5 Top-Performing Mid-Cap Growth Funds

Funds from MSCI and Vanguard attempt to match market returns.

While mutual fund investors continue to see the strongest results from strategies focused on large-growth funds, some mid-cap growth funds have been putting up competitive returns.

The average mid-cap growth fund is up 16.30% in 2024, significantly lagging the overall US market, which has returned 26.99% as measured by the Morningstar US Market Index. Reflecting a challenging environment, only a handful of funds have consistently ranked at the top of the category in recent years, and most are index funds.

Notably, three of the five top performers in our screen tracked the S&P Mid-Cap 400 Growth Index. That includes the $1 billion Vanguard S&P Mid-Cap 400 Growth Index Fund IVOG, which has posted a 24.64% year-to-date gain. While it still lags the broader stock market, the fund outperforms its peers by a significant margin over the last one-, three-, and five-year periods.

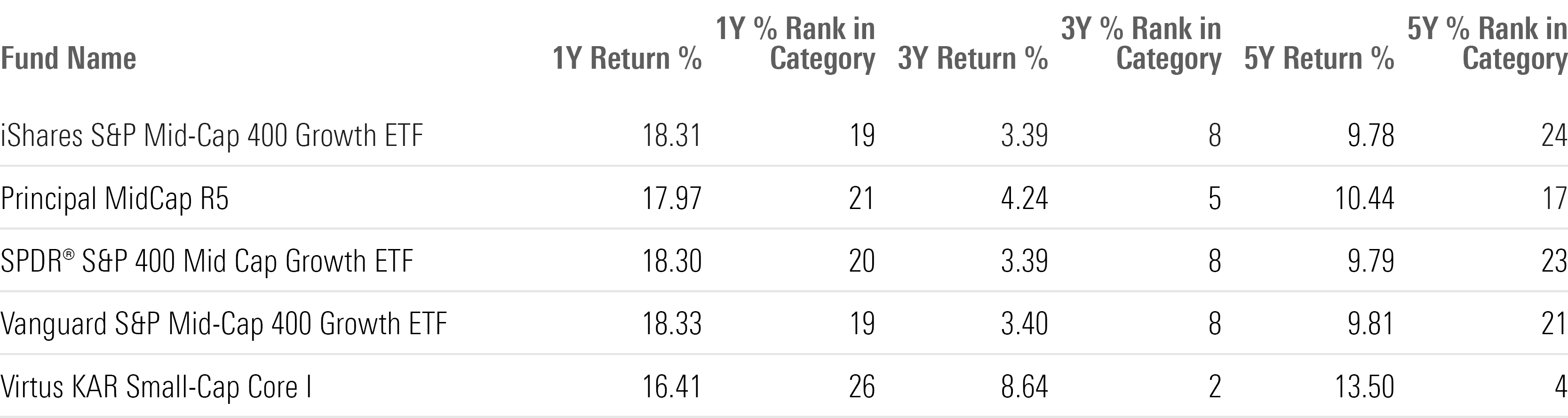

Here are the best-performing mid-cap growth funds, based on our screen:

- iShares S&P Mid-Cap 400 Growth IJK

- Principal MidCap PMBPX

- SPDR S&P 400 Mid Cap Growth MDYG

- Vanguard S&P Mid-Cap 400 Growth Index Fund IVOG

- Virtus KAR Small-Cap Core PKSFX

What Are Mid-Cap Growth Funds?

Stocks in the middle 20% of the capitalization of the US equity market are defined as mid-cap. Some mid-cap growth portfolios invest in stocks of all sizes, leading to an overall mid-cap profile, while others focus exclusively on mid-cap stocks. Typically, these funds will target US firms projected to grow faster than other mid-cap stocks, which can yield better returns. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Mid-Cap Growth Funds vs. the US Stock Market

Best-Performing Mid-Cap Growth Funds

For this screen, we looked for the mid-cap growth funds that have posted the top returns across multiple periods.

We first screened for funds in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year timeframes. In addition, we screened for funds with Morningstar Medalist Ratings of at least Bronze. We also excluded funds with less than $100 million in assets. From this, we highlighted the five funds with the best year-to-date performances. This group consists of three index funds and two actively managed funds.

Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, reducing shareholder returns. A table with the funds’ returns can be found at the bottom of this article.

iShares S&P Mid-Cap 400 Growth ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“The $9.5 billion iShares S&P Mid-Cap 400 Growth ETF rose 23.43% over the past year. The gain on the passively managed fund beat the 16.30% gain on the average fund in the mid-cap growth category. Over the past three years, the iShares fund is up 3.70%, while the average fund in its category is down 2.24%. Over the past five years, the fund has climbed 10.74%, compared to the 8.95% gain for the category.

“The S&P MidCap 400 Growth Index assigns a growth and value score to each stock in the S&P MidCap 400 Index. Those in the cheapest third are allocated to the S&P MidCap 400 Value Index, while the fastest growing third are swept into the S&P MidCap 400 Growth Index. The middle third is split between the two indexes based on their style traits until the market cap for each amounts to approximately half of the S&P MidCap 400 Index. This approach admits some blend and value names into the growth index, improving its breadth across the value-growth spectrum relative to peers.”

—Zachary Evens, manager research analyst

Principal MidCap Fund

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

“The actively managed Principal MidCap Fund is up 21.92% over the past year, outperforming the average fund in the mid-cap growth category, which rose 16.30%. The $24.3 billion fund has gained 4.64% over the past three years, while the average fund in its category is down 2.24%. Over the past five years, the Principal fund has climbed 11.46%, compared to the 8.95% gain for the category.

“Manager Bill Nolin crafted his investment philosophy around a simple central principle. He believes that owner-operators, or leaders that think and act like owners, typically take the long view and make more-prudent operational and capital-allocation decisions. Thus, Nolin and his team prefer companies where the executives are also major shareholders. Often, firms’ founders or their family members are at the helm.”

—Tony Thomas, associate director of equity strategies

SPDR S&P 400 Mid Cap Growth ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“The $2.4 billion SPDR S&P 400 Mid Cap Growth ETF rose 23.41% over the past year. The gain on the passively managed fund beat the 16.30% gain on the average fund in the mid-cap growth category. Over the past three years, the State Street fund is up 3.70%, while the average fund in its category is down 2.24%. Over the past five years, the fund has climbed 10.75%, compared to the 8.95% gain for the category.

“Those in the cheapest third are allocated to the S&P MidCap 400 Value Index, while the fastest growing third are swept into the S&P MidCap 400 Growth Index. The middle third is split between the two indexes based on their style traits until the market cap for each amounts to approximately half of the S&P MidCap 400 Index. This approach admits some blend and value names into the growth index, improving its breadth across the value-growth spectrum relative to peers.”

—Zachary Evens

Vanguard S&P Mid-Cap 400 Growth Index Fund

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“Over the past year, the passively managed Vanguard S&P Mid-Cap 400 Growth Index Fund rose 23.45%, while the average mid-cap growth fund gained 16.30%. The $1.2 billion fund has climbed 3.71% over the past three years, outperforming the average fund in its category, which fell 2.24%. Over the past five years, the Vanguard fund is up 10.76%, while the average fund in its category is up 8.95%.

“Those in the cheapest third are allocated to the S&P MidCap 400 Value Index, while the fastest growing third are swept into the S&P MidCap 400 Growth Index. The middle third is split between the two indexes based on their style traits until the market cap for each amounts to approximately half of the S&P MidCap 400 Index. This approach admits some blend and value names into the growth index, improving its breadth across the value-growth spectrum relative to peers.”

—Zachary Evens

Virtus KAR Small-Cap Core Fund

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“The actively managed Virtus KAR Small-Cap Core Fund is up 20.48% over the past year, outperforming the average fund in the mid-cap growth category, which rose 16.30%. The $2.1 billion fund has gained 8.89% over the past three years, while the average fund in its category is down 2.24%. Over the past five years, the Virtus fund has climbed 14.26%, compared to the 8.95% gain for the category.

“The investment approach centers on quality and conviction. Managers Todd Beiley and Jon Christensen look for small-cap companies whose competitive advantages help generate and maintain superior returns on capital better than the market expects. They seek companies that exhibit a degree of market control and possess strengths such as well-regarded brands, cost advantages, or high customer switching costs. They also prefer firms with high insider ownership. The approach closely resembles that of Silver-rated Virtus KAR Small-Cap Growth PXSGX but differs in that it emphasizes slightly more mature companies.”

—Tony Thorn, manager research analyst

Long-Term Returns of Top-Performing Mid-Cap Growth Funds

This article was generated with the help of automation and reviewed by Morningstar editors. Learn more about Morningstar’s use of automation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)