Health Insurer Review Results in Higher Valuations

Our Anthem and Humana fair value estimates get a boost.

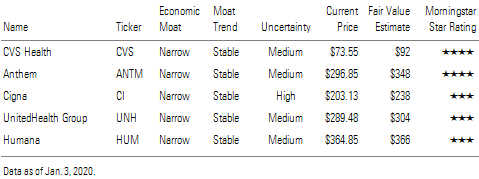

We have completed our review of the U.S. health insurance industry and have a fresh take on Anthem ANTM and Humana HUM. After the review, we raised our fair value estimates for both companies to reflect higher cash flow assumptions and recently generated cash flow since our last update. We are reiterating our narrow economic moat and stable trend ratings for Anthem and Humana, putting them in line with the rest of their managed-care peers.

Our narrow-moat view of the industry is informed by an analysis of potential changes to the U.S. healthcare system. Polling suggests that about half of the U.S. population is supportive of a “Medicare for All” scenario. In a Medicare for All scenario where U.S. insurers have no place in the U.S. insurance market, private insurers’ operations could be in jeopardy. However, we believe this scenario represents a very low-probability risk (5% or less) within our 10-year forecast period, as it would require significant shifts in current federal government control, including a filibuster-proof Democratic majority position in the Senate and a new president from the left wing of the Democratic Party, as Republican voters remain significantly opposed to such a plan.

During the next 10 years, we view scenarios where private insurers provide medical and pharmaceutical benefits through employers and even government entities, such as Medicare Advantage and Medicaid managed-care plans, as much more likely than the extreme Medicare for All scenario where the private insurance industry no longer exists. Polling shows that adding public options to the current U.S. healthcare system is supported by roughly three fourths of potential voters, with strong support even from Republicans. This is reflected in our view as well.

Considering these factors, we have examined a downside scenario where a public option is introduced to the current U.S. healthcare system in 2022--the earliest year possible, in our opinion--that steals significant share from the small and medium-size employer-based insurance rolls of each private insurance company that we cover. In these scenarios, we assume each company retains that “lost” business through a Medicare Advantage or Medicaid-based managed-care plan at similar profitability as its existing government business, which is typically lower than the employer-based business.

Comparing the downside risk with each company’s fair value estimate in this relatively aggressive public option scenario, we see Cigna CI as facing the least downside risk (around 5%) due to its concentration in fee-based insurance plans for larger employers as well as its sizable pharmacy benefit management operations after the Express Scripts merger in late 2018. CVS CVS and UnitedHealth UNH face similar downside risks from fair value in the low double digits, primarily reflecting their relatively diverse operations outside the insurance industry.

We see significantly higher risks--between 25% and 30%--from fair value for Anthem and Humana than their more diverse peers, reflecting their more concentrated operations in insurance. However, these companies may also be more exposed to the upside potential of a public option scenario that merely increases the number of insured people in the United States rather than significantly stealing share from employer-based insurance plans. This opportunity may be influencing recent stock prices for Humana in particular, given its concentration in Medicare Advantage plans, which could be a tool used in potential public options.

Beyond this analysis, Congress repealed the health insurance tax in late December, which is expected to take effect in 2021. We have adjusted our future earnings estimates for all covered managed-care organizations accordingly. While this change increased the industry’s earnings prospects mildly, we have maintained our fair value estimates for UnitedHealth, CVS, and Cigna based on our initial take on the repealed tax. This repeal played a mild role in our higher fair value estimates for Anthem and Humana.

CVS Health, Anthem, Cigna, UnitedHealth Group, Humana

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)