Berkshire Hathaway: A Mutual Fund in Disguise?

A fresh look at a much-analyzed company.

Technically, I own two stocks: Morningstar MORN and Berkshire Hathaway BRK.B. But I regard the latter as an unusually appealing mutual fund. As with a mutual fund, Berkshire Hathaway is broadly diversified and professionally managed. In this case, though, Warren Buffett makes the decisions, while working essentially for free (the annual cost of his private jet amounts to less than 1 basis point of Berkshire Hathaway’s assets). Finally, the company makes no distributions—a key virtue, since I own it in a taxable account.

The other day, I checked on my surrogate fund. I knew that it owned three types of investments: 1) privately held operations, 2) publicly listed equities, and 3) cash. As a former fund analyst, I had the occupation’s standard questions. What was the investment’s asset allocation? In addition, what was the price for the securities in its portfolio—in particular, its price/earnings ratio?

To my surprise, I could not find this information. Google searches located several articles that parsed through Berkshire Hathaway’s filings, but as none observed the above format, none answered my queries. Thus, this column.

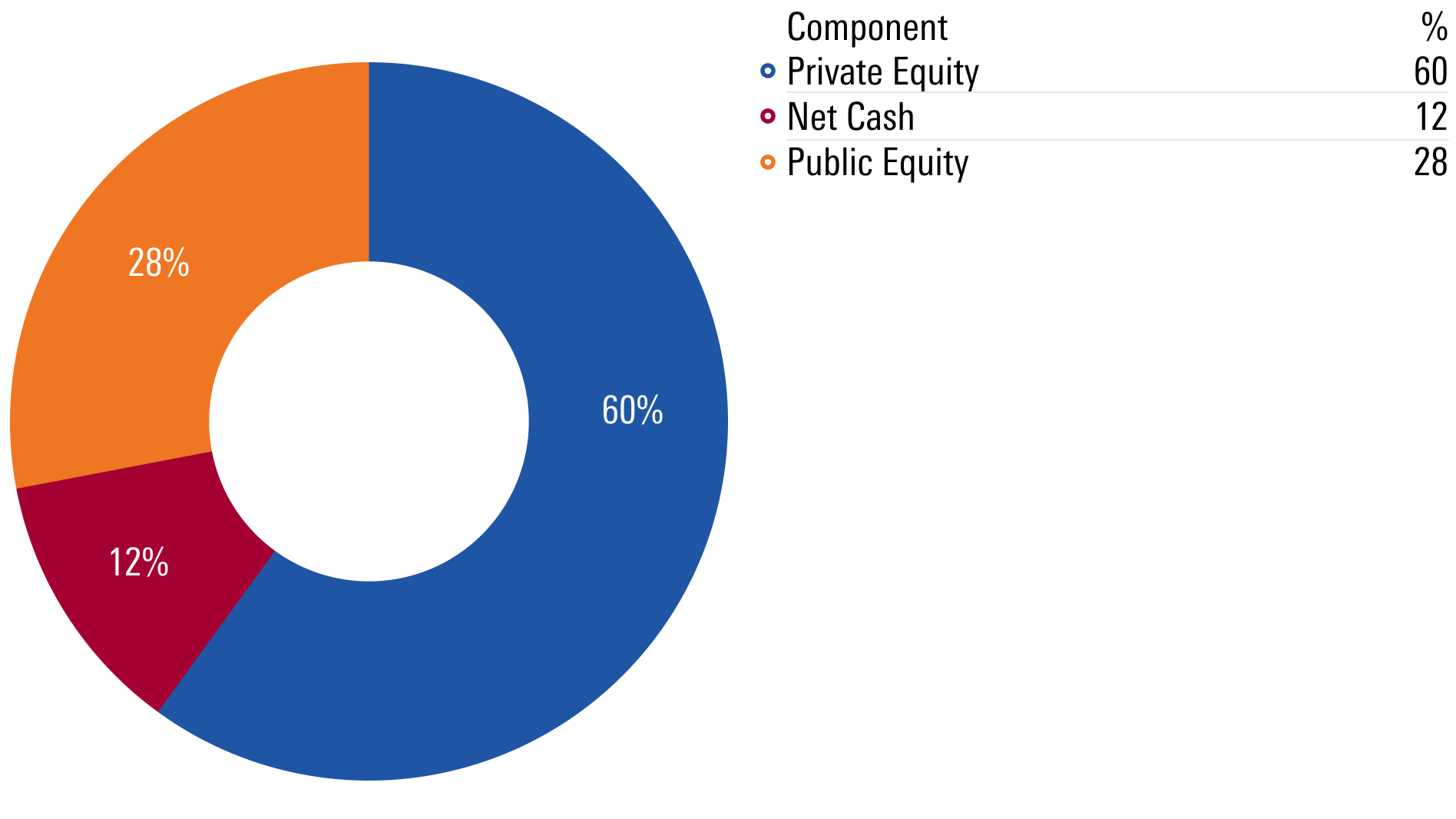

Berkshire Hathaway’s Asset Allocation

Unlike most mutual funds, Berkshire Hathaway is leveraged. However, its borrowing is implicit rather than explicit. When funds borrow, they do so conventionally, by taking out short-term loans and investing those proceeds. The same process applies to corporations that issue debt to finance their operations. Berkshire Hathaway, however, achieves its leverage not by indebting the parent company, but instead by investing the loss reserves of its insurance subsidiaries.

According to Morningstar’s Greggory Warren, who helped with this section of the analysis (I cannot be trusted to dissect insurance-company finances), Berkshire Hathaway currently carries $175 billion in loss reserves tied to its insurance operations. Against this liability, it owns $241 billion in fixed-income securities and cash, most of which consists of Treasury bills, in its insurance operations. It owns another $48 billion in cash within its other businesses. Its net cash position is therefore $114 billion—a hefty sum, but as we shall soon see, nothing remarkable by mutual fund standards.

The company’s portfolio of publicly traded available-for-sale equities was worth $267 billion, as of last Friday. When added to the net cash, the sum is $381 billion. As Berkshire Hathaway’s stock market capitalization is $958 billion, its privately held businesses account for the difference. The marketplace values them at $577 billion. (Later, we shall see the amount of earnings that these businesses generate.)

The chart below restates these figures as percentages.

Berkshire Hathaway's Asset Allocation

Unremarkable. Once Berkshire Hathaway’s insurance liabilities are netted from its cash position, the company’s asset allocation looks much like that of a typical, if slightly cautious, stock fund. It has 88% of its assets in equities (both privately held companies and publicly traded stocks), in a well-diversified portfolio that contains over 100 positions, counting both its public and private holdings. Among the former, only Apple AAPL accounts for more than 5% of Berkshire’s total net assets. (The stake is currently at 9%, down sharply from earlier levels, as Buffett has recently sold 506 million shares.)

Berkshire Hathaway’s Portfolio Characteristics

The company’s industry exposures need little explanation. Besides Apple and a small purchase of Amazon.com AMZN, Berkshire Hathaway confines itself to such traditional endeavors as insurance, consumer services, rail, and energy. As is widely known, Buffett wants investments that generate cash today, not promises about what tomorrow will bring.

More interesting than the activities of Berkshire Hathaway’s companies are their prices. After all, their operations are very consistent. Even apparent newcomer Apple has sold consumer electronics for almost half a century. (See’s Candies, featured in this column just two weeks ago, is older yet.) However, the price investors will pay for those activities varies over time.

Given that Buffett buys mature companies rather than startups, the most appropriate valuation yardstick is price/earnings ratio. How much does each dollar of corporate earnings cost?

With the listed stocks, I cross-referenced Berkshire Hathaway’s most recent Form 13F filing with the trailing 12-month earnings reported for those companies by Morningstar’s equity database. Easy enough!

However, assigning a P/E ratio to Berkshire’s private businesses proved trickier, not only because one must strip out investment gains from Berkshire Hathaway’s officially reported earnings, but also because its Geico subsidiary receives separately reported investment income. Should those moneys also be removed, because their amounts depend upon the markets’ fortunes, or should they be considered a normal part of Geico’s operations?

I split the difference and did the calculation both ways. The following graph shows four different P/E ratios: 1) the 100 largest US stocks, 2) Berkshire Hathaway’s public equity portfolio, 3) Berkshire Hathaway’s private businesses, including its insurance subsidiaries’ investment income, and 4) Berkshire Hathaway’s private businesses, excluding the insurance investment income.

In all cases, the ratios were computed by dividing the total market capitalization for each group by its total income, using (as previously stated) the trailing 12 months for the public stocks and fiscal-year 2024 for the privately held companies. If companies sustained losses, those were included in the calculations, although as the organization is Berkshire Hathaway and the investment manager is Warren Buffett, few such businesses were found.

Note: As space is tight, I have inelegantly labeled the P/E ratio for Berkshire Hathaway’s listed equities as “BH Public,” for its private businesses including Geico’s investment income as “Private Yes,” and for its private businesses excluding that income as “Private No.” My apologies for the clumsy wording.

Price/Earnings Ratios

Long, long ago, Buffett ceased being a diehard value investor, seeking instead what he regarded as great companies at good prices. It is not for me to say whether he currently owns great companies (aside from See’s, that is). But their prices are certainly moderate. Were this a fund, Morningstar would classify its portfolio as large (or possibly mid) value.

Buried in the exhibit is Apple’s P/E ratio of 34. No surprise, then, that Buffett has been aggressively selling the stock since late 2023. Whatever the qualities of the firm, it doesn’t match Berkshire Hathaway’s normal price profile.

Wrapping Up

This spot is where I normally offer my opinion. Not today. Because I own Berkshire Hathaway shares, I will keep this article descriptive rather than prescriptive. As always, though, you are free to draw your own conclusions!

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1dc0e832-2662-4ab4-be02-cfbeb933f44b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NWXDIGIC6FG5TE6CX4VIZIS5XA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1dc0e832-2662-4ab4-be02-cfbeb933f44b.jpg)