical allocation calls that missed their mark have moderated our confidence in the team’s approach, triggering a downgrade to Above Average from High, resulting in Morningstar Analyst Rating of Neutral on its priciest share classes.

New to Coverage

The Fidelity Freedom Blend and Advisor Freedom Blend target-date mutual fund series, recognized for its sound construction underpinnings, debuted with a Morningstar Analyst Rating of Bronze on its cheapest share classes and a Neutral on its pricier ones.

Ratings Roundup

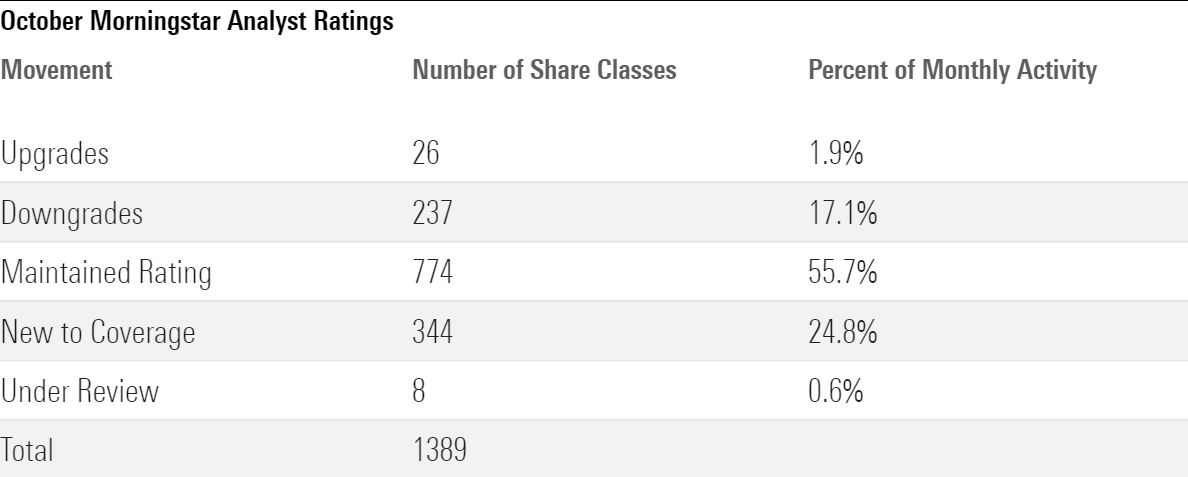

Morningstar updated the Analyst Ratings for 1,389 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios last month. Of these, 774 maintained their previous rating, 26 earned upgrades, 237 received downgrades, 344 were new to coverage, and 8 went under review owing to material changes such as manager departures or subadvisor switches. Looking through share classes and vehicles to their underlying strategies, Morningstar issued 272 Analyst Ratings during October. Of these, 31 were new to coverage. While about one fifth of the strategies saw either an upgrade or a downgrade, the majority (66%) maintained their previous ratings.

Below are some highlights of the upgrades, downgrades, and strategies new to coverage.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/38919e04-dfa7-44a4-8ae1-61a17026713c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)

/d10o6nnig0wrdw.cloudfront.net/09-27-2024/t_c482f9886c534a7a8c406623fe438463_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/38919e04-dfa7-44a4-8ae1-61a17026713c.jpg)