A Coronavirus Vaccine, or Three, Could Be Available by Year-End

We expect multiple approved vaccines by early 2021 with wide vaccine distribution in developed markets by mid-2021.

Resurgences in COVID-19 outbreaks have made it clear that ending the pandemic will require more than diagnostics, contact tracing, and social distancing. It will require an effective vaccine and vaccine distribution.

- We're increasingly bullish that most of the vaccines entering late-stage development in the United States will meet Food and Drug Administration guidelines for approval. We expect the FDA could award three emergency use authorizations for use in high-risk individuals before the end of the year for Moderna MRNA, Pfizer/BioNTech PFE/BNTX, and AstraZeneca/Oxford AZN, based on interim efficacy data from phase 3 studies. We expect most U.S. adults will be vaccinated in the first half of 2021.

- We think the global COVID-19 vaccine market could surpass $40 billion in 2021, including at least $11 billion in U.S. government contracts at a $24 average price per course.

- We still expect minimal vaccine profit from not-for-profit strategies at AstraZeneca and Johnson & Johnson JNJ and minimal long-term valuation impact for Big Pharma in general, given uncertainty surrounding duration of sales.

We continue to expect an effective and safe vaccine--and potentially three--to be available in high-risk populations by the end of 2020. Although it isn’t clear what level of antibody or T-cell response is necessary to protect against infection or against severe disease, in-study comparisons to neutralizing antibody levels in recovered patients give us some comfort, despite the fact that different samples of convalescent sera serving as control arms and variations in how assays are run make it difficult to directly compare the studies for different vaccine with each other. In addition, preclinical challenge studies (immunizing an animal and then inoculating it with the virus) have produced encouraging data for the leading vaccines, with viral replication and lung infections either dramatically reduced or absent, relative to control animals.

Overall, we see probabilities of approval of 50%-70% for the leading programs--from Moderna, Pfizer/BioNTech, Astra/Oxford, and Novavax NVAX--with variation due to neutralizing antibody efficacy. Novavax’s efficacy looks the strongest, in our opinion, while Astra’s weaker preclinical data and tougher comparisons to convalescent sera in phase 1 could give it a slightly weaker probability of reaching efficacy thresholds in phase 3. Importantly, these four vaccines represent three different platforms, which we think should reduce any correlation between failure or success.

- We do not include data from China's vaccine programs, which are not moving as quickly or at as large a scale as the leading efforts in the U.S. and haven't compared neutralizing antibody levels with those seen in convalescent sera, making it even harder to assess their potential ability to protect humans from infection.

- Russia's August approval of the Sputnik V vaccine appears quite premature; the drug is apparently just entering phase 3 of development (details are scarce) so has no proven ability to protect patients from the virus.

- We have not seen published data for Inovio's INO vaccine, although initial phase 1 results in press releases and the decision to expand phase 1 at lower doses indicate a potentially weaker vaccine and slower progress.

For all these vaccines, we still need data on their ability to prevent infections in humans (from phase 3 studies) and longer-term data on safety before we expect regulators to allow an emergency use authorization, or EUA. However, if expected data is strongly positive, we think this could provide enough information to allow EUAs this fall.

Overall, we expect multiple approved vaccines by early 2021 with wide vaccination in developed markets by mid-2021. We see potential for more global vaccination of high-risk populations in late 2021.

Vaccine Distribution in 2021 and Beyond Operation Warp Speed is a public-private partnership that seeks to deliver 300 million doses of a vaccine to Americans by January 2021, with an additional three months for distribution. It has already allocated roughly $11 billion in government contracts for COVID-19 vaccine development, manufacturing, and delivery. Dose pricing varies substantially, and several of these contracts have options to expand, which could add more than $6 billion in OWS spending on vaccines. Most of the other contracts also include options for delivery of additional vaccines if trials and manufacturing are successful and supply is needed.

We assume a 40%-50% vaccination distribution rate through 2021 for adults in countries where vaccine will be sold and not donated. This amounts to roughly 1.6 billion adults requiring more than 3 billion doses through next year. We assume the $14 average per dose price for OWS contracts so far could be representative of future pricing as well. Assuming this price and four vaccine approvals (enough to supply 3 billion doses next year) leads us to a potential market through 2021 of more than $40 billion for COVID-19 vaccines.

The impact on profits for vaccine makers is all over the map, from negligible for AstraZeneca and Johnson & Johnson (which pledged not-for-profit prices) to potentially quite significant for novel mRNA technologies at newer vaccine-focused biotechs like Moderna and BioNTech. Historically, vaccine distribution businesses have seen operating margins of 30%-40%. But at pandemic scale and with newer manufacturing technologies and strong pricing in negotiated contracts so far, we see potential for higher operating margins with mRNA-based vaccines.

How Vaccines Work Vaccines require the patient's immune system to produce the protective response to the pathogen, typically as a direct response to an antigen (a part of the pathogen, in this case a virus).

There are generally two types of cells that work together to mount this response:

- B-cells produce antibodies that recognize the pathogen (SARS-CoV-2).

- T-cells kill infected cells and support the B-cell response.

Vaccines involve either direct injection of a viral antigen itself or the tools for an antigen to be made within the patient’s body. This second alternative can take many forms, including an inactivated version of the virus, genetic information for the antigen transported in a different (harmless) viral vector, or genetic code for the antigen escorted to cells by a lipid shield. Most vaccines will be administered as two shots, with an initial prime and a follow-up boost, typically three to four weeks later, to maximize antibody and T-cell responses.

The first vaccines are RNA or adenoviral vector vaccines, because these are the easiest to manufacture; however, more established vaccine technologies, like antigen-based or inactivated virus vaccines, are also making their way through development.

AstraZeneca’s adenovirus-based vaccine can be made in bioreactors that are capable of producing billions of doses in just months, at about the cost of "a cup of coffee." Vaccines from Moderna and BioNTech, which are mRNA-based, have even simpler manufacturing that does not require cells or bioreactors, although one weakness is the fragility of genetic information and the fact that these vaccines will need to be frozen for longer-term storage. Pfizer is working on a freeze-dried version of BNT162 that could be ready by 2022.

Expect First EUAs by Year-End, With Wider Approvals in Early 2021 We assume that emergency use authorization could be granted for high-risk populations (healthcare and essential workers, older adults, adults with medical conditions) following initial phase 3 efficacy and safety data for several programs in the fourth quarter of 2020, but filing for and receiving full FDA approval could require six months of safety data following the last dose, setting up official approval in broader populations in the first quarter of 2021.

This timeline for the leading vaccines seems reasonable, assuming the companies are able to find regions of the U.S. and other countries with significant ongoing outbreaks, enroll trials rapidly, meet the FDA threshold of 50% efficacy, and avoid unexpected safety issues or findings of enhanced disease for vaccine recipients.

It is unclear what level of antibodies or T-cell response is sufficient to protect an individual from infection or illness. However, we think early-stage data is promising and points to potential duration of vaccine efficacy for at least one year. If data remains positive and a high percentage of adults in the U.S. choose to be vaccinated, we think the U.S. is likely to achieve herd immunity in the second half of 2021, largely due to vaccination, not infection. Assuming a 70% efficacy rate (vaccine prevents disease in 70% of vaccinated individuals) and a 70% vaccination rate, this should cover half of the adult population, with some residual immunity in previously infected individuals and individuals with cross-reactive antibodies (from other coronavirus infections in the past), boosting us to the level of immunity needed for herd immunity.

Efficacy Data So Far: Promising Neutralizing Antibodies and T-Cell Response SARS-CoV-2 uses the S (spike) protein on its surface to enter cells, making this the key target for vaccines in development. So far, vaccines are beginning to produce data from phase 1/2 studies that compare levels of antibodies capable of neutralizing the virus in vaccinated volunteers with levels seen in patients who have recovered from COVID-19. Although it is unclear what level of neutralizing antibodies is needed to protect against future infection, this provided a ballpark for determining doses for phase 3 trials. Several phase 1 studies showed levels well above the FDA's standard for the level of neutralizing antibodies in convalescent sera, which to us implies a high likelihood of preventing infection and disease.

T-cell responses are also viewed as important to the durability of a patient’s defense against the virus. In fact, some recovered patients, especially those who had milder or asymptomatic disease, don’t have detectable levels of neutralizing antibodies but still have strong T-cell responses, and research on SARS showed that B-cell responses faded quickly while memory T-cells persisted many years and protected against challenge in mouse models. Asymptomatic COVID-19 patients perhaps fight off the virus more easily due to pre-existing, cross-reactive T-cells that may have formed due to prior infection with a common cold. The first evidence of strong T-cell responses to SARS-CoV-2 is starting to be published.

Phase 1 efficacy data from elderly volunteers in Moderna and Pfizer/BioNTech clinical studies released in August has been encouraging, with neutralizing antibody levels generally above levels seen in convalescent sera. However, given uncertainties around approval and access, we still assume significant sales of targeted antibodies in this population, due to potentially faster availability and better efficacy.

The ultimate durability of these vaccines, and the relevance of T-cell responses for that durability, won’t be clear until vaccinated individuals have been followed for several months or potentially years. Moderna management noted that since antibody levels among mRNA-1273-vaccinated volunteers are significantly higher than those in recovered patients, this could indicate that duration of efficacy could be longer than natural immunity duration (but this is also an unknown). T-cell responses in phase 1 data from Moderna, BioNTech/Pfizer, and AstraZeneca programs also indicate that those vaccinated are seeing a two-pronged defense, involving both B-cells and T-cells, supporting the possibility of long-term (at least one year) immunity.

In addition, a two-shot booster strategy could allow the immune system to mount a stronger response than with natural infection, and annual revaccination (like with influenza) could also allow us to maintain protection for years. Durability could be a long-term differentiator among the vaccines, particularly if recurrences lead to seasonal vaccination, although we don’t expect to have meaningful data on this prior to EUAs.

Also, it is unclear how well recovered patients are protected from reinfection. Antibodies for SARS-CoV-2 appear to protect monkeys that are rechallenged with the virus after infection, pointing to some immunity following infection. A King’s College study (preprint July 2020) found that antibody levels fade in some infected patients within three months, similar to the common cold, making it possible that some patients (particularly those with less severe disease) could be reinfected every year.

However, antibody responses are generally linked to T-cell responses, and T-cells can generally defend patients longer than antibodies (perhaps years) against future infections--helper T-cells recognize the virus and push B-cells to act and create antibodies, and killer T-cells destroy infected cells.

Safety: Virus Enhancement Still Possible, but Unlikely Safety risks from phase 1 data so far look manageable. Transient flulike symptoms after a second dose were common for the BioNTech and Moderna mRNA vaccines, and mild symptoms like headache, soreness, and fatigue have been typical for most of the vaccines. We expect regulatory agencies to watch for confirmation of this profile in phase 3, based on a much higher number of patients exposed and on longer duration of follow-up.

For vaccines and monoclonal antibodies (active and passive immunization), there is a theoretical risk of antibody-dependent enhancement, or ADE; that is, a risk that the antibodies produced as a result of the vaccine, and the antibodies passively administered in the case of monoclonal antibodies, won’t neutralize the virus when a patient is ultimately exposed and could instead paradoxically reduce a patient’s ability to fight a virus.

Immune enhancement can be due to ADE (antibodies help infection spread) or cell-based enhancement (allergic, type 2 helper T-cell-based inflammation). Therefore, the ability of the Moderna and BioNTech vaccines to produce neutralizing antibodies and also to trigger a Th1 based T-cell response (not Th2 based allergic inflammation, which occurred with a lethal RSV vaccine in the 1960s) appears to be a positive sign for safety. Preclinical challenge data (infecting monkeys with the virus after vaccination) has also persuaded Moderna that the risk of enhancement is nil. However, until we see evidence that vaccinated individuals have been challenged with the virus, we won’t know for sure whether the antibodies created in response to the vaccine defend the individual from harm or exacerbate disease.

Beyond ADE risk, there will continue to be a risk of very rare side effects, as with any approved vaccine. We do not see this risk as elevated for COVID-19 vaccines, but this is unlikely to be determined until hundreds of thousands (or millions) of people are administered a vaccine following approval. Overall, given the safety profile of the vaccines to date and assuming that ADE is not a factor (we will find out in phase 3), the risk of not being vaccinated looks significantly higher than the risk of being vaccinated.

Anticipating Hurdles in Manufacturing, Medical Product Supply, and Vaccine Distribution We've already seen the U.S. government take action to lock in supply of vaccines and manufacturing capacity. Contract manufacturing could also be a big boost for manufacturing capacity, either through contracts directly with several of the vaccine manufacturers or with the government.

We expect vaccine supply to be limited initially (in late 2020 and early 2021) for several reasons. While data readouts will begin this fall for phase 3 studies, EUAs will likely begin with one to three vaccines, and manufacturing is still ramping. A World Health Organization vaccine allocation framework estimates we will need more than 4 billion doses of vaccine globally (assuming two doses per person) to serve target populations like healthcare system workers (1% of population), adults older than 65 (8% of population), and other high-risk adults (15% of population). In the U.S., these segments amount to about 100 million Americans (including essential workers), or 30 million-40 million Americans focusing on those considered at risk for severe disease. Dr. Moncef Slaoui, head of Operation Warp Speed, hopes we will be able to vaccinate these 30 million-40 million individuals between December and February and has expressed confidence in this happening within the first half of 2021.

In June 9 Senate testimony, the vice director of logistics for the Joint Chiefs of Staff said he expected the U.S. to have 400 million needles and syringes for COVID-19 vaccination by the end of 2020 and more than 700 million by next summer, implying enough supply to vaccinate the entire country by mid-2021.

Specific contracts appear capable of covering this production. The Department of Health & Human Services signed contracts with Marathon Medical and Retractable Technologies RVP to supply 320 million needles and syringes (160 million courses of vaccine), roughly corresponding to the number we would expect to volunteer for vaccines initially in the U.S. A deal with ApiJect should supply 100 million prefilled syringes by the end of 2020 and 500 million in 2021. The Department of Defense and HHS also signed a deal with Corning GLW for 164 million glass vials annually for a vaccine. As of mid-July, Becton Dickinson BDX disclosed that it has total U.S. orders for needles and syringes of 190 million, with most delivery expected by the end of 2020.

On a global scale, Becton Dickinson is the largest player in the syringe market by far, but the other players combined hold a much larger share. The WHO estimates there are 16 billion injections annually. Becton makes 6 billion syringes annually. The company has said it could generate an additional 1 billion syringes over a 12- to 18-month time frame and already has some larger orders in place. Assuming other players could scale operations in a similar fashion, we could perhaps see 3 billion additional syringes in the next year, enough to vaccinate 1.5 billion people.

If medical products are in short supply, there are also several ways to use fewer materials, like using multidose vials instead of prefilled syringes, using basic needles instead of retractable safety needles, and using reusable glass syringes instead of disposable plastic ones.

Distribution will be a joint effort of the Centers for Disease Control and the Department of Defense. We expect the effort to involve coordination among government agencies and payers, pharmacies, hospitals, and physician offices to maximize efficiency. The CDC also exercised an option in mid-August to use McKesson MCK as a key distributor for vaccines and related supplies. Still, COVID-19 vaccines are likely to face distribution challenges largely due to unprecedented need for scale and the potential for additional cold-chain requirements beyond most currently approved vaccines; some could require freezers instead of refrigerators, although mRNA companies are indicating that vaccines will be stable with short-term refrigeration or portable thermal shippers.

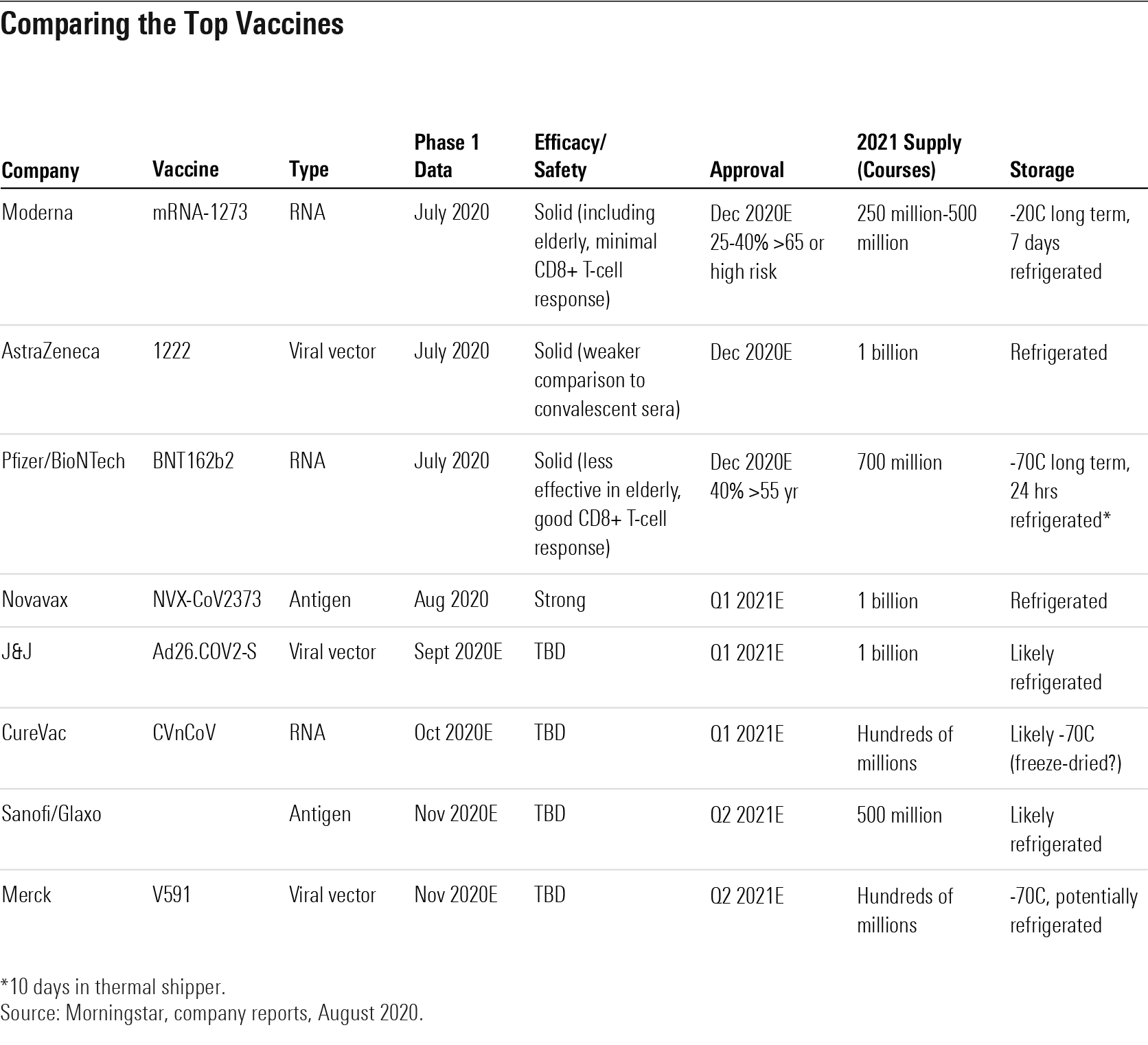

Comparing the Top Vaccines

Trade-Offs Between Leading Vaccines: Efficacy, Ease of Distribution, and Price Will Vary If early data is strongly positive for any of the leading vaccines in phase 3 development (from Moderna, Pfizer/BioNTech, and AstraZeneca), we expect we could see these begin to launch under emergency use authorizations in late 2020. We see eight COVID-19 vaccine programs that are likely to enter phase 3 in 2020 and have both promising mechanisms of action and global supply capabilities.

However, the vaccines are likely to have slightly different profiles in phase 3 trials, making some more successful and ultimately more broadly than others. Long-term storage for mRNA vaccines like those from Moderna and BioNTech requires a freezer, which might create distribution challenges. Other leading vaccines from AstraZeneca, J&J, and Novavax only require refrigeration, which should allow for broader distribution. Pfizer/BioNTech could have differentiated efficacy if CD8-positive T-cell responses are found to drive durability.

On the other hand, the antibody response in elderly volunteers receiving Moderna’s vaccine appeared on par with the response seen in younger adults in phase 1, while Pfizer/BioNTech’s vaccine produced a slightly lower antibody response in elderly volunteers, which could imply weaker efficacy in this higher-risk group for the Pfizer/BioNTech program.

Leading not-for-profit programs at AstraZeneca and J&J could also eventually produce enough global supply that there is less need for more expensive vaccines from Moderna and Pfizer/BioNTech, which might be available earlier in 2021. Novavax phase 1 data was strong, and the very low dosage required could give the firm the ability to produce large supply of an antigen-based vaccine. This could be the first vaccine approved that uses a more established vaccine technology (as opposed to mRNA and viral vector technologies with other leading vaccine programs).

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)