Utilities Stock Outlook: A Defensive Rotation Could Lift These Dividend-Paying Names

Undervalued Entergy, NiSource and Duke Energy are bright spots in this low-performing sector.

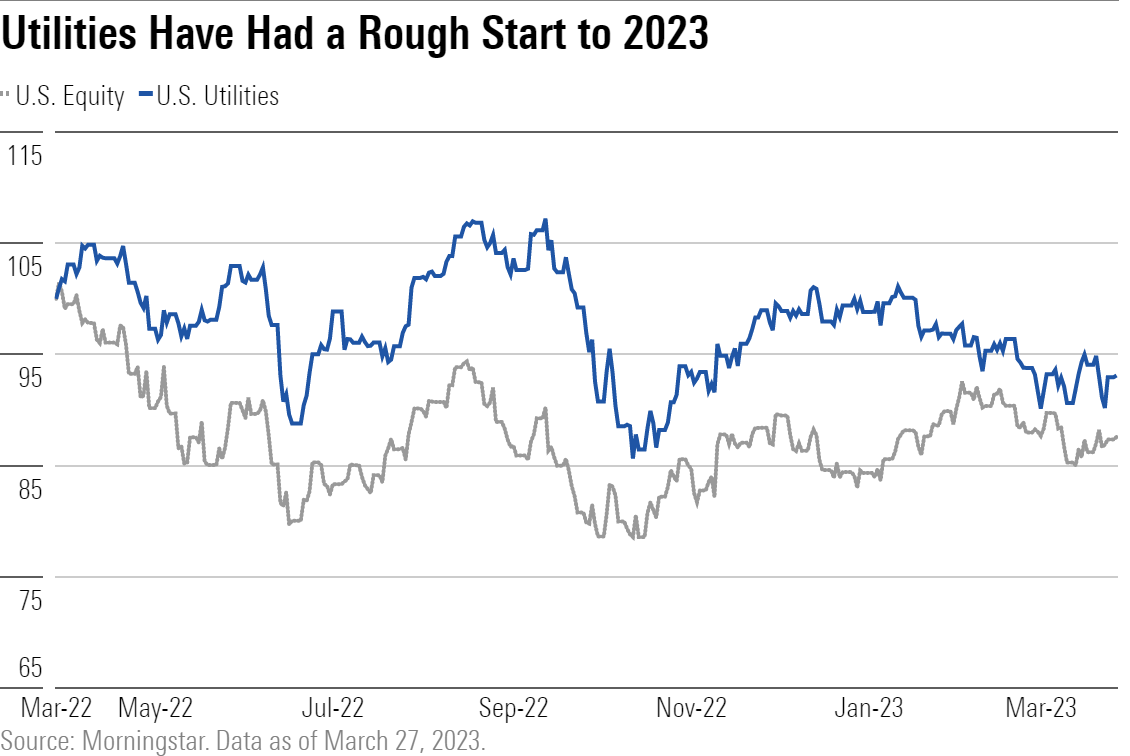

Banking industry uncertainties and a slowdown in the upward march of interest rates could give utilities’ investors a brief sigh of relief. Utilities have been the second-worst-performing sector this year through late March, but a defensive rotation in the markets could allow utilities stocks to claw back some of those losses.

We don’t expect an immediate turnaround. Most utilities reported impressive earnings for 2022 and reaffirmed their growth outlooks. We continue to expect 6% average annual dividend and earnings growth from the sector during at least the next three years. This steady growth along with dividend yields that have stuck near 3.5% suggests attractive total returns for most utilities.

We think it’s unlikely utilities stocks will finish 2023 with a performance like 2022 when they outperformed the market by 21 percentage points. But an 8% total return from utilities, including dividends, should make investors happy after three years of mostly flat returns. Growing earnings and a drop in utilities’ stock prices during the past six months have brought valuations back to recent historical norms. We now consider the sector fairly valued.

We had expected a volatile start to the year as long-term interest-rate policy remained uncertain and high energy prices hit customer bills this winter. Both risks have eased, and we expect utilities stocks will fall on to a steadier path.

Utilities’ biggest challenge in the coming years is executing their growth plans. Not only do utilities have to complete their planned capital investments on time and on budget, they also must ensure regulators allow them to recover those costs in customer rates, even if it means higher customer bills. Inflation remains a concern. Utilities that can stay on plan while minimizing operating and financing costs should produce the best earnings and dividend growth for investors. Environmental policymaking at the federal, state, and local levels will continue to play a big role in utilities’ growth investment opportunities.

Top Utilities Sector Stock Picks

Entergy ETR

- Fair Value Estimate: $120.00

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

We think Entergy offers one of the most attractive combinations of yield, growth, and value in the utilities sector. The market has been slow to accept Entergy’s decadelong business transformation. For the first time in two decades, nearly all of Entergy’s 2023 earnings will come from its five regulated utilities in the Southeast United States. But the market doesn’t give Entergy the same valuation as other regulated utilities. We believe Entergy’s long-term growth prospects are misunderstood and undervalued. We forecast 8% annual earnings growth at least through 2026, among the fastest growth of any U.S. utility. Population growth, economic growth, and renewable energy development in the Southeast are tailwinds that few other utilities enjoy.

NiSource NI

- Fair Value Estimate: $32

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

We believe NiSource offers investors an opportunity to buy a high-growth utility trading at the same valuation as its slower-growing peers. NiSource’s transition from fossil fuels to clean energy in the Midwest supports a decade of above-average growth. Its electric utility plans to close its last coal-fired power plant in 2028 and replace the generation with wind, solar, and energy storage. We expect NiSource to invest $12 billion over the next five years and as much as $30 billion during the next 10 years, leading to 7% earnings and dividend growth.

Duke Energy DUK

- Fair Value Estimate: $105

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Narrow

After divesting its commercial renewable energy business, Duke will be a fully regulated utility with a clear pathway to achieving the company’s 5%-7% earnings growth target. Duke’s $65 billion capital investment plan for 2023-27 is focused on clean energy and infrastructure upgrades, as the company works toward its net-zero carbon emissions goal by 2050. In North Carolina, Duke’s most important jurisdiction, regulation has improved significantly through new legislation. Duke’s 4.2% yield is among the highest in the sector; however, dividend growth likely will lag earnings growth given the company’s higher payout ratio.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)