When Will U.S. Autos Recover From the Chip Shortage?

We think the worst of the damage was in the second quarter.

Just as the United States seemed to be rebounding from the pandemic, its auto industry got hit with another major setback: a massive shortage of semiconductors. We believe this problem is the result of the pandemic as well as the automakers probably not anticipating such a fast recovery last year. A fire at a chip plant in Japan and Texas winter storms have not helped, either. More capacity is coming but will not be on line until well after this year. The lead time from a wafer firm to an automaker's assembly plant is just over six months, so the second quarter saw severe pain in lost production, resulting in severely low vehicle inventories.

We believe the second quarter was the worst of the pandemic-caused issues. Demand looks excellent, especially for light-truck models, which is very good news for pricing and mix tailwinds that should remain in place in the second half of 2021. The rapid recovery on the demand side led us to increase our five-year U.S. light-vehicle sales forecast from our earlier outlook. The demand for autos is there; the industry just needs more inventory. General Motors GM and Ford F have said that their inventories will not go back to the highs of before the pandemic, which should enable them to keep some of the pricing tailwinds they've enjoyed recently.

A Year of Haves and Have-Nots

2021 was supposed to be a year of pandemic recovery for the U.S. auto industry, and that has somewhat been the case. U.S. light-vehicle sales through June were up 29.3% versus the first half of 2020, albeit helped by some easy comparable months from the pandemic, such as April 2020, when sales fell nearly 50% from April 2019. 2021 half-year sales were down 1.3% from the first half of 2019. The recovery from the pandemic lows has turned out to be not just a matter of getting demand back. Demand actually seems to be fantastic, but a global semiconductor shortage--brought on by an increase in consumer electronics demand as well as automakers not anticipating demand recovering so soon, in our view--is wreaking havoc on 2021’s auto recovery. The demand for autos is there, but not the supply.

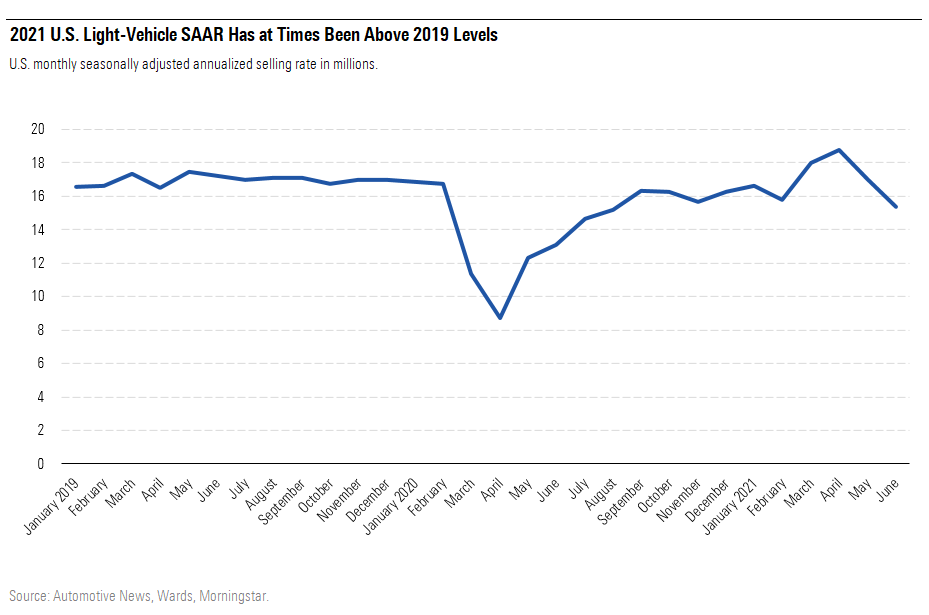

We’re not ignoring the chip shortage, but we know it will eventually pass. The end-market imbalance can be solved; however, it will take a while, given the high demand in nonautomotive sectors and long lead times. After U.S. light-vehicle sales showed seasonally adjusted annualized selling rates in March, April, and May of about 18 million, 18.8 million, and 17 million units, respectively, according to Wards, we increased our five-year U.S. light-vehicle sales forecast. June’s SAAR did fall to 15.4 million and July’s to 14.8 million, which we attribute to low inventory rather than poor demand. We think that barring a macroeconomic slowdown, 2022 will be a strong year and that the industry will return to over 17 million units faster than we expected when we issued our February forecast. We expect the second quarter of 2021 to have been the worst of the chip shortage, but recovery will take time, probably into at least 2022. The U.S. automakers we cover have held up fairly well despite the bad news; we consider any sell-offs because of the chip shortage to be a buying opportunity for long-term investors.

Demand and Mix Look Extremely Attractive

Sales through the first half of the year did not collapse despite the semiconductor shortage and staggered U.S. reopening from the pandemic. We note that the 2021 SAAR for March through May was above prepandemic levels. U.S. sales for the first half of 2021 were down 1.3% from the first half of 2019 (up 29.3% from the first half of 2020), but we believe the chip shortage’s impact on inventory and sales probably peaked in the second quarter.

There’s also been some good news upstream in the semiconductor supply chain. Taiwan Semiconductor Manufacturing Co.’s CEO, C.C. Wei, said in April that he expects the semiconductor shortage for the company’s automotive customers, which are chipmakers such as NXP and Texas Instruments, to be greatly reduced by the third quarter. The automotive value chain for chips starts at a wafer firm like TSMC, which then sells to a chip firm such as NXP or Renesas, which then sells to a Tier 1 auto supplier such as Visteon or Lear, which then sells a completed module for part of a vehicle to the automaker. This chain takes about 26 weeks, according to Ford, which means that the extra supply TSMC said is coming in the third quarter probably will not reach automaker assembly plants until late 2021 or the first quarter of 2022. Wei said in July that TSMC had increased production of microcontroller units, a key part of automotive semiconductors, by about 30% year over year in the first half of 2021; by year-end, he expects about a 60% increase versus 2020, which he noted is about a 30% increase from 2018 levels. Renesas suffered a fire in March at a plant in Japan, which along with the winter storms in Texas worsened the chip shortage, but the company said in a June 25 press release that the affected production line had returned to full output on June 24. Things may look bad now, but we expect they will get better as 2021 progresses.

2021 U.S Light-Vehicles SAAR Has at Times Been Above 2019 Levels

We believe that the media place too much emphasis on volume. Volume is important to achieve scale, but mix also matters greatly to profits, with light trucks carrying higher margins. The Detroit Three are favoring pickup truck production to protect profits as much as possible during the chip shortage. Their market share of the full-size pickup truck segment last year was about 94%; our calculations using Automotive News data show this share since 2002 has averaged about 93%, with the lowest at 88.1% in 2007.

Americans’ love of light trucks has not stopped. Crossovers continue to steal U.S. sales share from sedans as they offer more space without giving up much, if anything, in fuel economy. The total light-truck mix of 76.9% for the first half of 2021 is up 150 basis points from the year-ago period and drastically higher from this century’s low of 45.4% in 2009, which was the byproduct of gas prices spiking just before the Great Recession.

We expect the U.S. industry light-truck mix will eventually top out at 80%-85%, as more consumers still need to trade in their (on average) approximately 12-year-old vehicles. We think those consumers are likely to follow the market trend and buy a light-truck model; also, automakers’ new products are likely to be skewed toward light trucks for at least the next few years.

First-half numbers do show pickup mix down year over year while crossovers continue to thrive. We are blaming the semiconductor shortage rather than pickups falling out of favor with the American consumer. For 2021, after mostly decent sequential pickup production growth in March, April’s production fell hard, especially for Ford, which in some years sells the most full-size pickups in the U.S. In fact, the F-Series has been America’s top-selling vehicle for 39 straight years, according to the company. All three pickup truck leaders in April had sequential declines in pickup production, with Ford the worst, down 42% from March, more than double the North American industry decline of 20%. Things improved from April for GM, while Ford continued to lag GM and Stellantis’ STLA Ram brand in May.

June production saw a hard year-over-year decline for Ford, again we think due to semiconductors, while GM saw good year-over-year growth from its full-size truck models. GM’s Silverado and Sierra both posted low-single-digit production growth in June versus May, while Ford’s F-Series production fell 12% in June versus May.

Stellantis’ Ram brand saw the full-size Ram truck’s production down 2.8% year over year in June, while the midsize Gladiator’s output rose 39%. Both Stellantis models posted sequential production increases in June, with Ram up 13.8% and Gladiator up 2.9%. When we look at inventory days’ supply by month for the Detroit Three’s midsize and full-size pickup truck models for the first halves of 2019-21, 2021 is clearly severely depressed in terms of inventory, with the average across the Detroit Three for June about two thirds lower than it was at June 2019. We believe fewer units to sell led to the falling pickup truck share.

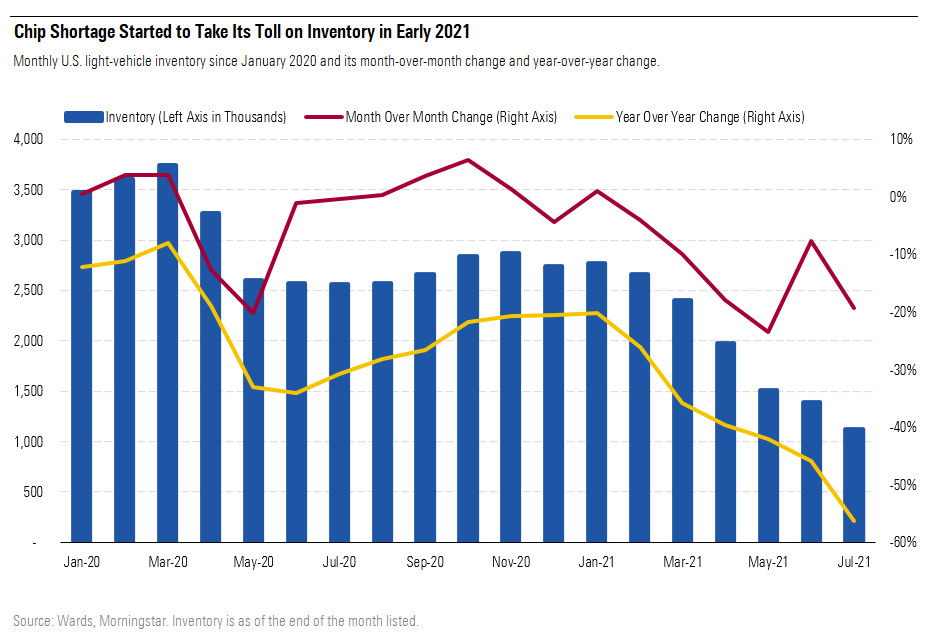

Inventory Is the Key Issue for 2021

The auto industry won’t recover from the pandemic until inventory normalizes, and right now, it’s in the worst of its shortfall. Inventory at the end of June falling 7.5% compared with May is an improvement from the 24% and 18% sequential declines for May and April. But July inventory declined 19.4% from the end of June, showing that the recovery will be choppy.

This shortage hurts sales now, but we think it will lead to some robust numbers later. Wards said the April 2021 U.S. light-vehicle inventory of 1.972 million units was the lowest for April in at least 30 years and the lowest for any month since 1.969 million in July 2011.

End-of-April inventory fell 17.8% from the end of March, according to Wards, and end-of-May inventory fell 23.5% from the end of April to 1.5 million units, the lowest for any month since August 2009. June’s sequential fall of 7.5% was still a decline of 46% from June 2020 and a 64% decline from June 2019, while the 1.4 million units was far below the five-year average for 2015-19 of 3.9 million units. Inventory of 1.1 million units at the end of July was down 19.4% from the end of June and down 56.2% from July 2020.

U.S. light-vehicle inventory units have been sliding all year, both year over year and sequentially, other than a 1% sequential increase at the end of January versus the end of December 2020. Still, the fact that auto stock prices are holding up in value rather than falling when inventory is likely at its worst is a good sign that the industry will persevere.

Chip Shortage Started to Take it's Toll on Inventory in Early 2021

No company seems untouched by the pandemic, although Toyota TM seems to have more inventory of chips than others due to having backups in place after the 2011 tsunami. Lost production estimates from AutoForecast Solutions as of Aug. 9 have the shortage costing the industry about 7.1 million units globally, with 4.4 million of that coming from North America and Europe. Data published from AutoForecast Solutions by Automotive News for lost North American production by company has Ford hit the most in terms of lost units with 324,616 as of May 18. Ford’s F-Series has the most vehicles lost of any single vehicle produced in North America at 109,710 units lost. All top 10 vehicles lost are Detroit Three models, though the F-Series is the only full-size pickup truck among the 10. On July 5, Automotive News cited LMC data that Ford’s plants (we assume in North America) had just a 55% capacity utilization through May for 2021. This lost utilization means over 350,000 lost vehicles, 37% of which were full-size pickups.

For perspective, every 100,000 units of lost F-Series production costs Ford about $4.7 billion of revenue. Given what we assume is an EBIT margin in the high teens to 20%, we calculate lost EBIT of about $937 million for every 100,000 lost U.S. F-Series wholesale units.

A positive outcome of the chip shortage is that this year we’ve heard commitments from GM and Ford to reduce inventory permanently relative to prepandemic levels. When we asked one of the dealers that we cover what they thought of GM and Ford pulling back on inventory, they were not at all concerned about having too few vehicles to sell after the chip shortage ends. Instead, they said they’ve lobbied for leaner inventory for years. We do think that in the long term, inventory should stay above summer 2021 levels, but we don’t mind possibly needing to forecast lower sales long term that still enable pricing power for both automakers and dealers to yield results similar to the first quarter this year. Dealers seem happy to increase prices accordingly when inventory is low.

On June 29, The Wall Street Journal, citing J.D. Power, said that in mid-June, about 75% of vehicles sold in the U.S. sold for sticker price or higher, up from 67% at the end of May and about 36% before the pandemic. If GM and Ford follow through on their inventory-reduction plans, consumers may have to adjust to less generous discounts than they are used to from those companies. This means that consumers may pay more, but we also think less discounting is good for GM's and Ford's brand perception. The key for them is to prove to consumers that their products are competitive with the likes of Toyota; we think their products have been for a long time now.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)