Election Impact on U.S. Healthcare Looks Modest

Our moat ratings and undervalued view of the MCO and drug/biotech sectors are intact.

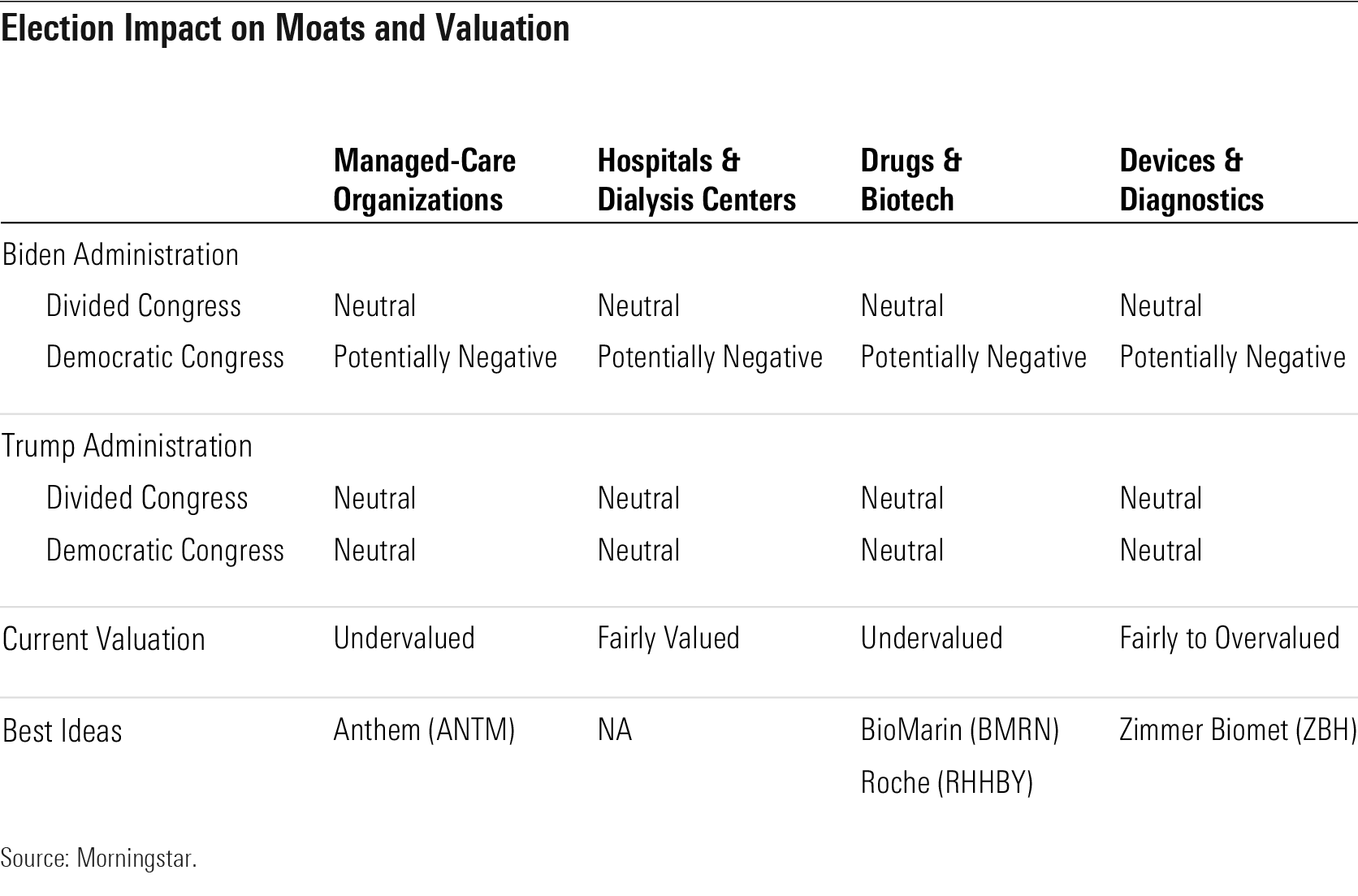

Healthcare policy remains a key debate in the upcoming election, but we have made no changes to our economic moat ratings or fair value estimates for our healthcare coverage based on potential changes after the election. As a positive for the healthcare industry, a "Medicare for All" scenario appears dead during this election cycle. However, we still see a path to more-affordable insurance options that could help the United States almost reach universal coverage if Democrats sweep the electable bodies of the federal government. Proposed changes by Joe Biden's campaign look likely to expand the existing safety nets in the U.S., and we think a public option has the most potential to alter the U.S. healthcare system. However, we suspect it would be much more likely to influence the individual exchanges than the employer-sponsored insurance that covers roughly half of Americans. Based on our projected pricing of a public option, we suspect that any shifts from employer-based insurance would be limited to very small employers with a risk up to about 10% of that market.

Election Impact on Moats and Valuation

- Though the 2020 presidential election holds an opportunity for further healthcare reform, we think the dramatic change already took place with the passage and implementation of the Affordable Care Act in 2010. There is ample evidence that the law has significantly reduced the number of uninsured and growing evidence that it has led to improved patient health and slower growth in U.S. healthcare spending--the three original objectives of the ACA. Also, in the first decade of the ACA, popular opinion of the law has increased, which could make it difficult to introduce any radical changes.

- We think the status quo in the U.S. healthcare system is likely to be maintained if control of the federal government remains split by Republicans and Democrats, with mild erosion to the ACA if Republicans retain control of the executive branch and partial expansion of the ACA if Democrats control the White House. If a second Trump administration comes to be, we'd expect him to stick with the present strategy of altering the ACA through executive orders, rules, and guidance to erode access and patient protections. Similarly, we would expect a Biden administration to pursue executive actions to bolster the ACA.

- However, most Americans want universal, affordable coverage, and we believe steps toward those goals are possible through incremental changes to the existing U.S. healthcare system after this election. In a scenario where Democrats control the federal government's electable bodies, a Biden administration would likely focus on increasing access to affordable health insurance, including a public option, increasing tax credits on the individual exchanges, expanding Medicaid, and lowering the age of Medicare eligibility.

- Of those changes, we think a public option has the most potential to alter the U.S. healthcare system, but its impact will depend on its pricing. Within our projected price range of $8,500-$10,500 per year for a public option with no deductible, we forecast that it would have only a limited effect (0%-10%) on the employer-based insurance market. However, a public option priced in that range could greatly influence affordability and market share on the individual exchanges.

- In the health insurance sector, we see significant margins of safety related to potential policy changes in the stocks of Anthem ANTM, Cigna CI, Centene CNC, and CVS CVS, all of which are trading below our policy bear scenarios. Also, depending on the compromises needed to enact reforms to reach universal, affordable coverage, upside opportunities from our fair value estimates are even possible for the insurers.

- For caregivers, including dialysis services companies and hospitals, all of our coverage list is trading above our policy bear scenarios, and in general, we see more downside risk in shares than upside potential related to potential policy changes. Specifically, the potential mix shift from higher reimbursement rates from commercial insurers to lower rates from government-sponsored programs could cut into these companies' earnings power in 2022 and beyond, although increasing access could help offset some of those negatives.

- We view the drug and biotech space as 7% undervalued, with investors too concerned about major policy reform. But we forecast only modest changes, such as updates to the Medicare Part D catastrophic phase payments, as the most likely, which would affect the industry by only 2% on the top line.

- We think medical technology companies are fairly to overvalued because the industry is relatively insulated from any policy moves from either a Biden or Trump administration. Med tech offers a haven to investors seeking healthcare exposure while minimizing the election risks that could affect other segments of the sector, which has pushed shares up.

Any Policy Changes Should Have Minimal Effect Considering the limited potential for changes to the U.S. healthcare system directly after this election, we have made no changes to our fair value estimates or moat assessments of the healthcare companies we cover. In fact, if the electable bodies of the U.S. federal government remain in split control, no major changes appear likely to any of the sectors that could be affected by policy changes.

In a Democratic sweep of the White House and Congress, we see a spectrum of opportunities and risks, and while we think investors are probably more focused on the downside risks associated with potential healthcare legislation in that scenario, there is upside potential, too. Specifically, we could raise our fair value estimates in several sectors if policy changes look likely to merely increase access to insurance coverage. However, if policy changes look likely to cause significant mix shifts from employer-based insurance to government-sponsored plans, we could see downside risks, primarily for health insurers and caregivers. Pharmaceutical pricing reforms are also possible, but the most potentially disruptive change to U.S. pharmaceutical pricing--international reference pricing--appears to have a very low probability of passing through Congress.

Beyond those three sectors, we see less potential for direct influence related to potential policy changes, although the sectors that serve them--such as medical device, life science, and diagnostic companies--could see some residual effects if policy changes are significant enough.

The preceding information was published Sept. 16 as part of a Healthcare Observer, which is available to Morningstar’s institutional clients.

Supreme Court Shakeup Adds Layer of Complexity With Justice Ruth Bader Ginsburg's death Sept. 18, another layer of complexity has been added to this election year. The Supreme Court is scheduled to hear oral arguments on the Affordable Care Act on Nov. 10, a week after the U.S. election. Before Ginsburg's death, the court looked likely to uphold the ACA at least along the previous voting lines (5-4). Without her vote, the path to upholding the law is more complicated, creating the potential for the millions of Americans who gained access to insurance through the ACA to lose that coverage. We are not changing our views on any moats or valuations in the industry, but investors should be aware of the various scenarios that could influence the U.S. healthcare system over the next several weeks.

The Supreme Court has a couple of options related to hearing oral arguments on the ACA. First, the court could decide to hear the arguments with only eight justices. In the event of a 4-4 tie, the court could turn the case back to the original district court to decide which parts of the law could be upheld without the individual mandate that is in question. In that case, further appeals of that court’s decision-making process could be possible while the ACA remains the law of the land. To avoid such uncertainty related to a potential tie vote, though, the Supreme Court could wait to hear oral arguments until another justice is named to the court, which would lead to a definitive vote.

Despite previous precedent from Republican leadership in the Senate that delayed voting on an Obama nominee in 2016 because it was an election year, Trump and Senate leadership appear intent on voting on a new justice before the end of the year. If that is the case, there is a chance that a 5-4 vote upholding the ACA could turn to a 5-4 vote against the law, assuming the new justice votes in line with most of the other conservative jurists.

One notable exception last time was Chief Justice John Roberts, who previously cast the deciding vote for the ACA based on Congress’ right to tax through the individual mandate. There is a chance that he will change his view on the law, given the elimination of the individual mandate in the 2017 tax reform act. However, some legal experts believe that Roberts and other conservative jurists (such as new Justice Brett Kavanaugh) could rule that the individual mandate is severable from the other aspects of the ACA, meaning that the other parts of the law were able to stand despite the individual mandate being dropped to $0 with the tax reform act in late 2017.

Considering all of these potential changes to the Supreme Court and the ACA in the near future, we think there is an increased probability that Democrats may decide to "go nuclear" in a Democratic sweep scenario to remedy any potential actions that are not supported by the upcoming election result. By going nuclear, Senate voting requirements could decline to a simple majority from a supermajority for legislative bills. Democrats could pursue a number of new initiatives from healthcare reform to expanding the Supreme Court to alleviate the perceived imbalance on the court.

In general, we think going nuclear to reduce voting requirements in the Senate on major legislation could create more risk for healthcare industry players in the long run. As Senate majorities whip back and forth after each election, significant changes to the U.S. healthcare system could be possible after each election. While we still believe the public-private partnerships that the U.S. system has been built on will likely remain in place, the uncertainty surrounding the managed care, service provider, and pharmaceutical sectors may rise in the long run in a nuclear scenario.

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)