Healthcare Policy Changes Could Result in Opportunities

Expanded insurance rolls would be good news for the managed-care organizations and service providers we cover.

Potential healthcare policy changes look set to expand U.S. insurance rolls through existing programs like the individual exchanges and Medicaid. That expansion provides opportunities for managed-care organizations and caregivers, which should largely offset (and even override, in some cases) the potential U.S. corporate tax rate increase needed to pay for various government initiatives. We have adjusted our fair value estimates for these effects, with relatively mild changes for the MCOs and much larger increases for some caregivers related to the latter's more significant margin expansion opportunities and leverage that magnifies that effect on residual equity values. Our September 2020 research on potential healthcare policy changes highlighted the public option as the key downside risk for these sectors. Now, with the public option not being considered, we think the policy landscape is rife with opportunity rather than risk for MCOs and caregivers.

After each presidential election cycle, healthcare policy changes are often considered, creating volatility in some healthcare shares in the lead-up to those potential changes. However, after Democrats swept the federal electable bodies with narrow majorities in the 2020 election, the specter of big changes like "Medicare for All" and even a high-impact public option has largely faded. Now, further expansion of parts of the existing system under the Affordable Care Act appear to be the most likely healthcare policy changes in a potential budget reconciliation bill that is possible in late 2021, with the goal of primarily increasing access to insurance. The potential for permanently extending new tax credits on the individual exchanges and further expanding Medicaid in nonexpansion states appears most likely to move the needle on insured rates. That and other minor initiatives could positively affect demand for health insurance plans at private insurers and increase profitability at service providers, too. Those prospects and the reduction of policy-related risks have positively affected shares of the MCOs and caregivers since we published our healthcare policy-related research in September 2020.

Healthcare service providers, particularly those with acute hospital operations, appear even more likely to benefit from increasing access to insurance in the U.S. than the MCOs; this has been priced into the market for a while, and we have now recognized those opportunities directly in our base cases. While we have adjusted some of our fair value estimates, investors should be aware that some MCO and healthcare provider shares may not be fully pricing in potential corporate tax rate changes in the U.S., which would likely be required to pass the Biden administration’s various initiatives through a budget reconciliation process that requires budget neutrality. Morningstar is incorporating a probability-weighted U.S. corporate tax rate of 26% starting in 2022, up from 21% currently.

Potential Healthcare Changes Likely to Extend ACA Initiatives

During the 2020 election season, Joe Biden campaigned on four major ways to potentially increase health insurance rates to at least 97% of the U.S. population from about 91% before the pandemic, which amounts to about a 20 million increase in insured people. Those four initiatives were improving affordability on the individual exchanges, expanding the ACA’s Medicaid protections to all states, introducing a public option, and lowering the age of Medicare eligibility. We continue to view the first two initiatives as only having budget neutrality concerns to make it through the budget reconciliation process, while the last two initiatives may have budget neutrality and substantive concerns that arise when the parliamentarian scores them during the legislative process, which could make the latter harder to pass.

The first two parts of Biden’s plan--adding tax credits to improve affordability on the individual exchanges and adding incentives for states to expand Medicaid further--were already implemented in early 2021, at least temporarily, as part of the American Rescue Plan Act. The extended tax credits on the exchanges will only last for two years under this plan. While the Medicaid-related incentives technically do not expire, the benefits for each state only last two years once its expansion plan is initiated, and Congress may even consider other methods to expand Medicaid to people in nonexpansion states. Procedurally, we think permanently extending the tax credits to improve affordability on the exchanges could be easily achieved in the budget reconciliation process, assuming enough congressional support and appropriate tax offsets. Based on the American Families Plan outlined by the Biden administration in April and recent congressional resolutions, we expect Congress to take up that initiative in a budget reconciliation bill planned for later this year. Details remain uncertain on future Medicaid plans beyond the ongoing carrot already provided by the American Rescue Plan Act of early 2021.

Generally though, with the potential expansion of coverage on the individual exchanges and in the Medicaid program, we think reaching the goal of 97% insurance coverage appears improbable, with a potential shortfall of at least 5 million people of the 20 million goal, by our estimates, even in the long run. Therefore, other efforts may be required to reach nearly universal coverage in the U.S. Biden campaigned on introducing a high-impact public option and lowering the age of Medicare eligibility, which could help the U.S. reach nearly universal coverage. However, the public option appears to have been dropped from the legislative agenda, and changing Medicare eligibility rules may run into substantive concerns and would likely have limited impact on the insured rate (less than a 1% increase). We would also note that private insurers may benefit from Medicare-related initiatives like lowering the age of eligibility, if the newly eligible opt into Medicare Advantage plans or supplemental plans to offset cost-sharing requirements in traditional Medicare plans. Also, as with Medicare Part D for pharmaceutical coverage, proposals to expand benefits for the traditional Medicare population (potentially dental, hearing, and vision) would likely be run by private insurers.

Overall, we expect private insurers to play a big role in any policy changes that are introduced in the near future. The continued participation of private insurers in the U.S. healthcare system remains roughly in line with the view of most Americans, who want to guarantee health insurance for all and reduce out-of-pocket healthcare costs without materially disrupting the current healthcare system. This gives us confidence that private insurers will likely have an important and profitable place in the U.S. healthcare system for the foreseeable future; this should also benefit caregivers that typically generate higher reimbursement rates on commercially insured patients relative to patients on government-sponsored plans for the same service.

As of late 2020, most Americans appeared to prefer keeping the Affordable Care Act intact and expanding upon it. Given polling data like this, we are not surprised that the Biden administration appears focused on pursuing expansion of the existing system under the ACA rather than making potentially larger regulatory changes, like a public option, which we think has the potential to disrupt the existing healthcare system, depending on the details of the plan.

Looking out to the longer term, we think that reaching nearly universal healthcare coverage in the U.S. while maintaining the current private insurance-based system may require implementing passive enrollment features in existing safety nets. Fully utilizing the Medicaid safety net by expanding further into nonexpansion states and auto-enrolling individuals could boost the insured population by roughly 13 million people. Adding that to the increased affordability on the exchanges (which could positively affect about 3 million-7 million in the long run, by our estimates) could significantly help the U.S. boost coverage closer to the Biden administration’s goal of reaching an insurance rate of at least 97% of Americans (adding about 20 million to insurance rolls).

Extending Tax Credits Should Eliminate Affordability Cliff

In early 2021, about 12 million Americans had obtained health insurance through the individual exchanges. Enrollment on the exchanges has ranged from 11 million to 13 million people since 2015. While a small part of the overall health insurance landscape in the U.S., the exchanges represent a key safety net for individuals not covered by their employer or a government-sponsored program like Medicare (for people 65 and older) or Medicaid (for lower-income individuals). The Biden administration aims to significantly increase enrollment on the exchanges by increasing plan affordability.

Since plans on the exchanges were introduced in 2014, affordability has been a key complaint of consumers, despite the federal government providing tax credits up to 400% of the federal poverty level originally in the ACA. For individuals who did not qualify for tax credits, the price of the average health insurance plan on the individual exchanges was not necessarily cheap at just over $7,250 per year for an individual in 2021. That premium represented about 14% of a person’s annual income at 401% of the federal poverty level.

The American Rescue Plan Act of 2021 increased affordability on the exchanges by expanding tax credits for all households for a two-year period starting April 1. People at any income level now only have to pay a maximum of 8.5% of their household income to obtain health insurance. We expect those tax credits will be extended permanently through a potential budget reconciliation bill being considered later in 2021.

Overall, the recent tax credit changes look like they have significantly improved affordability on the exchanges, especially right above 400% of the federal poverty level, where there was an affordability cliff previously. As a result of that and other initiatives, like marketing to expand awareness and an extended enrollment period, 2.5 million had obtained a new plan on the exchanges through early August.

Other factors influence affordability on the exchanges that could be helped by the new tax credits, too. For example, geographic disparities in premiums create the opportunity for even larger savings for end users in high-cost states, such as Vermont, West Virginia, and Wyoming where annual premiums on the exchanges exceed $10,000 per person on average. Also, deductibles add to the out-of-pocket costs for end users before insurance benefits kick in, and those deductibles could be offset somewhat by the tax credit extension.

Expansion More Likely for Medicaid Than Medicare

Since the ACA was implemented in 2014, enrollment in Medicaid and related programs for children has grown from 57 million in 2013 to 81 million in early 2021. By our estimates, nearly 60% of that enrollment was related to the expansion of Medicaid through the ACA’s initiative of covering low-income adults regardless of whether they have dependents. The balance appears primarily related to the economic effects of the COVID-19 pandemic.

The Biden administration aims to build on the ACA’s expansion of the Medicaid safety net. Medicaid is jointly funded by the federal government and each individual state; to encourage the expansion of Medicaid in lower-income adults with no dependents, the federal government agreed to pay 90% of the cost of those adults under the ACA’s Medicaid expansion rules. Through the ACA, only 12 states have not expanded their Medicaid population. In those nonexpansion states, about 4 million people would be eligible for Medicaid under the existing ACA rules, according to the Kaiser Family Foundation. This creates another opportunity to expand the insurance rate in the U.S. just by fully utilizing the existing Medicaid safety net through the ACA. The American Rescue Plan Act of 2021 has already added incentives for states to expand Medicaid coverage to low-income adults without dependents, and Congress may even consider other methods to increase this population in the forthcoming budget reconciliation bill.

Although part of Biden’s campaign promise to increase access to health insurance, adding a public option to the exchanges and reducing the Medicare eligibility age appear less likely to be included in the current round of potential healthcare policy changes. Currently, we think Congress could pursue the Medicare eligibility age change (which would have a limited effect of adding about 1 million-2 million people to the insurance rolls), but we think that initiative would be at risk of being overruled by the parliamentarian on substantive concerns during that process.

The public option, on the other hand, looks unlikely to be pursued at all. Previously, we viewed the public option as a key wild card that could have been impactful to the insurance rolls and could have included some downside implications for insurers and caregivers, given the potential to cause a mix shift in insurance demand, particularly at small employers.

Other Agency Directives Could Help Increase Access to Insurance

- Additional marketing support of the individual exchanges is already happening. The Biden administration has reversed the Trump administration spending cuts and actually increased spending on advertising and other supportive activities of the individual exchanges. Given the potential for marketing-related benefits to exchange enrollment, the Biden administration's increase in marketing dollars associated with the individual exchanges was not surprising. Also, the administration's marketing efforts could educate end users on the improving affordability on the exchanges, which could boost enrollment on the exchanges in the near term and over time.

- A work requirement could be no longer necessary for Medicaid eligibility in low-income adults. In Medicaid, federal and state governments jointly fund the program for each state's citizens that qualify for enrollment. States largely control enrollment requirements, but the federal government must approve certain exceptions. One such exception--a work requirement--has been pursued through waivers by nearly 20 states. With letters sent to relevant states in February, the Centers for Medicare & Medicaid Services under the Biden administration aims to end work requirements to access Medicaid by denying any pending or existing waivers, which should help individuals access that program more easily once those waivers expire in 2021.

- The eligibility period for short-term insurance plans could shrink. Under the Obama administration, individuals could access three-month insurance policies that did not meet certain standards required under the ACA. These cheaper plans without a full set of essential benefits were meant to act as an insurance bridge for people who were between jobs to protect against catastrophic events in the interim period. The Trump administration significantly extended the eligibility period for these plans to 364 days with annual renewals possible for three years. We expect the Biden administration to reduce the eligibility period of these plans in an effort to more adequately protect people through other major ACA programs, such as the individual exchanges.

More Opportunities Than Risks for MCOs and Caregivers

By the end of our 10-year forecast period, we expect the insured population to permanently increase by roughly 4% from pre-COVID levels, reaching about 95% coverage by 2030 primarily through efforts to improve affordability on the exchanges and expand Medicaid. To fund these and other government initiatives, we expect Congress to raise the corporate tax rate by a probability-weighted 500 basis points starting in 2022, which we include in the base-case scenarios for the companies we cover.

With the American Rescue Plan Act’s ongoing enrollment period, we expect increasing affordability on the exchanges to immediately add new members to the country’s insurance rolls. After adding tax credit extensions, more than 2.5 million Americans had signed up through early August. Based on those trends, we believe the exchanges are on pace to add about 3 million people to the insurance rolls this year, which is the near-term expansion we expect. Over the next decade, though, we suspect these tax credits may facilitate the slow expansion of this population cumulatively by up to 7 million people, if a potential budget reconciliation bill later this year makes these tax credits permanent and increasing awareness helps expand this safety net. Therefore, in our base-case scenarios, we assume the tax credits would add about 1% to the insured population immediately and about 2% to the insured population by the end of our 10-year explicit forecast period.

During the next decade, we think more states will opt in to expand their Medicaid populations further. With 4 million people in those nonexpansion states who would already qualify for Medicaid under the existing ACA rules, we see that population as the low-hanging fruit in further Medicaid expansion. However, in our models, we have only worked in states adopting these rules relatively slowly over the next 10 years in our base-case assumptions. Passive enrollment initiatives or extending access to other vulnerable groups may add another 5 million people to the insurance rolls through Medicaid over time, by our estimates. We assume the Medicaid population grows in line with general demographics plus 6.5 million, or about a 2% increase to the insured population. In total, we expect the Medicaid market to grow to about 84 million enrollees by the end of our explicit 10-year forecast period.

We assume the U.S. corporate tax rate will rise by a probability-weighted 500 basis points, to 26% from 21% currently, to help fund healthcare and other initiatives under the Democratic-controlled federal government. Therefore, we assume the effective tax rates of the managed-care organizations and care providers will see the tax rates on their U.S.-generated profits rise by 500 basis points starting in 2022. Most of these companies are focused on the U.S., so most of their profit bases will be affected.

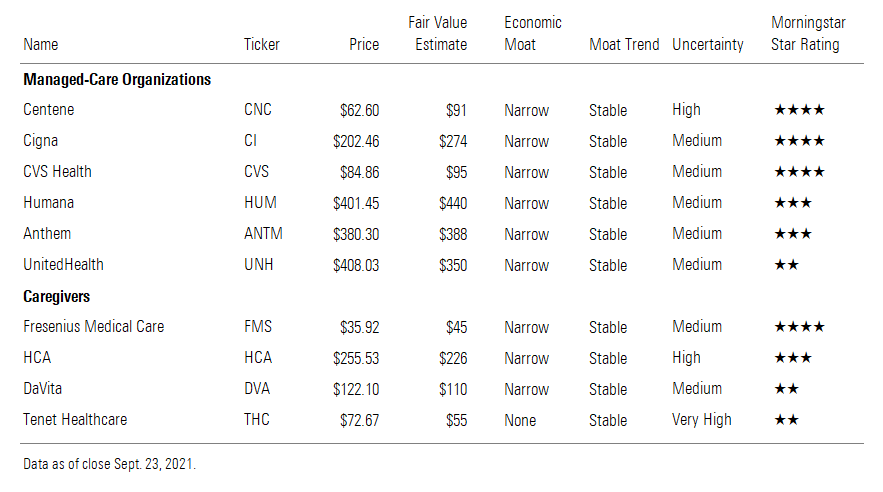

Our Top Picks

We currently view Centene CNC and Cigna CI as the best values we cover in managed care. We expect all of the other MCOs except CVS CVS to increase adjusted earnings per share in the low double digits compounded annually during the next five years; when considering their growth outlooks, Centene and Cigna in particular appear undervalued. UnitedHealth UNH looks the least attractive from a stock valuation perspective, especially when considering its low-double-digit earnings growth prospects similar to its peers. Therefore, we currently think investors should consider other options in this industry rather than UnitedHealth when putting new money to work.

Specifically related to how potential policy changes could affect their health insurance operations, we see the most operational upside in companies with exposure to the individual exchanges and Medicaid. Centene is the leader in those end markets with 66% of its medical membership in Medicaid and about 10% from the individual exchanges. Anthem ANTM (21% of medical members in Medicaid) and UnitedHealth (16%) also have decent exposure to the potential Medicaid expansions.

On a price/fair value basis, Fresenius Medical Care FMS is the cheapest caregiver that we cover. Management maintained its intermediate-term outlook (high-single-digit earnings growth from 2020 to 2025) despite weakness in 2021. In general, we see shares in this sector as moderately overvalued, and we question whether investors have fully incorporated the potential for the U.S. corporate tax rate to rise in some of these U.S.-centric organizations. However, we also highlight that further fair value estimate increases are possible, especially at firms like Tenet THC that are in a deleveraging mode. As these companies deleverage and commit to staying at those lower leverage levels, we may eventually reduce our capital cost assumptions without any other changes to our forecasts.

Managed-Care Organizations

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)