The Verdict on Wide-Moat Stocks

They can generate high returns, under the right conditions, but their best feature is safety.

Selling the Concept

Twenty years ago, Morningstar popularized the notion of investing in companies that own economic "moats." To be sure, favoring organizations that are able to protect their revenue streams, through (say) patents or network effects, is not a new idea. Long before business schools were invented, investors preferred firms that maintained some form of pricing power to those that sold commodities.

But Morningstar gave moats top billing in its equity coverage, prominently assigning all researched stocks to one of three categories: 1) wide moat, 2) narrow moat, and 2) no moat. Companies in the first group can comfortably shelter their operations; those in the second possess some safeguards; and those in the third have little to none. Examples are, respectively, Microsoft MSFT, Tesla TSLA, and Target TGT.

At that time, Morningstar avidly recommended wide-moat stocks. Wrote its equity team, "Successful stock investing involves more than just identifying solid businesses, or finding businesses that are growing rapidly, or buying cheap stocks. In a perfectly competitive market, rivals will eventually eat up any excess profit earned by a successful business. Only those firms with a competitive advantage–a moat–can withstand these competitive pressures for a long period."

The Bottom Line

Let’s test that hypothesis. Have the three moat groups performed significantly differently? If not, then the moat indicator may be instructive for individual cases, but it fails as a general signpost. If the performances have diverged, then a follow-up question would be, who won? Learning that wide-moat stocks reliably trail their rivals would be useful, but not exactly what Morningstar’s equity researchers desired.

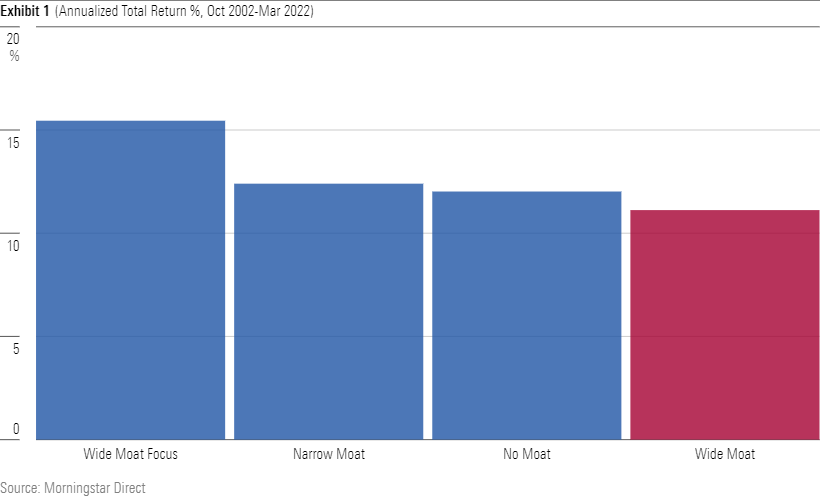

The first test yields mixed results.

When used carefully, the wide-moat designation has led to unusually high returns. Morningstar's Wide Moat Focus Index holds a small number of wide-moat stocks, chosen because they also have low prices. Since October 2002, when the moat classifications debuted, that benchmark has soundly outgained the S&P 500. A wide moat plus a cheap valuation is an attractive combination!

However, among the three broad moat groupings that capture the entire available universe, rather than a hand-picked subset, the wide category has posted lower returns than its competitors. In hindsight, this is not surprising. Because their businesses are strong, wide-moat firms tend to be popular, and therefore relatively expensive. For example, Morningstar currently calculates the price/earnings ratio for the overall Morningstar Wide Moat Index (as opposed to the focused version) at 24, with the overall stock market at 21.

Of course, pricey companies can become even pricier, should they exceed market forecasts. But it is not in the nature of wide-moat firms to surprise. By and large, they deliver on what they promise. Thus, the very reliability that makes such firms appealing also dampens their gains. It is harder for wide-moat businesses to alter the marketplace’s opinion than it is for companies that are less well-regarded.

Considering Risk

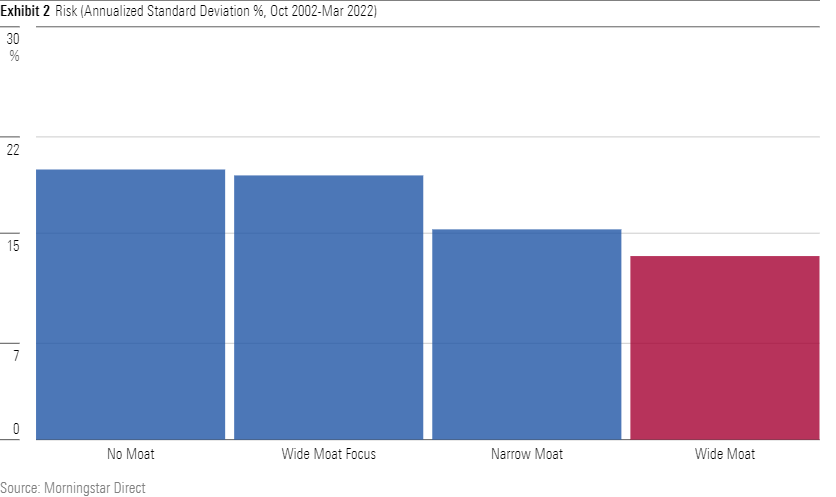

There is, however, a benefit to being predictable: safety. The Morningstar Wide Moat Index has been notably less risky than its rivals.

Whereas the first chart was somewhat puzzling, with the middle category of narrow-moat stocks posting the top returns, this outcome fully matches one’s expectations. Stocks without a moat were most volatile, which makes sense given their vulnerability to economic shocks. Also risky was the more-concentrated Morningstar Wide Moat Focus Index. Narrow-moat stocks were steadier, with the wide-moat firms steadiest of all. (In this instance, landing at the graph’s bottom right is best.)

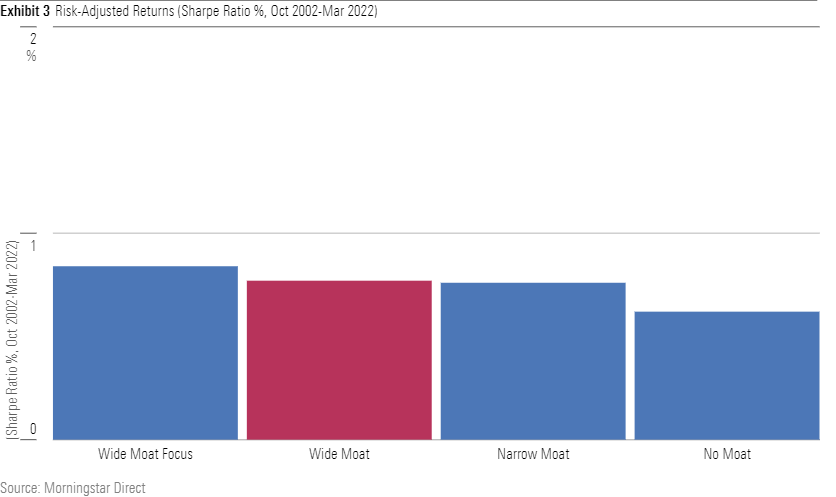

Thus, wide-moat companies look better when the results are risk-adjusted. Despite its volatility, the Morningstar Wide Moat Focus Index retains its lead after the risk adjustment, notching the highest Sharpe ratio. Then comes the entire universe of wide-moat stocks, followed closely by narrow-moat stocks. Stocks that lacked a moat were the poorest—no great surprise there, as their returns would need to be truly outstanding to overcome their steep volatility.

(For comparison’s sake, the largest U.S. index fund, Vanguard Total Stock Market VTSAX, posted a Sharpe ratio of 0.74 during that period, placing it slightly behind the wide-moat and narrow-moat indexes, but well ahead of the no-moat index.)

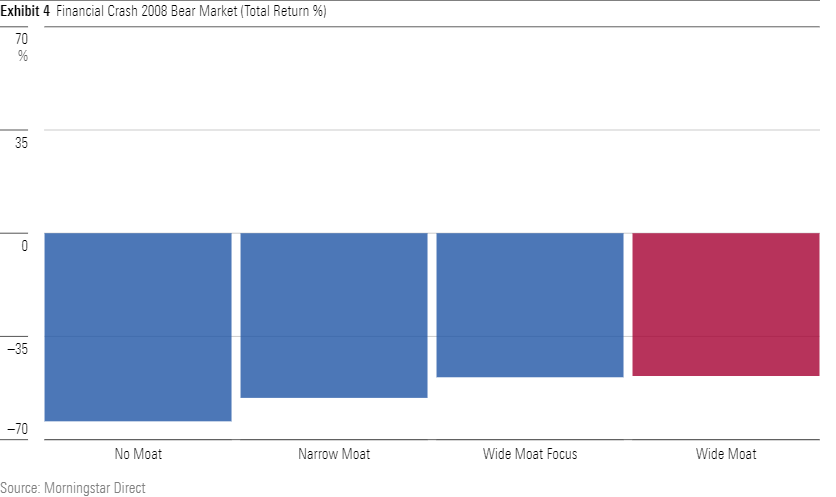

When Bears Rule

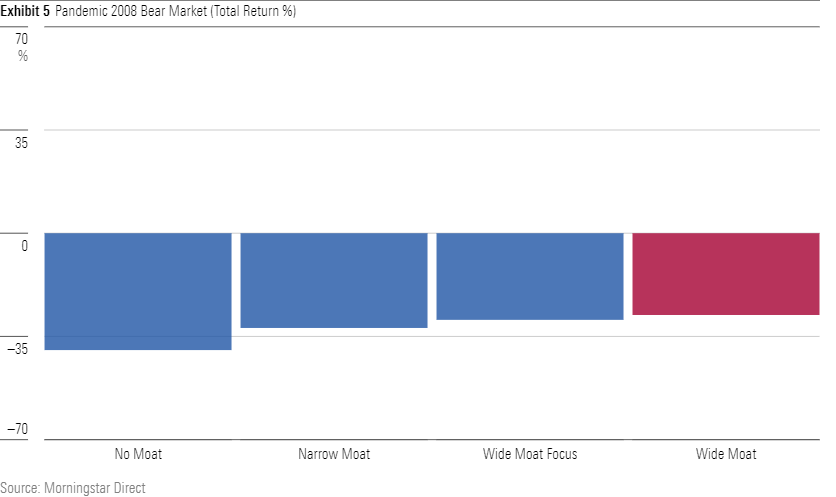

Another way of measuring risk-adjusted performance is to examine how the investments fared during the worst of times. There have been two such occasions since October 2002, one being the prolonged downturn from autumn 2007 through spring 2009, and the other being the brief but very sharp tumble caused by the onset of the coronavirus pandemic.

During the first bear market, the two versions of the wide-moat index performed almost identically, each losing about 48%. That sounds terrible—and it is. But it beat the 56% drop recorded by the Morningstar Narrow Moat Index, never mind the 64% plunge suffered by the Morningstar No Moat Index. To put that latter figure into perspective, no-moat stocks needed to gain 45% off their bottom merely to reach the wide-moat index’s low point.

The pattern was similar, albeit less dramatic, in 2020. Once again, wide-moat stocks took a licking, there being no true escape from the stock bear market, but they were meaningfully more resilient than their narrow- and no-moat rivals.

Wrapping Up

In and of itself, buying wide-moat companies hasn’t led to relative riches. To achieve above-market profits, investors have needed to be selective, by seeking unusually cheap wide-moat businesses. However, on a risk-adjusted basis, wide-moat companies have modestly outperformed the overall stock market. They also answered the call when the bear markets arrived.

That said, evaluating stand-alone performance only goes so far. To better understand the merits (or demerits) of investing in wide-moat companies, one must see how they combine with other assets. Next Tuesday’s column will do just that.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1dc0e832-2662-4ab4-be02-cfbeb933f44b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NWXDIGIC6FG5TE6CX4VIZIS5XA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1dc0e832-2662-4ab4-be02-cfbeb933f44b.jpg)