Bonds Reclaim Their Defensive Status

The recent stock slide proved the diversification value of bonds.

The stock market operated like the world’s greatest casino last week. We observed the third-largest spike in the history of the Volatility Index, trailing only 2008 and 2020, coinciding with the most significant stock market drawdown of the year.

However, even during periods of distress, some asset classes perform well, highlighting the critical importance of remaining diversified.

Enter bonds: an asset class that faced many questions because of its inability to provide defense during the bear market in 2022. Stocks and bonds both finished down by more than double digits that year, marking the first time in history.

But time heals all wounds. The increase in yields since that period has greatly benefited bond investors, and the results are starting to show.

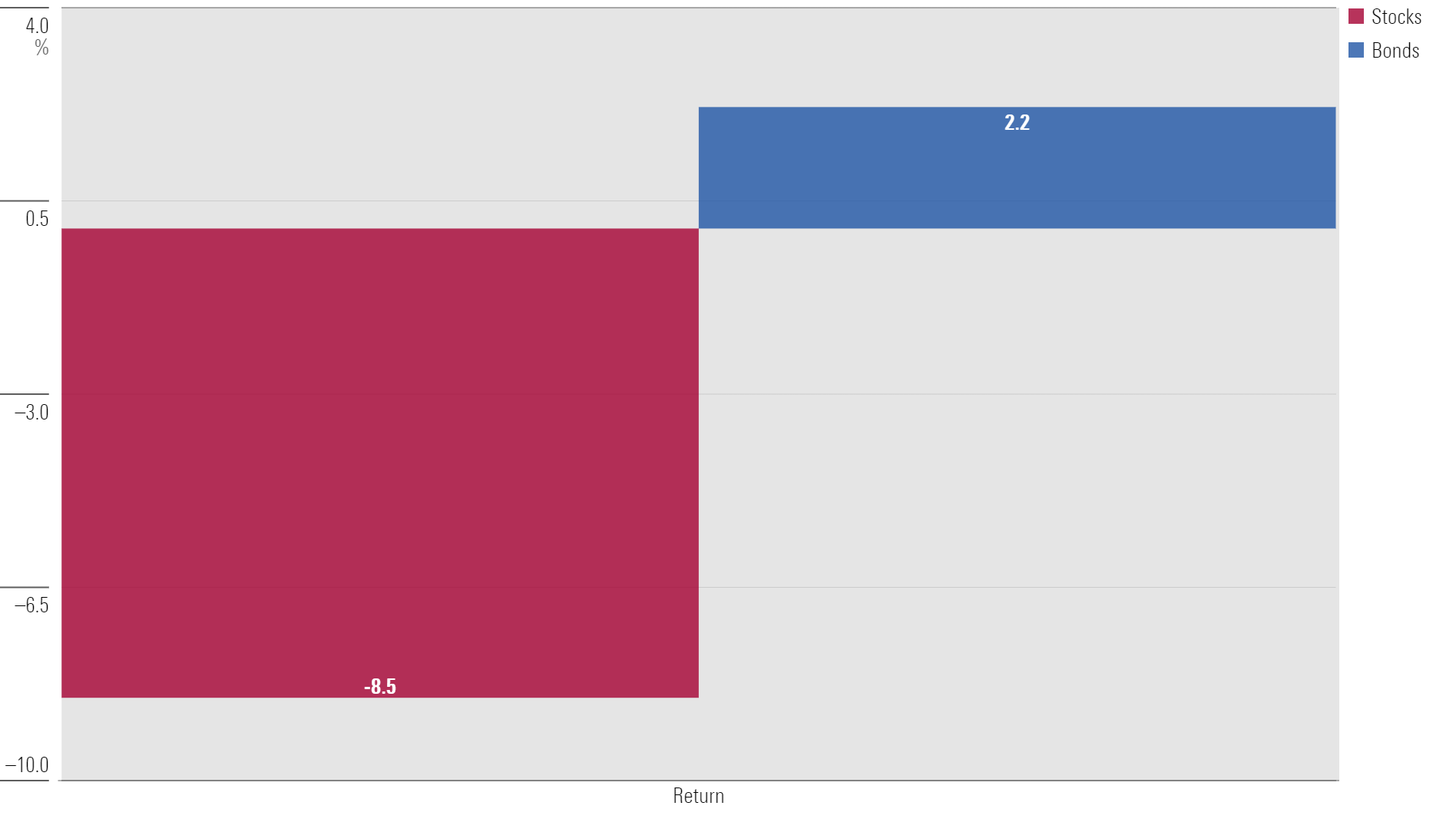

Since the S&P 500 peaked on July 17, it experienced a peak-to-trough drawdown of 8.5% through Aug. 5. Meanwhile, bonds were positive during this period, gaining over 2%.

Bonds Playing Defense (Returns Since July 17 Peak in US Stocks)

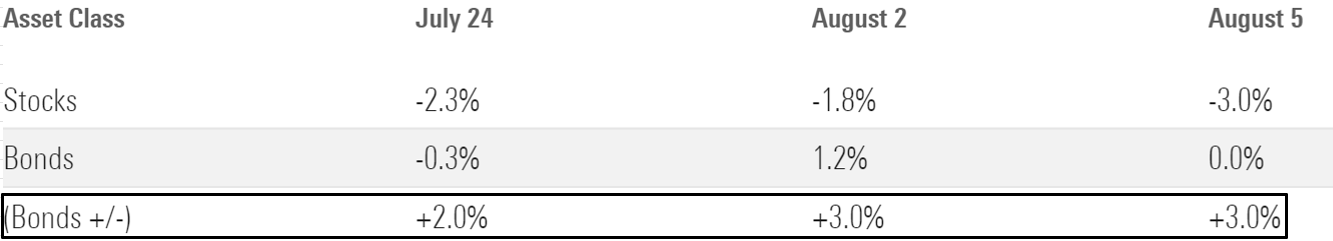

Examining the most volatile days during this period offers even greater insight. The S&P 500 experienced three separate trading days with declines of 2% or more. On each of those days, bonds significantly outperformed stocks.

Bonds Outperforming Stocks on the Most Volatile Days

This highlights the significant benefits of diversification, especially given the debate over the role bonds play in a portfolio since the bear market of 2022.

To be fair, the bond debate is rooted in logic. Bonds were down more than 12% during 2022′s challenging bear market. If you own an asset class for its defensive qualities and it fails to deliver, it’s reasonable to questions its effectiveness. However, we must be careful to not be captured by the moment. Put simply, we shouldn’t take a recent negative outcome and extrapolate those results permanently into the future.

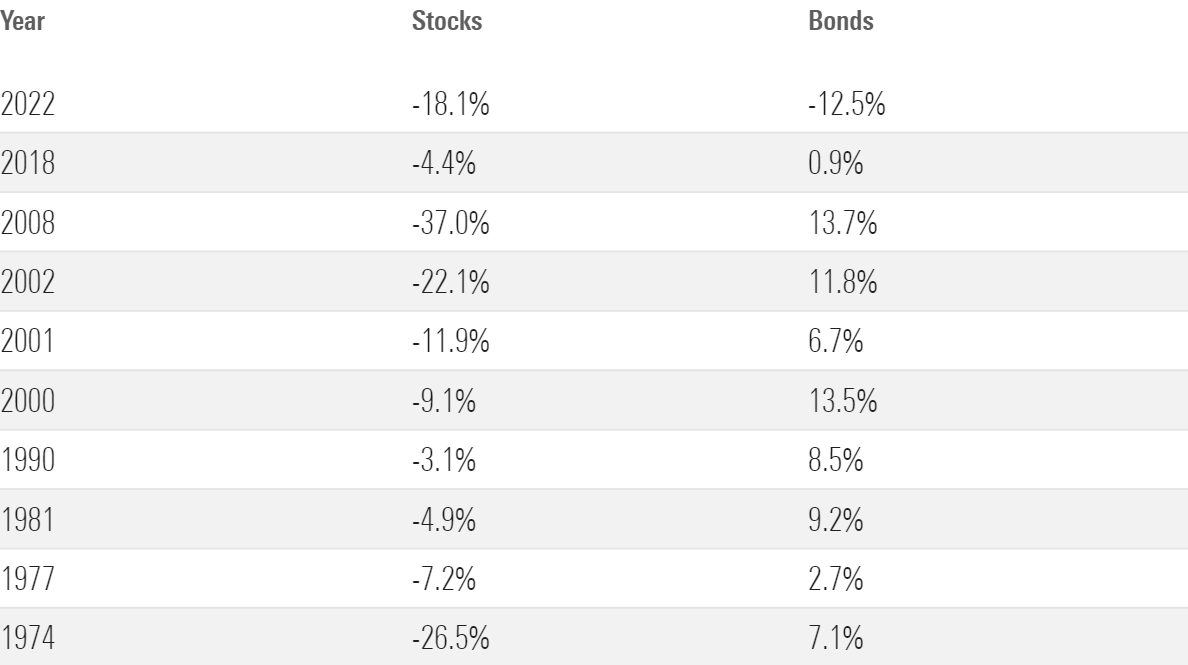

Bonds have a strong historical track record of delivering for investors when equities struggle, despite what happened in 2022. For example, since 1974, US stocks have had 10 negative calendar-year returns. In nine of those years, bonds were positive, with the only outlier being 2022.

Bonds: A Great Diversifier When Stocks Fall, Despite 2022

While 2022 was a tough year, it likely wasn’t the best predictor of the future. Unfortunately, this is part of investing—no asset class works all of the time. Perfect hedges only exist in gardens, not portfolios.

But if equities continue to be volatile, the data overwhelmingly suggests that bonds are likely to be a source of protection.

Managing through turbulent short-term periods is crucial for achieving strong long-term investment outcomes. The most effective way to manage through these periods is by not capitulating on your investment plan when markets get bumpy. Diversification plays a key role in this. The investment plan you had on June 30, when markets seemed unimpeachable, should remain your plan now—assuming there haven’t been any significant changes in your life.

Nobody can predict the future, but panic is never an investment strategy. Fortunately, if you’re diversified, you don’t need to predict the future.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)